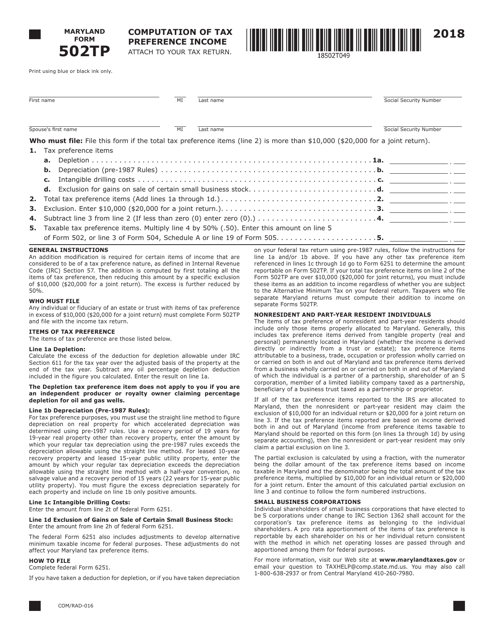

Form COM / RAD-016 (Maryland Form 502TP) Computation of Tax Preference Income - Maryland

What Is Form COM/RAD-016 (Maryland Form 502TP)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form COM/RAD-016?

A: Form COM/RAD-016 is also known as Maryland Form 502TP. It is used to compute Tax Preference Income in Maryland.

Q: What is Tax Preference Income?

A: Tax Preference Income refers to certain types of income that may receive preferential tax treatment in Maryland.

Q: Who needs to file Form COM/RAD-016?

A: Anyone who has tax preference income in Maryland must file Form COM/RAD-016.

Q: Is Form COM/RAD-016 applicable only for residents of Maryland?

A: Yes, Form COM/RAD-016 is specific to Maryland and is applicable only for residents of the state.

Q: Are there any instructions or guidelines available for completing Form COM/RAD-016?

A: Yes, the Maryland Comptroller's office provides detailed instructions and guidelines to help taxpayers complete Form COM/RAD-016 correctly.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD-016 (Maryland Form 502TP) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.