This version of the form is not currently in use and is provided for reference only. Download this version of

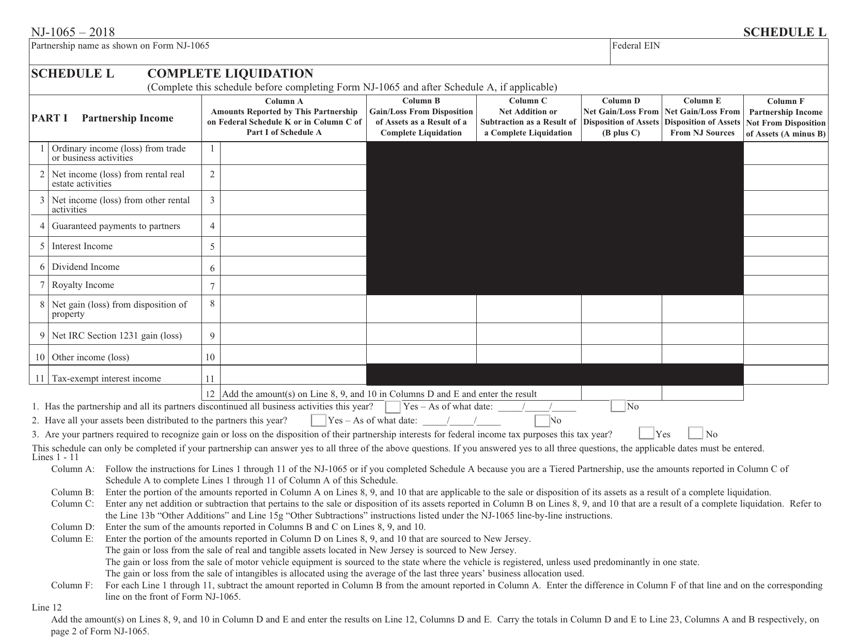

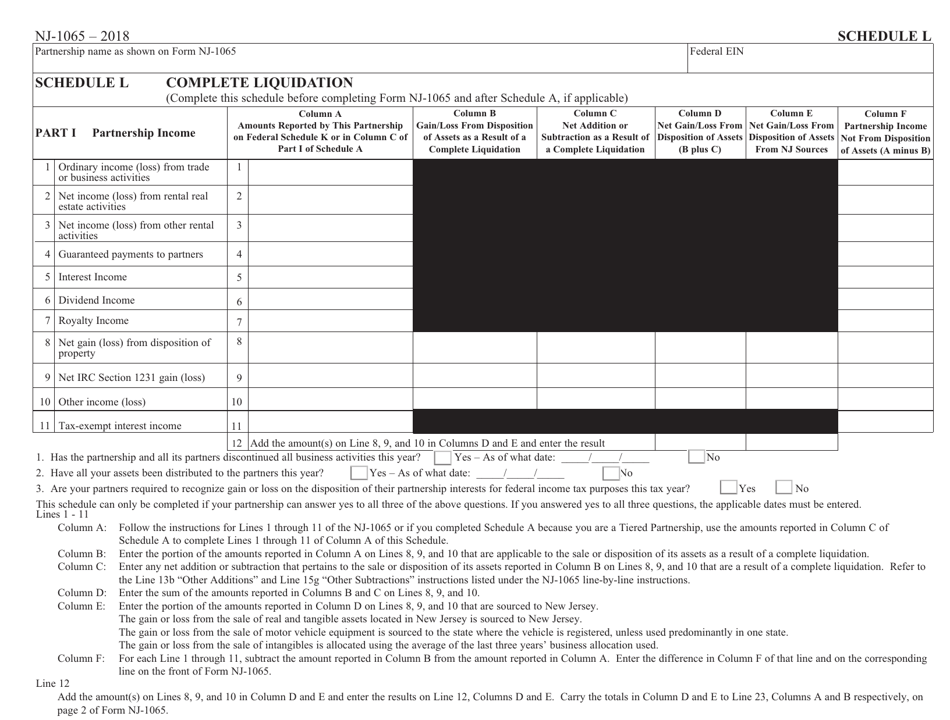

Form NJ-1065 Schedule L

for the current year.

Form NJ-1065 Schedule L Complete Liquidation - New Jersey

What Is Form NJ-1065 Schedule L?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1065 Schedule L?

A: Form NJ-1065 Schedule L is a tax form used by partnerships in New Jersey to report information about a complete liquidation.

Q: What does a complete liquidation mean?

A: A complete liquidation refers to a situation where a partnership is dissolved and its assets are distributed to partners.

Q: Who needs to file Form NJ-1065 Schedule L?

A: Partnerships in New Jersey that have undergone a complete liquidation need to file Form NJ-1065 Schedule L.

Q: What information does Form NJ-1065 Schedule L require?

A: Form NJ-1065 Schedule L requires information about the assets distributed during the liquidation, partners' capital accounts, and partnership liabilities.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1065 Schedule L by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.