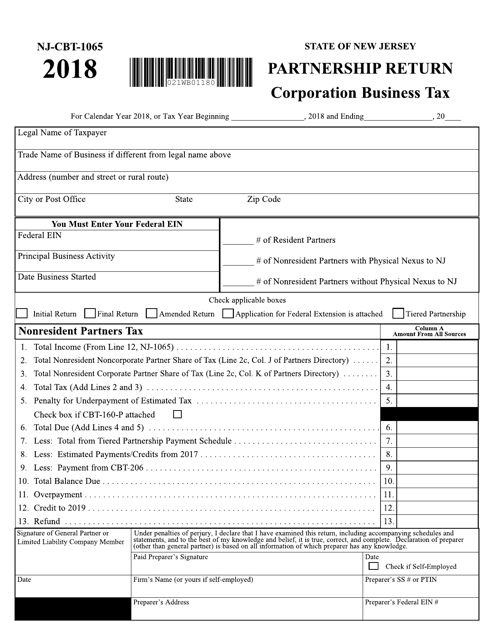

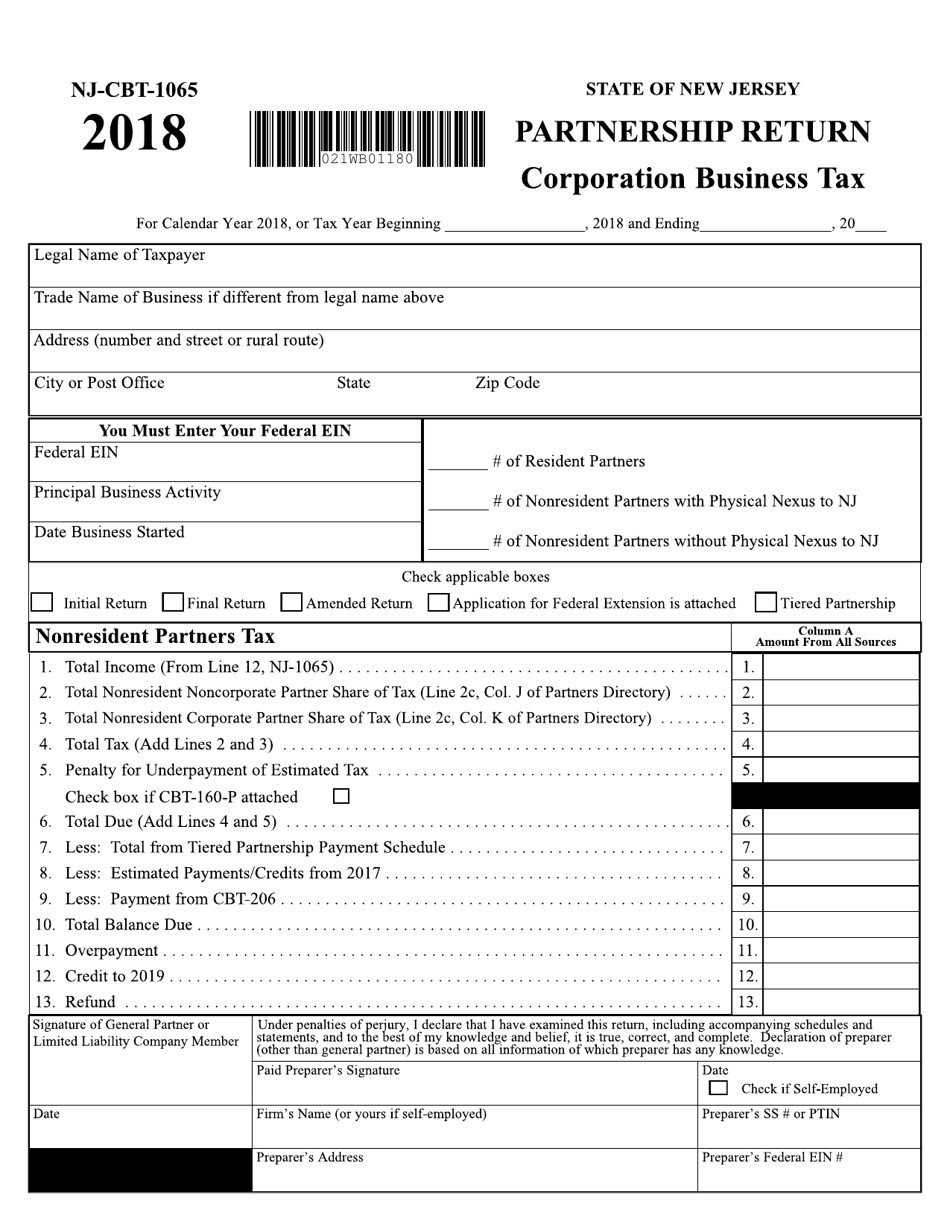

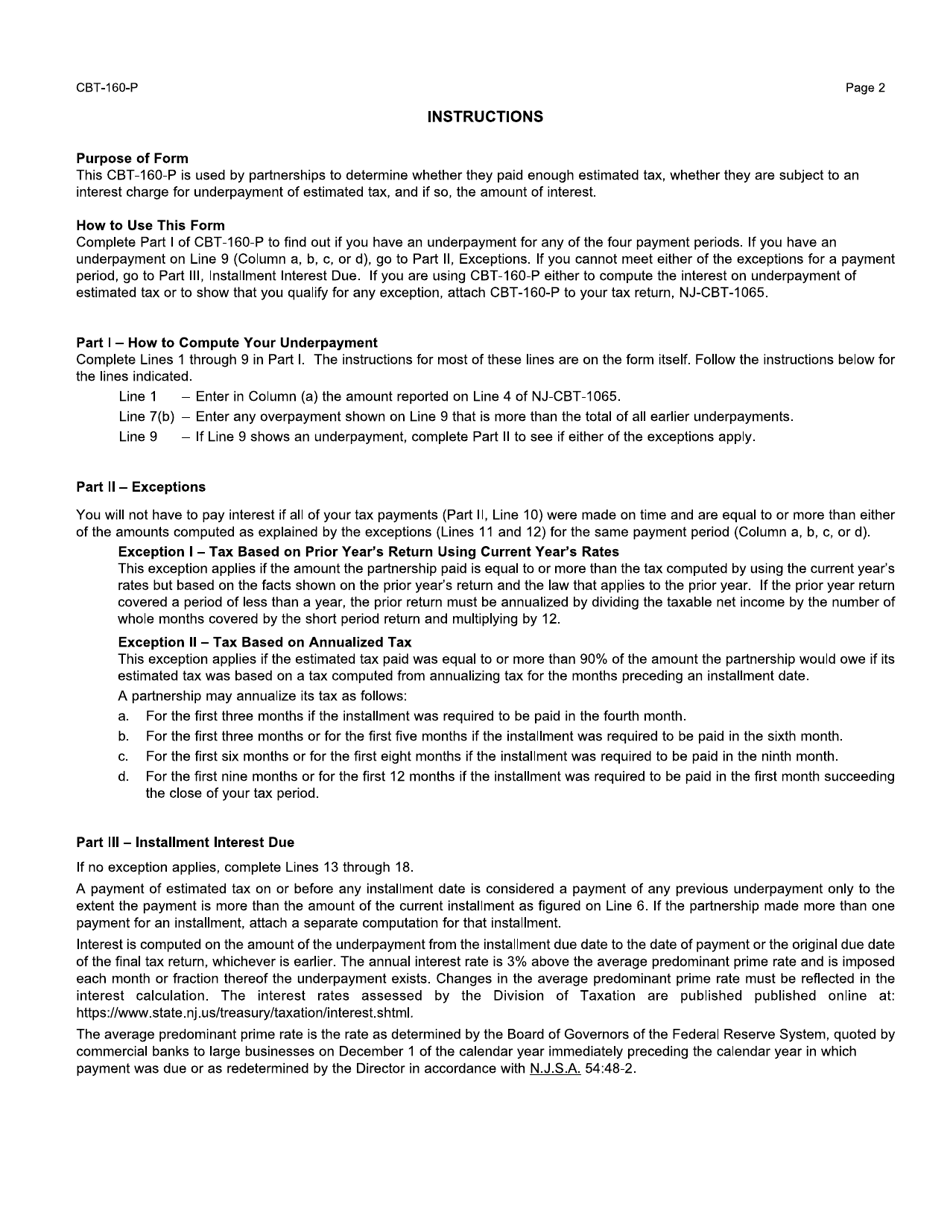

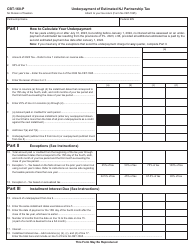

Form NJ-CBT-1065 Parthership Return - New Jersey

What Is Form NJ-CBT-1065?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NJ-CBT-1065 Partnership Return?

A: NJ-CBT-1065 is the Partnership Return form used by partnerships in New Jersey to report their income, deductions, and credits.

Q: Is NJ-CBT-1065 the same as federal Form 1065?

A: No, NJ-CBT-1065 is a state-specific form used for partnership tax filing in New Jersey. Partnerships still need to file federal Form 1065.

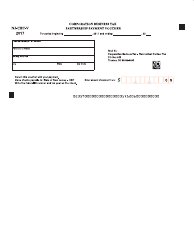

Q: Who needs to file NJ-CBT-1065 Partnership Return?

