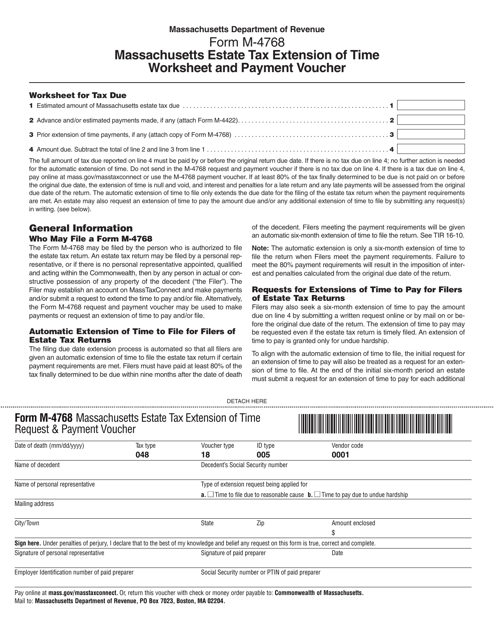

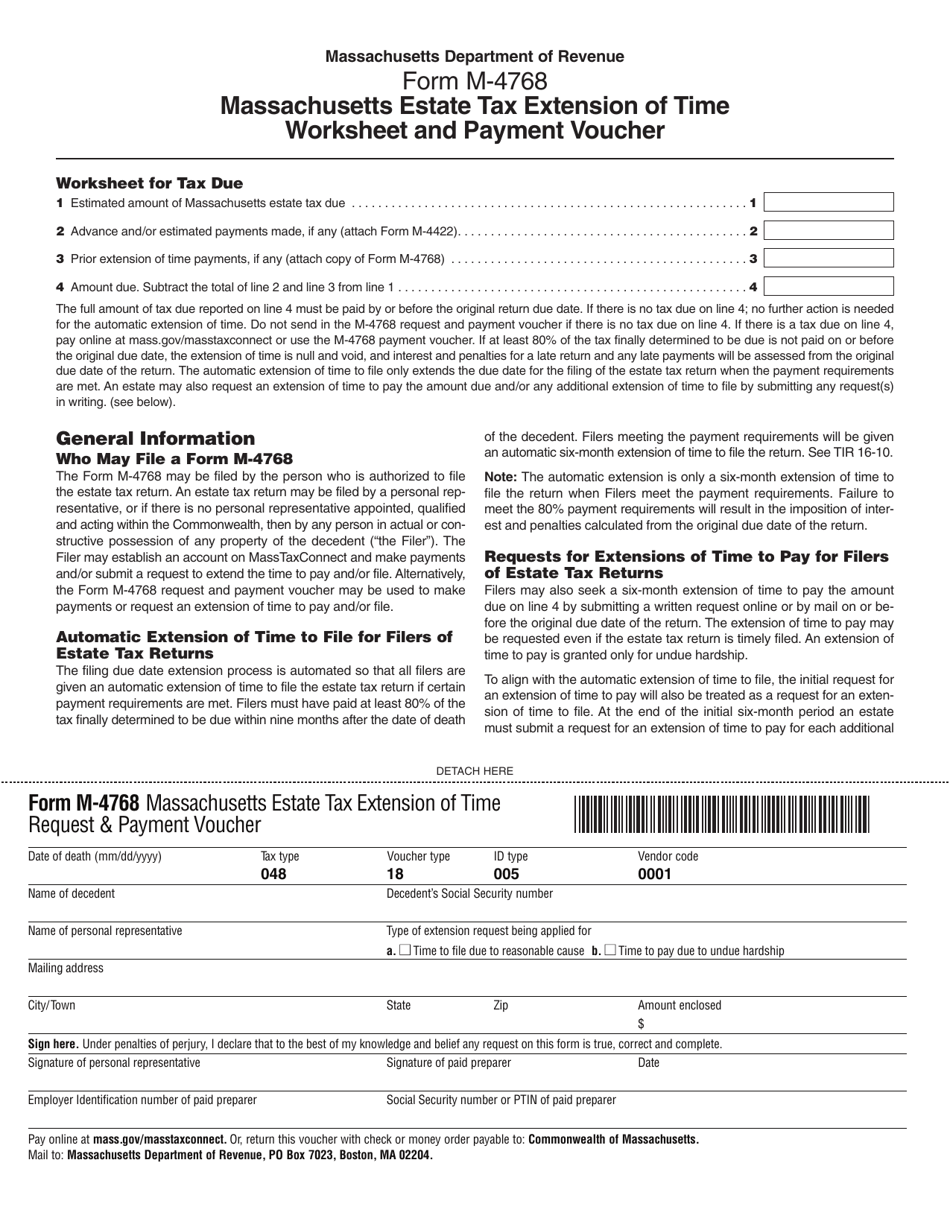

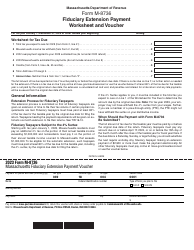

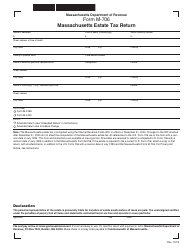

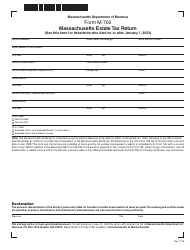

Form M-4768 Estate Tax Extension of Time Worksheet and Payment Voucher - Massachusetts

What Is Form M-4768?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-4768?

