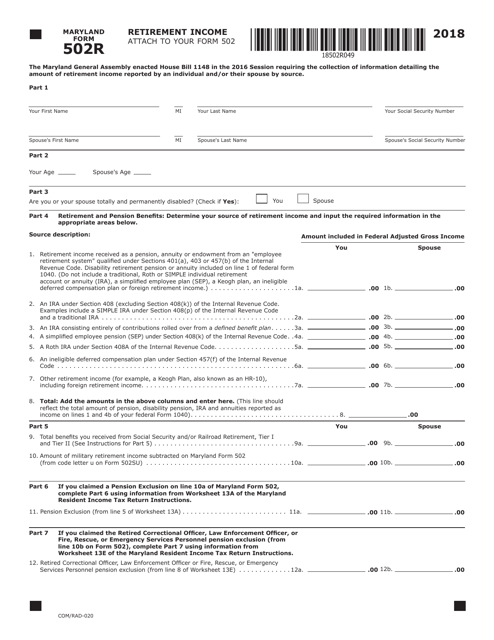

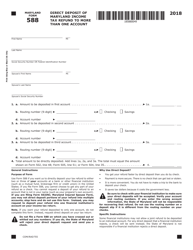

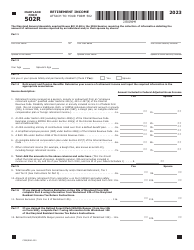

Form COM / RAD-020 (Maryland Form 502R) Retirement Income - Maryland

What Is Form COM/RAD-020 (Maryland Form 502R)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD-020?

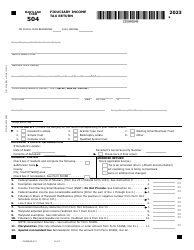

A: Form COM/RAD-020, also known as Maryland Form 502R, is used to report retirement income for Maryland residents.

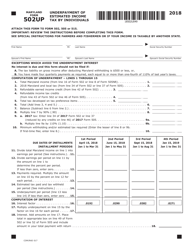

Q: Who needs to file Form COM/RAD-020?

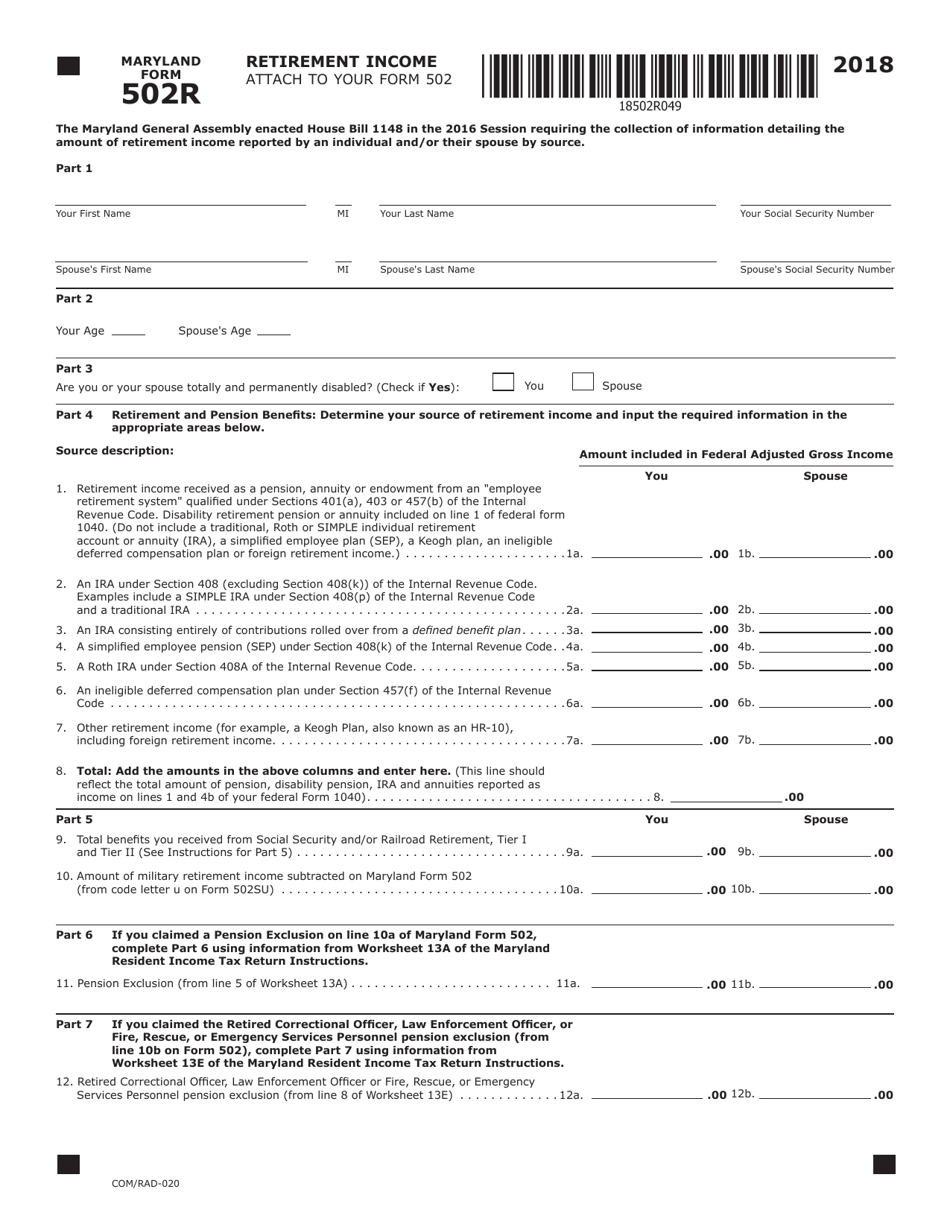

A: Maryland residents who have received retirement income during the tax year need to file Form COM/RAD-020.

