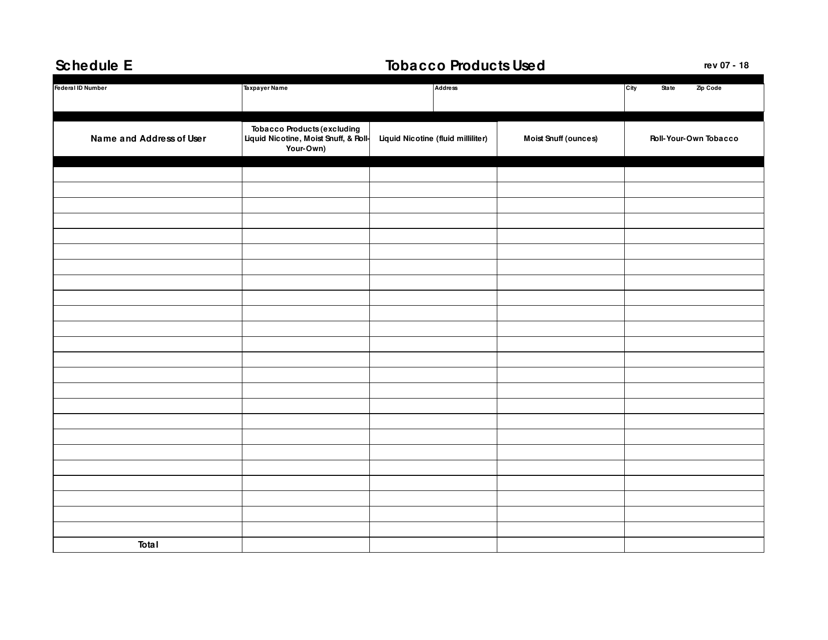

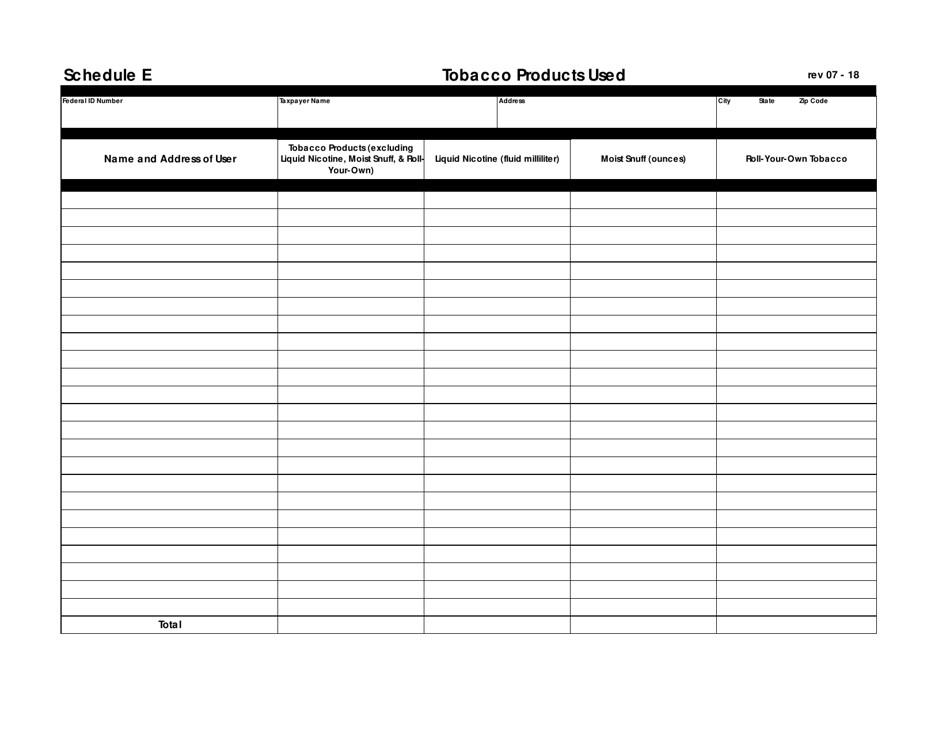

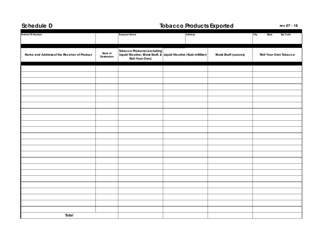

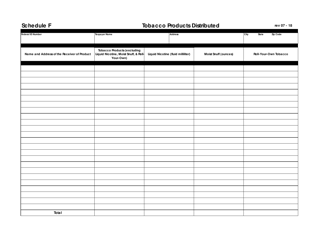

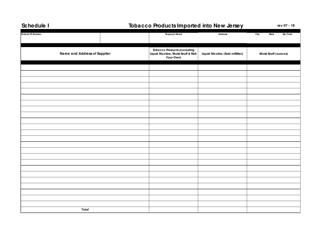

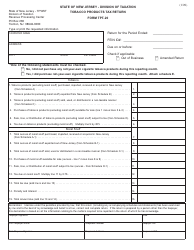

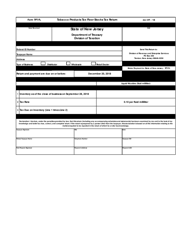

Schedule E Tobacco Products Used - New Jersey

What Is Schedule E?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule E?

