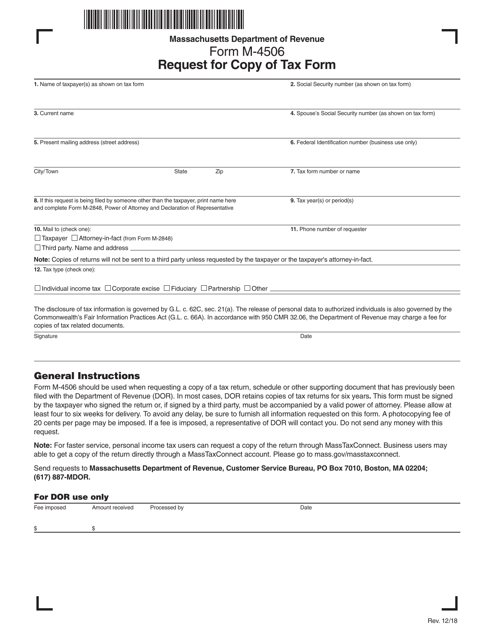

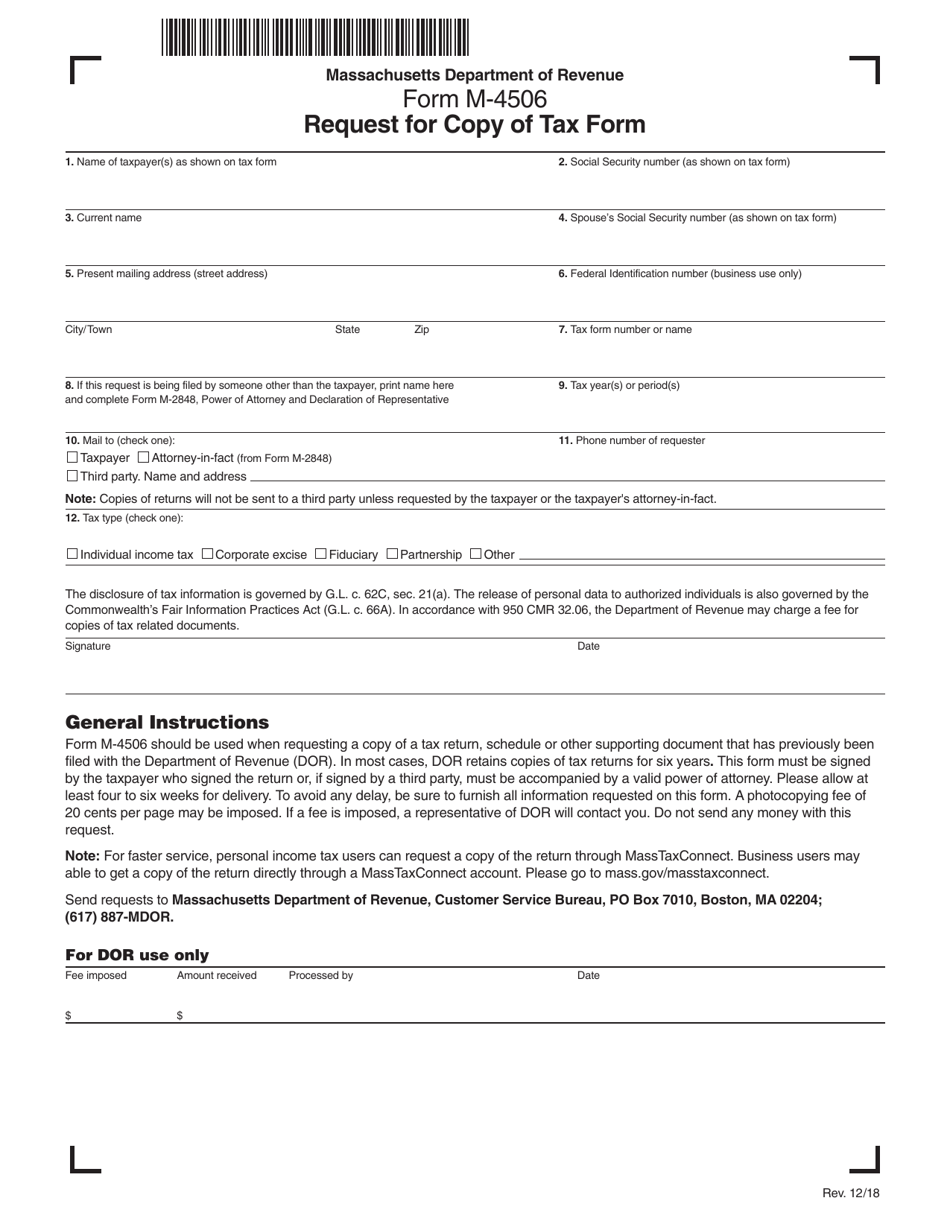

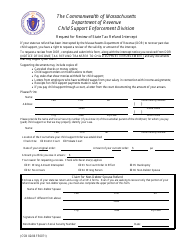

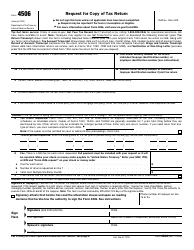

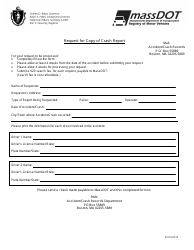

Form M-4506 Request for Copy of Tax Form - Massachusetts

What Is Form M-4506?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-4506?

A: Form M-4506 is a request form used to obtain a copy of your tax form in Massachusetts.

Q: What can I use Form M-4506 for?

A: You can use Form M-4506 to request a copy of your tax form in Massachusetts.

Q: What information do I need to provide on Form M-4506?

A: You will need to provide your name, social security number, tax year, and the type of tax form you are requesting.

Q: How long does it take to receive a copy of my tax form after submitting Form M-4506?

A: It typically takes 10-15 business days to receive a copy of your tax form after submitting Form M-4506.

Q: Can I submit Form M-4506 electronically?

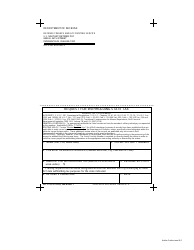

A: No, Form M-4506 cannot be submitted electronically. It must be mailed or faxed to the Massachusetts Department of Revenue.

Q: What if I need a copy of my tax form for a specific year?

A: If you need a copy of your tax form for a specific year, you should indicate the tax year on Form M-4506.

Q: Can someone else request a copy of my tax form using Form M-4506?

A: Yes, someone else can request a copy of your tax form using Form M-4506 if they have your written permission or power of attorney.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-4506 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.