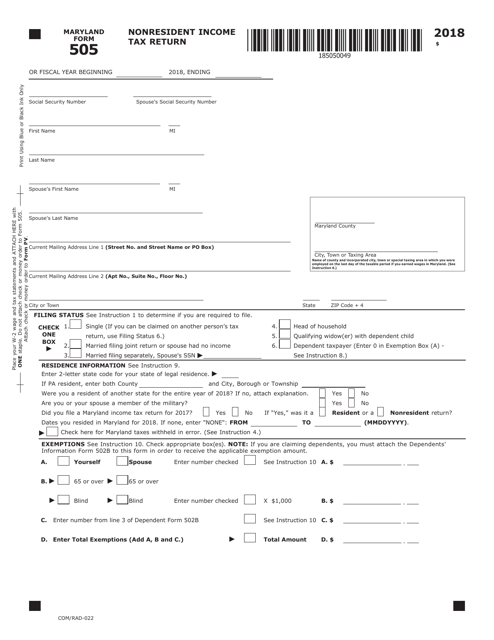

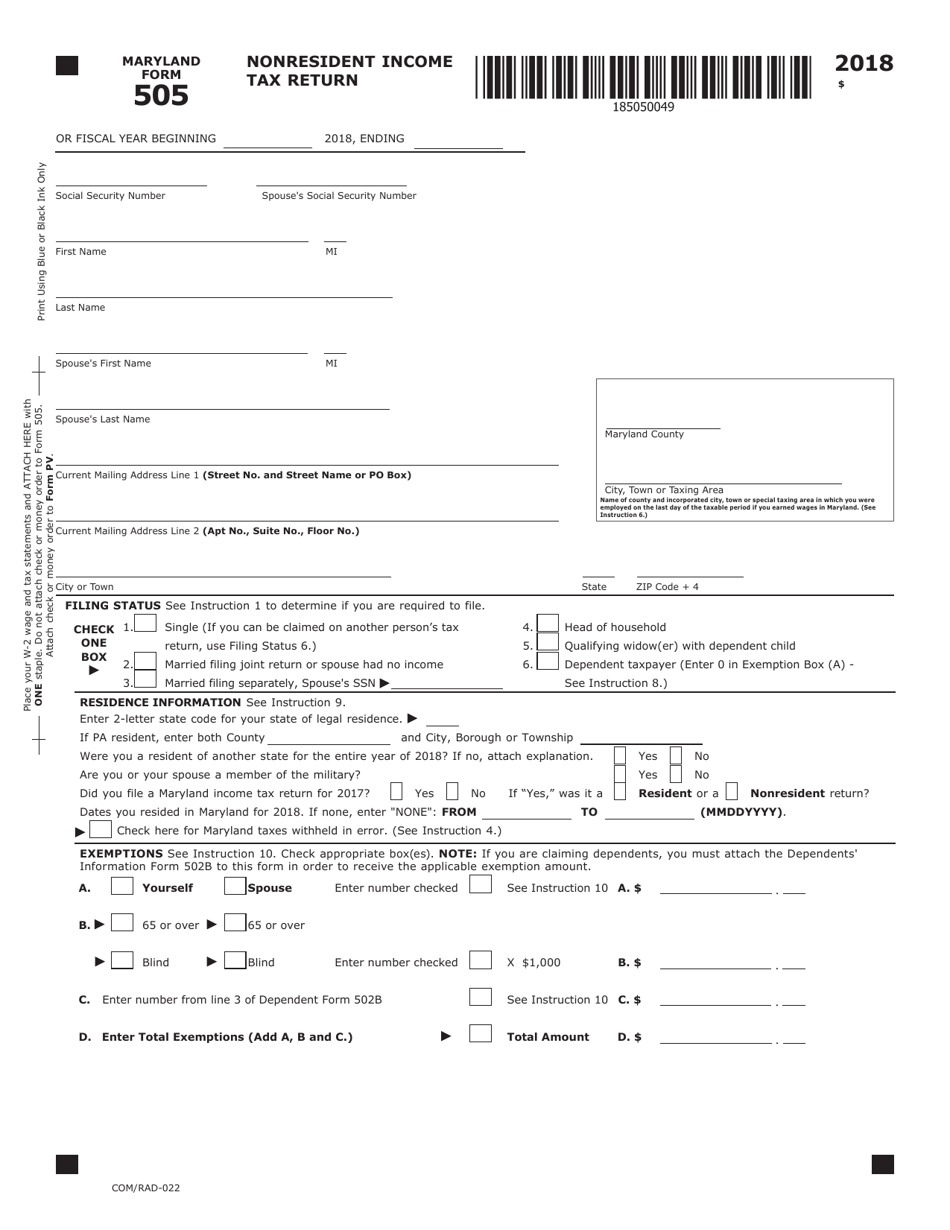

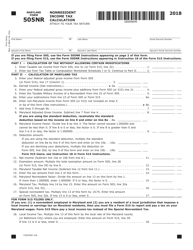

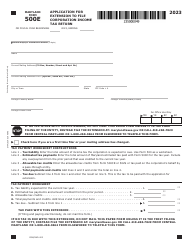

Form COM / RAD-022 (Maryland Form 505) Nonresident Income Tax Return - Maryland

What Is Form COM/RAD-022 (Maryland Form 505)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD-022?