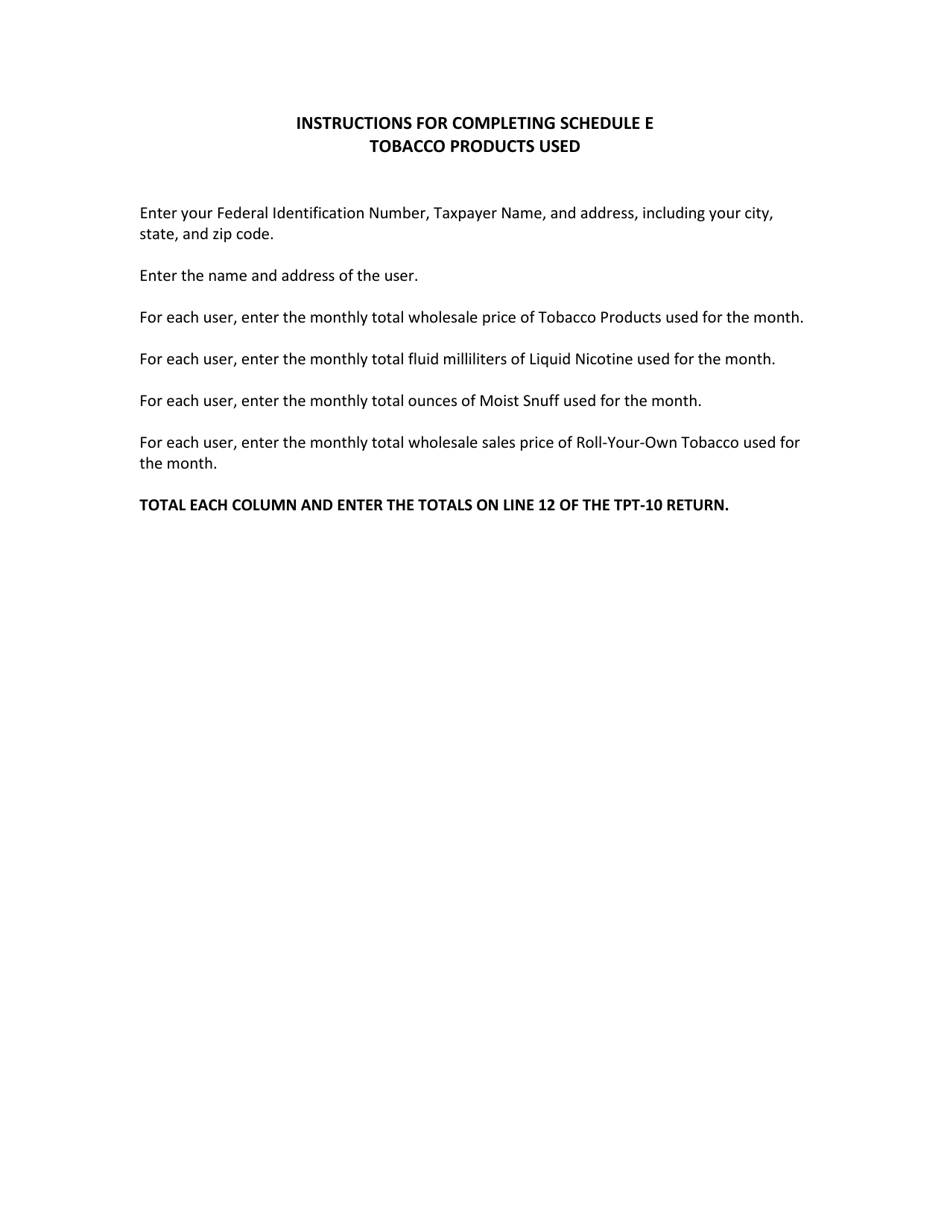

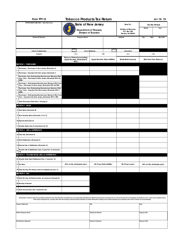

A: Schedule E is a form used to report tobacco products used in New Jersey.

Q: What types of tobacco products are included in Schedule E?

A: Schedule E includes cigarettes, cigars, smokeless tobacco, and other tobacco products.

Q: Who needs to file Schedule E?

A: Any individual or business that uses tobacco products in New Jersey needs to file Schedule E.

Q: How often do I need to file Schedule E?

A: Schedule E should be filed monthly.

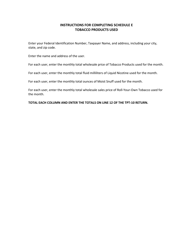

Q: What information do I need to complete Schedule E?

A: You will need to provide information about the quantity of tobacco products used and the tax due.

Q: Is there a minimum quantity of tobacco products that must be reported on Schedule E?

A: Yes, any quantity of tobacco products used must be reported on Schedule E.

Q: What happens if I do not file Schedule E?

A: Failure to file Schedule E or underreporting tobacco products may result in penalties and fines.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.