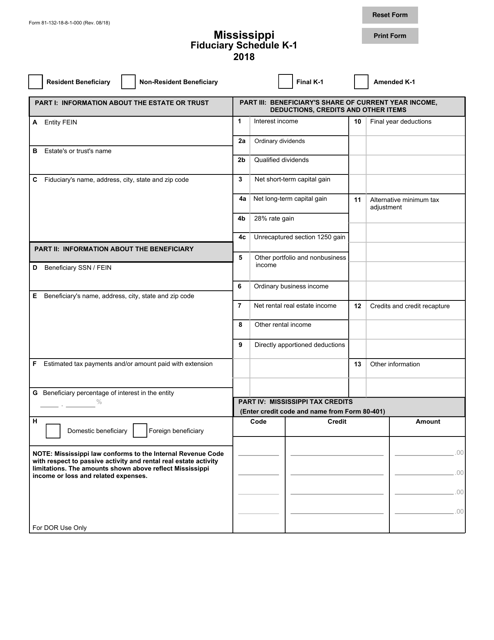

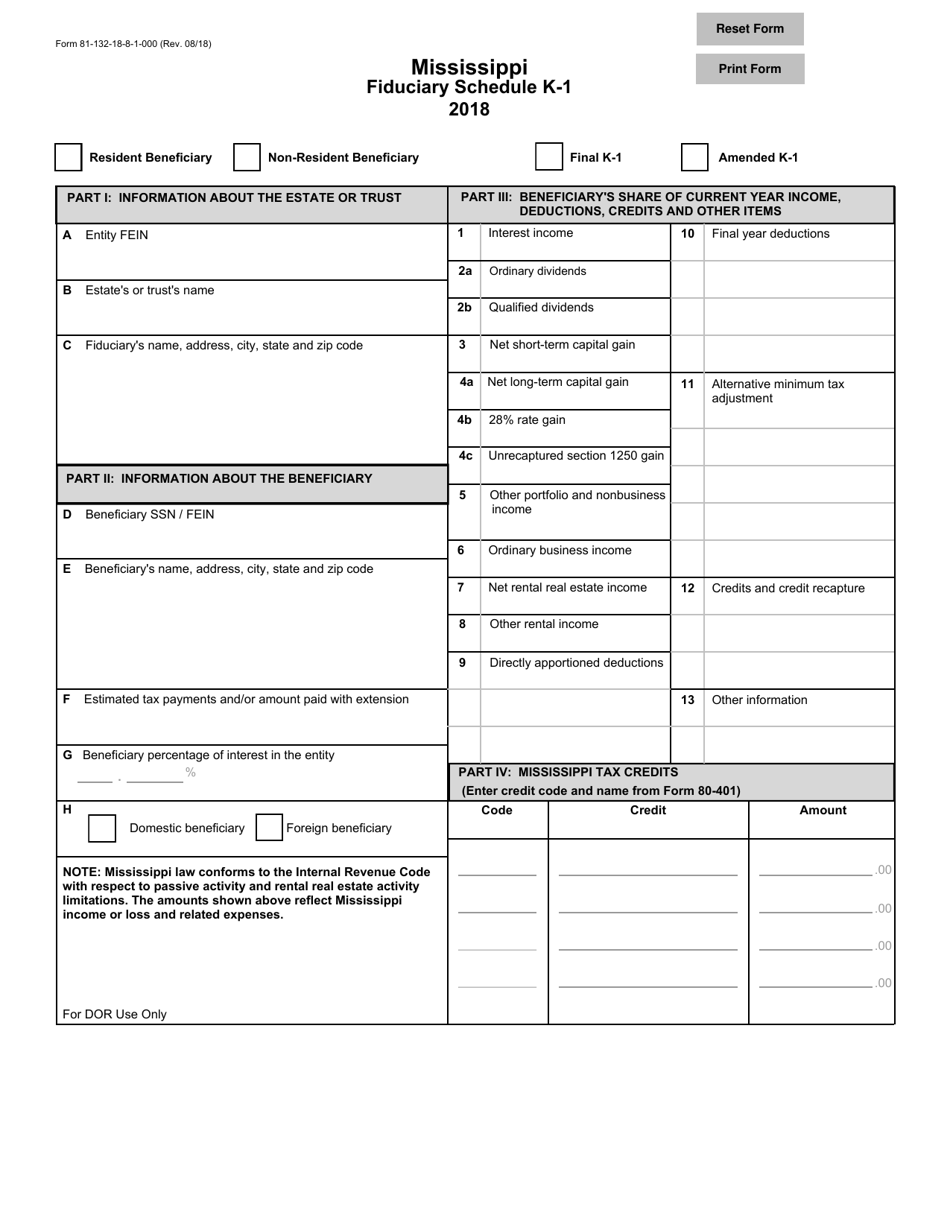

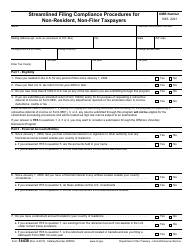

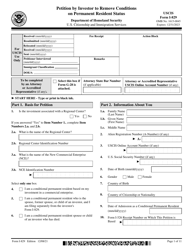

Form 81-132 Resident / Non-resident Beneficiary - Mississippi

What Is Form 81-132?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

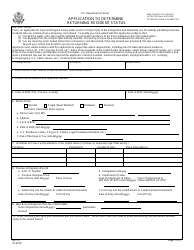

Q: What is Form 81-132?

A: Form 81-132 is a tax form used for reporting non-resident beneficiaries of Mississippi.

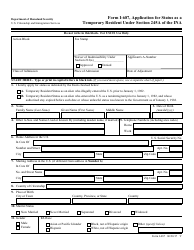

Q: Who needs to file Form 81-132?

A: Form 81-132 should be filed by non-resident beneficiaries who received income from Mississippi sources.

Q: What information is required on Form 81-132?

A: Form 81-132 requires information about the beneficiary, the source of the income, and the income received.

Q: When is Form 81-132 due?

A: Form 81-132 is generally due on or before April 15th of the year following the tax year.

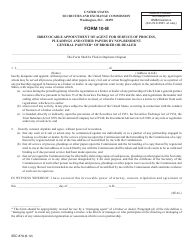

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing or failure to file Form 81-132.

Q: Is Form 81-132 the same as a tax return?

A: No, Form 81-132 is not a tax return. It is a form used to report income from Mississippi sources by non-resident beneficiaries.

Q: Can I file Form 81-132 electronically?

A: No, currently Mississippi does not offer electronic filing for Form 81-132. It must be filed by mail.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 81-132 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.