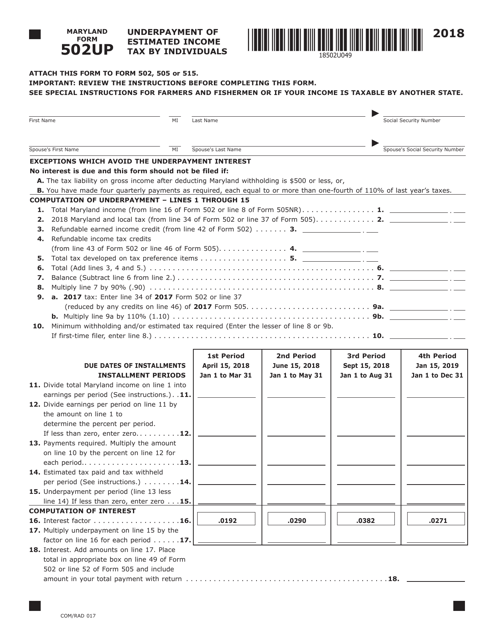

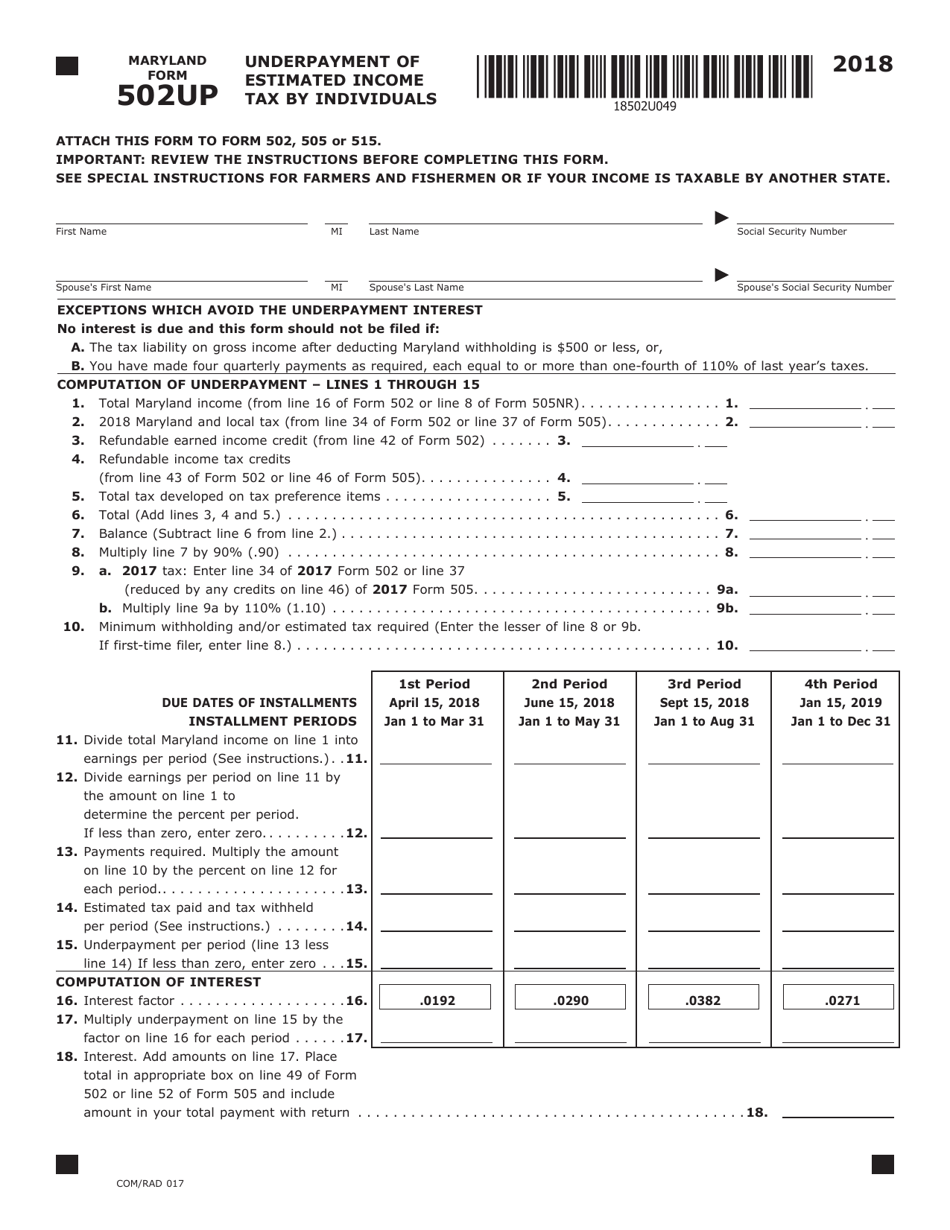

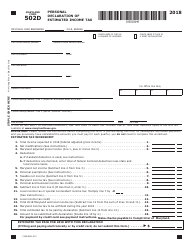

Form COM / RAD017 (Maryland Form 502UP) Underpayment of Estimated Income Tax by Individuals - Maryland

What Is Form COM/RAD017 (Maryland Form 502UP)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD017?

