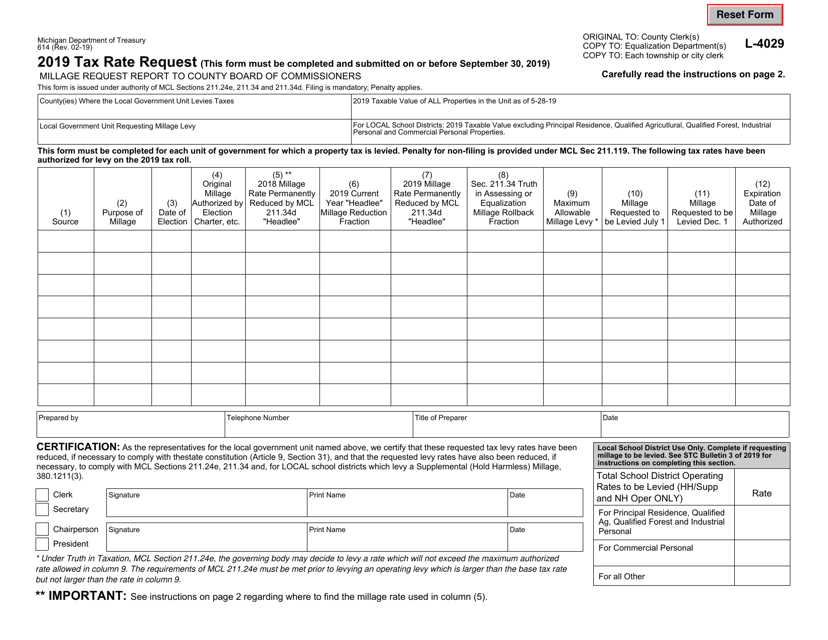

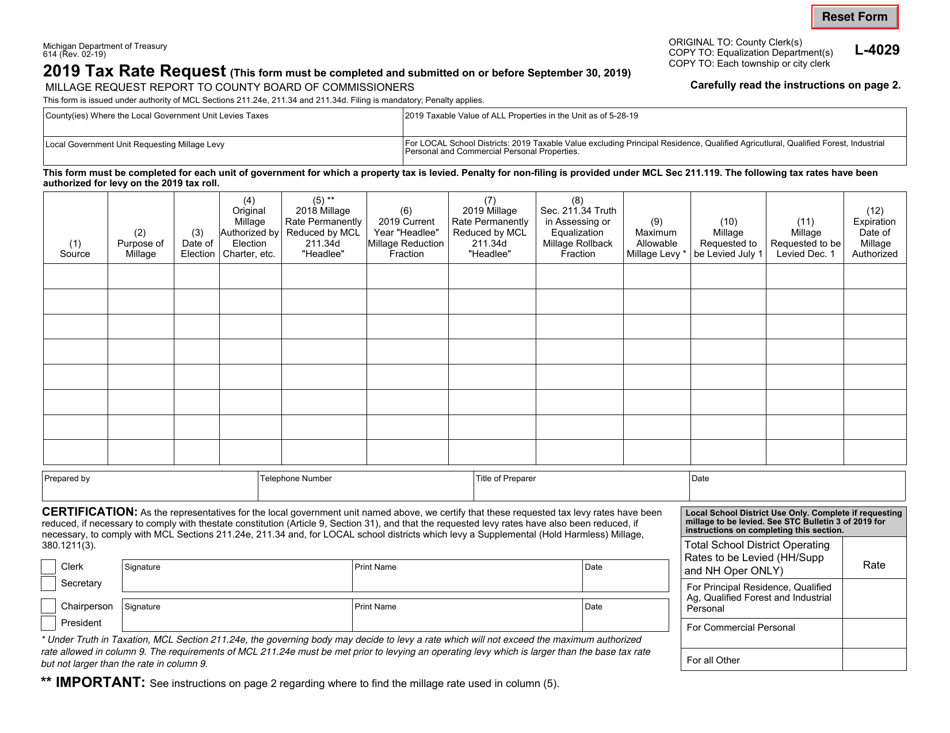

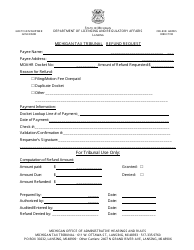

This version of the form is not currently in use and is provided for reference only. Download this version of

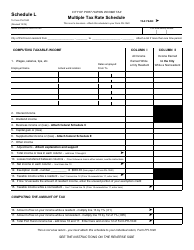

Form 614 (L-4029)

for the current year.

Form 614 (L-4029) Tax Rate Request - Michigan

What Is Form 614 (L-4029)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

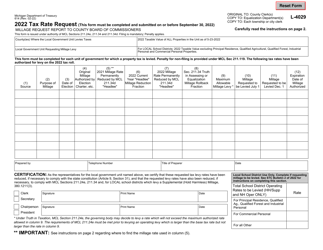

Q: What is Form 614?

A: Form 614 is the Tax Rate Request form in Michigan.

Q: What is the purpose of Form 614?

A: The purpose of Form 614 is to request a tax rate for a specific tax jurisdiction in Michigan.

Q: Who needs to fill out Form 614?

A: Employers in Michigan who wish to request a tax rate for a specific tax jurisdiction need to fill out Form 614.

Q: What information is required on Form 614?

A: Form 614 requires the employer's name, address, tax identification number, and the requested tax rate information.

Q: Is there a deadline for submitting Form 614?

A: Yes, Form 614 must be submitted by February 15th of the calendar year for which the requested tax rate applies.

Q: Are there any fees associated with Form 614?

A: No, there are no fees associated with submitting Form 614.

Q: Is it mandatory to fill out Form 614?

A: It is not mandatory to fill out Form 614, but it is required if an employer wishes to request a tax rate for a specific tax jurisdiction in Michigan.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 614 (L-4029) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.