A: Form COM/RAD-022 is also known as Maryland Form 505. It is a Nonresident Income Tax Return for Maryland.

Q: Who needs to file Form COM/RAD-022?

A: Nonresidents who earned income in Maryland during the tax year need to file Form COM/RAD-022.

Q: What is the purpose of Form COM/RAD-022?

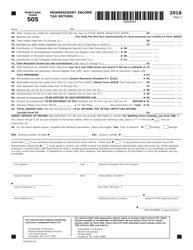

A: The purpose of Form COM/RAD-022 is to report and pay income tax on the income earned by nonresidents in Maryland.

Q: What information do I need to complete Form COM/RAD-022?

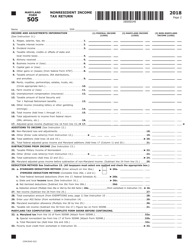

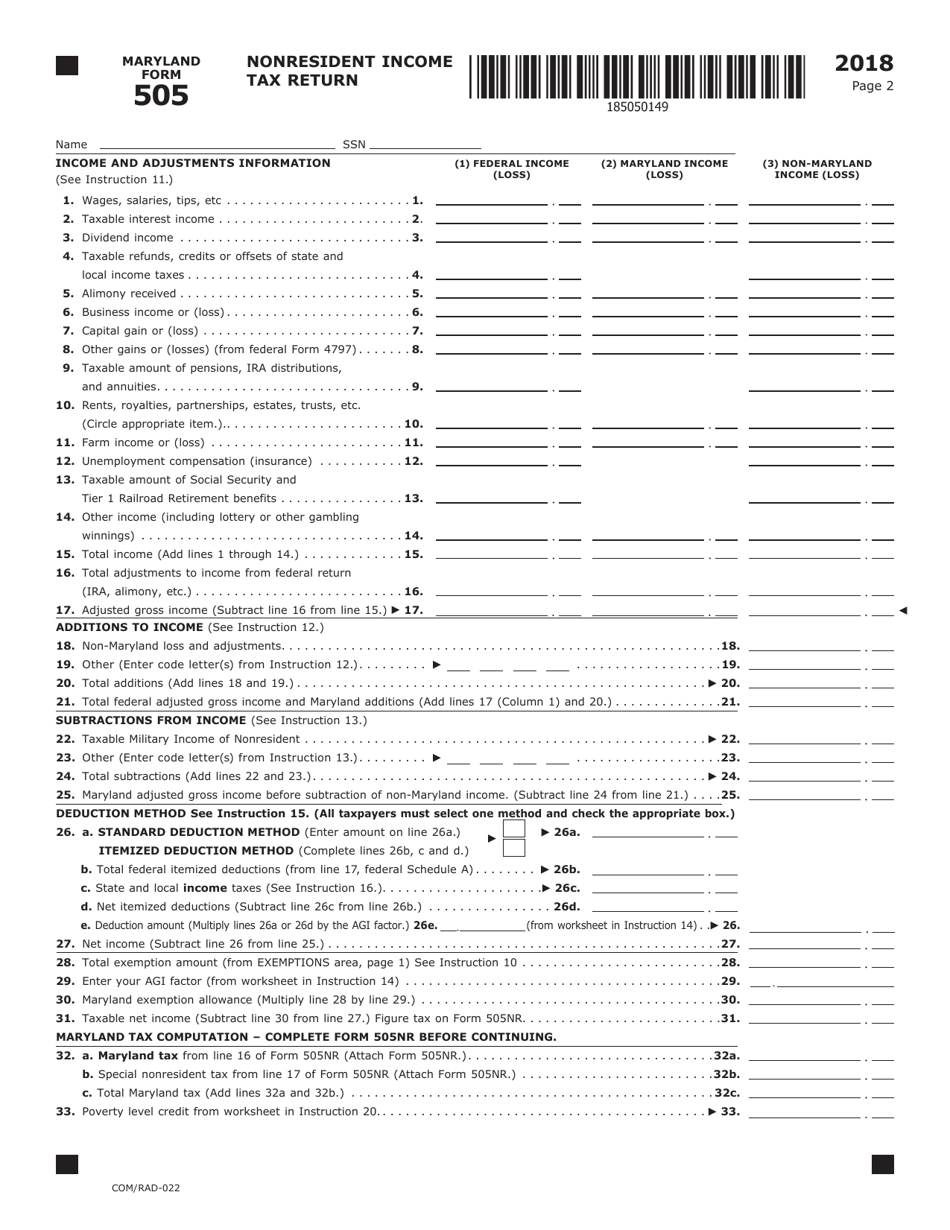

A: You will need information about your income earned in Maryland, including wages, self-employment income, and any other taxable income.

