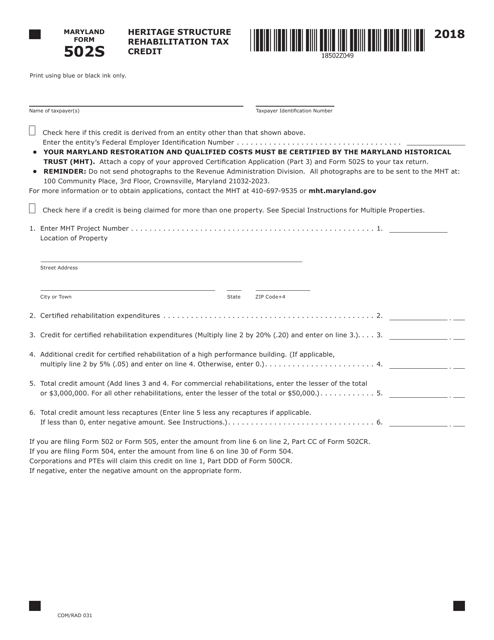

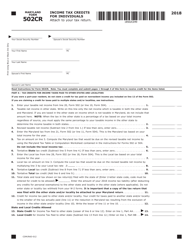

Form COM / RAD031 (Maryland Form 502S) Heritage Structure Rehabilitation Tax Credit - Maryland

What Is Form COM/RAD031 (Maryland Form 502S)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the COM/RAD031 form?

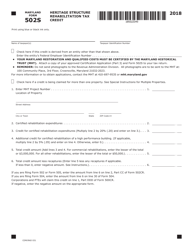

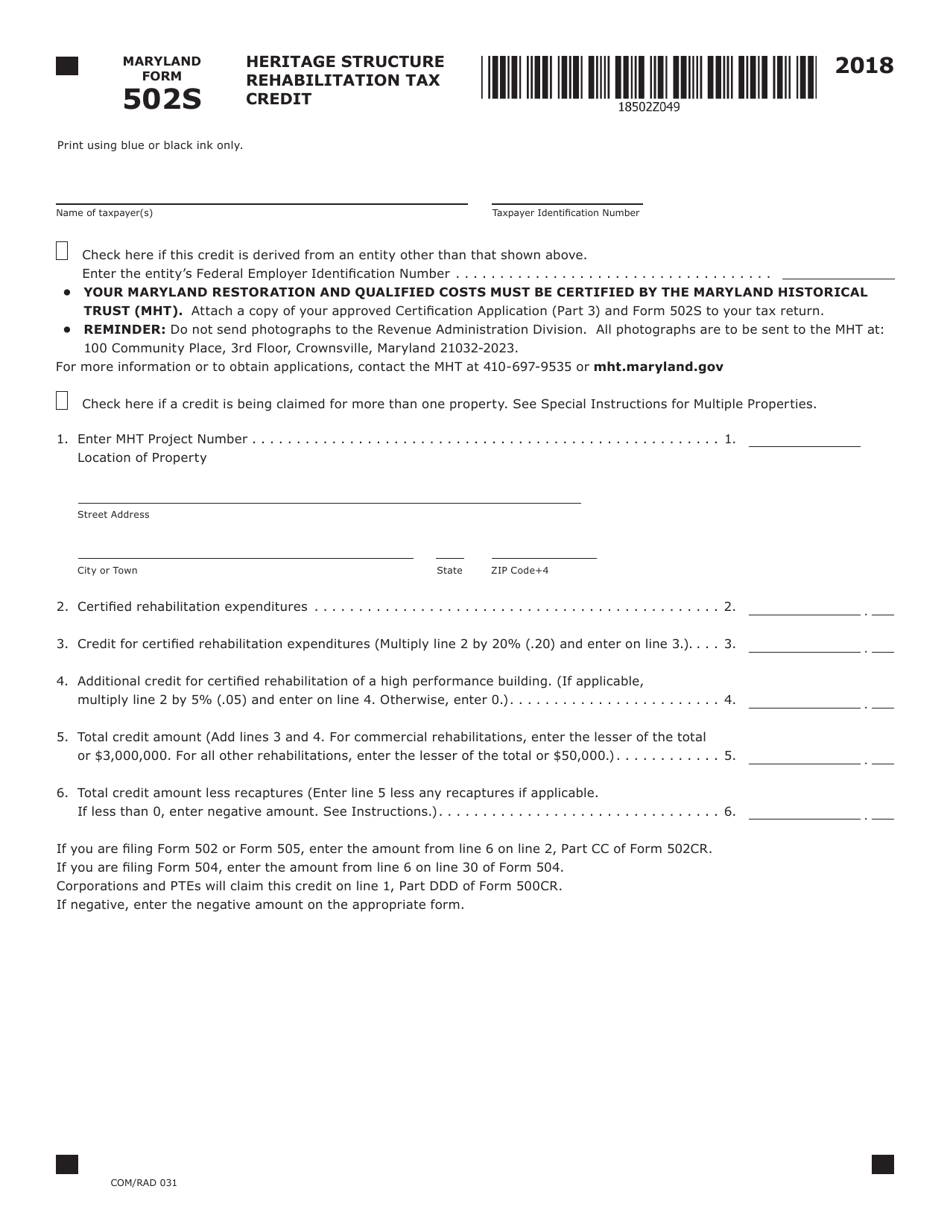

A: The COM/RAD031 form is also known as the Maryland Form 502S, and it is used to apply for the Heritage Structure Rehabilitation Tax Credit in Maryland.

Q: What is the Heritage Structure Rehabilitation Tax Credit?

A: The Heritage Structure Rehabilitation Tax Credit is a tax credit offered in Maryland to incentivize the rehabilitation and preservation of historic structures.

Q: Who can claim the Heritage Structure Rehabilitation Tax Credit?

A: Property owners who undertake qualified rehabilitation projects on eligible historic structures in Maryland can claim the tax credit.

Q: What is the purpose of the COM/RAD031 form?

A: The purpose of the COM/RAD031 form is to provide the necessary information and documentation for property owners to apply for the Heritage Structure Rehabilitation Tax Credit.

Q: Is the Heritage Structure Rehabilitation Tax Credit refundable?

A: Yes, the Heritage Structure Rehabilitation Tax Credit is refundable, which means that if the amount of credit exceeds the taxpayer's tax liability, the excess will be refunded to the taxpayer.

Q: Are there any requirements to be eligible for the Heritage Structure Rehabilitation Tax Credit?

A: Yes, there are certain requirements that must be met to be eligible for the Heritage Structure Rehabilitation Tax Credit, such as the structure being listed on the National Register of Historic Places or located in a designated historic district.

Q: What expenses can be claimed for the Heritage Structure Rehabilitation Tax Credit?

A: Expenses related to the rehabilitation and preservation of the historic structure, such as construction costs and architectural fees, can be claimed for the Heritage Structure Rehabilitation Tax Credit.

Q: What is the maximum amount of the Heritage Structure Rehabilitation Tax Credit?

A: The maximum amount of the Heritage Structure Rehabilitation Tax Credit is 20% of the qualified rehabilitation expenses, up to a maximum credit of $3 million.

Q: What is the deadline to submit the COM/RAD031 form?

A: The COM/RAD031 form must be submitted within three years after the completion of the rehabilitation project.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COM/RAD031 (Maryland Form 502S) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.