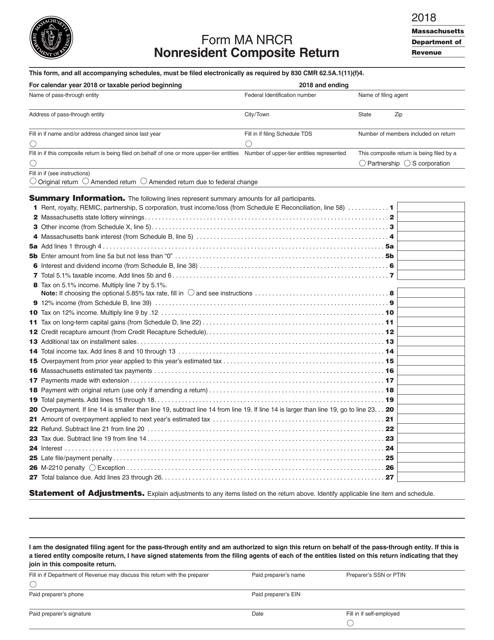

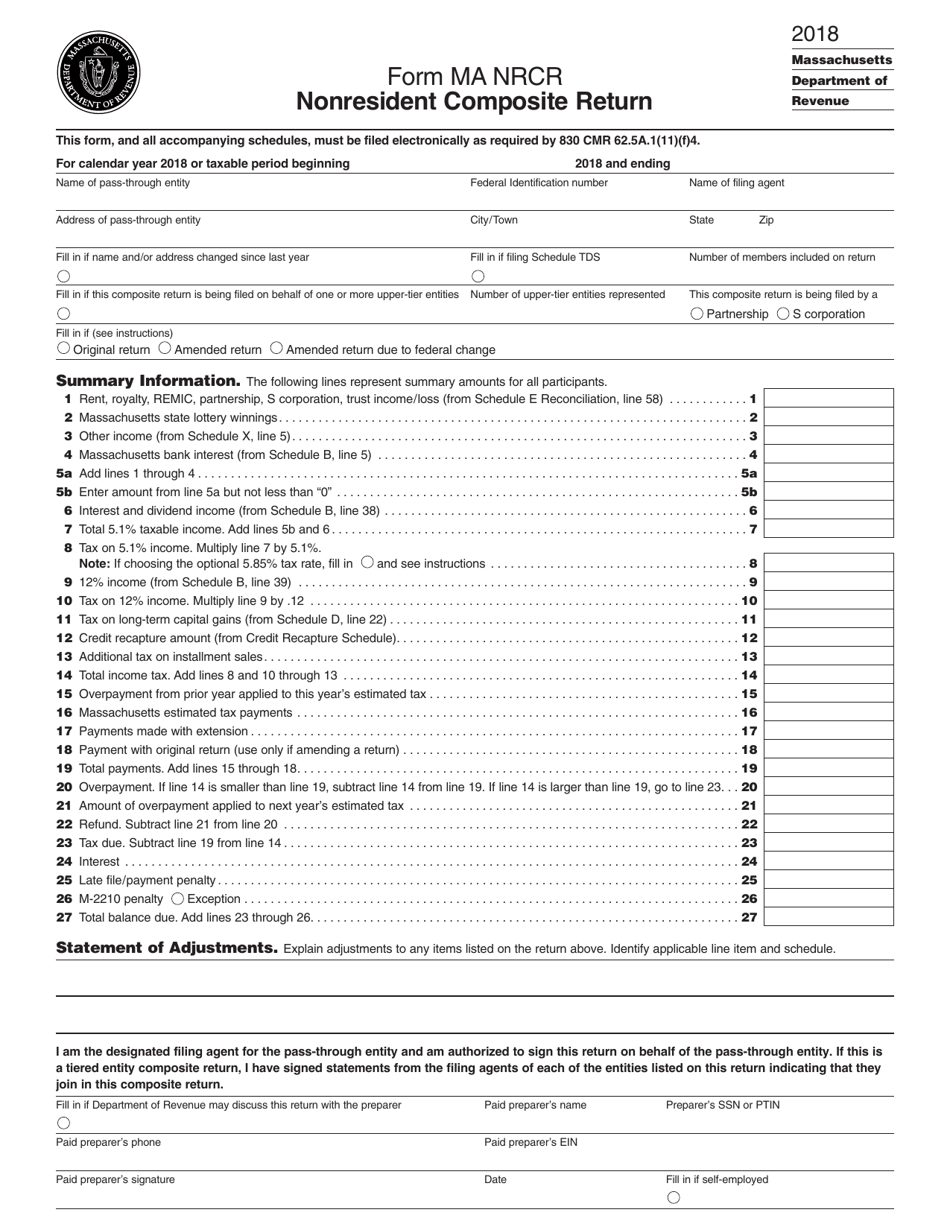

Form MA Nonresident Composite Return - Massachusetts

What Is Form MA?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

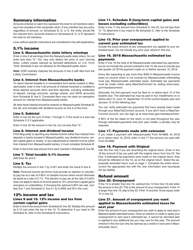

Q: What is Form MA Nonresident Composite Return?

A: Form MA Nonresident Composite Return is a tax form used by nonresident individuals to report and pay their income tax in Massachusetts.

Q: Who needs to file Form MA Nonresident Composite Return?

A: Nonresident individuals who have income from Massachusetts sources and are not required to file an individual income tax return in Massachusetts need to file Form MA Nonresident Composite Return.

Q: What is the purpose of filing Form MA Nonresident Composite Return?

A: The purpose of filing Form MA Nonresident Composite Return is to report and pay any income tax owed to Massachusetts for nonresidents.

Q: When is the deadline for filing Form MA Nonresident Composite Return?

A: The deadline for filing Form MA Nonresident Composite Return is the same as the deadline for filing individual income tax returns in Massachusetts, which is usually April 15th.

Q: Are there any penalties for late filing or non-filing of Form MA Nonresident Composite Return?

A: Yes, there are penalties for late filing or non-filing of Form MA Nonresident Composite Return. It is important to file the form and pay any tax owed by the deadline to avoid penalties.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MA by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.