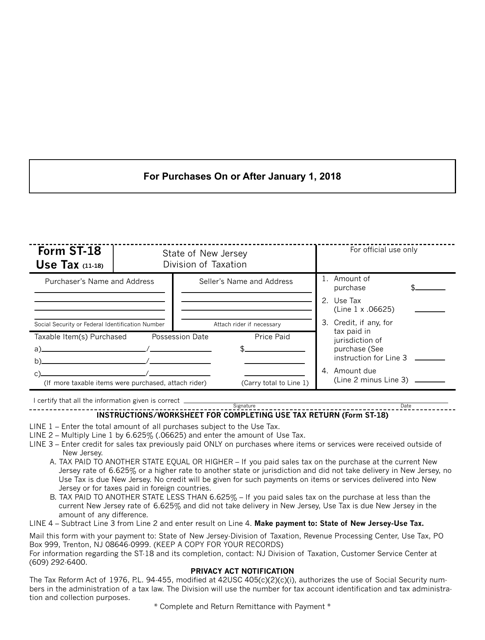

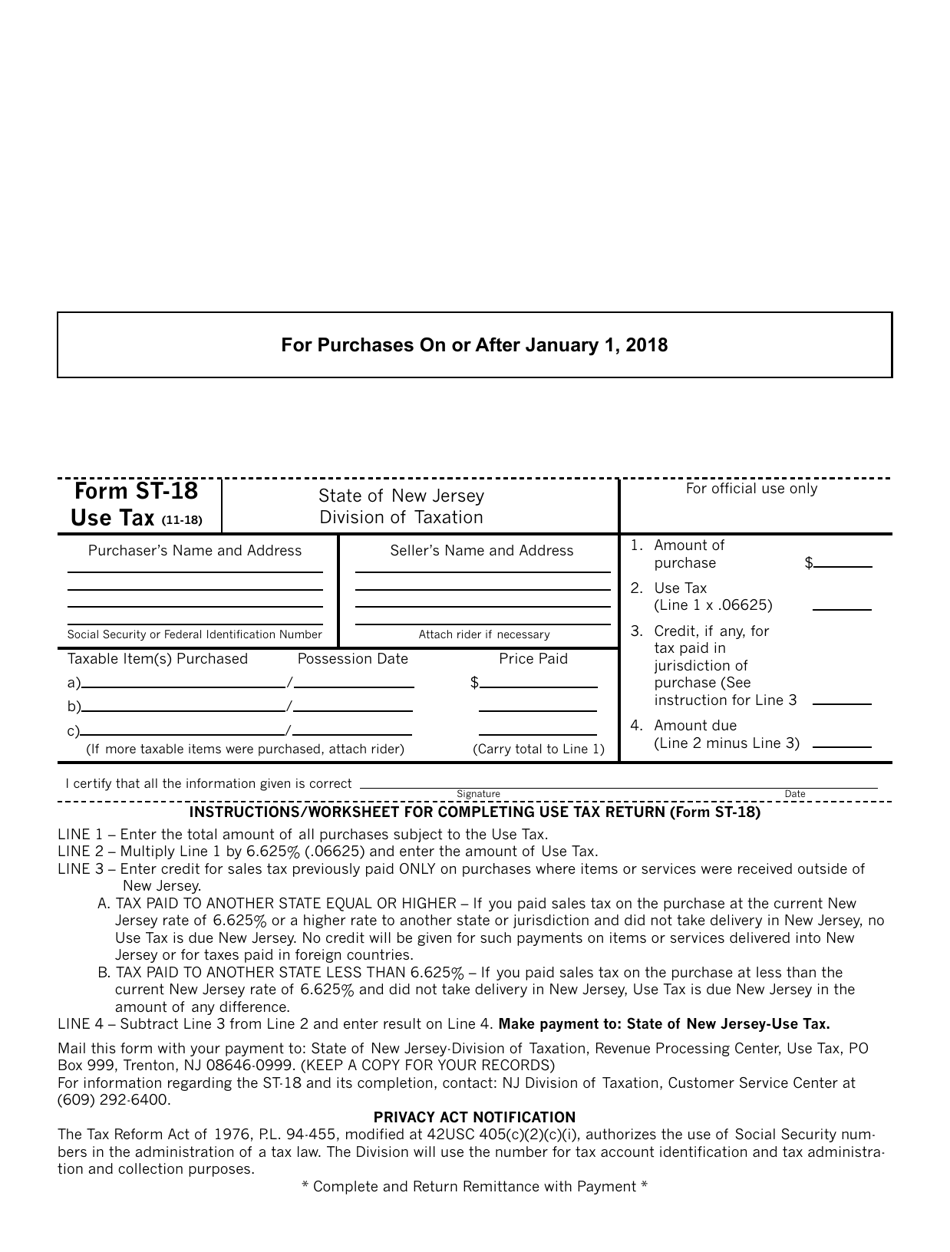

Form ST-18 Use Tax - New Jersey

What Is Form ST-18?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-18?

A: Form ST-18 is the Use Tax return form for the state of New Jersey.

Q: What is Use Tax?

A: Use Tax is a tax imposed on goods or services purchased from out-of-state retailers for use, storage, or consumption in New Jersey.

Q: Who needs to file Form ST-18?

A: Individuals or businesses in New Jersey who have made purchases subject to Use Tax are required to file Form ST-18.

Q: What purchases are subject to Use Tax?

A: Purchases made from out-of-state retailers that did not charge sales tax are usually subject to Use Tax.

Q: How often is Form ST-18 filed?

A: Form ST-18 is filed on a quarterly basis.

Q: What are the consequences of not filing Form ST-18?

A: Failure to file Form ST-18 or pay the Use Tax owed may result in penalties and interest being assessed by the state.

Q: Can I claim exemptions on Form ST-18?

A: Yes, certain purchases may be exempt from Use Tax. These exemptions should be reported on Form ST-18.

Q: How can I pay the Use Tax on Form ST-18?

A: Use Tax can be paid using various methods, including electronic payment, check, or money order.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-18 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.