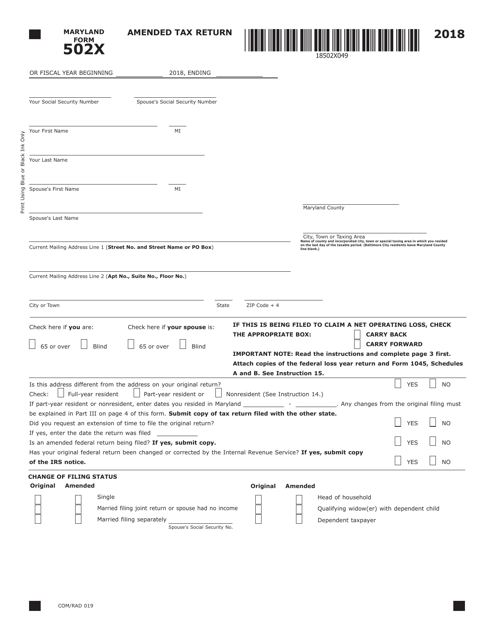

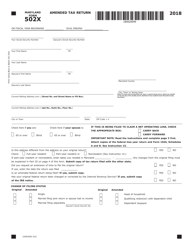

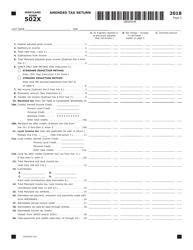

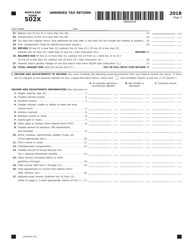

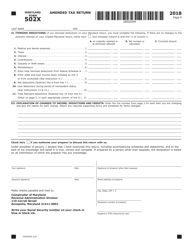

