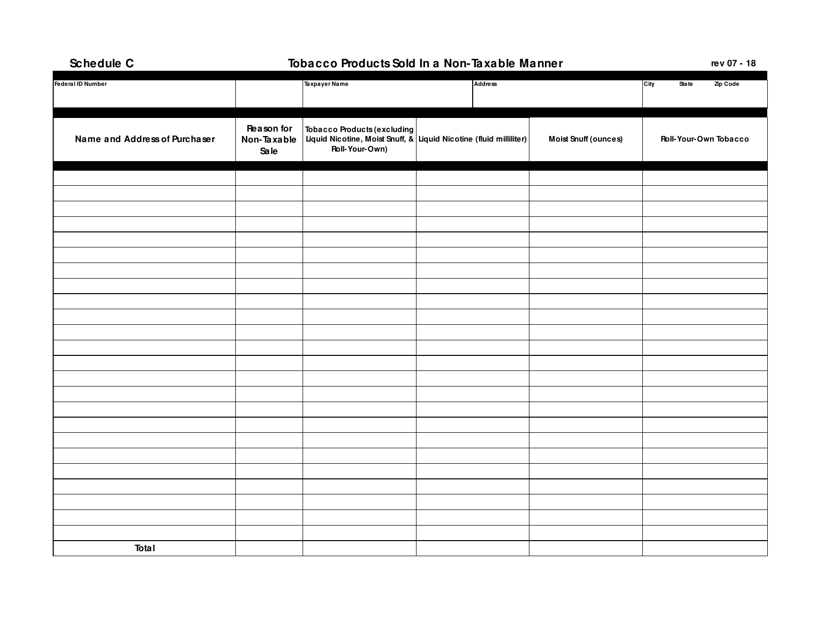

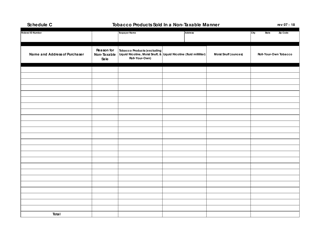

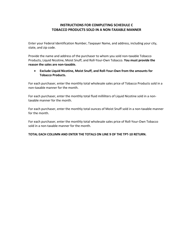

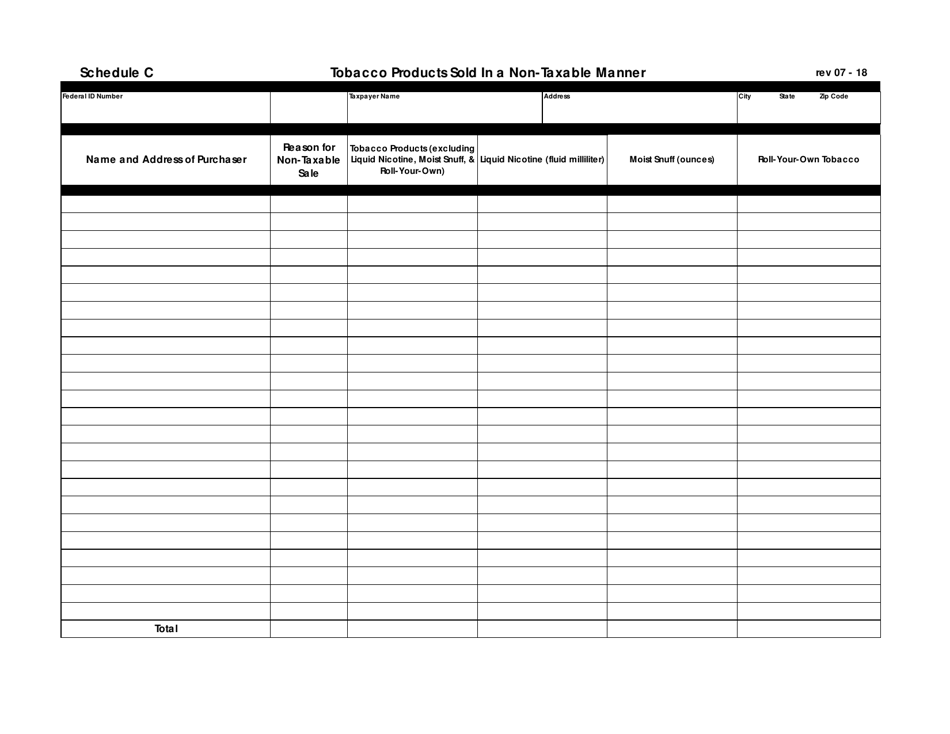

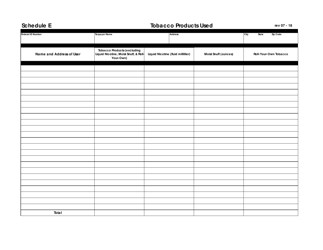

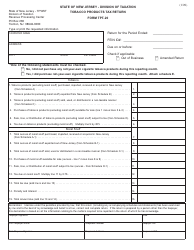

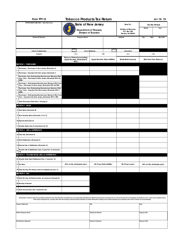

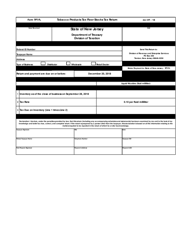

Schedule C Tobacco Products Sold in a Non-taxable Manner - New Jersey

What Is Schedule C?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule C?

A: Schedule C is a form used to report income from business activities.

Q: What are tobacco products?

A: Tobacco products refer to items such as cigarettes, cigars, chewing tobacco, and snuff.

Q: What does it mean to sell tobacco products in a non-taxable manner?

A: Selling tobacco products in a non-taxable manner means not charging or collecting sales tax on the products.

Q: Is selling tobacco products in a non-taxable manner legal in New Jersey?

A: No, it is not legal to sell tobacco products in a non-taxable manner in New Jersey. Sales tax must be charged and collected on such products.

Q: What happens if someone sells tobacco products in a non-taxable manner in New Jersey?

A: Selling tobacco products in a non-taxable manner in New Jersey is considered a violation of the law and can result in penalties and fines.

Q: Are there any exceptions to this rule in New Jersey?

A: No, there are no exceptions to the requirement of charging and collecting sales tax on tobacco products in New Jersey.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule C by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.