This version of the form is not currently in use and is provided for reference only. Download this version of

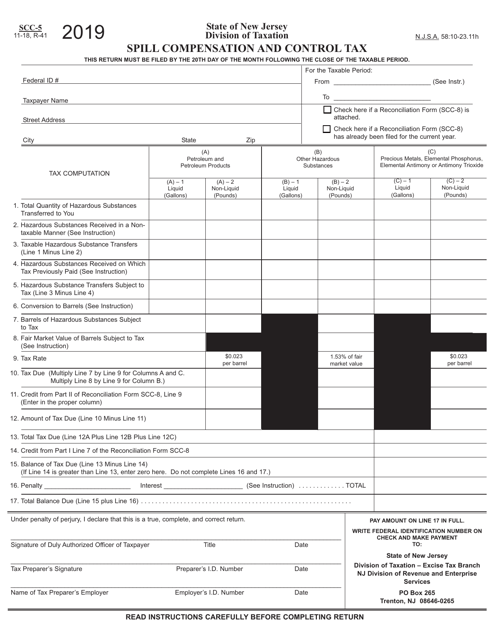

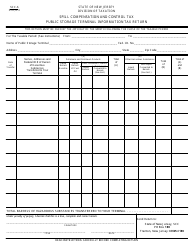

Form SCC-5

for the current year.