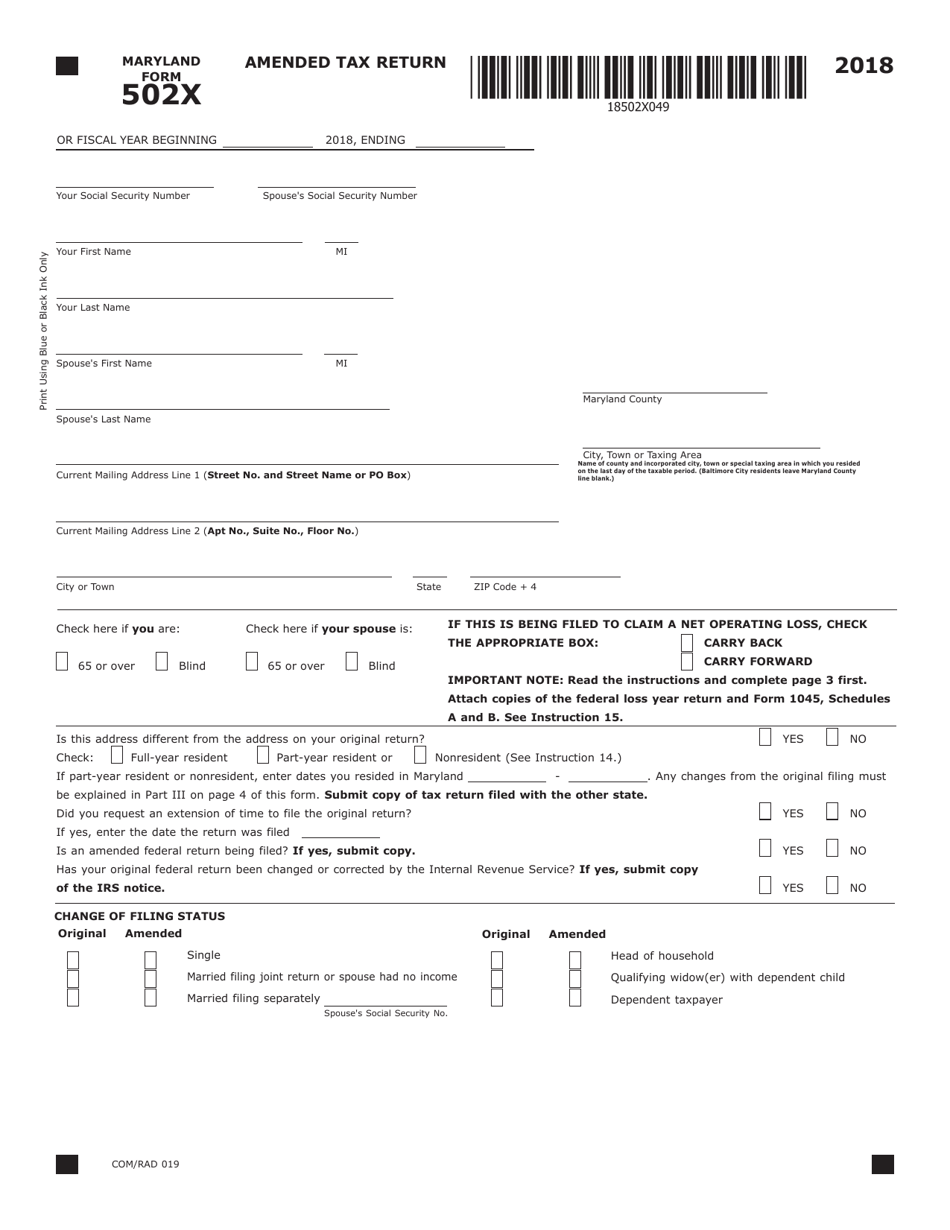

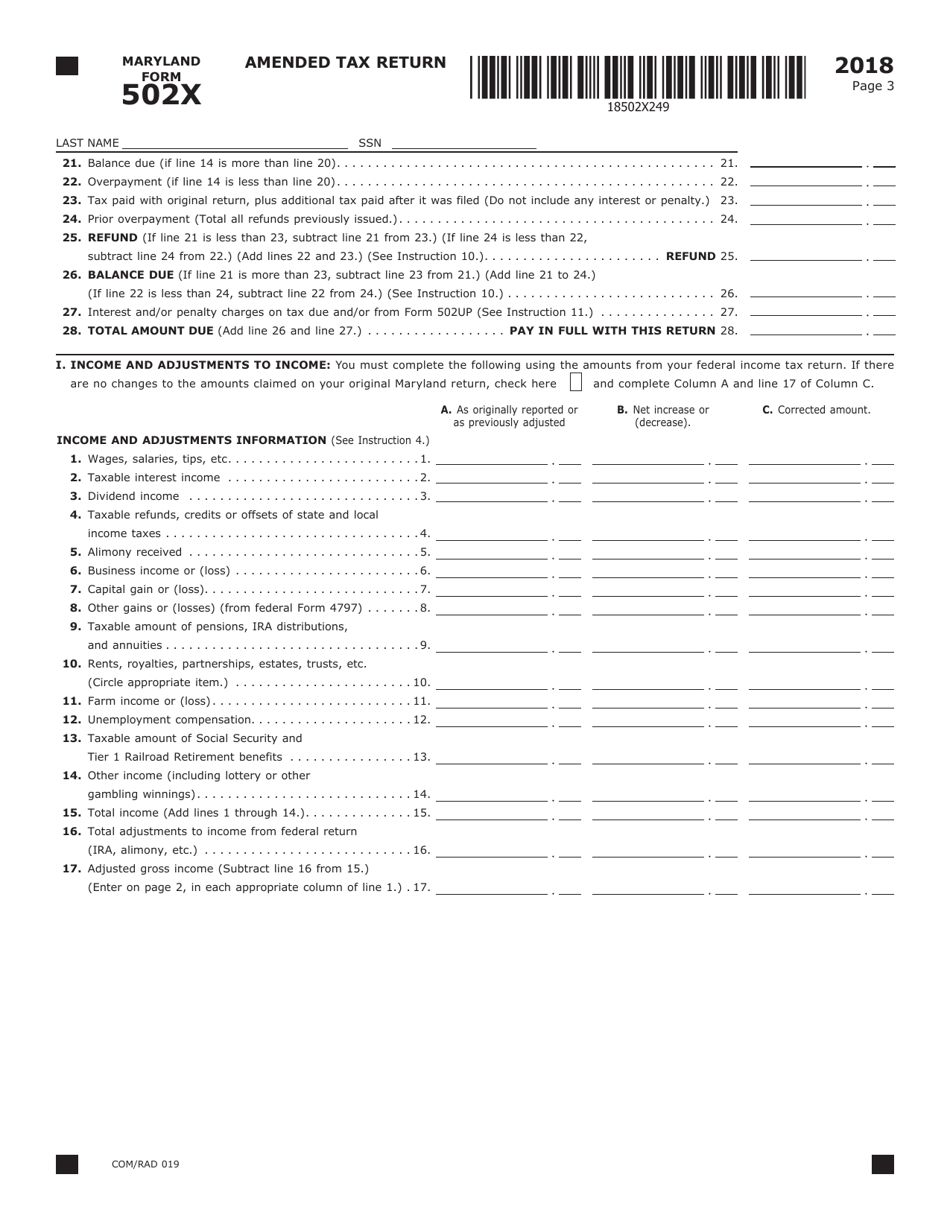

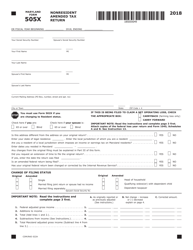

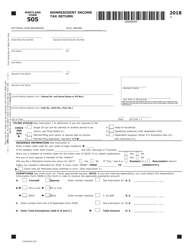

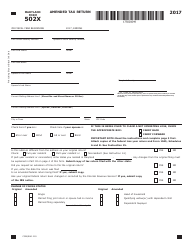

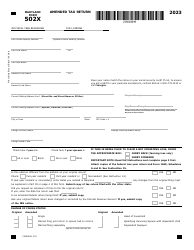

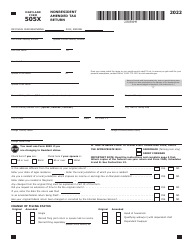

Form COM / RAD019 (Maryland Form 502X) Amended Tax Return - Maryland

What Is Form COM/RAD019 (Maryland Form 502X)?

