This version of the form is not currently in use and is provided for reference only. Download this version of

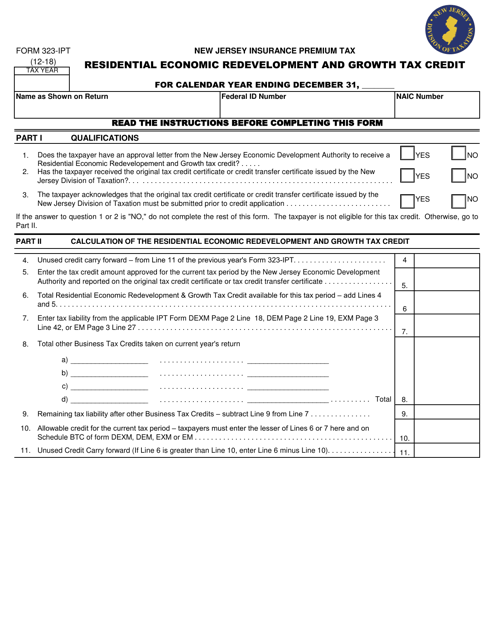

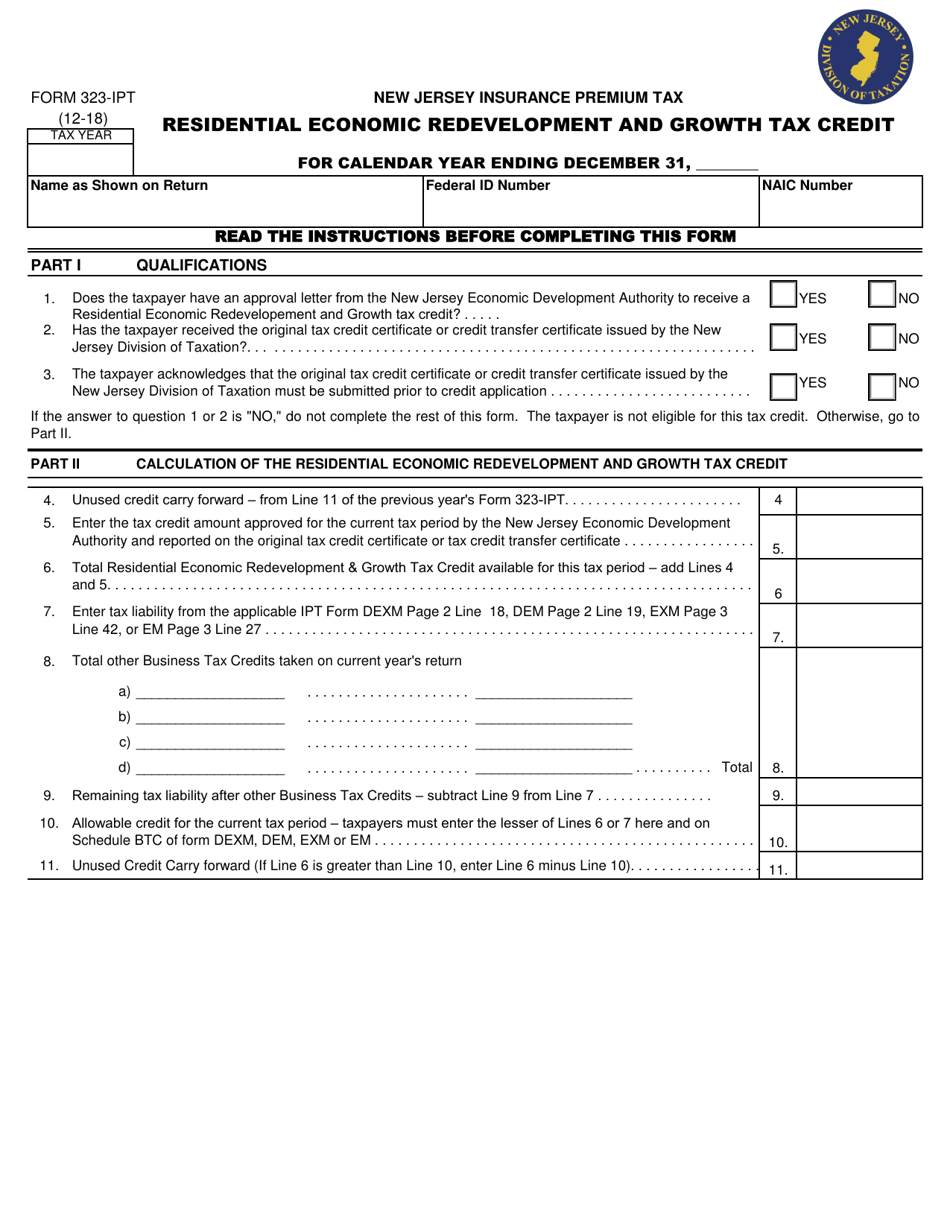

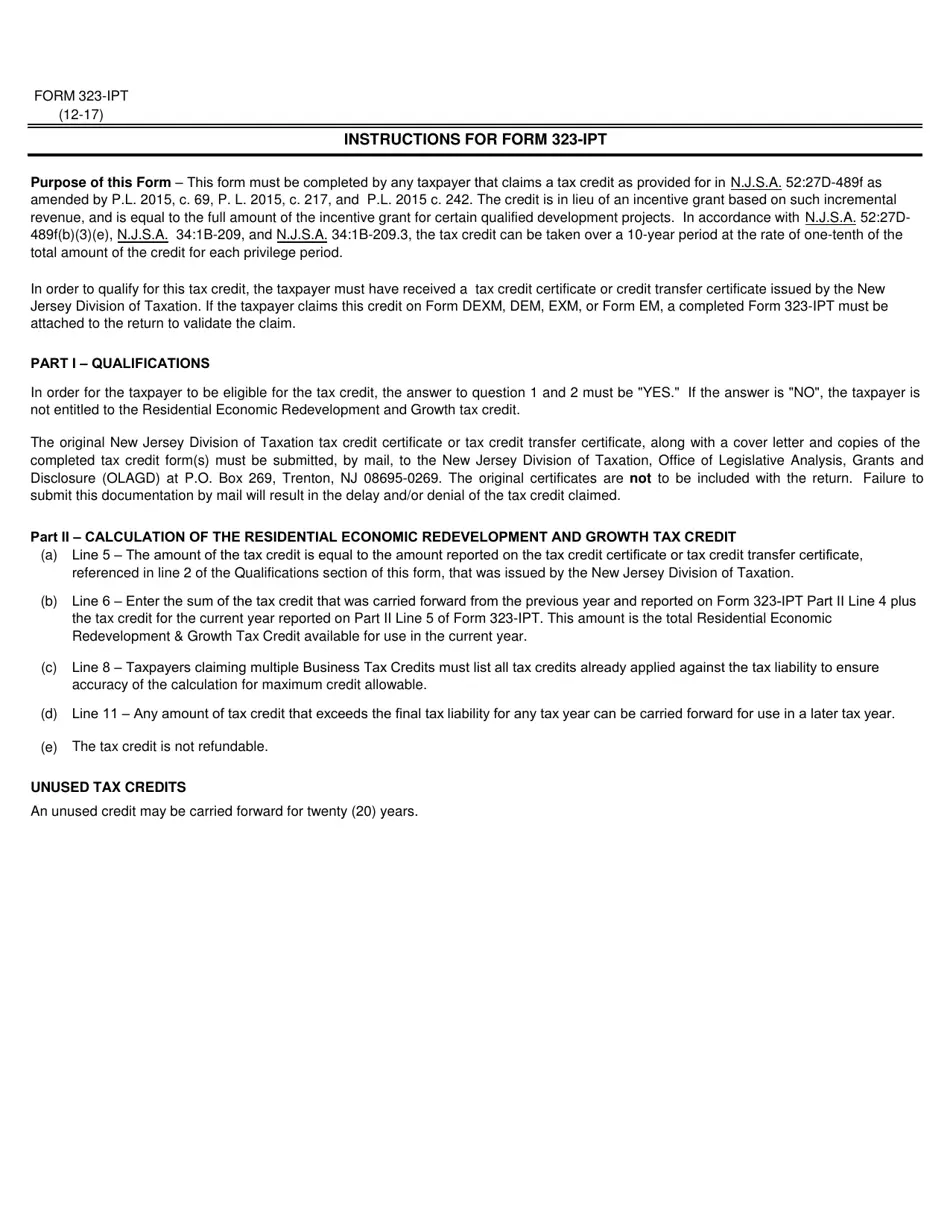

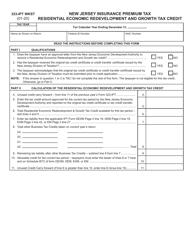

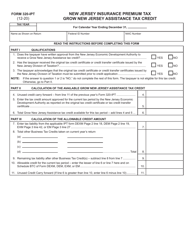

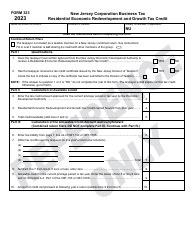

Form 323-IPT

for the current year.

Form 323-IPT Residential Economic Redevelopment and Growth Tax Credit - Insurance Premium Tax - New Jersey

What Is Form 323-IPT?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 323-IPT?

A: Form 323-IPT is a tax form related to the Residential Economic Redevelopment and Growth Tax Credit - Insurance Premium Tax in New Jersey.

Q: What is the purpose of Form 323-IPT?

A: The purpose of Form 323-IPT is to claim the Residential Economic Redevelopment and Growth Tax Credit for insurance premium tax in New Jersey.

Q: Who needs to file Form 323-IPT?

A: Individuals or businesses that are eligible for the Residential Economic Redevelopment and Growth Tax Credit in New Jersey and have paid insurance premium tax need to file Form 323-IPT.

Q: What is the Residential Economic Redevelopment and Growth Tax Credit?

A: The Residential Economic Redevelopment and Growth Tax Credit is a tax incentive program in New Jersey that provides credits against insurance premium tax for eligible redevelopment projects.

Q: Are there any filing deadlines for Form 323-IPT?

A: Yes, the filing deadline for Form 323-IPT is typically the same as the deadline for filing the insurance premium tax return in New Jersey.

Q: What supporting documents do I need to include with Form 323-IPT?

A: You may need to include documentation such as project certification and proof of insurance premium tax paid with Form 323-IPT.

Q: Can I claim the Residential Economic Redevelopment and Growth Tax Credit for multiple years?

A: Yes, the tax credit can be claimed for up to 20 years as long as the project continues to meet the eligibility requirements.

Q: Who can I contact for more information about Form 323-IPT?

A: For more information about Form 323-IPT and the Residential Economic Redevelopment and Growth Tax Credit, you can contact the New Jersey Division of Taxation or consult a tax professional.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 323-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.