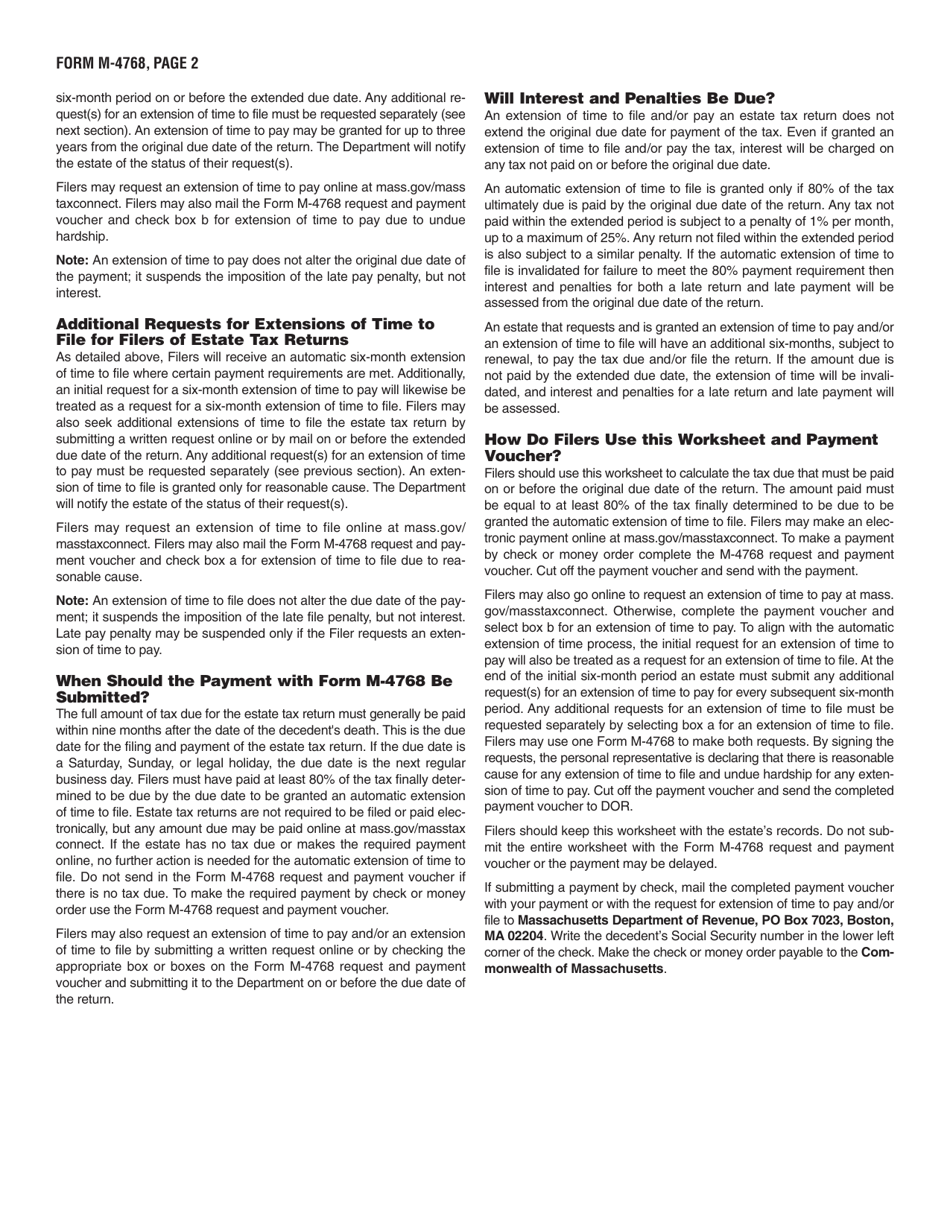

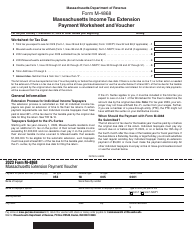

A: Form M-4768 is a worksheet and payment voucher used to request an extension of time to file the Estate Tax return in Massachusetts.

Q: Who needs to use Form M-4768?

A: Anyone who needs additional time to file their Estate Tax return in Massachusetts should use Form M-4768 to request an extension.

Q: How do I use Form M-4768?

A: To use Form M-4768, you need to fill out the worksheet section to calculate your estimated estate tax liability and the payment voucher section to make an estimated payment.

Q: What is the deadline to file Form M-4768?

A: Form M-4768 must be filed on or before the original due date of your Estate Tax return in Massachusetts.

Q: Is there a fee for filing Form M-4768?

A: No, there is no fee for filing Form M-4768 in Massachusetts.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-4768 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.