This version of the form is not currently in use and is provided for reference only. Download this version of

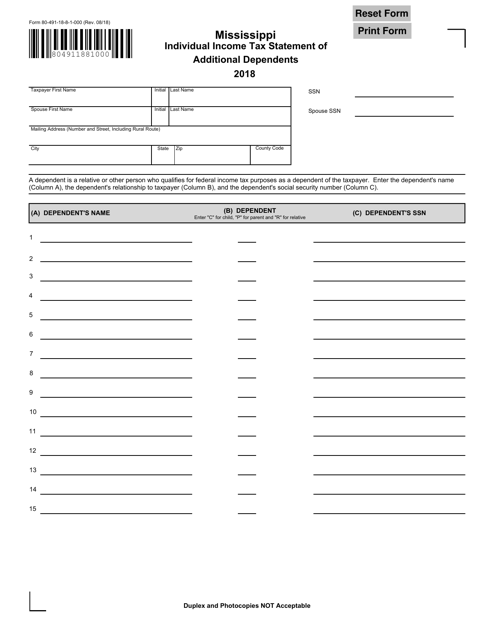

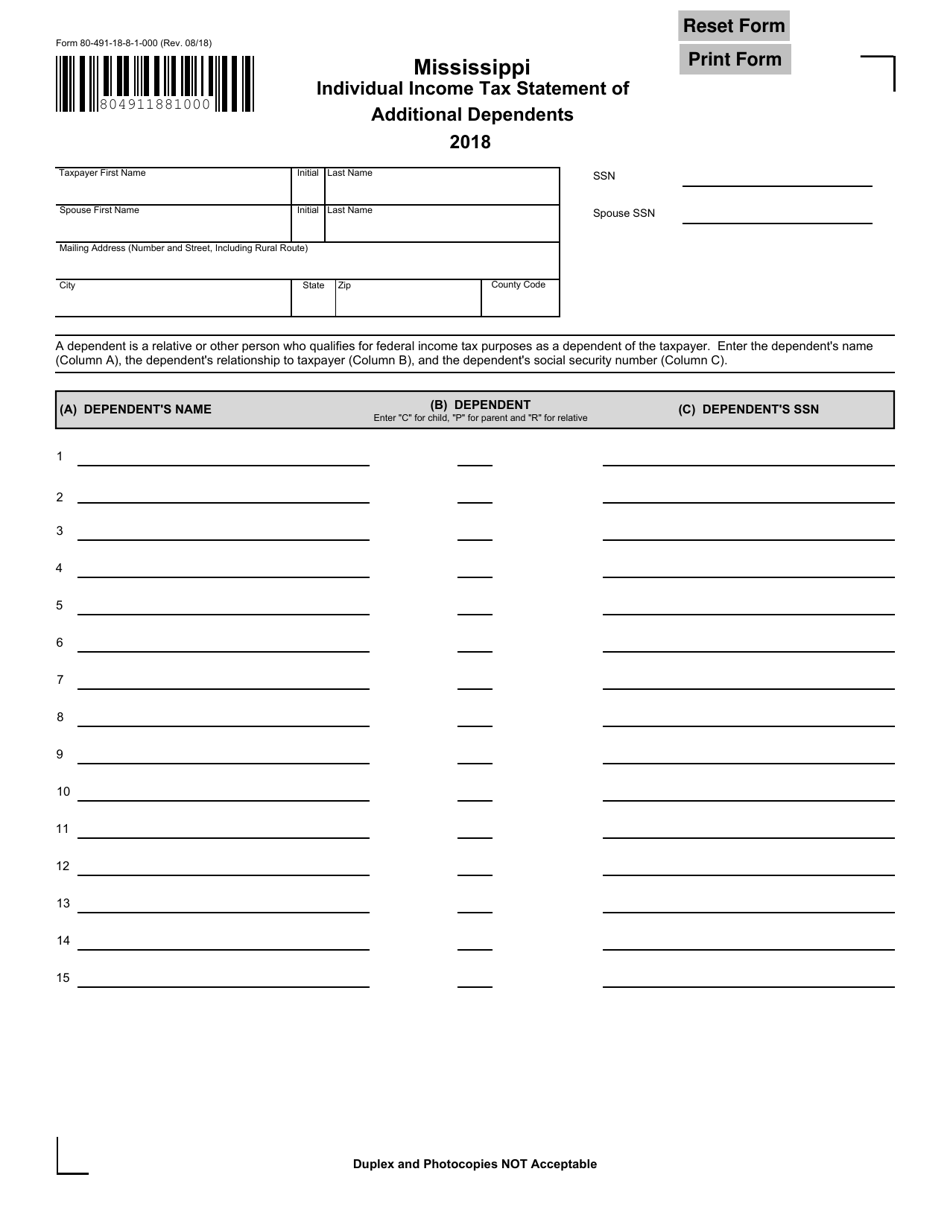

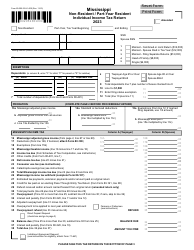

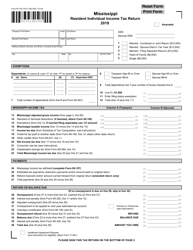

Form 80-491

for the current year.

Form 80-491 Individual Income Tax Statement of Additional Dependents - Mississippi

What Is Form 80-491?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-491?

A: Form 80-491 is the Individual IncomeTax Statement of Additional Dependents for Mississippi.

Q: Who needs to fill out Form 80-491?

A: Individuals who live in Mississippi and have additional dependents that they want to claim on their state income tax return.

Q: What is the purpose of Form 80-491?

A: The purpose of Form 80-491 is to provide information about additional dependents for tax purposes.

Q: Is Form 80-491 only for residents of Mississippi?

A: Yes, Form 80-491 is specifically for residents of Mississippi.

Q: Are there any deadlines for filing Form 80-491?

A: The deadlines for filing Form 80-491 are the same as the deadlines for filing your state income tax return.

Q: Do I need to include documentation with Form 80-491?

A: You may be required to include supporting documentation, such as birth certificates or adoption papers, to verify the additional dependents.

Q: What if I make a mistake on Form 80-491?

A: If you make a mistake on Form 80-491, you should complete a new form with the correct information and submit it.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-491 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.