This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

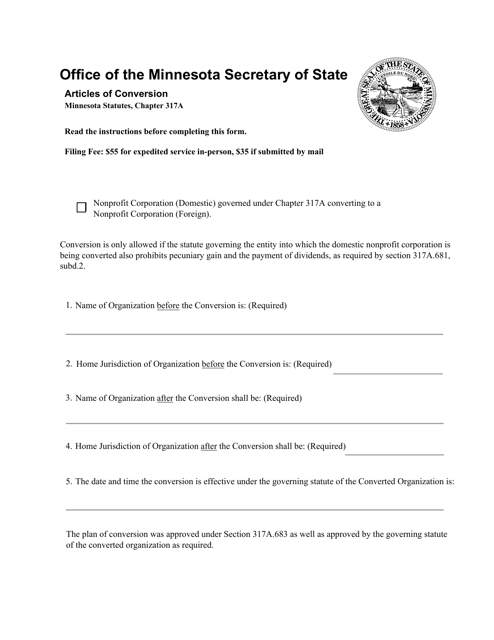

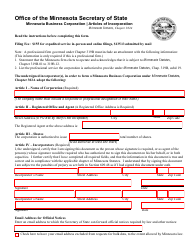

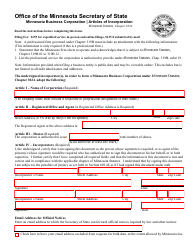

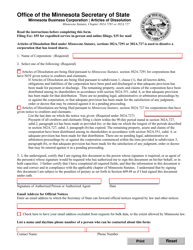

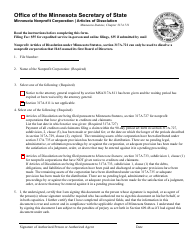

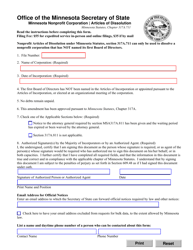

Non-profit Corporation Articles of Conversion - Minnesota

Non-profit Corporation Articles of Conversion is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What are Non-profit Corporation Articles of Conversion?

A: Non-profit Corporation Articles of Conversion are legal documents used when a non-profit corporation wants to convert to a different type of business entity.

Q: What is the purpose of the Non-profit Corporation Articles of Conversion?

A: The purpose of the Non-profit Corporation Articles of Conversion is to provide a formal record of the corporation's decision to convert and to ensure compliance with state laws.

Q: Is there a specific form for the Non-profit Corporation Articles of Conversion in Minnesota?

A: Yes, there is a specific form provided by the Minnesota Secretary of State that must be used for filing the Non-profit Corporation Articles of Conversion.

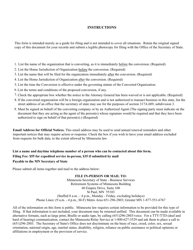

Q: What information is required in the Non-profit Corporation Articles of Conversion?

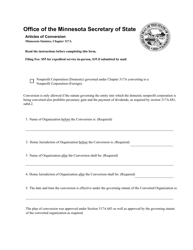

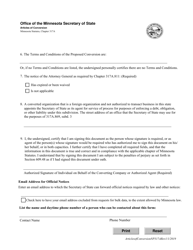

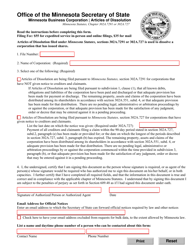

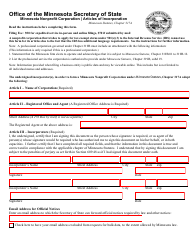

A: The Non-profit Corporation Articles of Conversion typically require information such as the corporation's name, registered office address, the type of business entity it intends to convert to, and the effective date of the conversion.

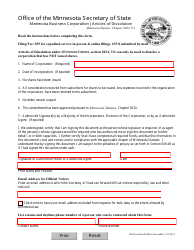

Q: Are there any fees associated with filing the Non-profit Corporation Articles of Conversion?

A: Yes, there are filing fees associated with the Non-profit Corporation Articles of Conversion. The fees vary depending on the type of conversion and the specific requirements of the state.

Q: What is the timeline for the processing of the Non-profit Corporation Articles of Conversion?

A: The timeline for processing the Non-profit Corporation Articles of Conversion may vary depending on the workload of the Secretary of State's office, but it typically takes a few weeks to a few months.

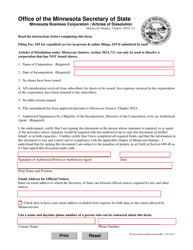

Q: Can a non-profit corporation convert to a for-profit corporation?

A: Yes, a non-profit corporation can convert to a for-profit corporation, but it must comply with the legal requirements and regulations of the state in which it operates.

Q: Are there any tax implications of converting a non-profit corporation to a different type of entity?

A: Yes, there may be tax implications when converting a non-profit corporation to a different type of entity. It is advisable to consult with a tax professional for guidance.

Q: Is legal assistance required for filing the Non-profit Corporation Articles of Conversion?

A: While it is not always required, it is highly recommended to seek legal assistance when filing the Non-profit Corporation Articles of Conversion to ensure compliance with all legal requirements and to avoid any potential issues.

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.