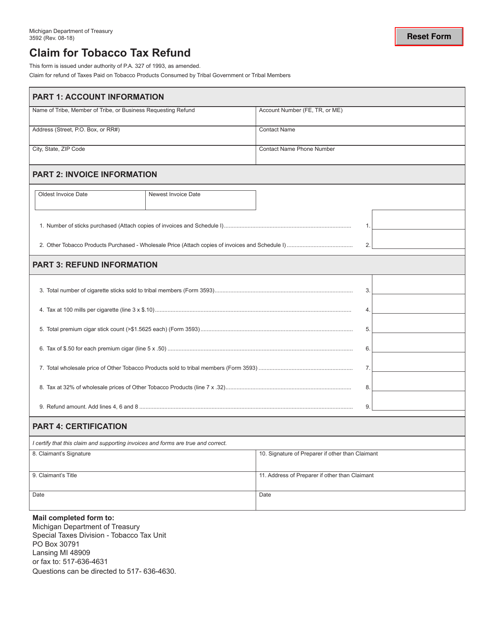

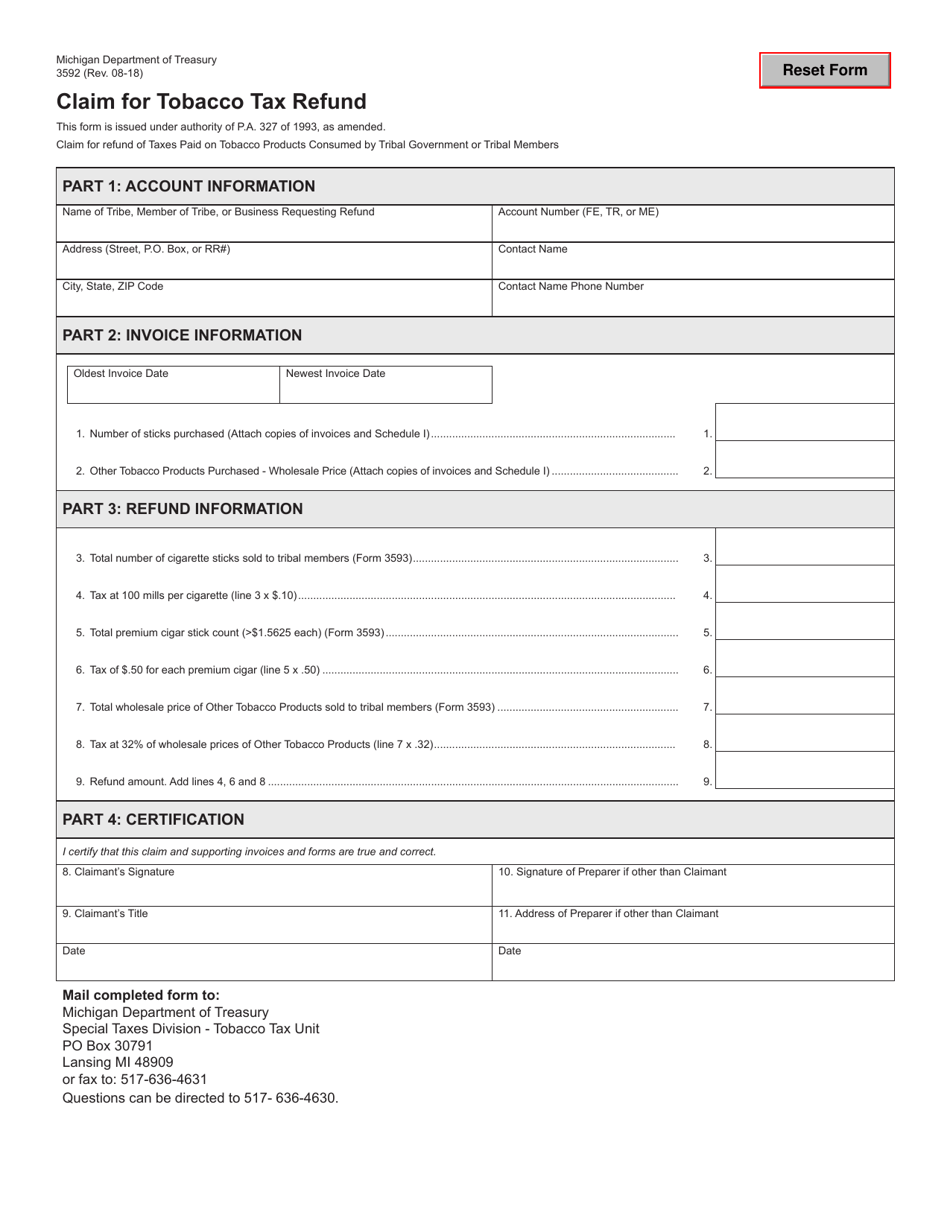

Form 3592 Claim for Tobacco Tax Refund - Michigan

What Is Form 3592?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3592?

