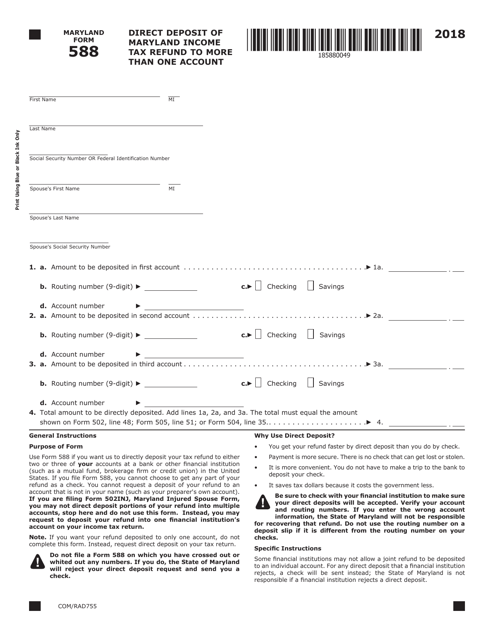

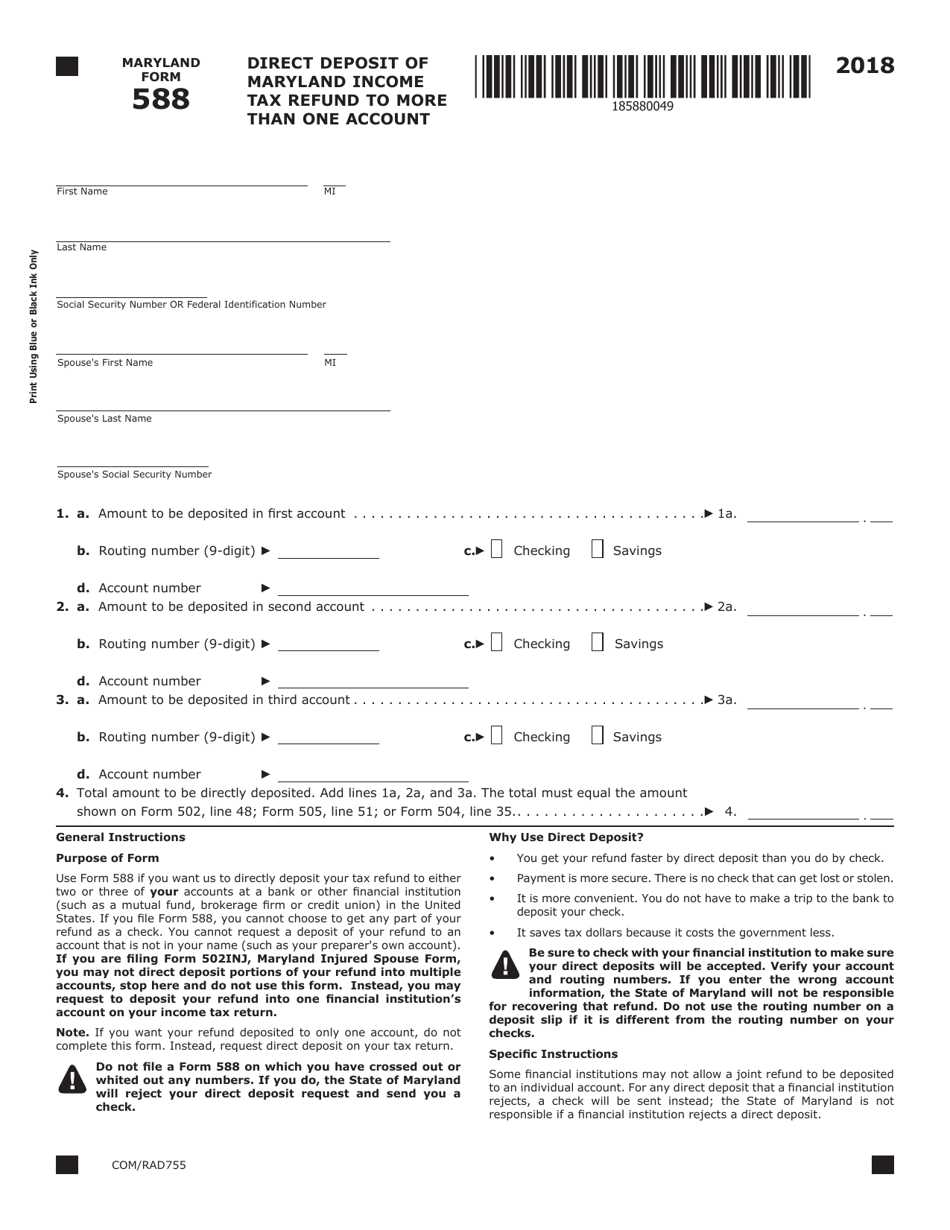

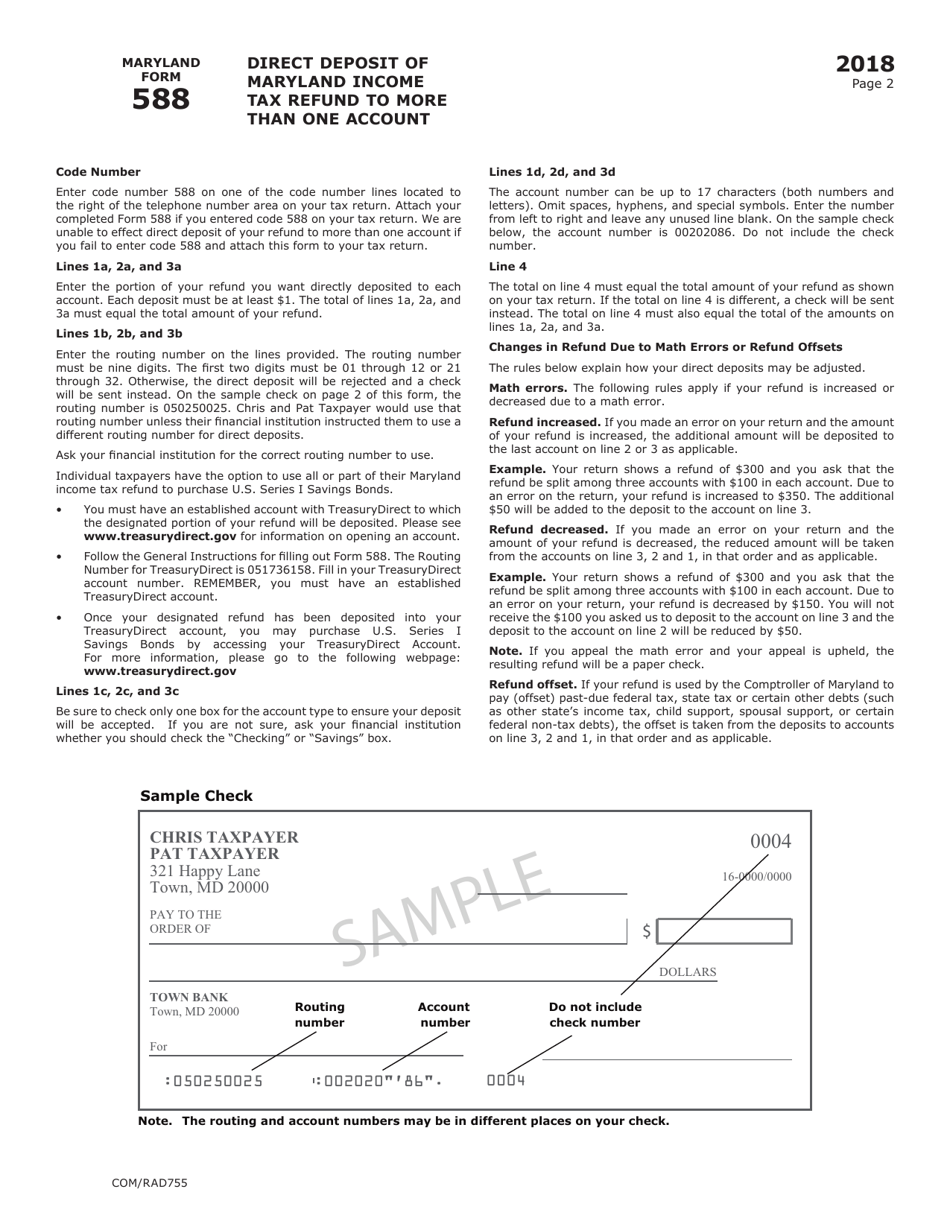

Form COM / RAD755 (Maryland Form 588) Direct Deposit of Maryland Income Tax Refund to More Than One Account - Maryland

What Is Form COM/RAD755 (Maryland Form 588)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD755?

A: Form COM/RAD755 is the Maryland Form 588, which is used to set up direct deposit of your Maryland income tax refund to more than one account.

Q: What is the purpose of Form COM/RAD755?

A: The purpose of Form COM/RAD755 is to allow you to split your Maryland income tax refund between multiple bank accounts.

Q: Can I use Form COM/RAD755 to receive my entire Maryland income tax refund in just one account?

A: No, Form COM/RAD755 is used to split your Maryland income tax refund between multiple bank accounts, not to receive the entire refund in one account.

Q: Is Form COM/RAD755 mandatory?

A: No, Form COM/RAD755 is optional. You can choose to use it if you want to split your Maryland income tax refund between multiple accounts.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD755 (Maryland Form 588) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.