This version of the form is not currently in use and is provided for reference only. Download this version of

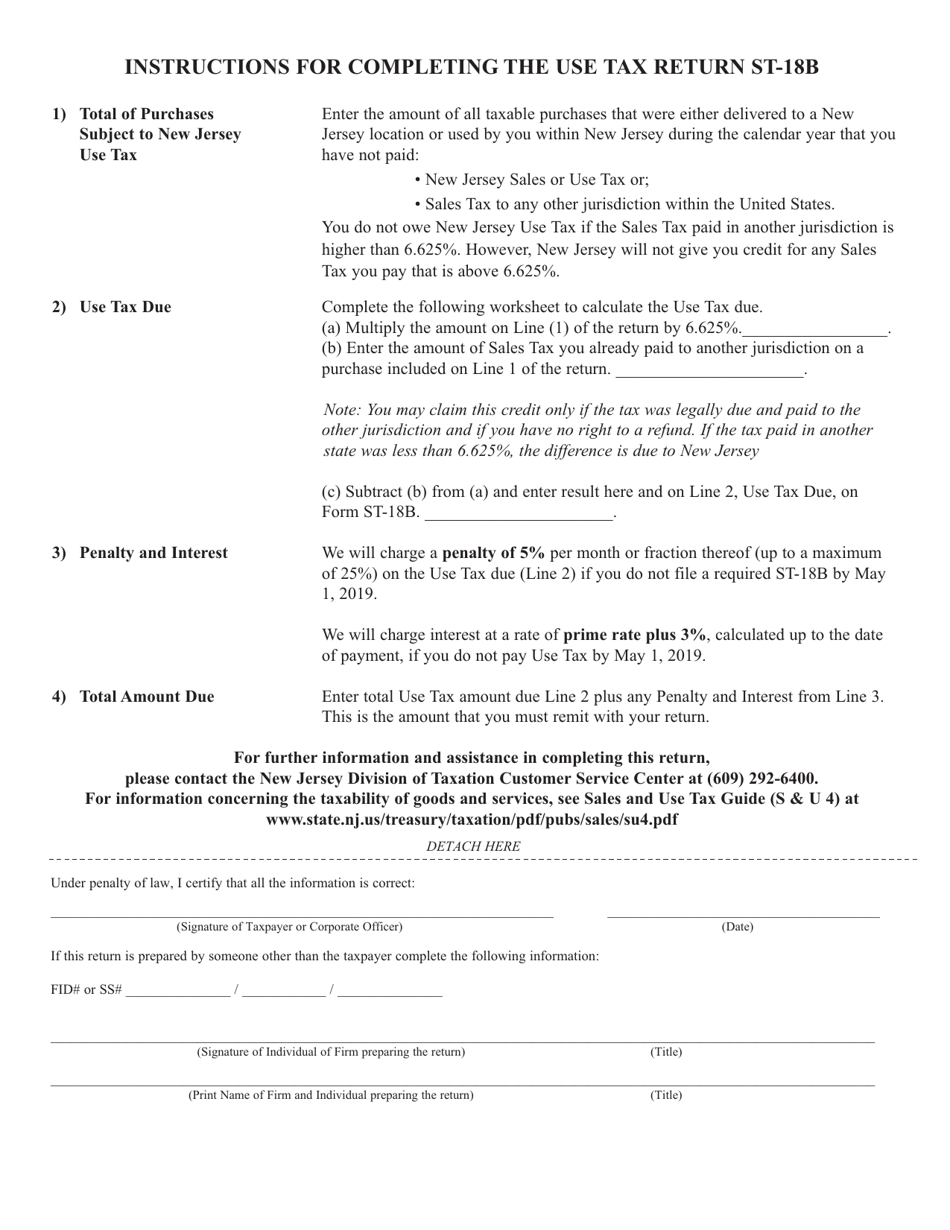

Form ST-18B

for the current year.