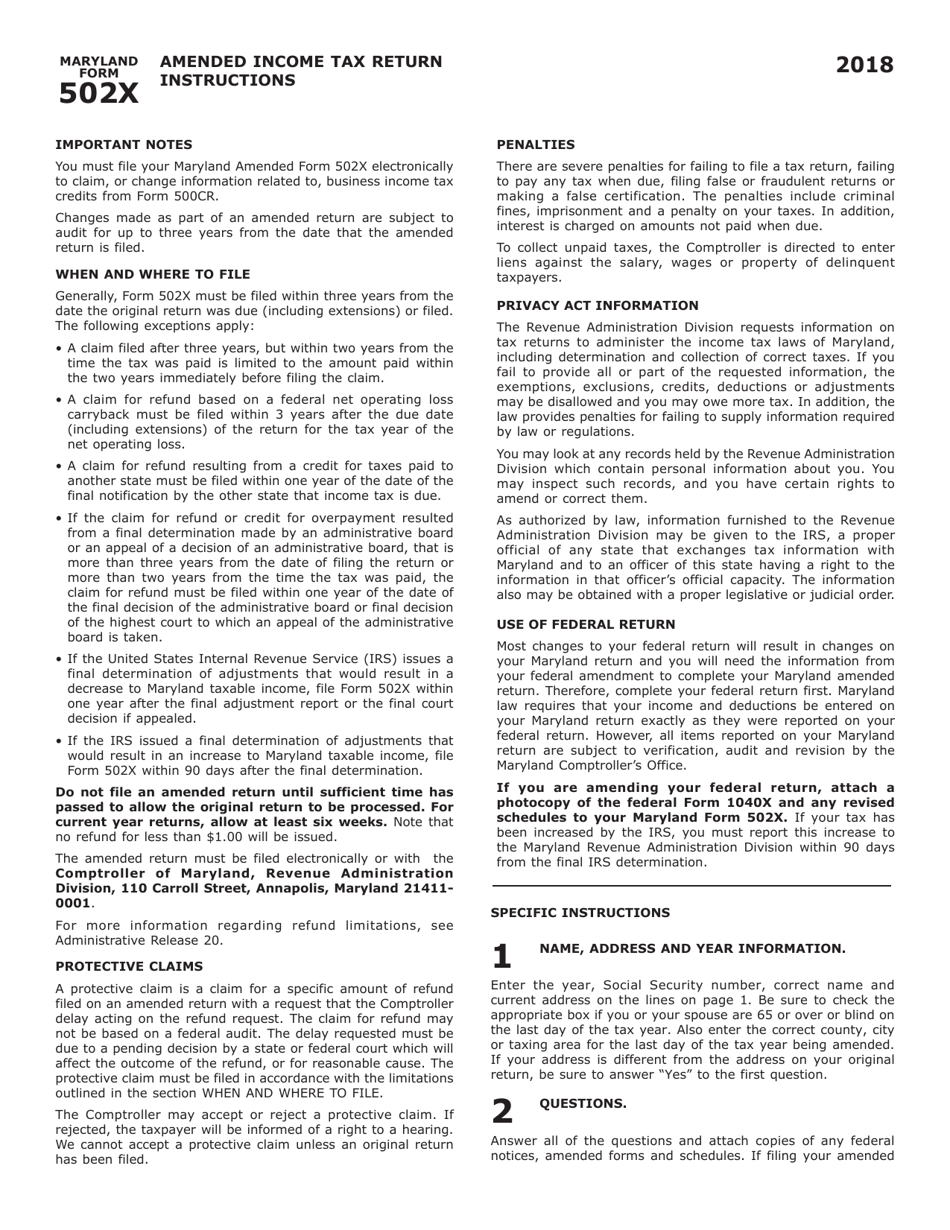

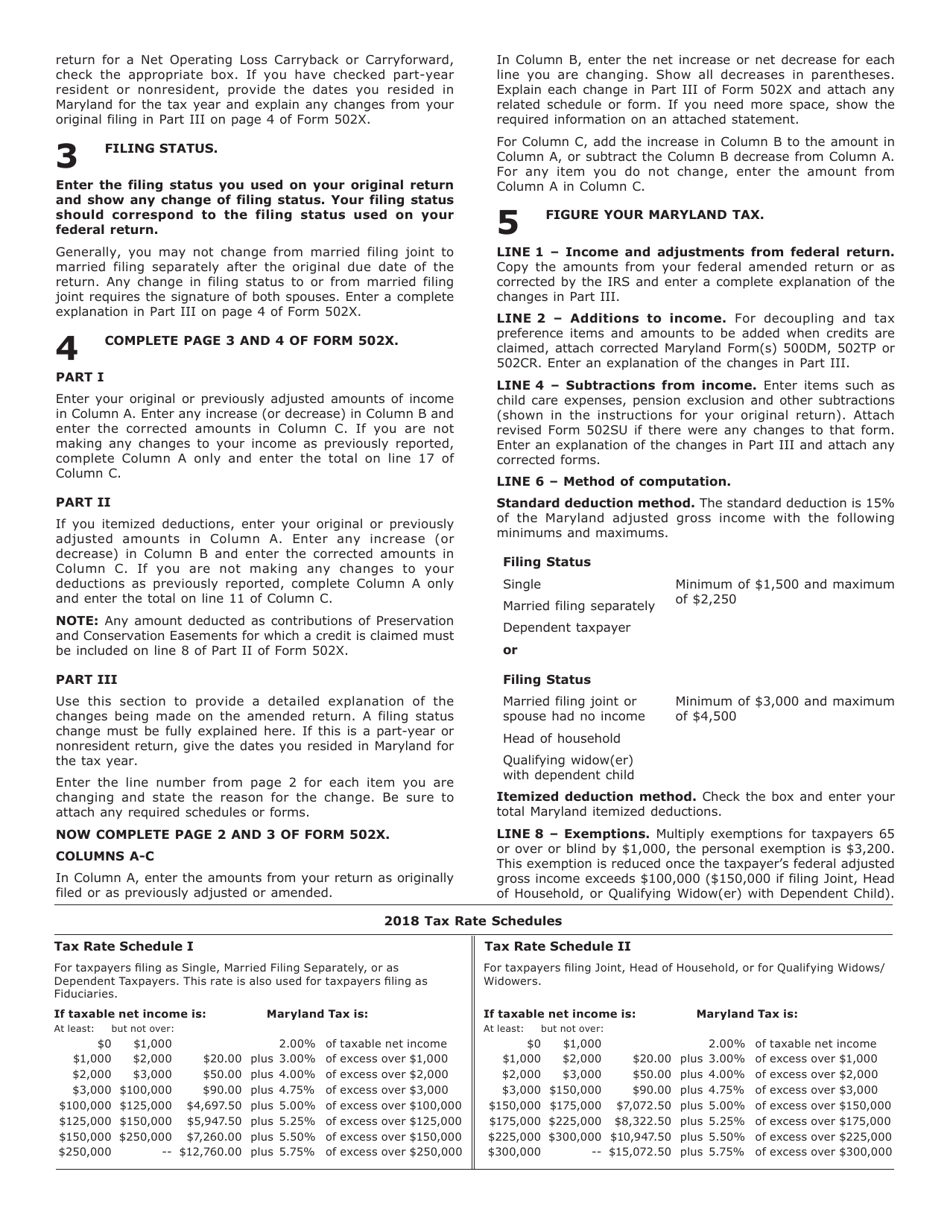

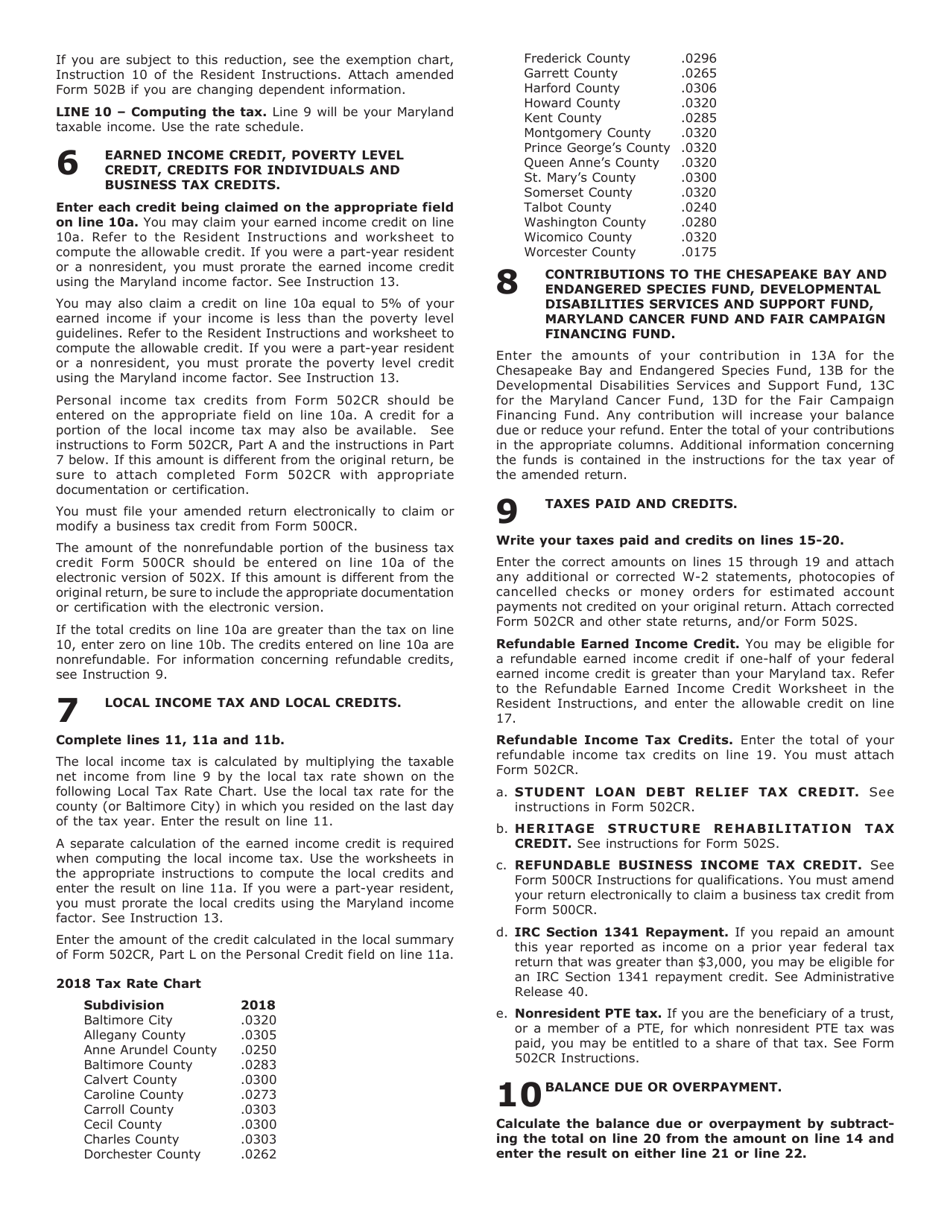

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD019?

A: Form COM/RAD019 is commonly known as the Maryland Form 502X, which is an amended tax return for Maryland.

Q: When should I use Form COM/RAD019?

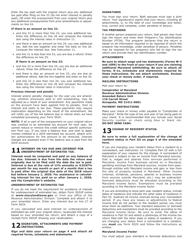

A: You should use Form COM/RAD019 when you need to make changes or corrections to your previously filed Maryland tax return.

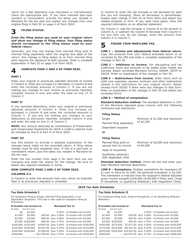

Q: What information do I need to complete Form COM/RAD019?

A: To complete Form COM/RAD019, you will need information from your original Maryland tax return as well as any supporting documents for the changes you are making.

Q: Is there a deadline for filing Form COM/RAD019?

A: Yes, you must file Form COM/RAD019 within three years from the original due date of the tax return you are amending.

Q: Can I amend a Maryland tax return if I have already received a refund?

A: Yes, you can still amend a Maryland tax return even if you have already received a refund.

Q: Will filing Form COM/RAD019 affect my federal tax return?

A: Filing Form COM/RAD019 will not automatically affect your federal tax return. However, you may need to make corresponding changes to your federal tax return if you are amending your Maryland tax return.

Q: What should I do if I made a mistake on my Form COM/RAD019?

A: If you made a mistake on your Form COM/RAD019, you will need to file another amended return to correct the error.

Q: What happens after I file Form COM/RAD019?

A: After you file Form COM/RAD019, you will receive a notice from the Maryland Comptroller's office acknowledging receipt of your amended return.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD019 (Maryland Form 502X) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.