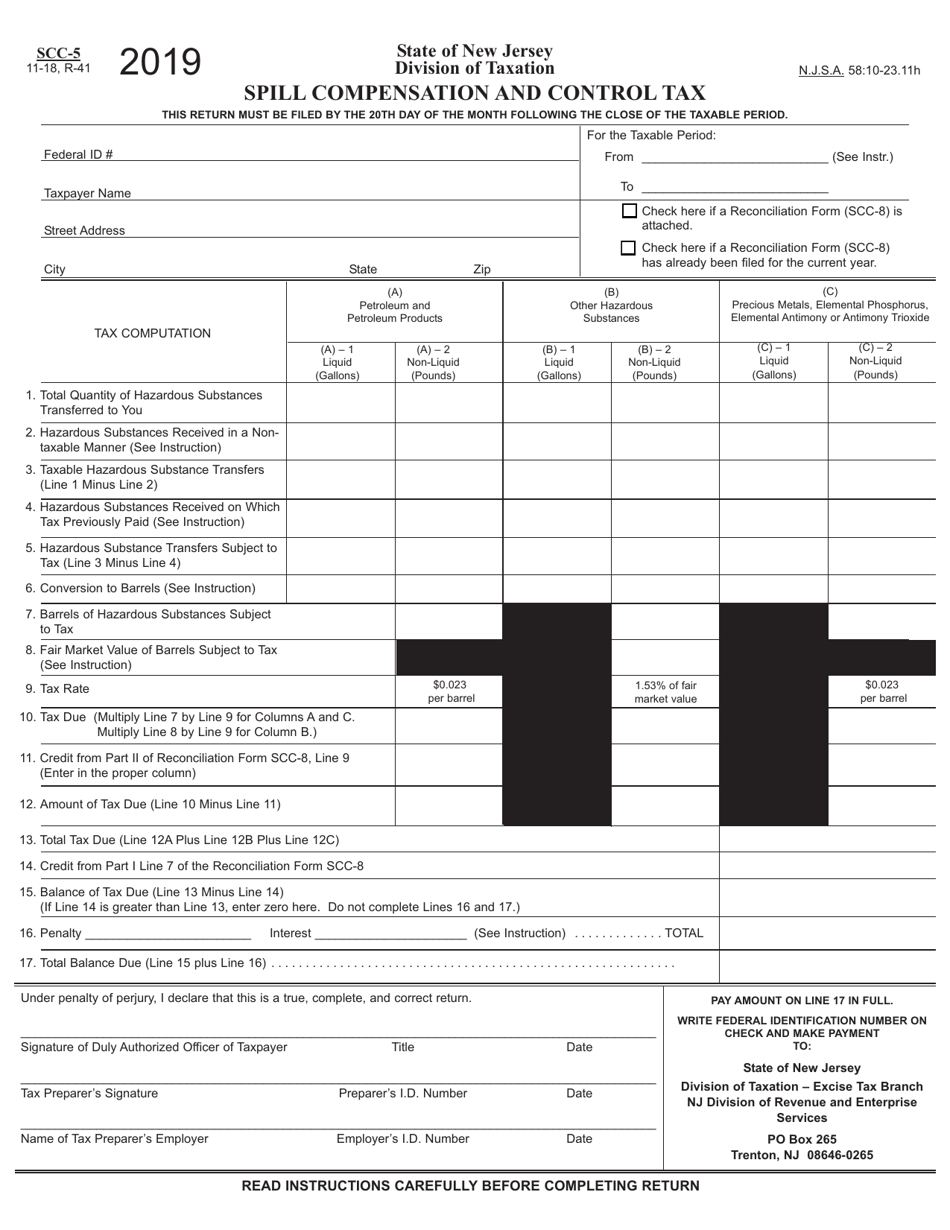

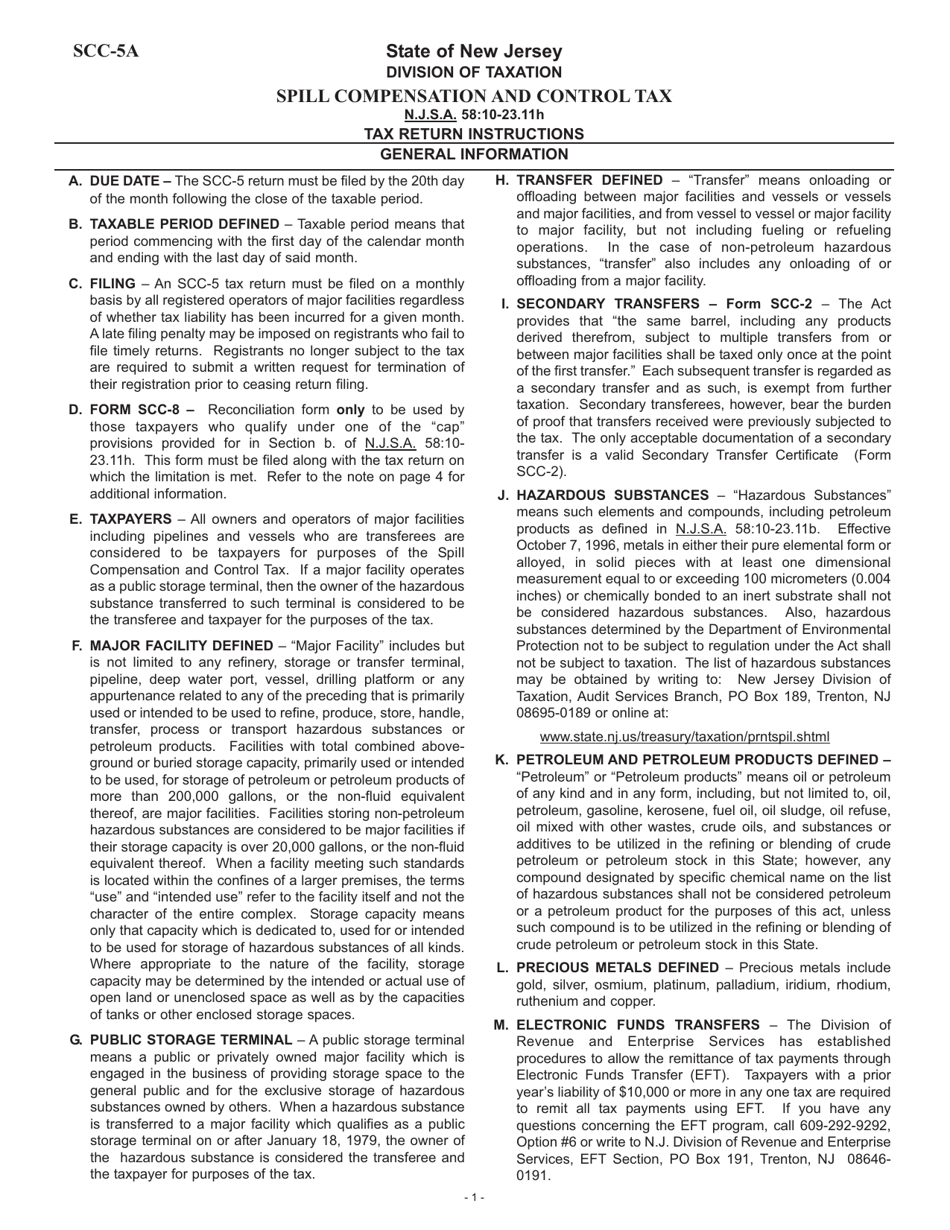

Form SCC-5 Spill Compensation and Control Tax - New Jersey

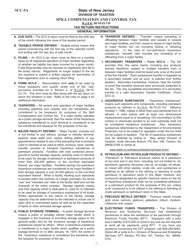

What Is Form SCC-5?

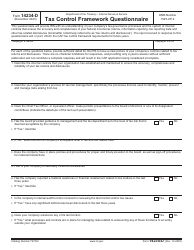

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form SCC-5?

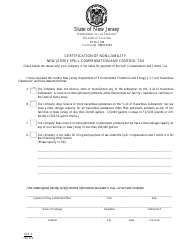

A: The Form SCC-5 is a tax form used in New Jersey to report and remit the Spill Compensation and Control Tax.

Q: What is the Spill Compensation and Control Tax?

A: The Spill Compensation and Control Tax is a tax imposed on the sale, use, or transfer of certain hazardous substances in New Jersey.

Q: Who needs to file the Form SCC-5?

A: Any person or entity that sells, uses, or transfers certain hazardous substances in New Jersey is generally required to file the Form SCC-5.

Q: What are hazardous substances?

A: Hazardous substances can include a wide range of chemicals, petroleum products, and other hazardous materials that have the potential to cause pollution or contamination.

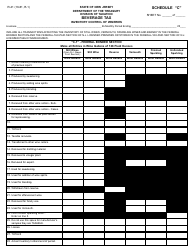

Q: How often do I need to file the Form SCC-5?

A: The Form SCC-5 is typically filed on a quarterly basis, with the tax due date falling on the 20th day of the month following the end of the quarter.

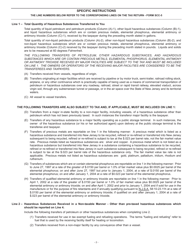

Q: What information do I need to include on the Form SCC-5?

A: The Form SCC-5 requires you to provide details about the hazardous substances sold, used, or transferred, as well as information about your business and any exemptions or deductions you may be eligible for.

Q: Are there any penalties for not filing or paying the Spill Compensation and Control Tax?

A: Yes, failure to file or pay the tax can result in penalties and interest being assessed by the New Jersey Division of Taxation.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-5 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.