This version of the form is not currently in use and is provided for reference only. Download this version of

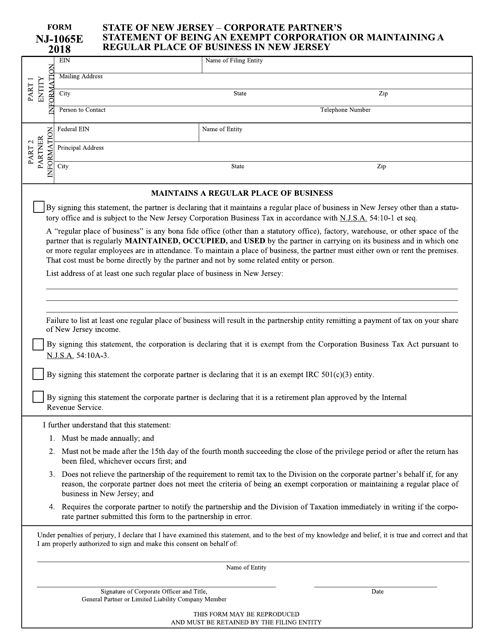

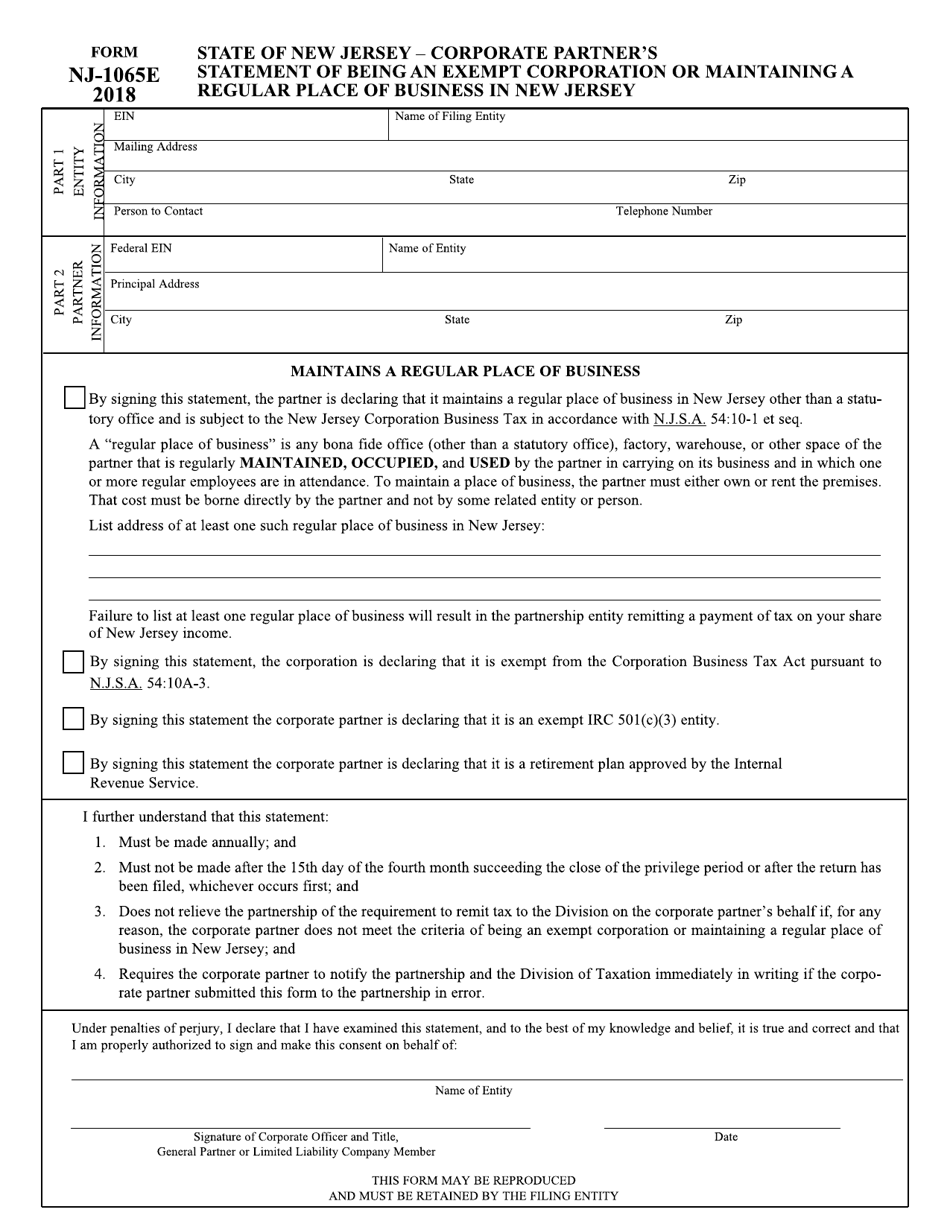

Form NJ-1065E

for the current year.

