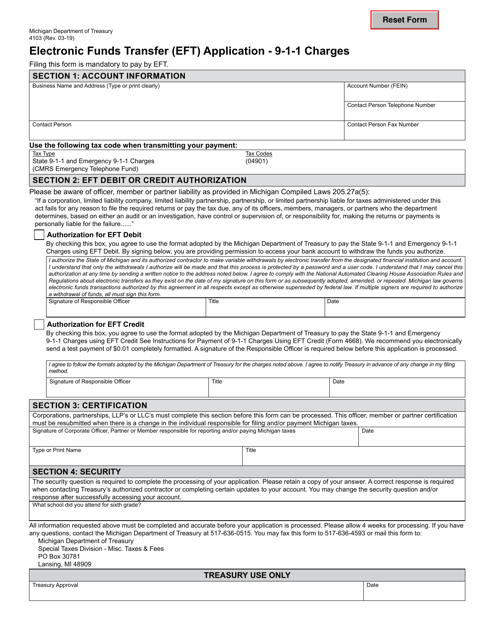

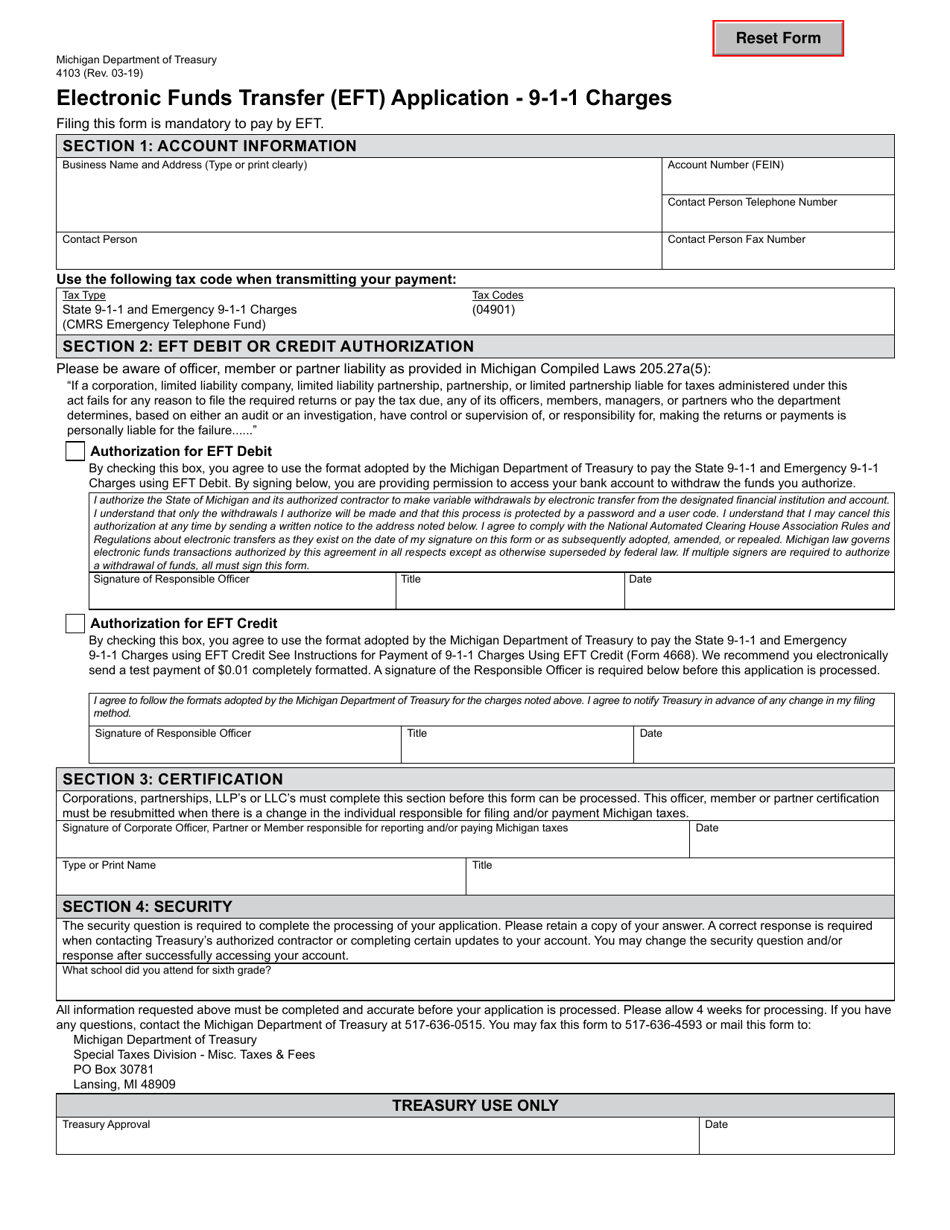

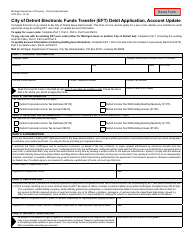

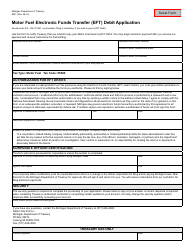

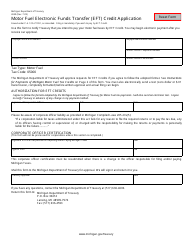

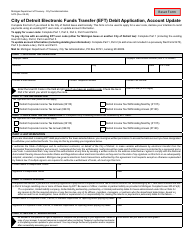

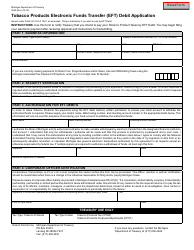

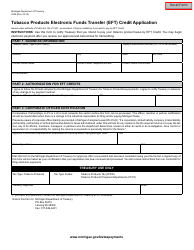

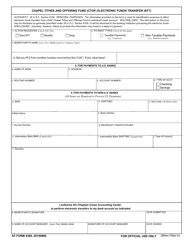

Form 4103 Electronic Funds Transfer (Eft) Application - 9-1-1 Charges - Michigan

What Is Form 4103?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4103?

A: Form 4103 is the Electronic Funds Transfer (EFT) Application specifically for 9-1-1 charges in Michigan.

Q: What does EFT stand for?

A: EFT stands for Electronic Funds Transfer.

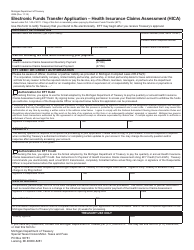

Q: What are 9-1-1 charges?

A: 9-1-1 charges are fees imposed on telecommunications customers to support the operation of emergency call response services.

Q: Who is required to use Form 4103?

A: Telecommunications service providers in Michigan who collect 9-1-1 charges from their customers are required to use Form 4103 for electronic funds transfer.

Q: Why is Form 4103 important?

A: Form 4103 is important because it ensures the timely and accurate transfer of funds for 9-1-1 charges, allowing for the smooth operation of emergency call response services.

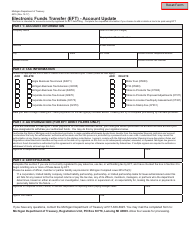

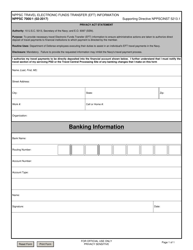

Q: What information is required on Form 4103?

A: Form 4103 requires information such as the telecommunications service provider's name, address, bank account details, and the total amount of 9-1-1 charges collected.

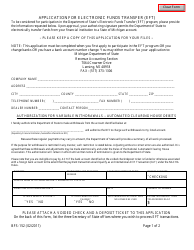

Q: Are there any deadlines for submitting Form 4103?

A: Yes, Form 4103 must be submitted by the 20th day of the month following the end of the calendar quarter.

Q: What happens if Form 4103 is not submitted on time?

A: Failure to submit Form 4103 on time may result in penalties and interest charges.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4103 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.