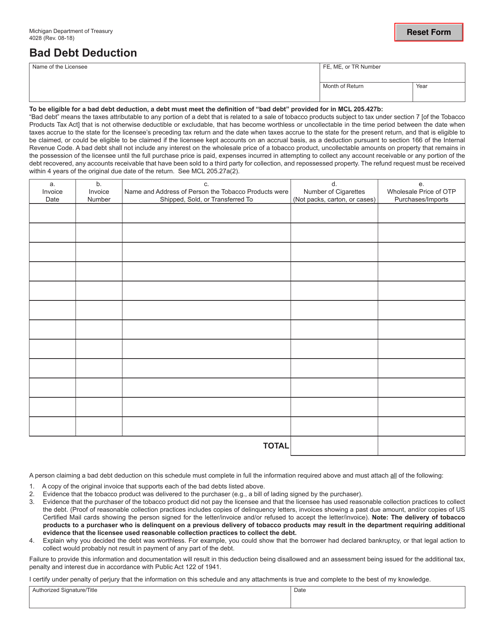

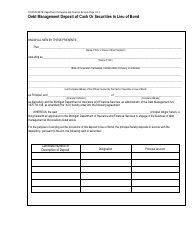

Form 4028 Bad Debt Deduction - Michigan

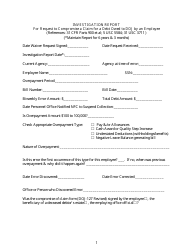

What Is Form 4028?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4028?

A: Form 4028 is a form used to claim a bad debt deduction in Michigan.

Q: What is a bad debt deduction?

A: A bad debt deduction allows you to deduct a debt that you are unable to collect.

Q: Who is eligible to claim a bad debt deduction?

A: Individuals, businesses, and corporations in Michigan may be eligible to claim a bad debt deduction.

Q: What types of debts can be claimed as bad debts?

A: Business loans, credit card debts, and unpaid invoices can all be claimed as bad debts.

Q: How do I claim a bad debt deduction in Michigan?

A: You can claim a bad debt deduction in Michigan by completing Form 4028 and attaching it to your tax return.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4028 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.