This version of the form is not currently in use and is provided for reference only. Download this version of

Form 80-315

for the current year.

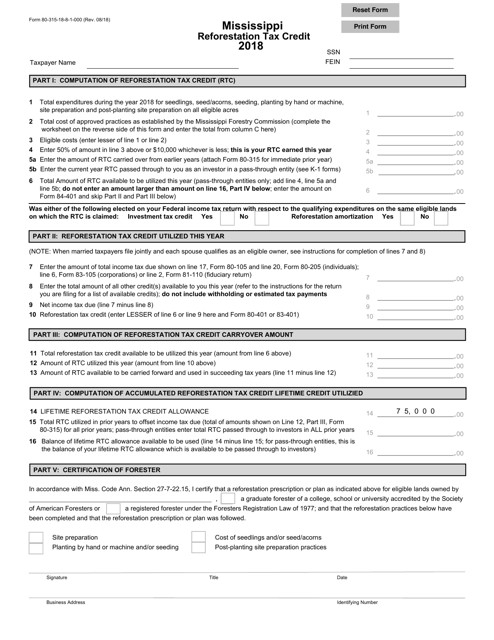

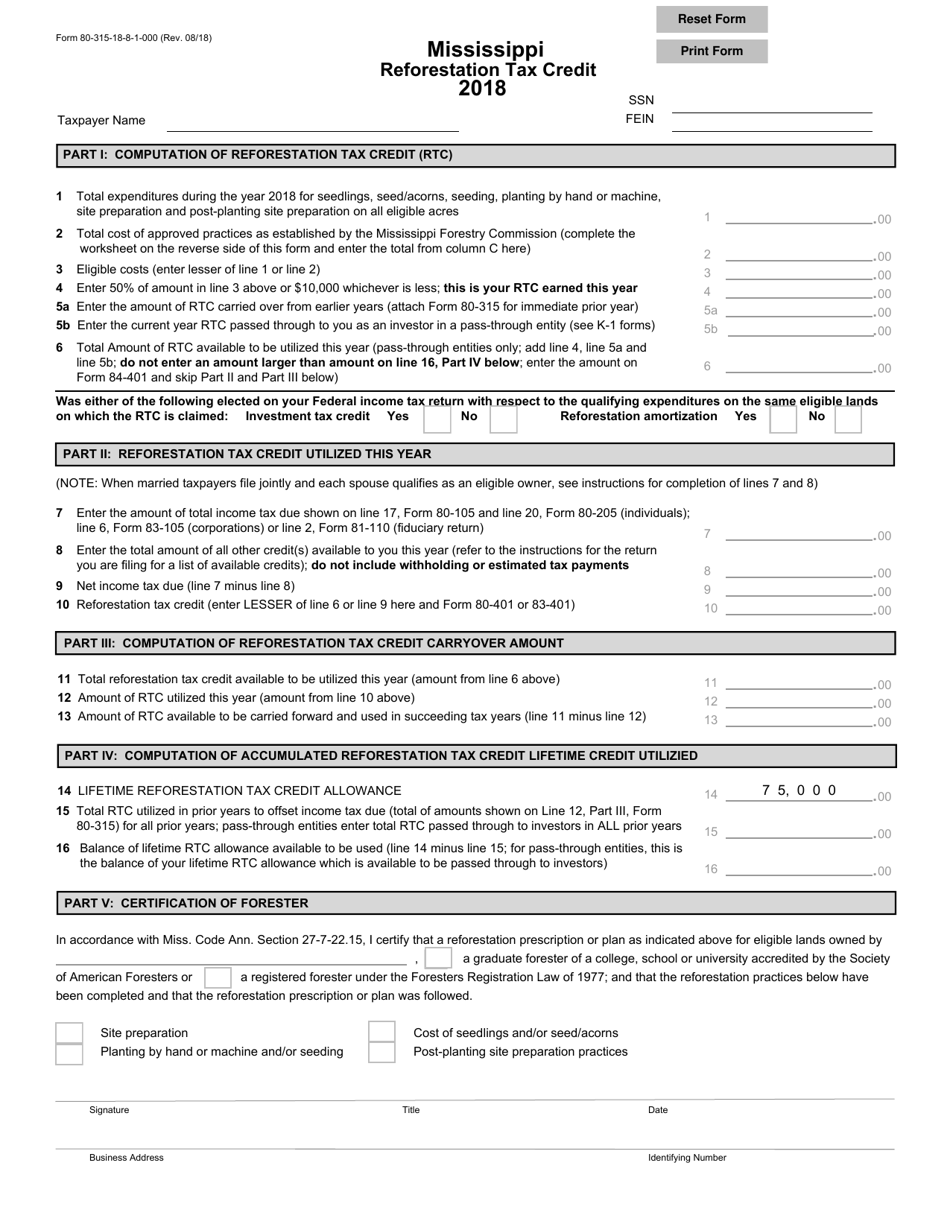

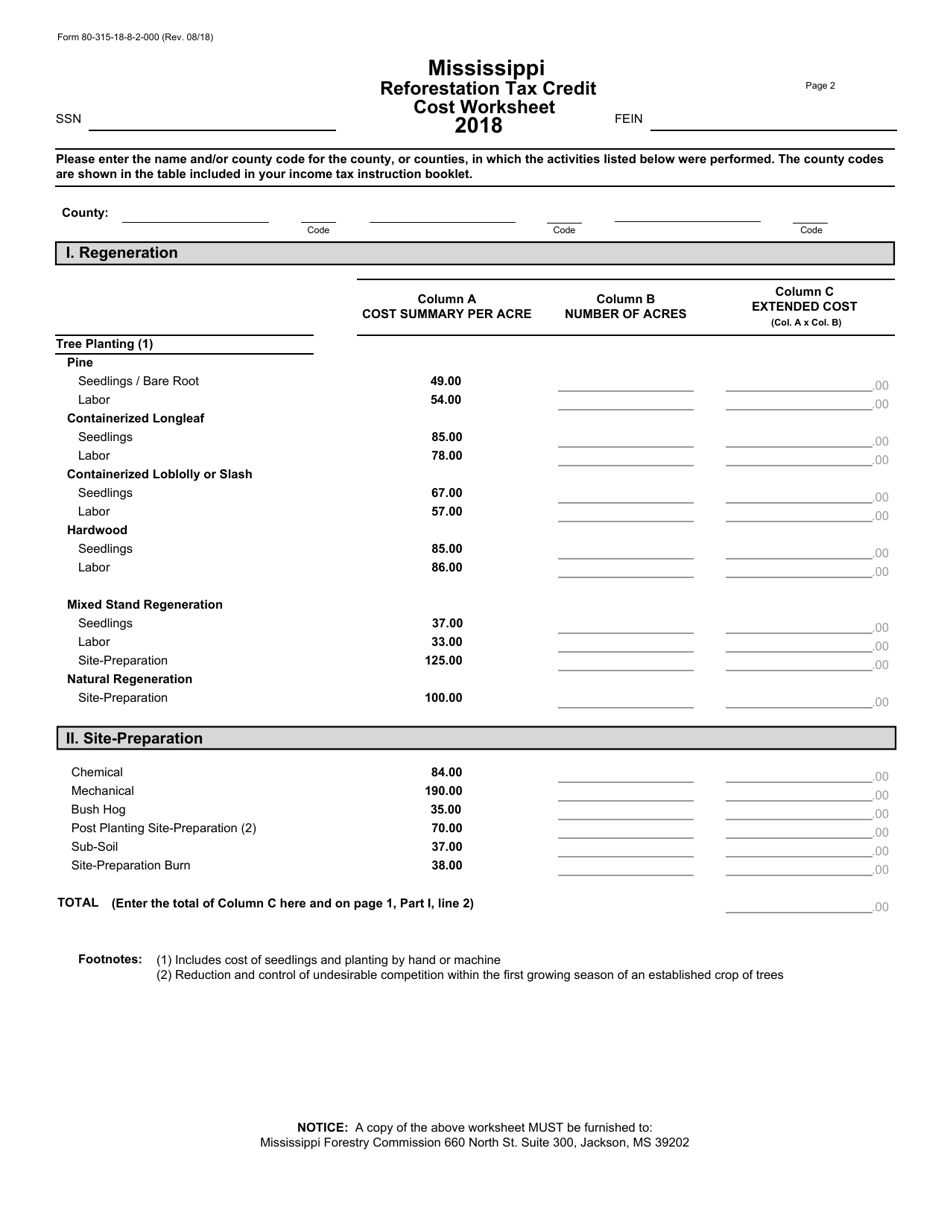

Form 80-315 Reforestation Tax Credit - Mississippi

What Is Form 80-315?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-315?

A: Form 80-315 is the Reforestation Tax Credit form used in the state of Mississippi.

Q: What is the Reforestation Tax Credit?

A: The Reforestation Tax Credit is a tax incentive offered by the state of Mississippi to encourage reforestation and timber management.

Q: Who is eligible for the Reforestation Tax Credit?

A: Individuals or businesses engaged in reforestation or timber management activities in Mississippi may be eligible for the tax credit.

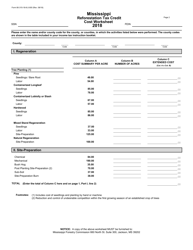

Q: What expenses are eligible for the Reforestation Tax Credit?

A: Expenses such as site preparation, seedlings or saplings, and post-planting care may be eligible for the Reforestation Tax Credit.

Q: How much is the Reforestation Tax Credit?

A: The tax credit is equal to 50% of eligible reforestation expenses, up to a maximum of $10,000 per taxpayer per year.

Q: How do I claim the Reforestation Tax Credit?

A: To claim the credit, you must complete and submit Form 80-315 along with your Mississippi state income tax return.

Q: Is there a deadline for claiming the Reforestation Tax Credit?

A: Yes, the tax credit must be claimed in the year in which the reforestation expenses were paid.

Q: Are there any restrictions or limitations for the Reforestation Tax Credit?

A: Yes, the credit cannot exceed the taxpayer's tax liability for the year and any unused credit cannot be carried forward or carried back.

Q: Are there any other forms or documentation required to claim the Reforestation Tax Credit?

A: In addition to Form 80-315, you may be required to provide supporting documentation such as receipts or invoices for reforestation expenses.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-315 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.