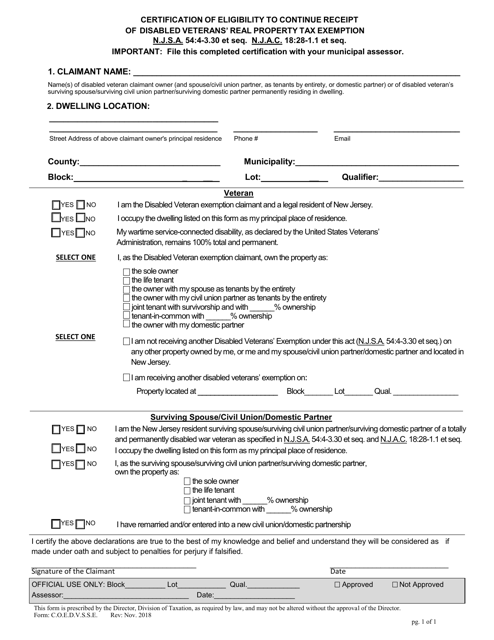

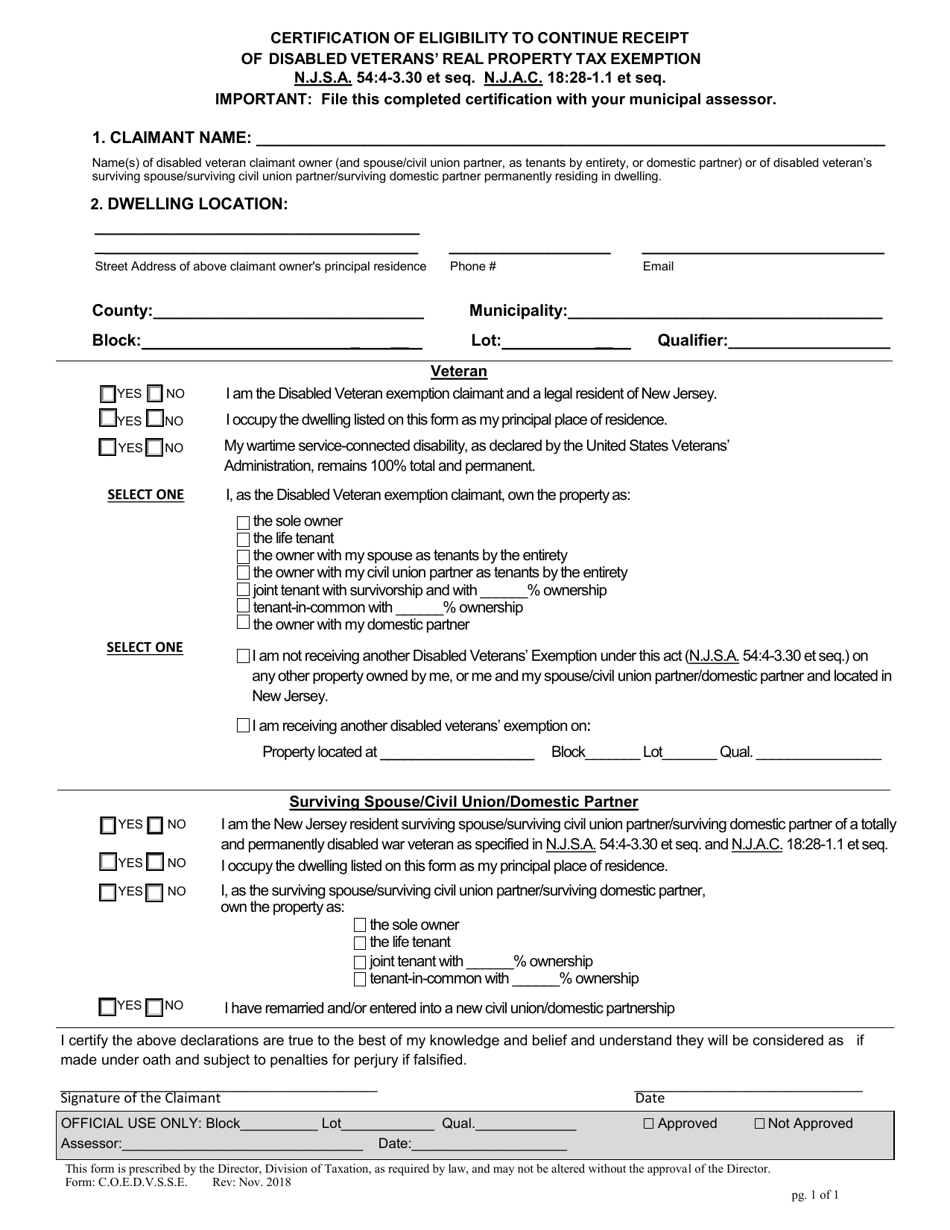

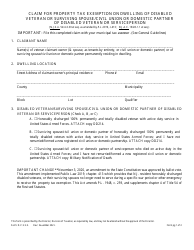

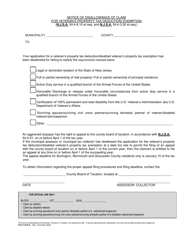

Form C.O.E.D.V.S.S.E. Certification of Eligibility to Continue Receipt of Disabled Veterans' Real Property Tax Exemption - New Jersey

What Is Form C.O.E.D.V.S.S.E.?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a C.O.E.D.V.S.S.E.?

A: C.O.E.D.V.S.S.E. stands for Certification of Eligibility to Continue Receipt of Disabled Veterans' Real Property Tax Exemption.

Q: What is the purpose of a C.O.E.D.V.S.S.E.?

A: The purpose of a C.O.E.D.V.S.S.E. is to certify the eligibility of disabled veterans to continue receiving a real property tax exemption in New Jersey.

Q: What is the Disabled Veterans' Real Property Tax Exemption?

A: The Disabled Veterans' Real Property Tax Exemption is a tax benefit that provides eligible disabled veterans with a reduction or exemption from property taxes in New Jersey.

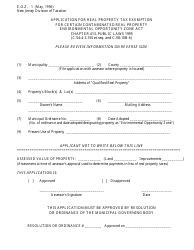

Q: How can I obtain a C.O.E.D.V.S.S.E.?

A: To obtain a C.O.E.D.V.S.S.E., you need to complete the application form and submit it to the appropriate county office in New Jersey.

Q: Who is eligible for the Disabled Veterans' Real Property Tax Exemption?

A: Disabled veterans who meet certain criteria, such as having a service-connected disability and being honorably discharged, may be eligible for the exemption.

Q: What documentation do I need to include with the C.O.E.D.V.S.S.E. application?

A: You may need to include documents such as proof of disability rating, proof of honorable discharge, and proof of residency in New Jersey with the application.

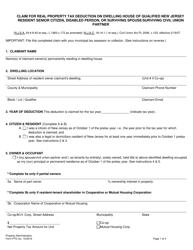

Q: Is there a fee for the C.O.E.D.V.S.S.E.?

A: There is no fee for the C.O.E.D.V.S.S.E. application.

Q: How often do I need to renew the C.O.E.D.V.S.S.E.?

A: The C.O.E.D.V.S.S.E. needs to be renewed every three years to ensure continued eligibility for the tax exemption.

Q: Can I transfer the Disabled Veterans' Real Property Tax Exemption to another property?

A: The tax exemption is generally non-transferable, meaning it applies to the property for which it was originally approved.

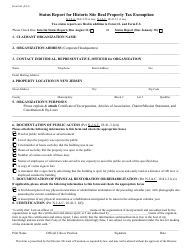

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C.O.E.D.V.S.S.E. by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.