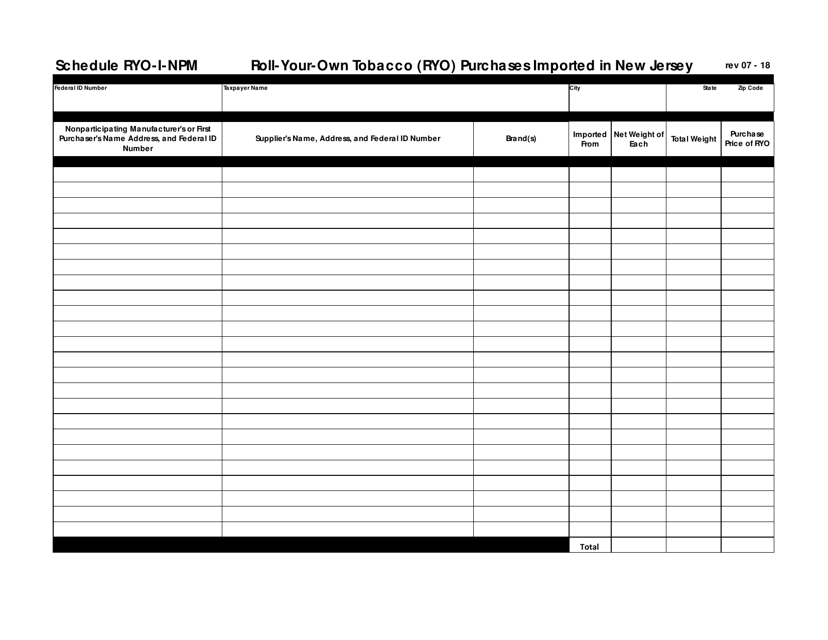

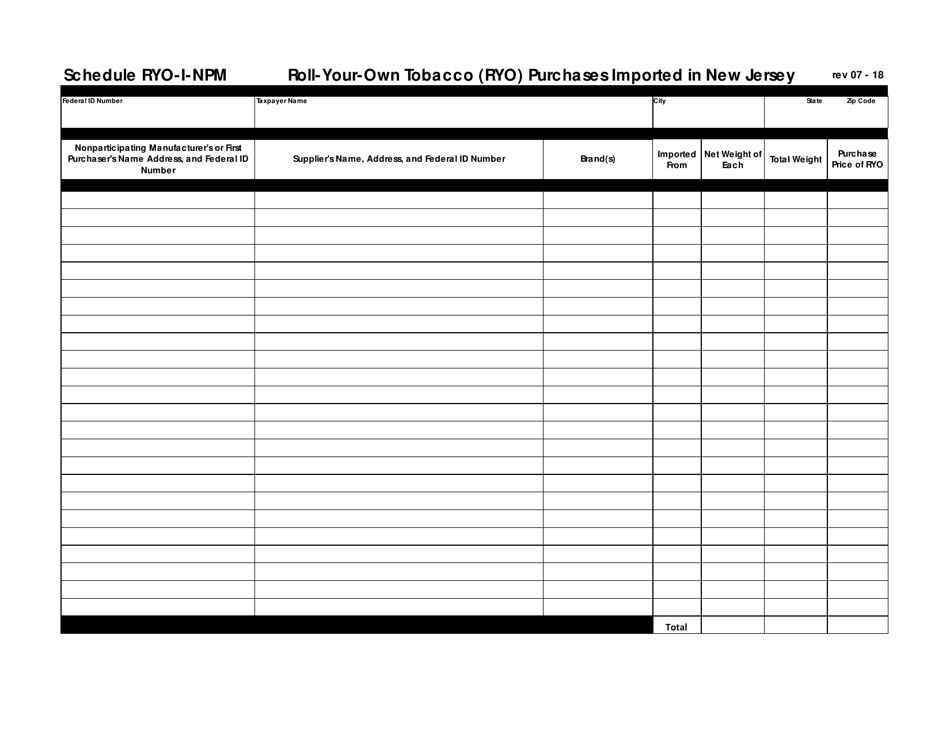

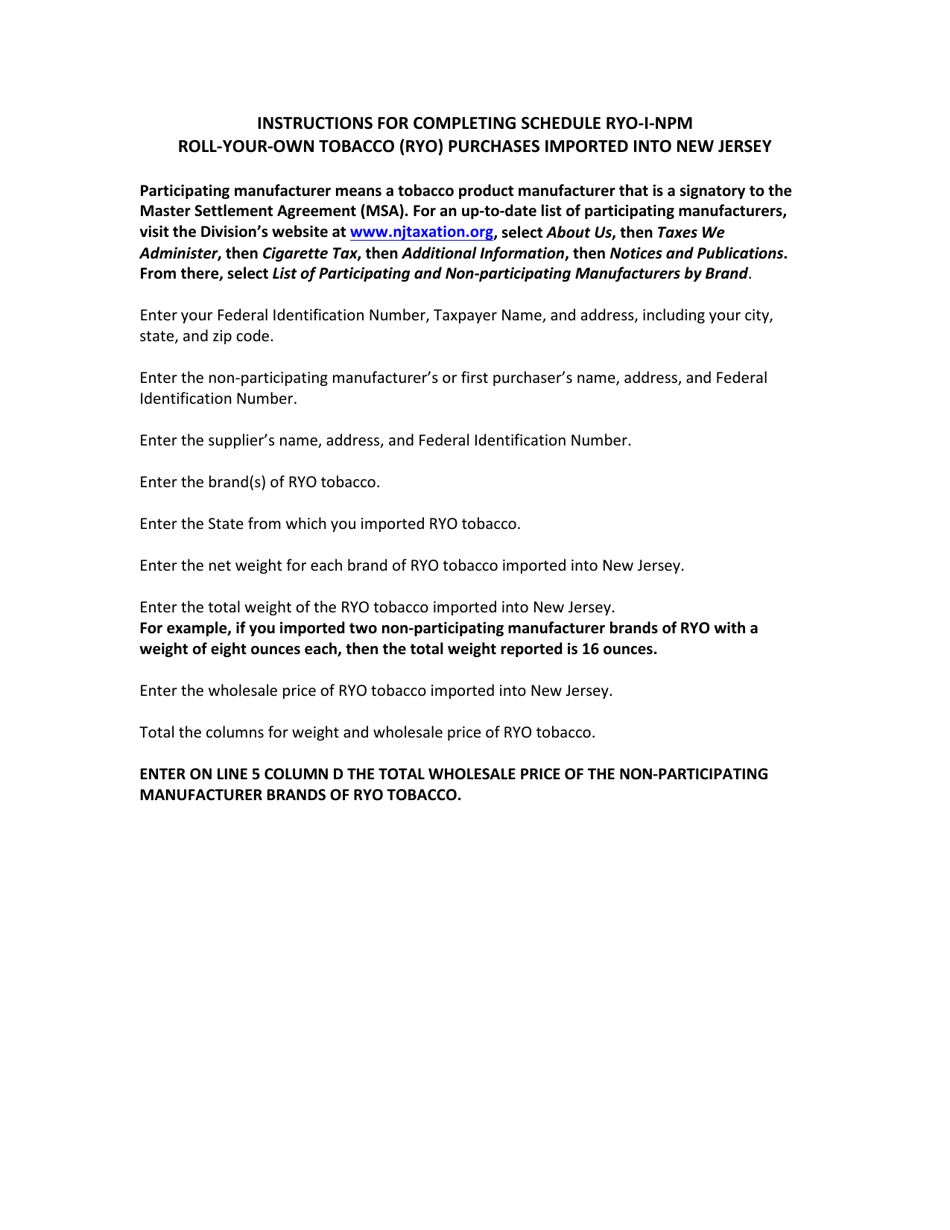

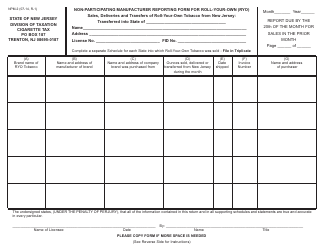

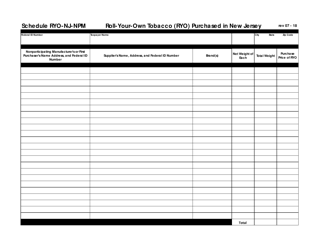

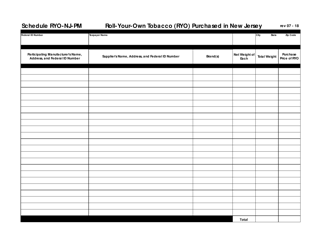

Schedule RYO-I-NPM Roll-Your-Own Tobacco (Ryo) Purchases Imported in New Jersey - New Jersey

What Is Schedule RYO-I-NPM?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule RYO-I-NPM?

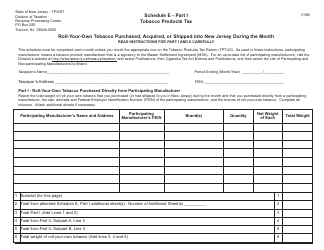

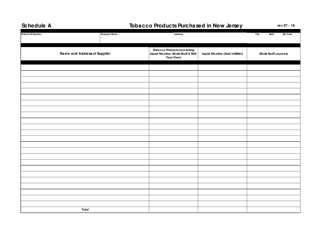

A: Schedule RYO-I-NPM is a form used for reporting Roll-Your-Own Tobacco (RYO) purchases imported into New Jersey.

Q: What is RYO?

A: RYO stands for Roll-Your-Own Tobacco, which is a type of tobacco product that allows consumers to assemble their own cigarettes.

Q: Who needs to use Schedule RYO-I-NPM?

A: Importers of RYO tobacco in New Jersey need to use Schedule RYO-I-NPM to report their purchases.

Q: What is the purpose of Schedule RYO-I-NPM?

A: The purpose of Schedule RYO-I-NPM is to track and regulate the importation of RYO tobacco products in New Jersey.

Q: Are there any penalties for not submitting Schedule RYO-I-NPM?

A: Yes, failure to submit Schedule RYO-I-NPM or providing false information may result in penalties and legal consequences.

Q: What information is required to be reported on Schedule RYO-I-NPM?

A: Schedule RYO-I-NPM requires importers to report the quantity, brand, and wholesaler of the RYO tobacco purchased.

Q: Is Schedule RYO-I-NPM only applicable to imported RYO tobacco?

A: Yes, Schedule RYO-I-NPM is specifically for reporting imported RYO tobacco purchases in New Jersey.

Q: What are the deadlines for filing Schedule RYO-I-NPM?

A: Schedule RYO-I-NPM must be filed on a monthly basis, with the due date falling on the 20th day of the following month.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule RYO-I-NPM by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.