A: Any partnership doing business in New Jersey or earning income from New Jersey sources must file NJ-CBT-1065. This includes both resident and non-resident partnerships.

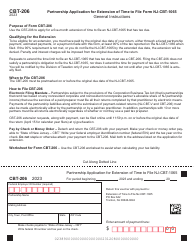

Q: When is the due date for NJ-CBT-1065 Partnership Return?

A: The due date for NJ-CBT-1065 is generally on or before the 15th day of the fourth month following the close of the partnership's tax year.

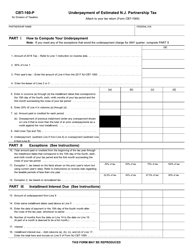

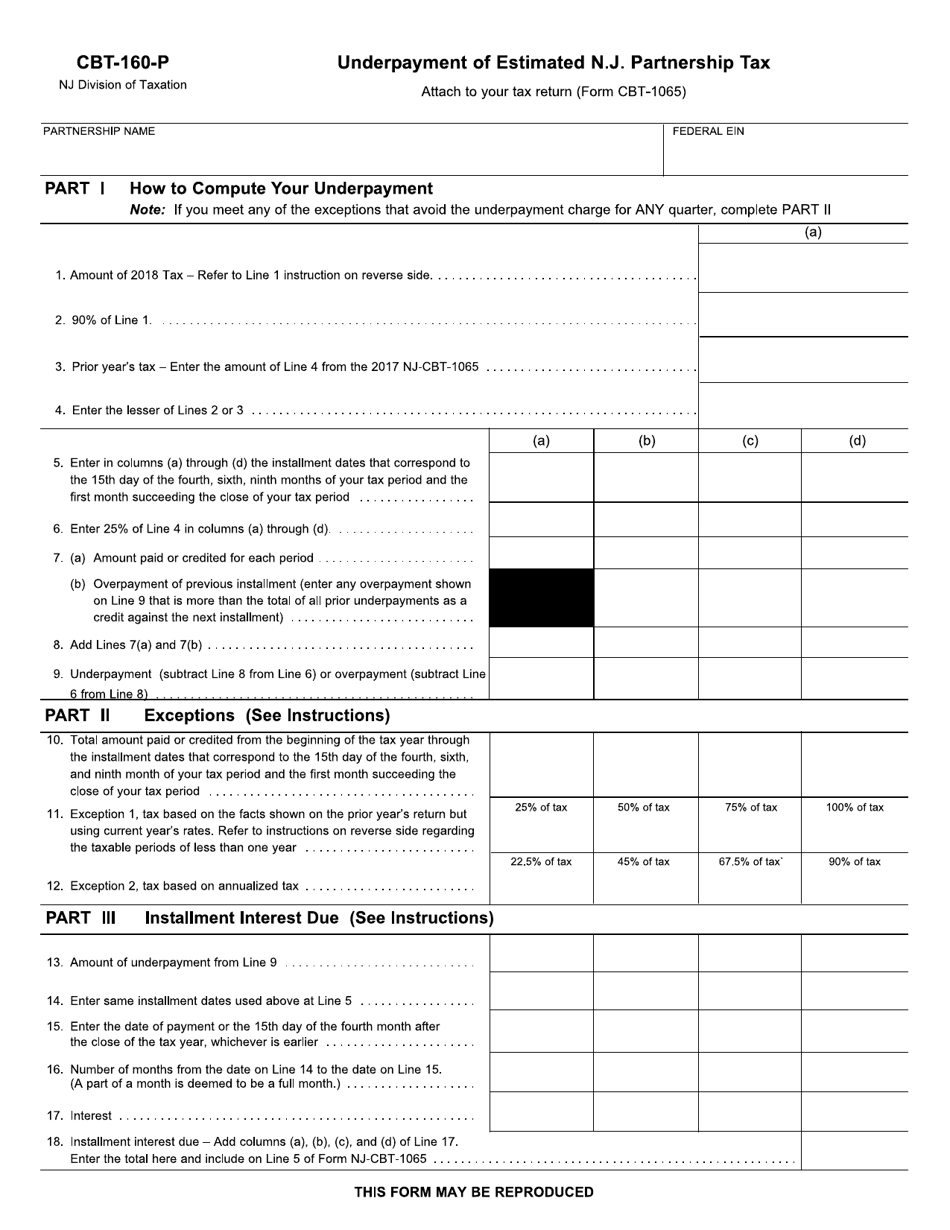

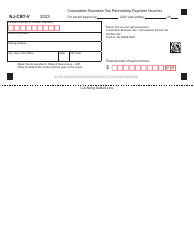

Q: Are there any penalties for late filing of NJ-CBT-1065?

A: Yes, late filing of NJ-CBT-1065 may result in penalties. It's important to file the return and pay any taxes owed by the due date to avoid penalties and interest.