Q: When is the deadline to file Form COM/RAD-022?

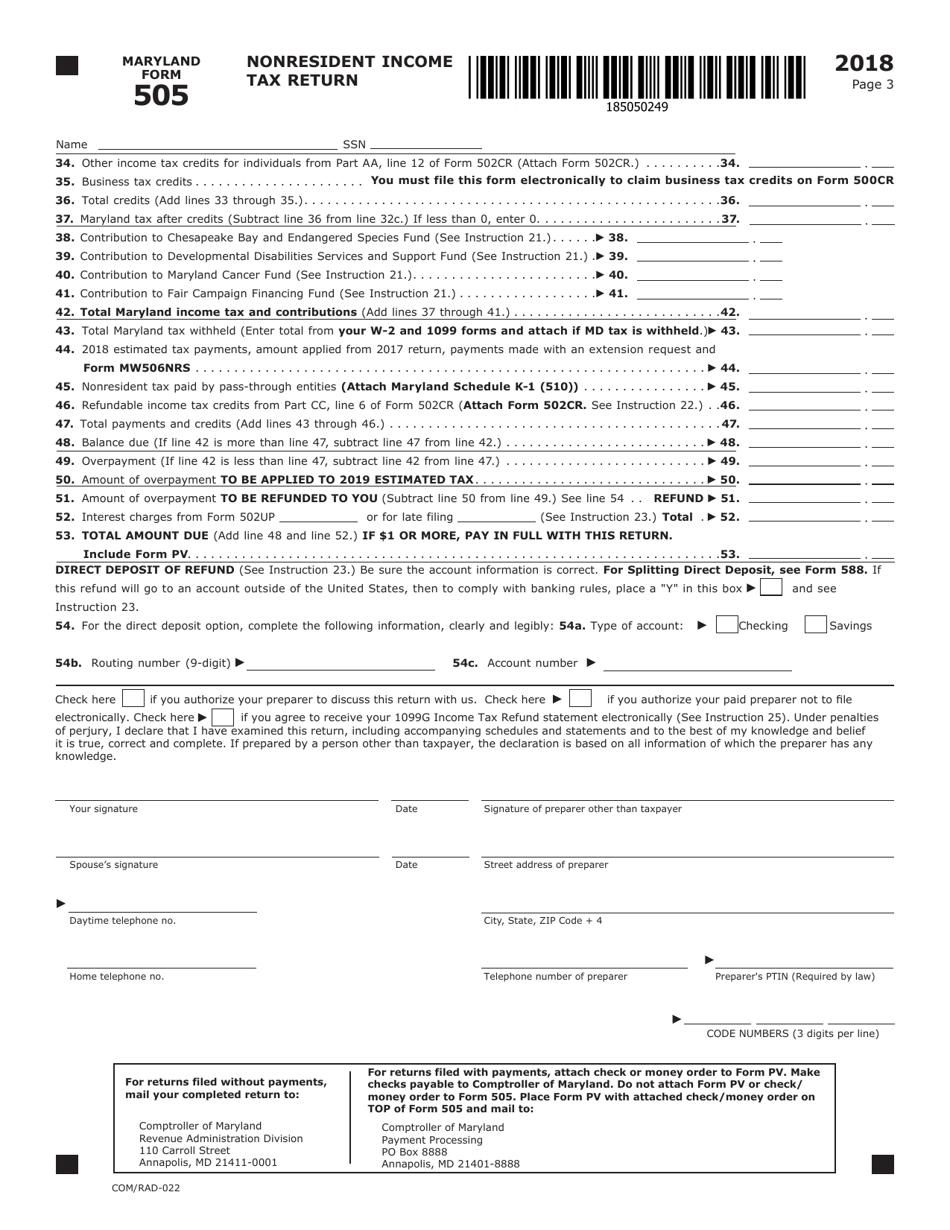

A: The deadline to file Form COM/RAD-022 is the same as the federal tax deadline, which is usually on April 15th.

Q: Can I e-file Form COM/RAD-022?

A: Yes, you can e-file Form COM/RAD-022 if you choose to do so. The Maryland Comptroller's Office provides an e-file option for this form.

Q: Is there a penalty for late filing of Form COM/RAD-022?

A: Yes, there may be penalties for late filing of Form COM/RAD-022, depending on the amount of tax owed and the duration of the delay.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD-022 (Maryland Form 505) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.