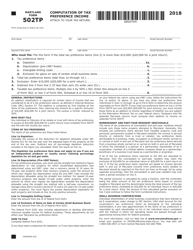

Q: What is considered retirement income?

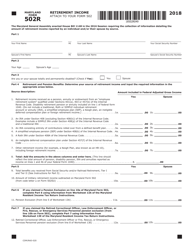

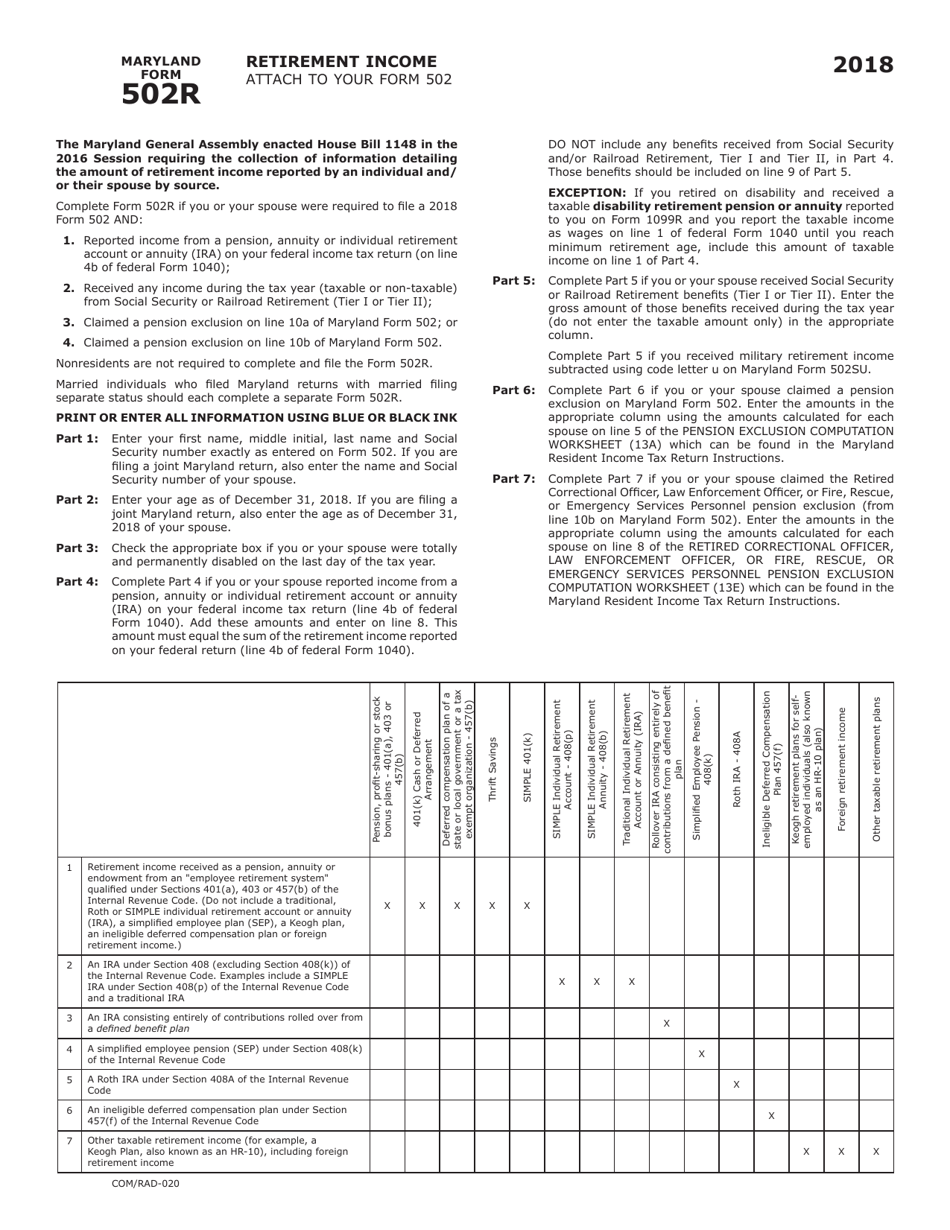

A: Retirement income includes pensions, annuities, Social Security benefits, and IRA distributions, among other sources.

Q: When is the deadline to file Form COM/RAD-020?

A: The deadline to file Form COM/RAD-020 is the same as the Maryland state tax return deadline, which is typically April 15th.

Q: How do I file Form COM/RAD-020?

A: Form COM/RAD-020 can be filed electronically or by mail. Instructions for both methods are provided on the form itself.

Q: Are there any exemptions or deductions available for retirement income?

A: Yes, there are certain exemptions and deductions available for retirement income in Maryland. It's recommended to review the specific instructions and requirements on the form.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD-020 (Maryland Form 502R) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.