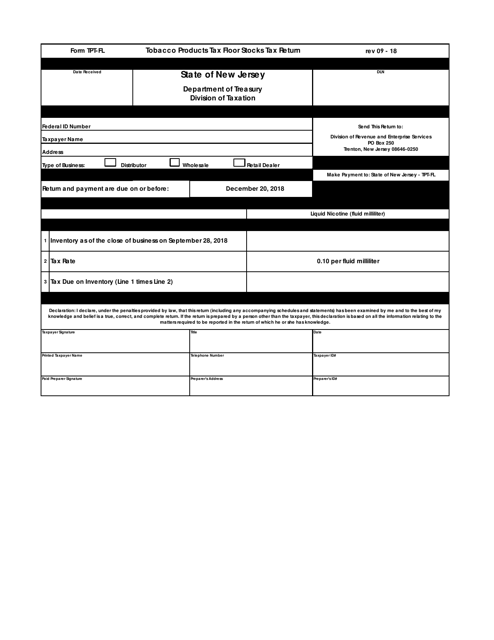

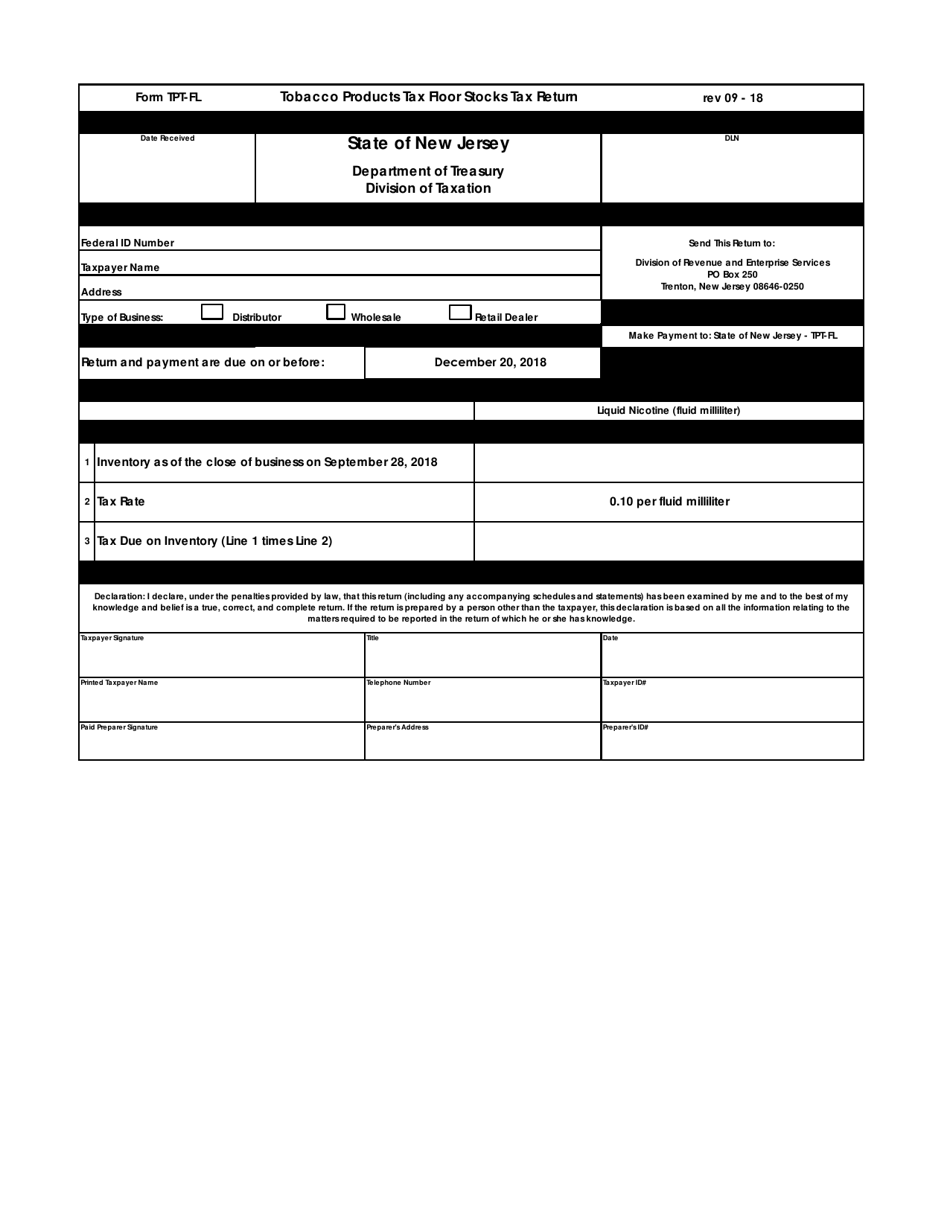

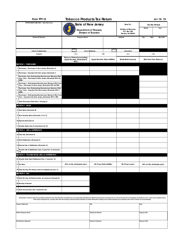

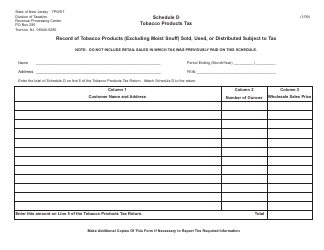

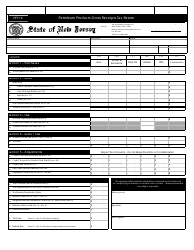

Form TPT-FL Tobacco Products Tax Floor Stocks Tax Return - New Jersey

What Is Form TPT-FL?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TPT-FL Tobacco Products Tax Floor Stocks Tax Return?

A: The TPT-FL Tobacco Products Tax Floor Stocks Tax Return is a form used in New Jersey to declare and pay taxes on tobacco products that were held in inventory before a tax increase.

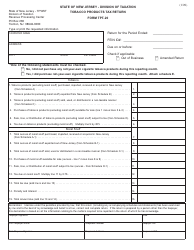

Q: Who needs to file the TPT-FL form?

A: Tobacco distributors, wholesalers, retailers, and manufacturers need to file the TPT-FL form if they have tobacco products subject to floor stocks tax in New Jersey.

Q: When is the TPT-FL form due?

A: The due date for the TPT-FL form depends on the effective date of the floor stocks tax increase. It is typically due within 30 days of the effective date.

Q: What information is required on the TPT-FL form?

A: The TPT-FL form requires information such as the name and address of the taxpayer, the effective date of the floor stocks tax increase, and details of the tobacco products subject to tax.

Q: Are there any penalties for late or incorrect filing of the TPT-FL form?

A: Yes, there are penalties for late or incorrect filing of the TPT-FL form. It is important to file the form accurately and on time to avoid penalties and interest charges.

Q: Are there any exemptions or deductions available for the TPT-FL tax?

A: No, there are no exemptions or deductions available for the TPT-FL tax on tobacco products.

Q: What should I do if I have additional questions about the TPT-FL form?

A: If you have additional questions about the TPT-FL form, you should contact the New Jersey Division of Taxation for assistance.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TPT-FL by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.