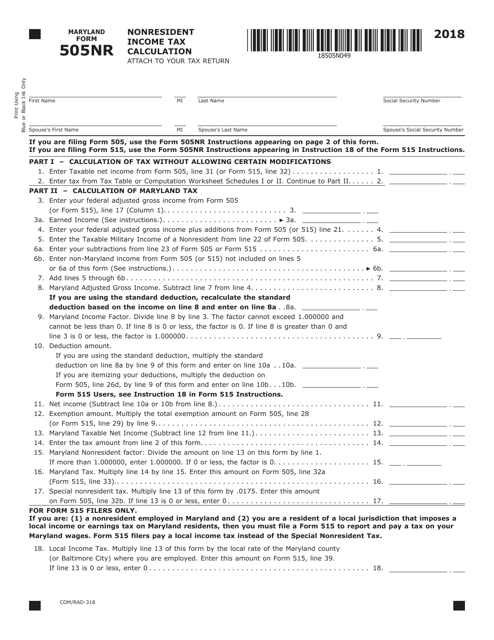

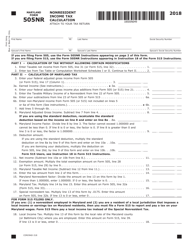

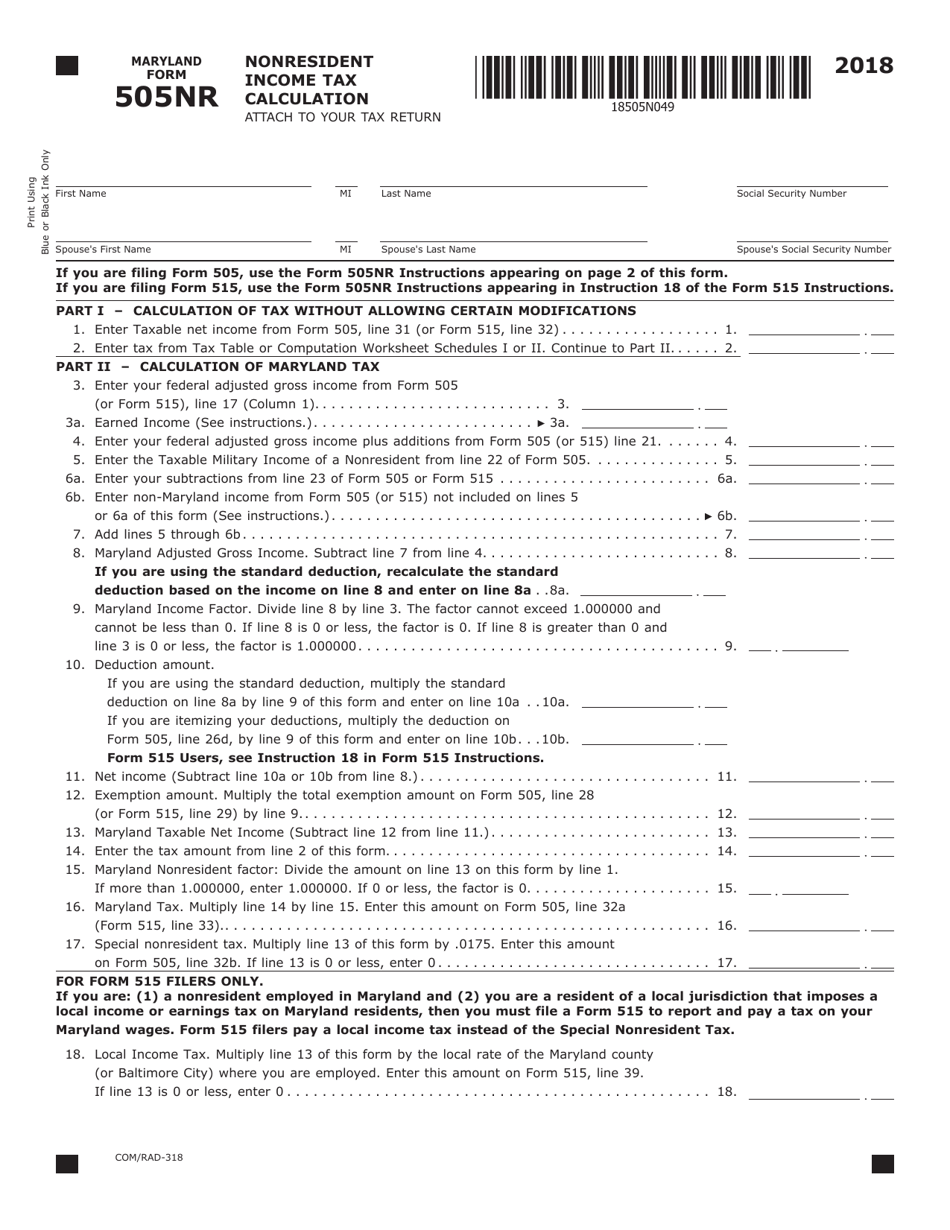

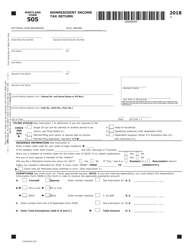

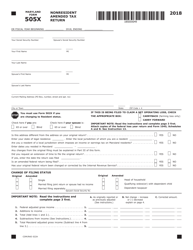

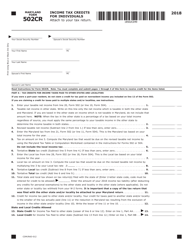

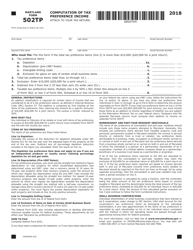

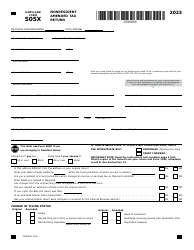

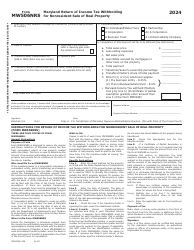

Form COM / RAD-318 (Maryland Form 505NR) Nonresident Income Tax Calculation - Maryland

What Is Form COM/RAD-318 (Maryland Form 505NR)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD-318?

A: Form COM/RAD-318 is also known as Maryland Form 505NR and is used to calculate nonresident income tax in Maryland.

Q: Who needs to file Form COM/RAD-318?

A: Nonresidents who earned income in Maryland need to file Form COM/RAD-318.

Q: What is the purpose of Form COM/RAD-318?

A: The purpose of Form COM/RAD-318 is to determine the amount of nonresident income tax owed to the state of Maryland.

Q: What information do I need to complete Form COM/RAD-318?

A: To complete Form COM/RAD-318, you will need information about your income earned in Maryland, deductions, and other relevant tax information.

Q: When is the deadline to file Form COM/RAD-318?

A: The deadline to file Form COM/RAD-318 (Maryland Form 505NR) generally coincides with the federal tax filing deadline, which is April 15th.

Q: Are there any penalties for late filing of Form COM/RAD-318?

A: Yes, if you fail to file Form COM/RAD-318 by the deadline, you may be subject to penalties and interest on any tax owed.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD-318 (Maryland Form 505NR) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.