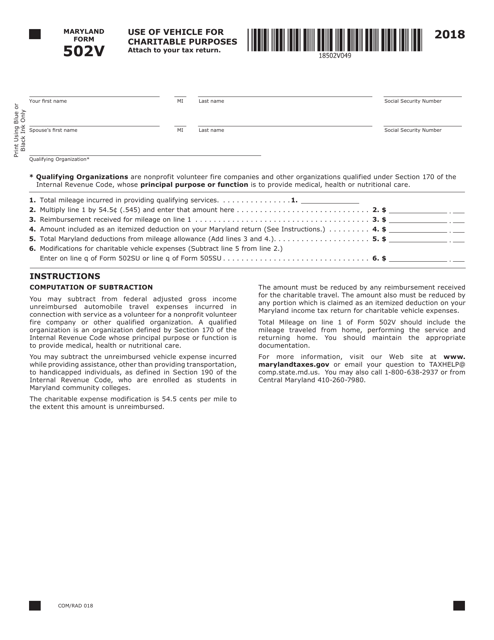

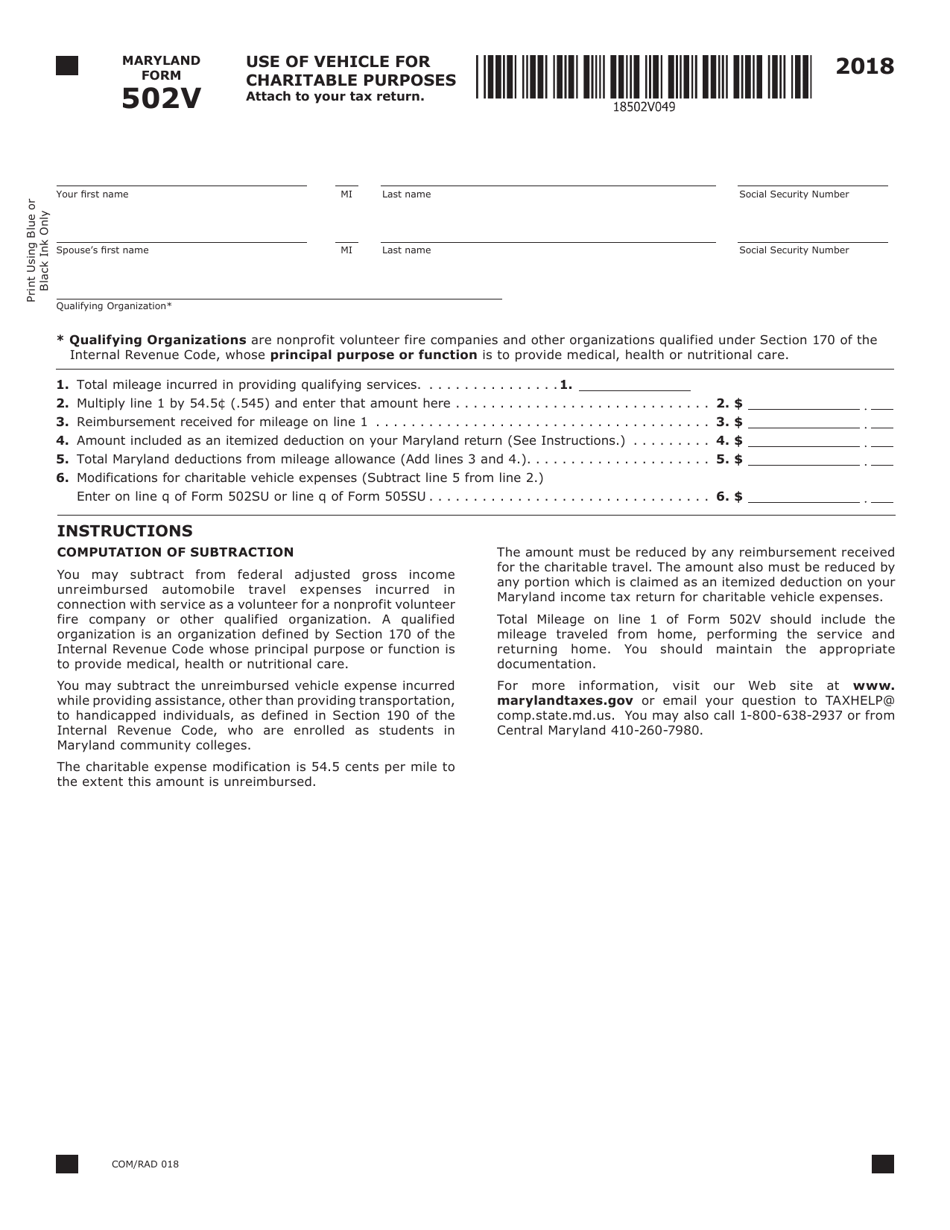

Form COM / RAD018 (Maryland Form 502V) Charitable Purposes - Maryland

What Is Form COM/RAD018 (Maryland Form 502V)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD018?

A: Form COM/RAD018, also known as Maryland Form 502V, is a tax form used for reporting charitable contributions made in the state of Maryland.

Q: Who needs to fill out Form COM/RAD018?

A: Anyone who made charitable contributions in Maryland may need to fill out Form COM/RAD018.

Q: What are charitable contributions?

A: Charitable contributions are donations made to qualifying organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code.

Q: What information is required on Form COM/RAD018?

A: Form COM/RAD018 requires you to provide your personal information, details about the charitable organization you donated to, and the amount of your contribution.

Q: Is Form COM/RAD018 only for Maryland residents?

A: No, Form COM/RAD018 is required for anyone who made charitable contributions in Maryland, regardless of residency.

Q: When is the deadline to file Form COM/RAD018?

A: The deadline to file Form COM/RAD018 is typically the same as the deadline for filing your Maryland income tax return, which is April 15th.

Q: Can I claim charitable contributions as a deduction on my taxes?

A: Yes, qualifying charitable contributions can be claimed as a deduction on your federal and state income tax returns.

Q: Do I need to attach any supporting documents with Form COM/RAD018?

A: Generally, you do not need to attach supporting documents when filing Form COM/RAD018. However, it is important to keep records of your charitable contributions in case of an audit.

Q: What happens if I don't file Form COM/RAD018?

A: Failure to file Form COM/RAD018 and report your charitable contributions may result in penalties or the disallowance of your charitable deduction.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD018 (Maryland Form 502V) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.