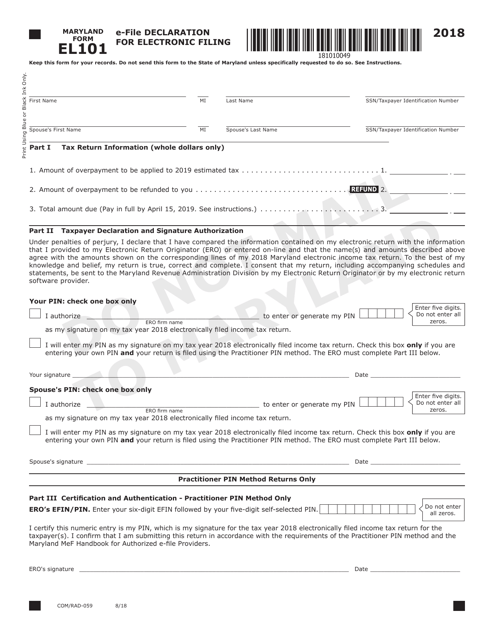

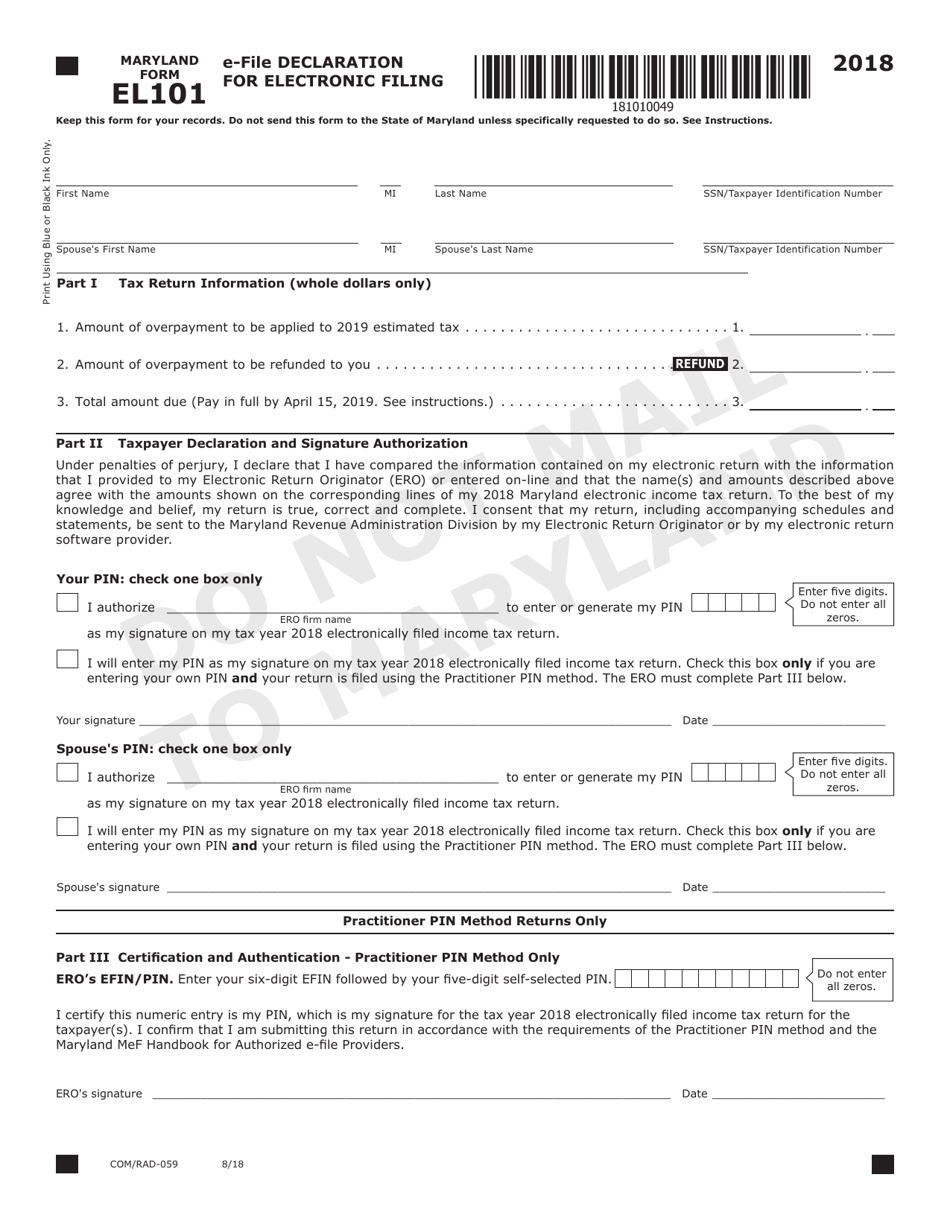

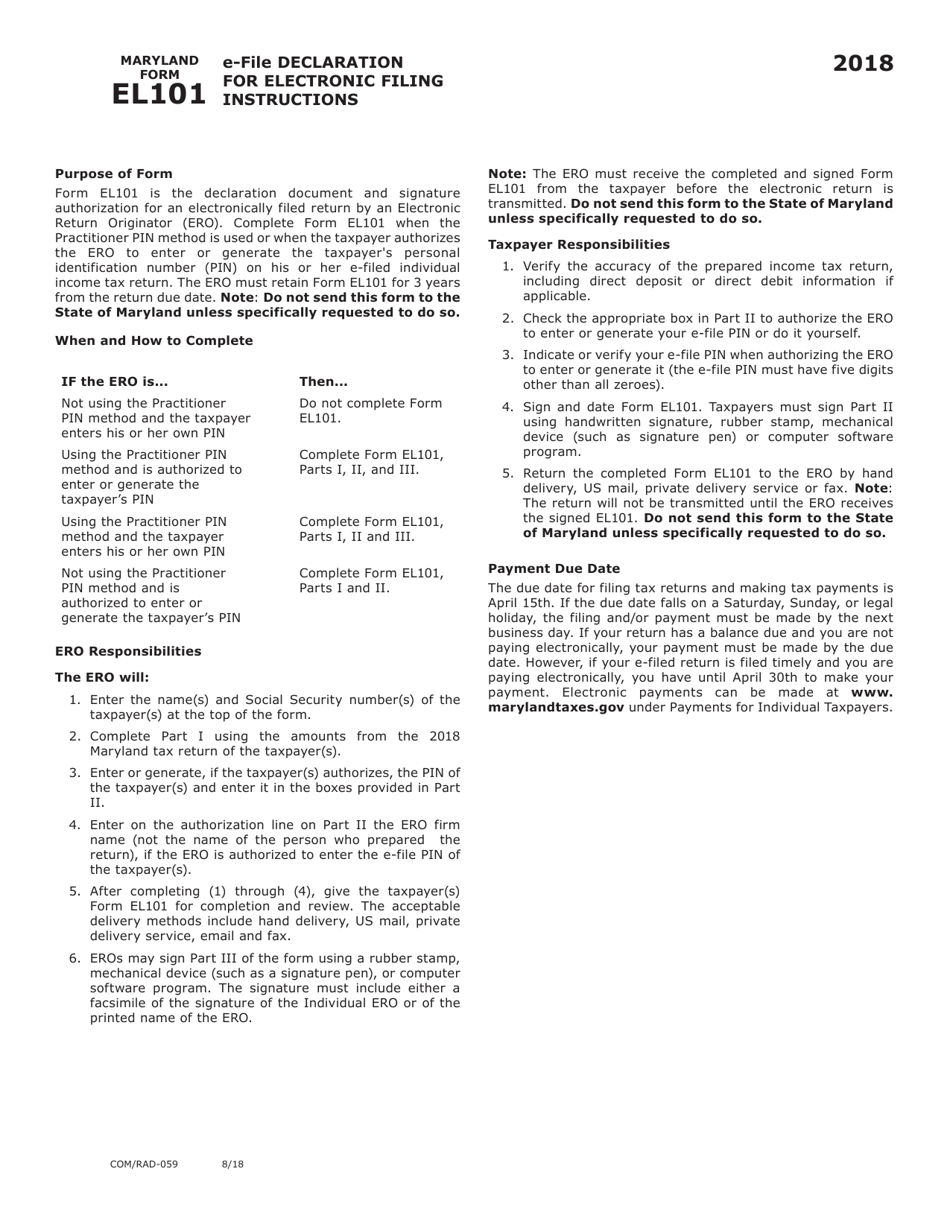

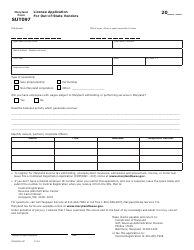

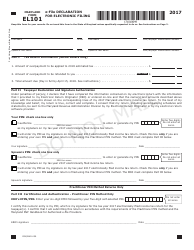

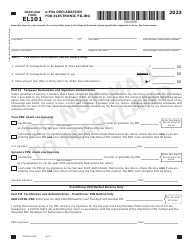

Form COM / RAD-059 (Maryland Form EL101) E-File Declaration for Electronic Filing - Maryland

What Is Form COM/RAD-059 (Maryland Form EL101)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FORM COM/RAD-059?

A: FORM COM/RAD-059 is the E-File Declaration for Electronic Filing in Maryland.

Q: What is Maryland Form EL101?

A: Maryland Form EL101 is another name for FORM COM/RAD-059, which is the E-File Declaration for Electronic Filing in Maryland.

Q: What is the purpose of FORM COM/RAD-059?

A: The purpose of FORM COM/RAD-059 is to declare your intention to file your tax documents electronically in Maryland.

Q: When is FORM COM/RAD-059 used?

A: FORM COM/RAD-059 is used when you plan to file your tax documents electronically in Maryland.

Q: Can I electronically file my tax documents without using FORM COM/RAD-059?

A: No, you must complete and file FORM COM/RAD-059 in order to electronically file your tax documents in Maryland.

Q: Are there any fees associated with electronically filing tax documents in Maryland?

A: Yes, there may be fees associated with electronically filing tax documents in Maryland. You should check with the Maryland state government or your tax preparation software for more information.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form COM/RAD-059 (Maryland Form EL101) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.