A: Form 3592 is a claim for tobacco tax refund in the state of Michigan.

Q: Who can use Form 3592?

A: Form 3592 can be used by individuals or businesses who want to claim a refund on tobacco taxes paid in Michigan.

Q: What types of tobacco taxes can be claimed on Form 3592?

A: Form 3592 can be used to claim a refund on cigarette and other tobacco product taxes.

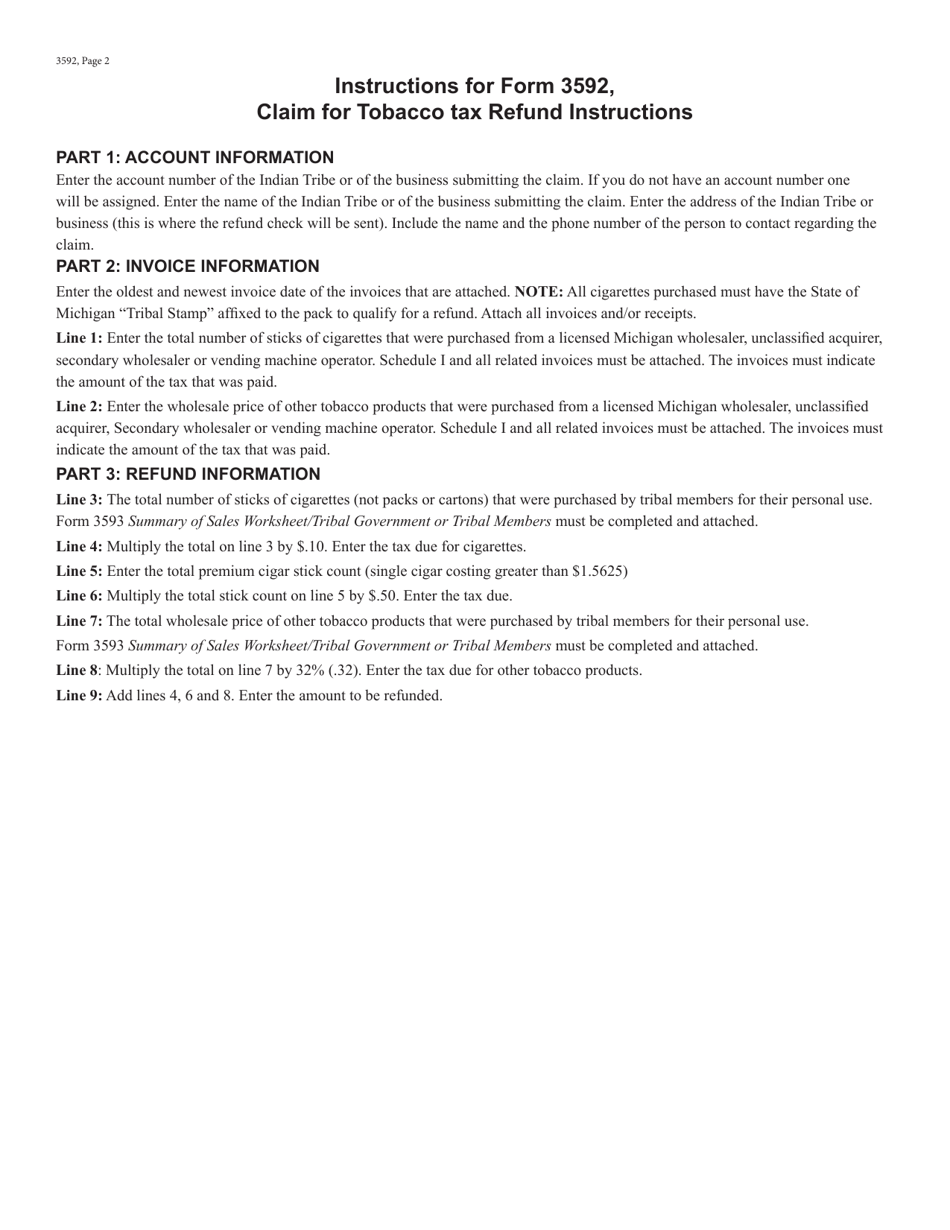

Q: How do I fill out Form 3592?

A: To fill out Form 3592, you will need to provide information about the type and quantity of tobacco products, the amount of tax paid, and any supporting documentation.

Q: Is there a deadline for submitting Form 3592?

A: Yes, Form 3592 must be submitted within three years from the date the tobacco tax was paid.

Q: How long does it take to receive a refund after submitting Form 3592?

A: The processing time for refund claims can vary, but you can expect to receive your refund within a few weeks to a few months.

Q: Can I file Form 3592 electronically?

A: No, Form 3592 must be filed by mail and cannot be submitted electronically.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3592 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.