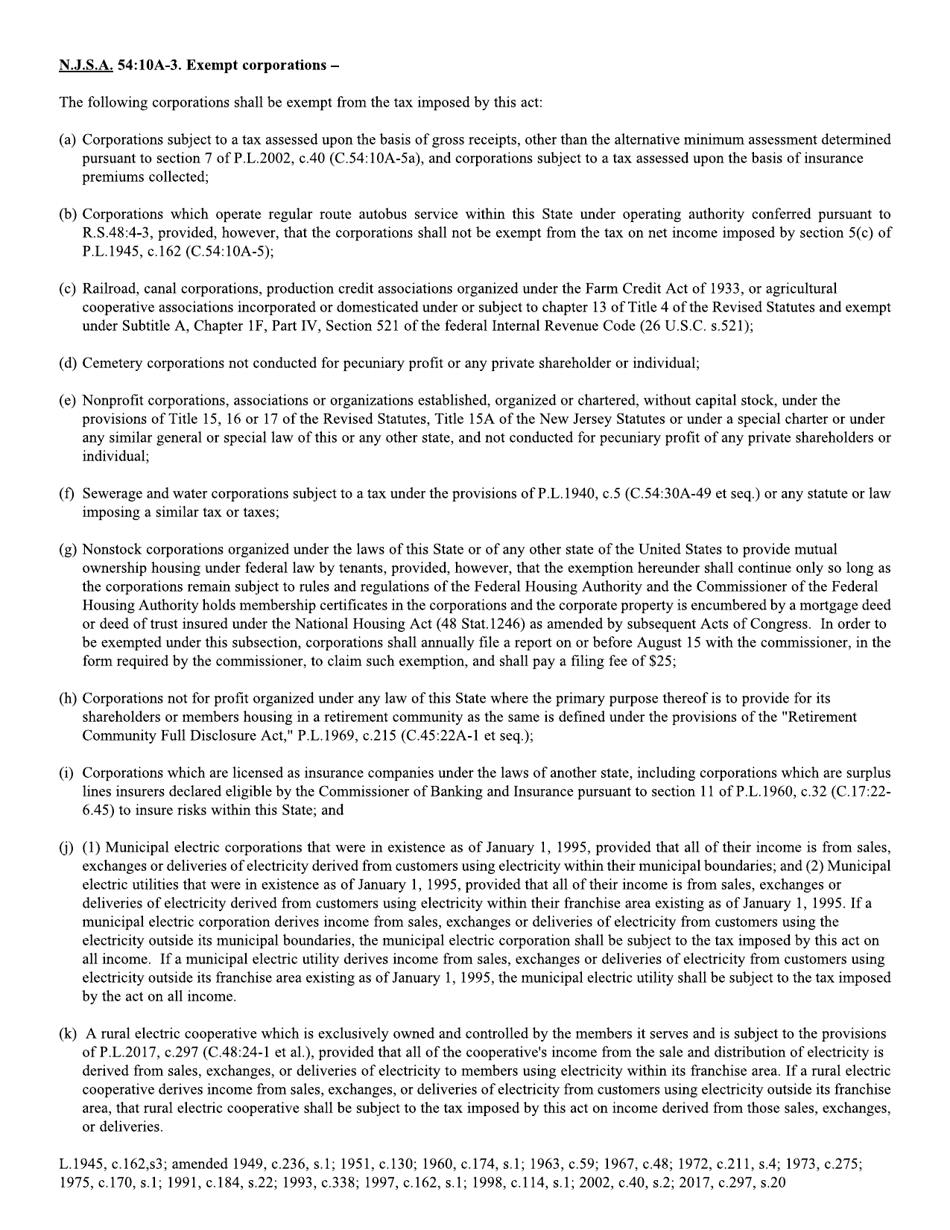

Form NJ-1065E Exempt Corporate Partner Statement - New Jersey

What Is Form NJ-1065E?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1065E?

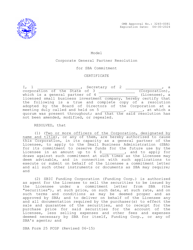

A: Form NJ-1065E is the Exempt Corporate Partner Statement for partnerships in New Jersey.

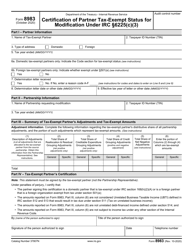

Q: Who needs to file Form NJ-1065E?

A: Partnerships that have exempt corporate partners need to file Form NJ-1065E.

Q: What is the purpose of Form NJ-1065E?

A: Form NJ-1065E is used to report the distributive share of income, gains, losses, and deductions to exempt corporate partners.

Q: When is Form NJ-1065E due?

A: Form NJ-1065E is generally due on the same date as Form NJ-1065, which is the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form NJ-1065E?

A: Yes, there may be penalties for late filing of Form NJ-1065E. It is important to file the form on time or request an extension if needed.

Q: Can Form NJ-1065E be e-filed?

A: Yes, Form NJ-1065E can be e-filed using the New Jersey Division of Taxation's e-filing system.

Q: Is Form NJ-1065E only for partnerships with exempt corporate partners?

A: Yes, Form NJ-1065E is specifically for partnerships that have exempt corporate partners.

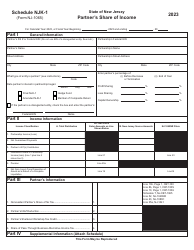

Q: What information is needed to complete Form NJ-1065E?

A: To complete Form NJ-1065E, you will need the partnership's information, including the exempt corporate partner's name, federal identification number, and distributive share of income, gains, losses, and deductions.

Q: Can Form NJ-1065E be amended?

A: Yes, if you need to make changes to Form NJ-1065E, you can file an amended version of the form.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1065E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.