This version of the form is not currently in use and is provided for reference only. Download this version of

Form 151

for the current year.

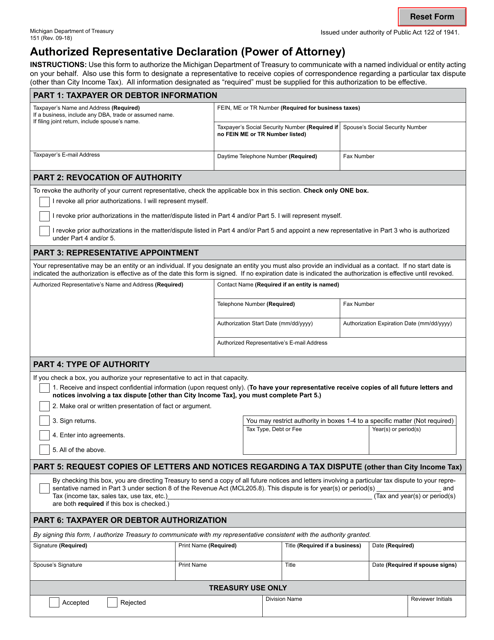

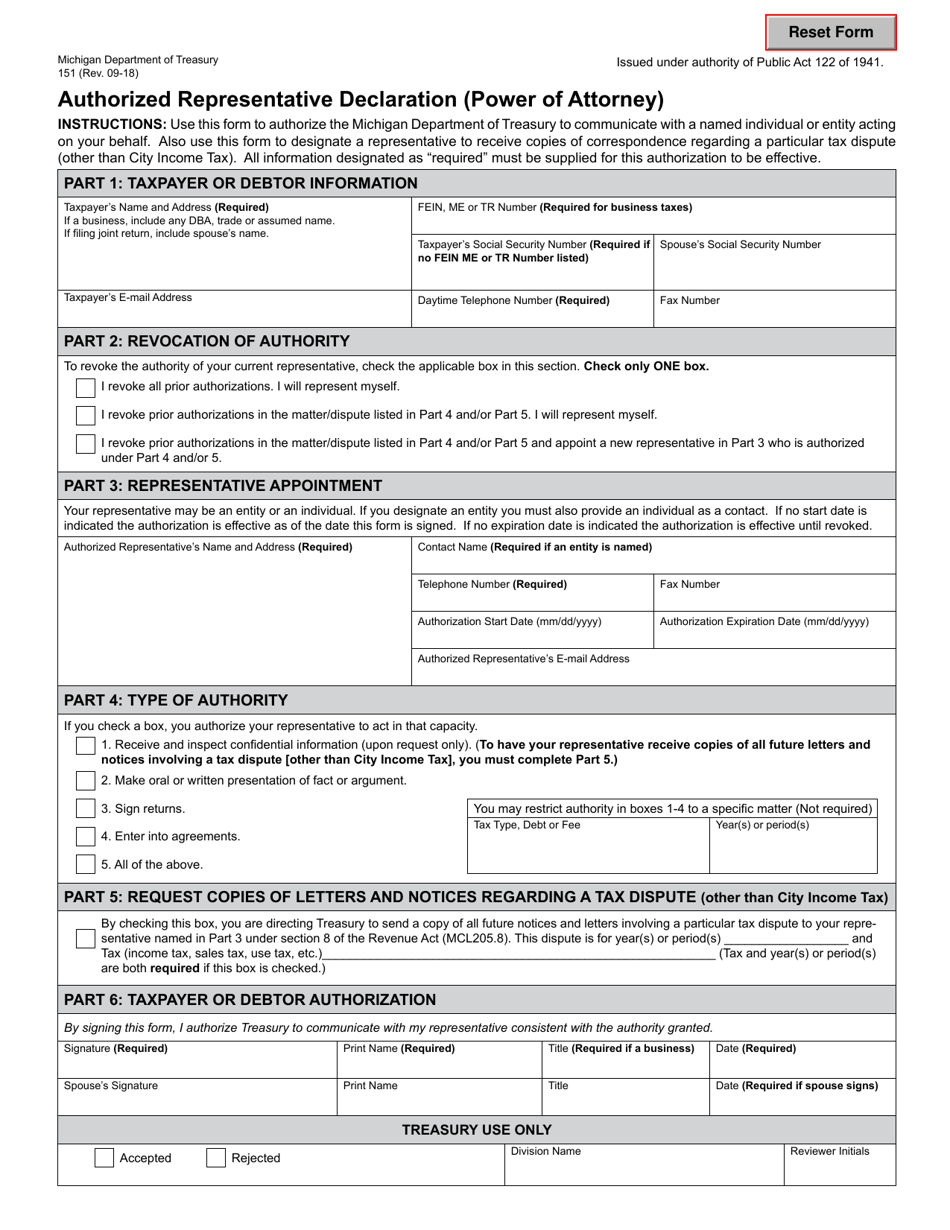

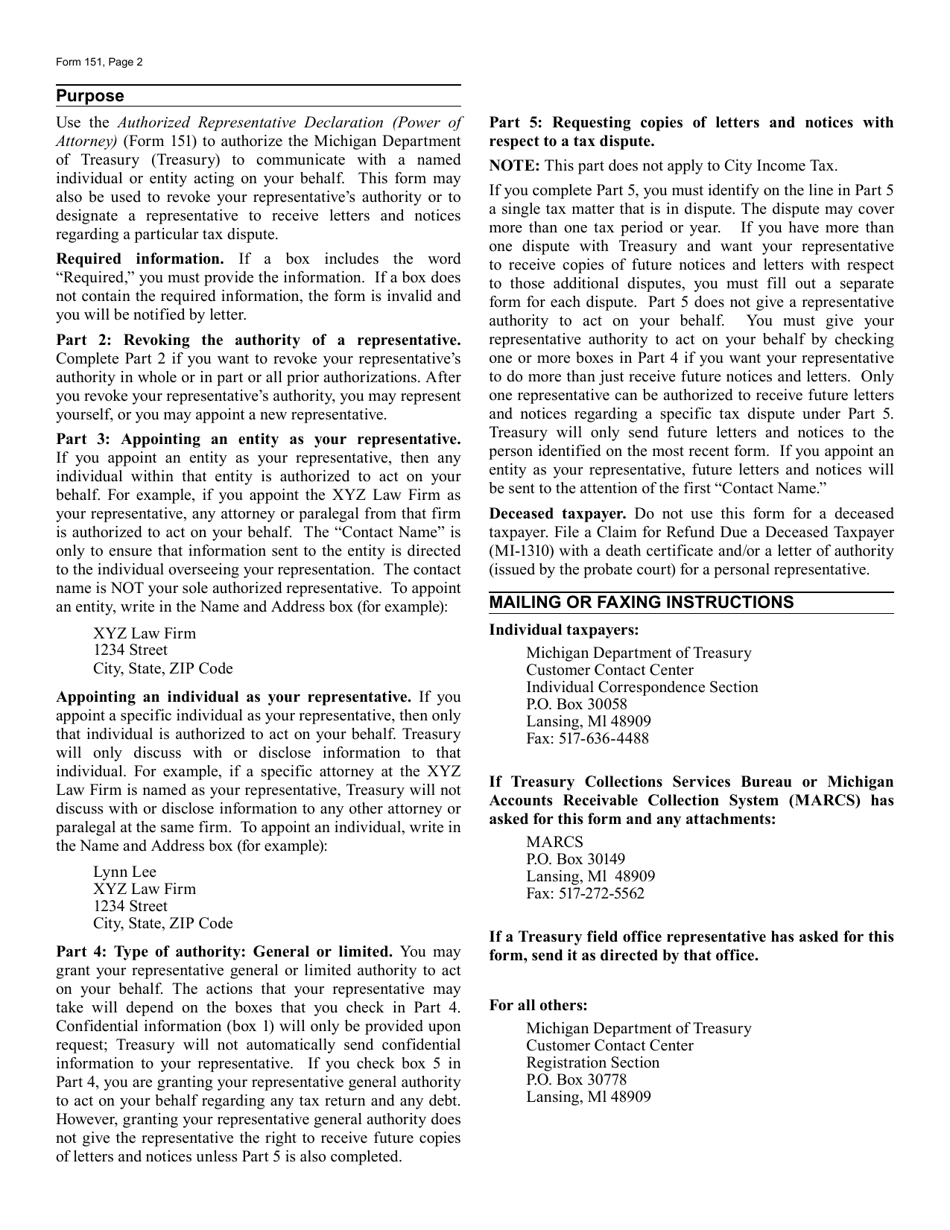

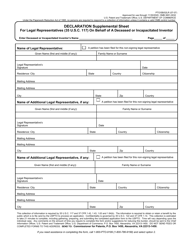

Form 151 Authorized Representative Declaration (Power of Attorney) - Michigan

What Is Form 151?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 151?

A: Form 151 is an Authorized Representative Declaration (Power of Attorney) in Michigan.

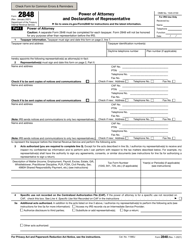

Q: What is the purpose of Form 151?

A: The purpose of Form 151 is to designate an authorized representative to act on behalf of a taxpayer in Michigan.

Q: Who can use Form 151?

A: Taxpayers in Michigan who want to authorize someone else to represent them in tax matters can use Form 151.

Q: What information is required on Form 151?

A: Form 151 requires the taxpayer's information, representative's information, and the tax periods or specific taxes covered by the authorization.

Q: Is there a fee to submit Form 151?

A: No, there is no fee to submit Form 151.

Q: Can more than one representative be designated on Form 151?

A: Yes, Form 151 allows for multiple authorized representatives to be designated.

Q: Is Form 151 valid for a specific period of time?

A: Form 151 remains valid until it is revoked or a new form is submitted.

Q: What does it mean to have an Authorized Representative?

A: Having an Authorized Representative means that the designated person has the authority to act on behalf of the taxpayer in tax matters.

Q: Can Form 151 be used for both individual and business taxes?

A: Yes, Form 151 can be used for both individual and business taxes in Michigan.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 151 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.