A: Form COM/RAD017 is the Maryland Form 502UP, which deals with the underpayment of estimated income tax by individuals in Maryland.

Q: Who needs to file Form COM/RAD017?

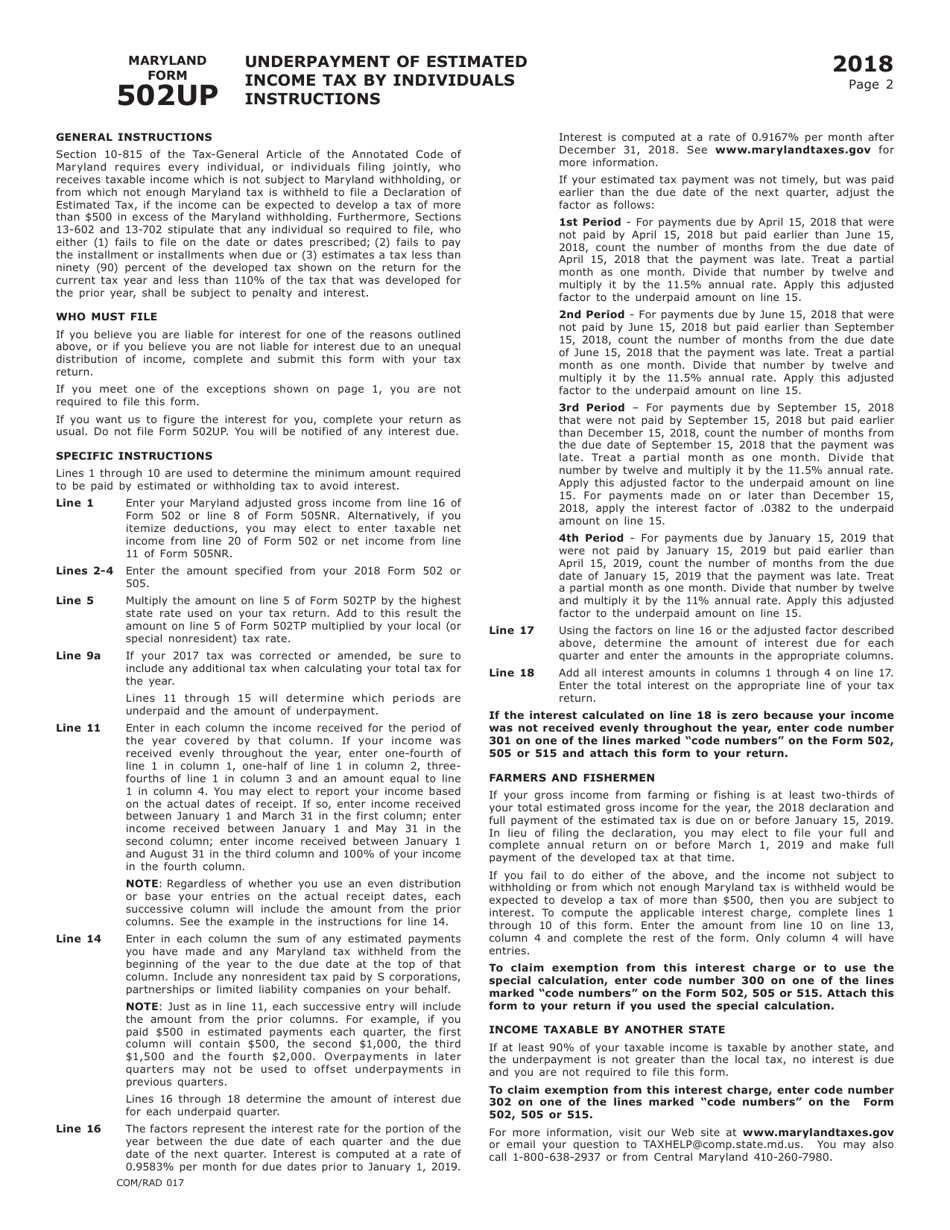

A: Individuals who had insufficient withholdings or failed to make quarterly estimated tax payments in Maryland may need to file Form COM/RAD017.

Q: When is Form COM/RAD017 due?

A: Form COM/RAD017 is due on or before the regular due date of your Maryland income tax return, which is usually April 15th.

Q: What are the consequences of not filing Form COM/RAD017?

A: If you had underpayment of estimated income tax in Maryland and failed to file Form COM/RAD017, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD017 (Maryland Form 502UP) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.