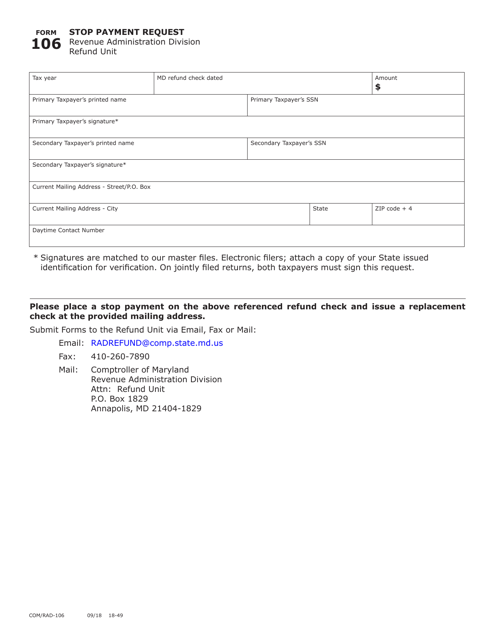

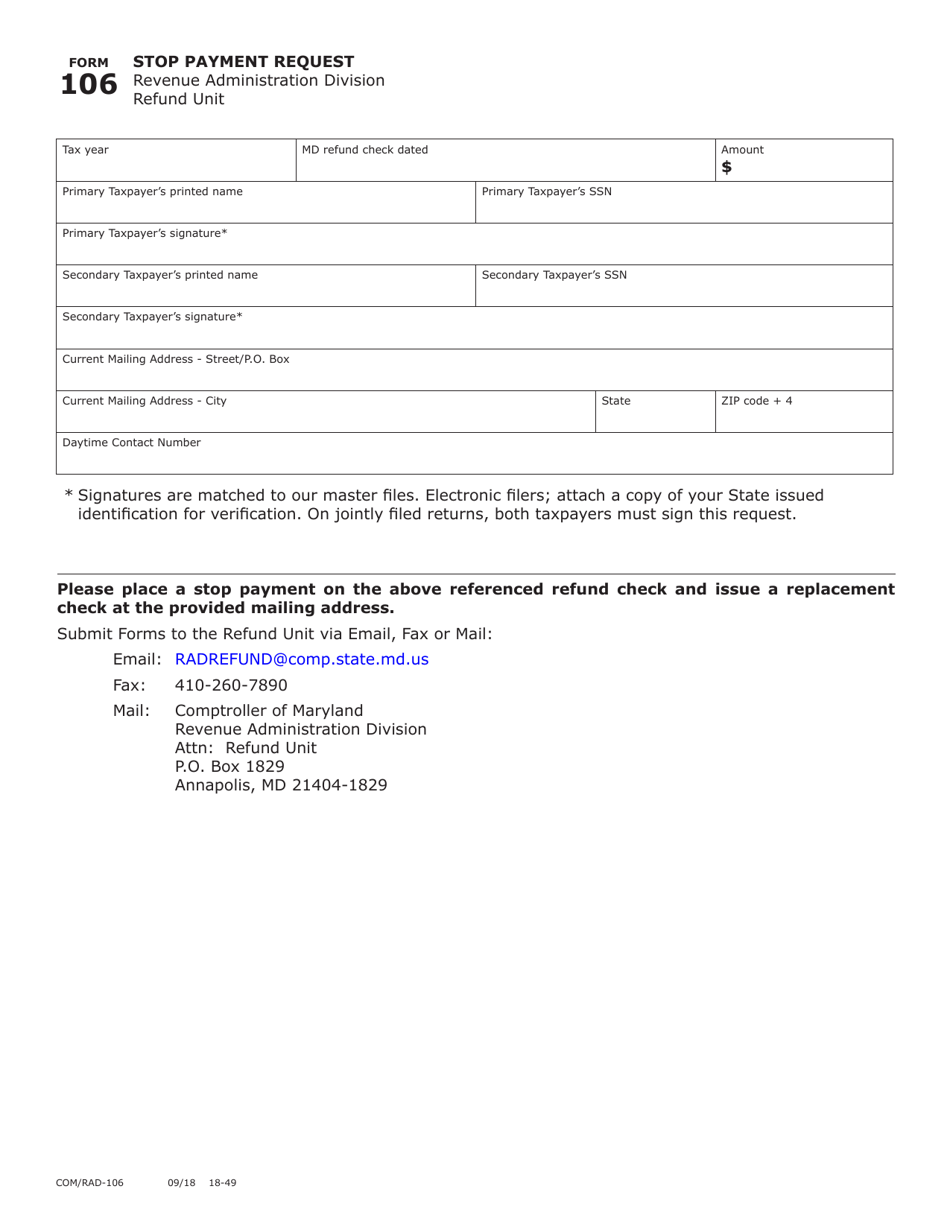

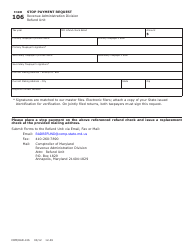

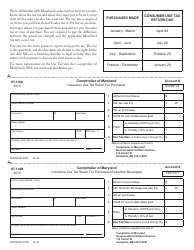

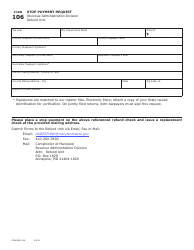

Form COM / RAD-106 (Maryland Form 106) Stop Payment Request - Maryland

What Is Form COM/RAD-106 (Maryland Form 106)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD-106?

A: Form COM/RAD-106 is the Stop Payment Request form in Maryland.

Q: Who can use Form COM/RAD-106?

A: Anyone in Maryland who needs to stop payment on a check can use Form COM/RAD-106.

Q: What is the purpose of Form COM/RAD-106?

A: The purpose of Form COM/RAD-106 is to request the cancellation of a previously issued check.

Q: Is there a fee to submit Form COM/RAD-106?

A: There is no fee to submit Form COM/RAD-106.

Q: How do I submit Form COM/RAD-106?

A: You can submit Form COM/RAD-106 by mail or in person at a local Maryland Comptroller office.

Q: What information do I need to provide on Form COM/RAD-106?

A: You need to provide the date, check number, payee name, and amount of the check, as well as your contact information.

Q: How long does it take for a stop payment request to be processed?

A: The processing time for a stop payment request can vary, but it is typically processed within a few business days.

Q: Can I cancel a stop payment request?

A: Yes, you can cancel a stop payment request by submitting a written request to the Maryland Comptroller.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD-106 (Maryland Form 106) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.