Form ST-18B Annual Business Use Tax Return - New Jersey

What Is Form ST-18B?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

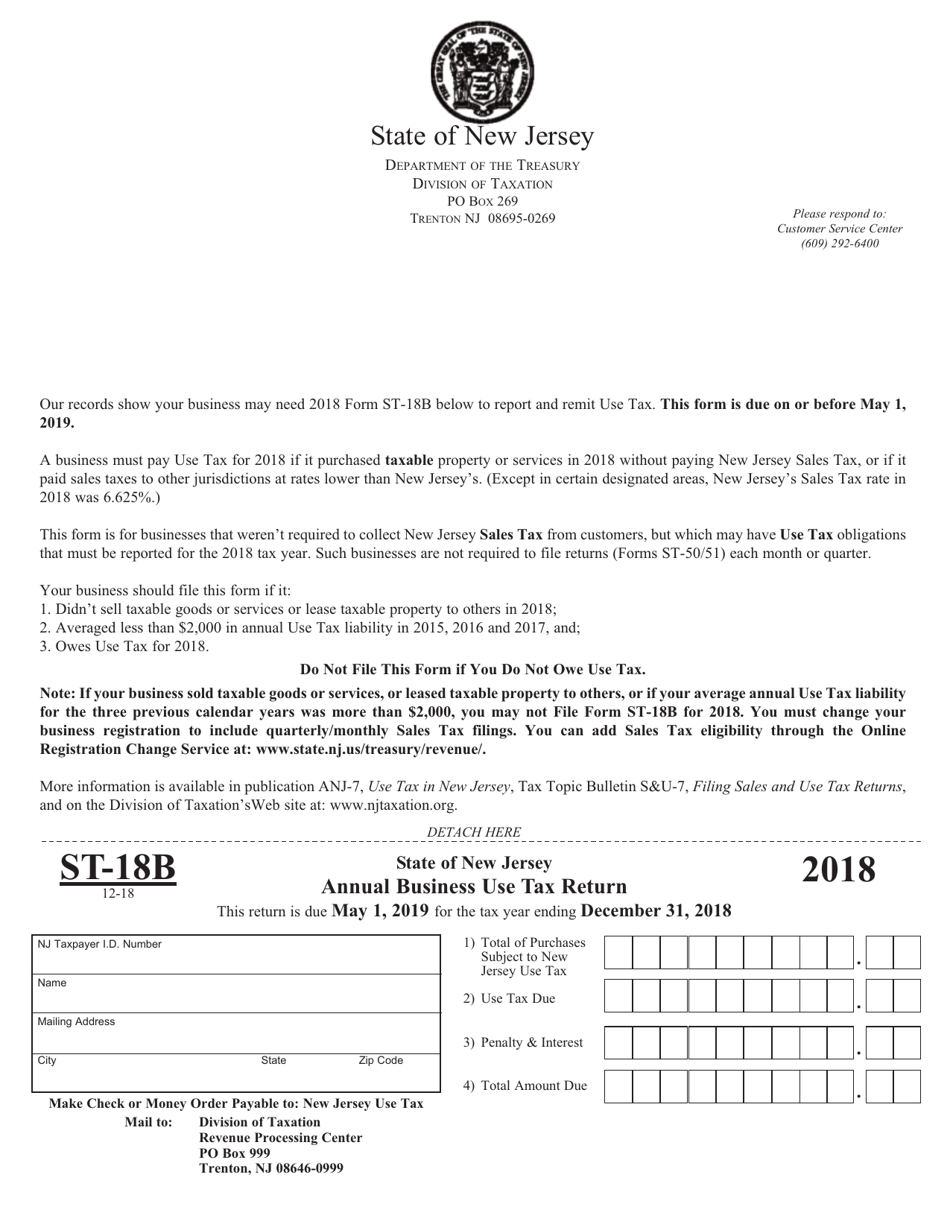

Q: What is the Form ST-18B?

A: Form ST-18B is the Annual Business Use Tax Return in New Jersey.

Q: Who needs to file Form ST-18B?

A: Businesses in New Jersey that are required to pay Business Use Tax need to file Form ST-18B.

Q: What is Business Use Tax?

A: Business Use Tax is a tax imposed on tangible personal property used in New Jersey.

Q: When is Form ST-18B due?

A: Form ST-18B is due on the 20th day of the month following the end of the business year.

Q: What information is required to complete Form ST-18B?

A: To complete Form ST-18B, you will need information about your business use tax liability, purchases subject to use tax, and any credits or deductions for which you may be eligible.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with Business Use Tax requirements. It is important to file and pay on time to avoid penalties.

Q: What should I do if I have questions or need assistance with Form ST-18B?

A: If you have questions or need assistance with Form ST-18B, you can contact the New Jersey Division of Taxation for guidance and support.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-18B by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.