Q: Can I e-file NJ-CBT-1065 Partnership Return?

A: Yes, New Jersey allows partnerships to e-file their NJ-CBT-1065 returns. E-filing can be done through approved software providers or tax professionals.

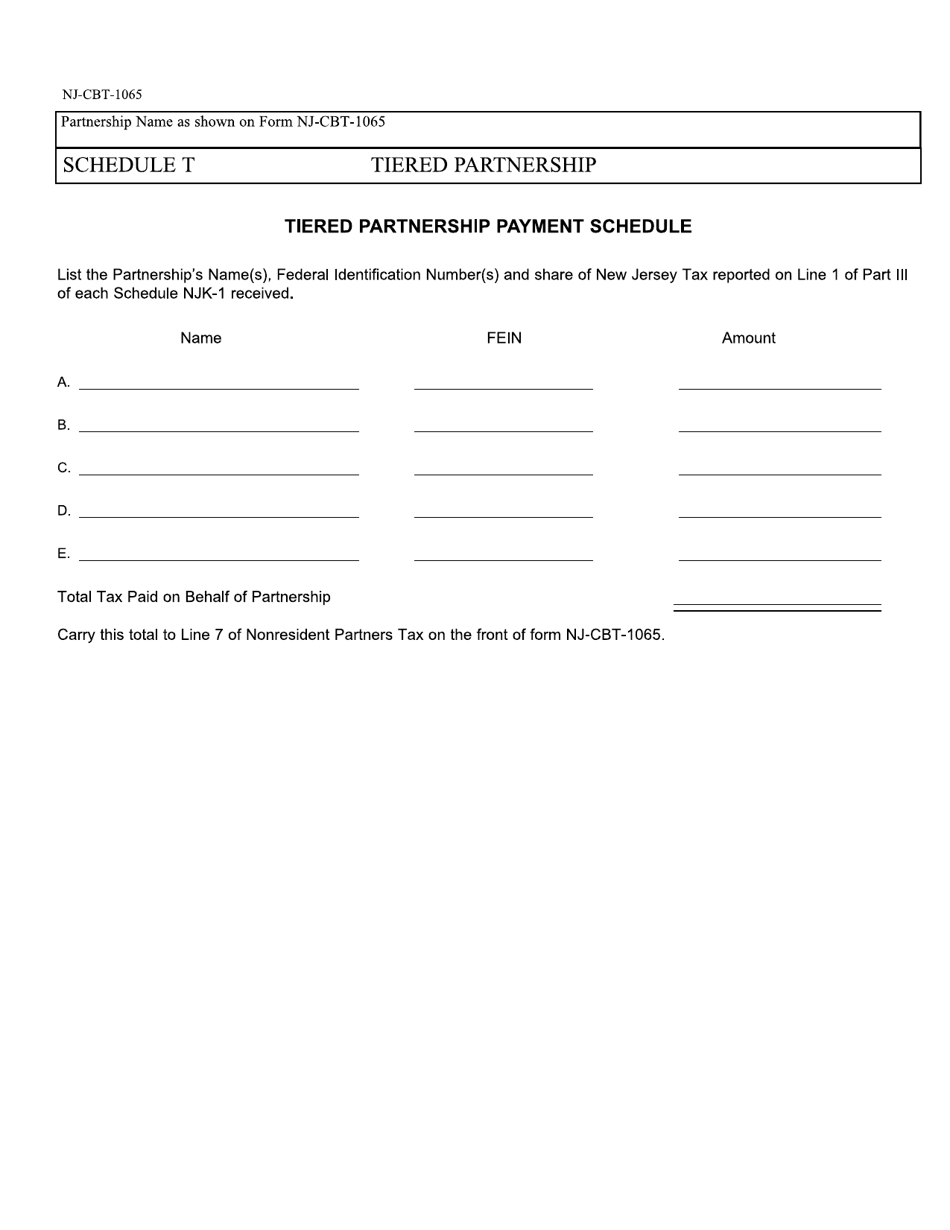

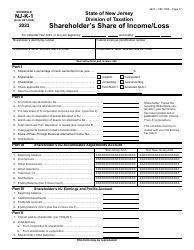

Q: What supporting documents should I attach with NJ-CBT-1065 Partnership Return?

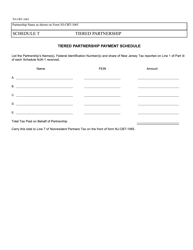

A: Partnerships should attach copies of federal Schedule K-1s, along with any other required schedules or forms specified by the New Jersey Division of Taxation.

Q: How can I get help with NJ-CBT-1065 Partnership Return?

A: For assistance with NJ-CBT-1065, you can contact the New Jersey Division of Taxation or seek guidance from a qualified tax professional.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-CBT-1065 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.