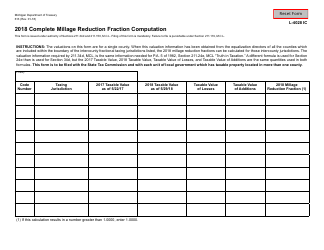

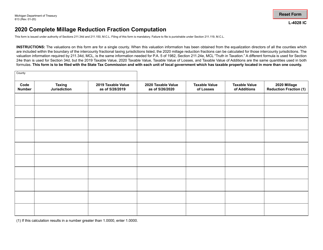

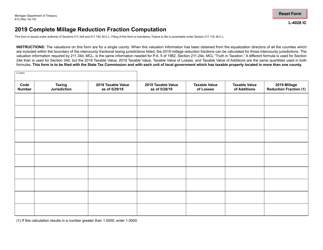

This version of the form is not currently in use and is provided for reference only. Download this version of

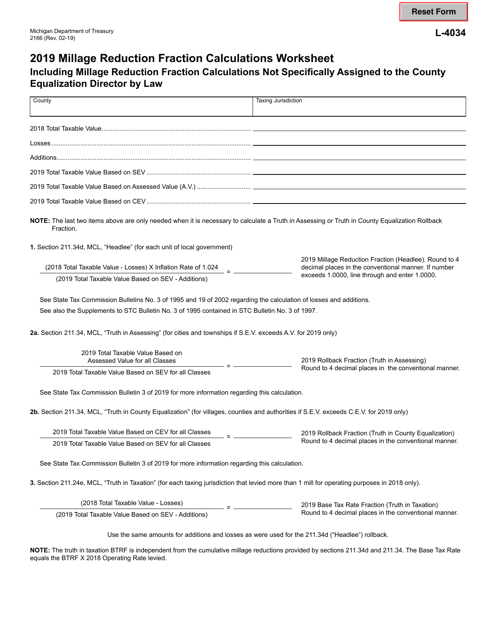

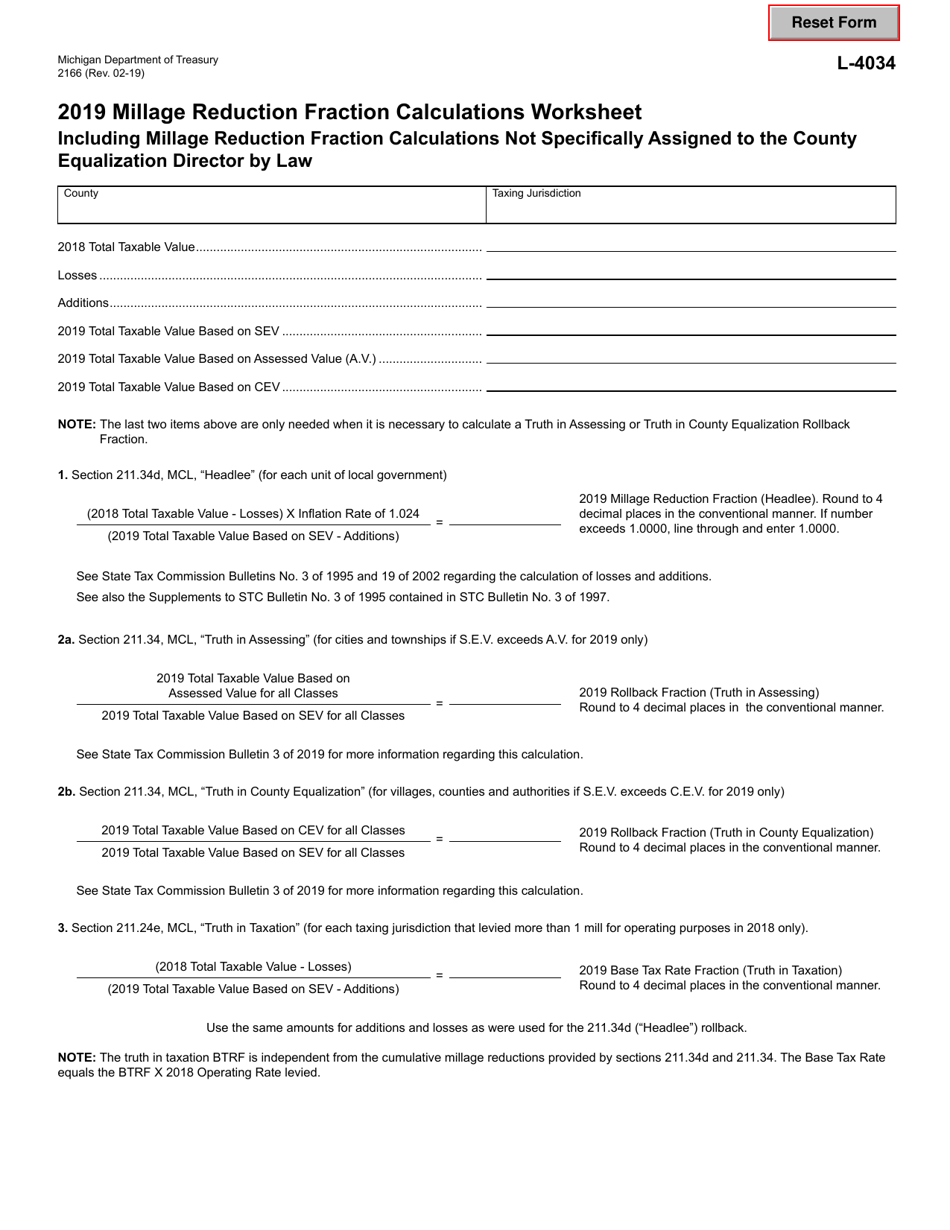

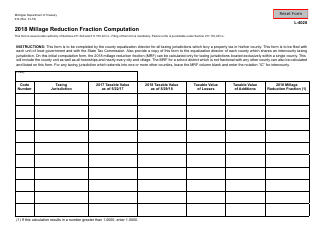

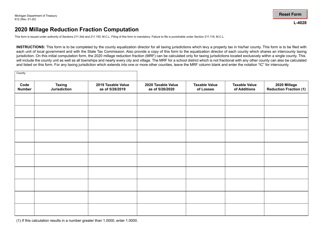

Form 2166 (L-4034)

for the current year.

Form 2166 (L-4034) Millage Reduction Fraction Calculations Worksheet - Michigan

What Is Form 2166 (L-4034)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2166 (L-4034)?

A: Form 2166 (L-4034) is the Millage Reduction Fraction Calculations Worksheet used in Michigan.

Q: What is the purpose of Form 2166 (L-4034)?

A: The purpose of Form 2166 (L-4034) is to calculate the Millage Reduction Fraction.

Q: Who uses Form 2166 (L-4034)?

A: Form 2166 (L-4034) is used by individuals, businesses, and organizations in Michigan.

Q: What does the Millage Reduction Fraction represent?

A: The Millage Reduction Fraction represents the decrease in property taxes due to the Headlee Amendment.

Q: How do I fill out Form 2166 (L-4034)?

A: Form 2166 (L-4034) has specific instructions on how to complete each section.

Q: Are there any filing deadlines for Form 2166 (L-4034)?

A: Yes, the filing deadlines for Form 2166 (L-4034) are determined by the Michigan Department of Treasury.

Q: What happens after I submit Form 2166 (L-4034)?

A: After submitting Form 2166 (L-4034), the Michigan Department of Treasury will review your calculation and determine the millage reduction.

Q: Can I file Form 2166 (L-4034) electronically?

A: Yes, Form 2166 (L-4034) can be filed electronically through the Michigan Department of Treasury's e-File system.

Q: Is there a fee for filing Form 2166 (L-4034)?

A: No, there is no fee for filing Form 2166 (L-4034).

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2166 (L-4034) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.