This version of the form is not currently in use and is provided for reference only. Download this version of

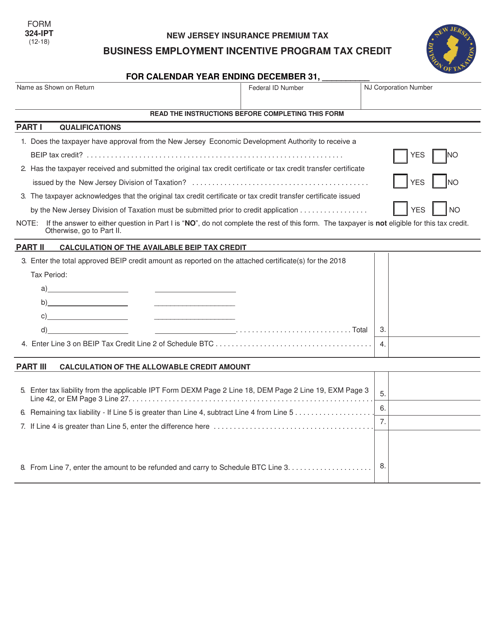

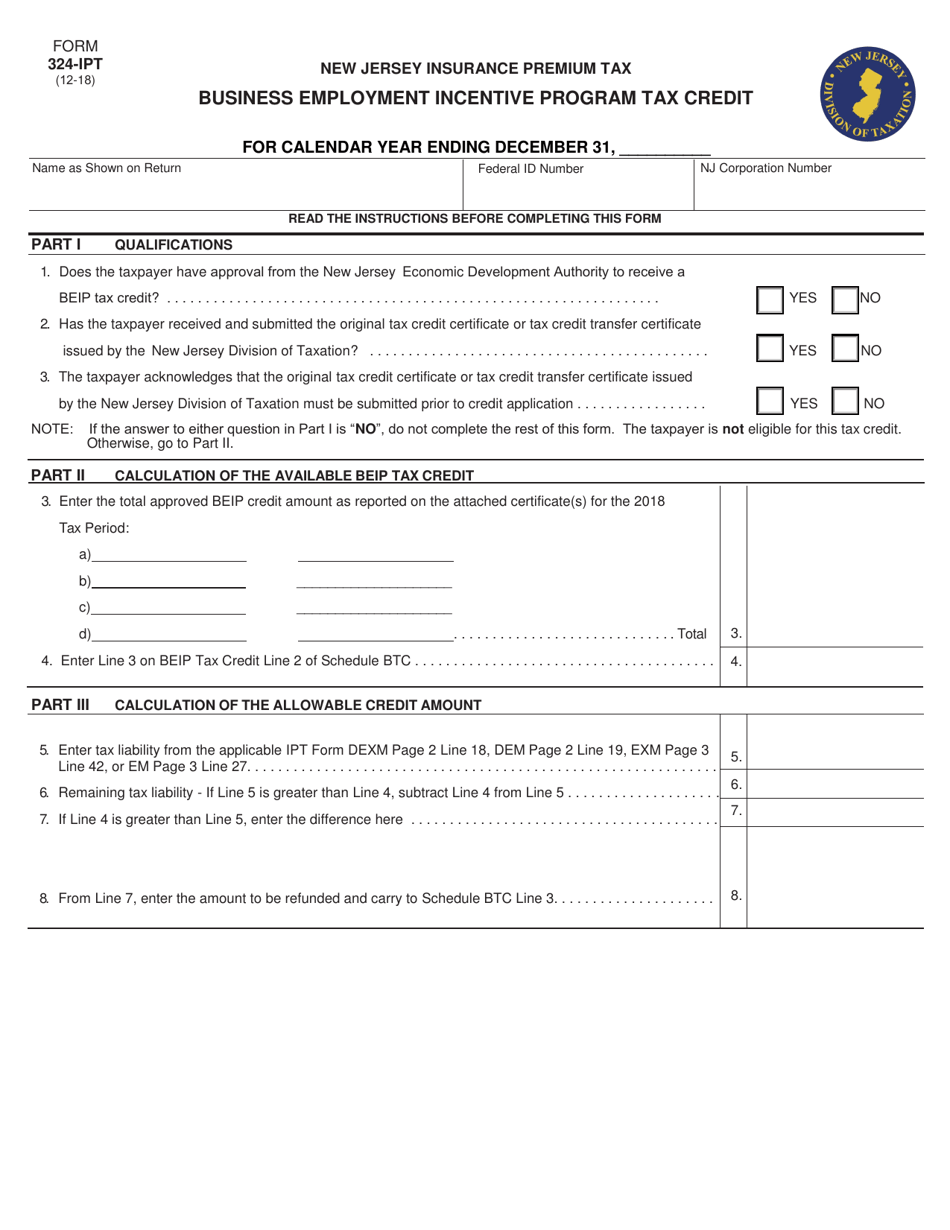

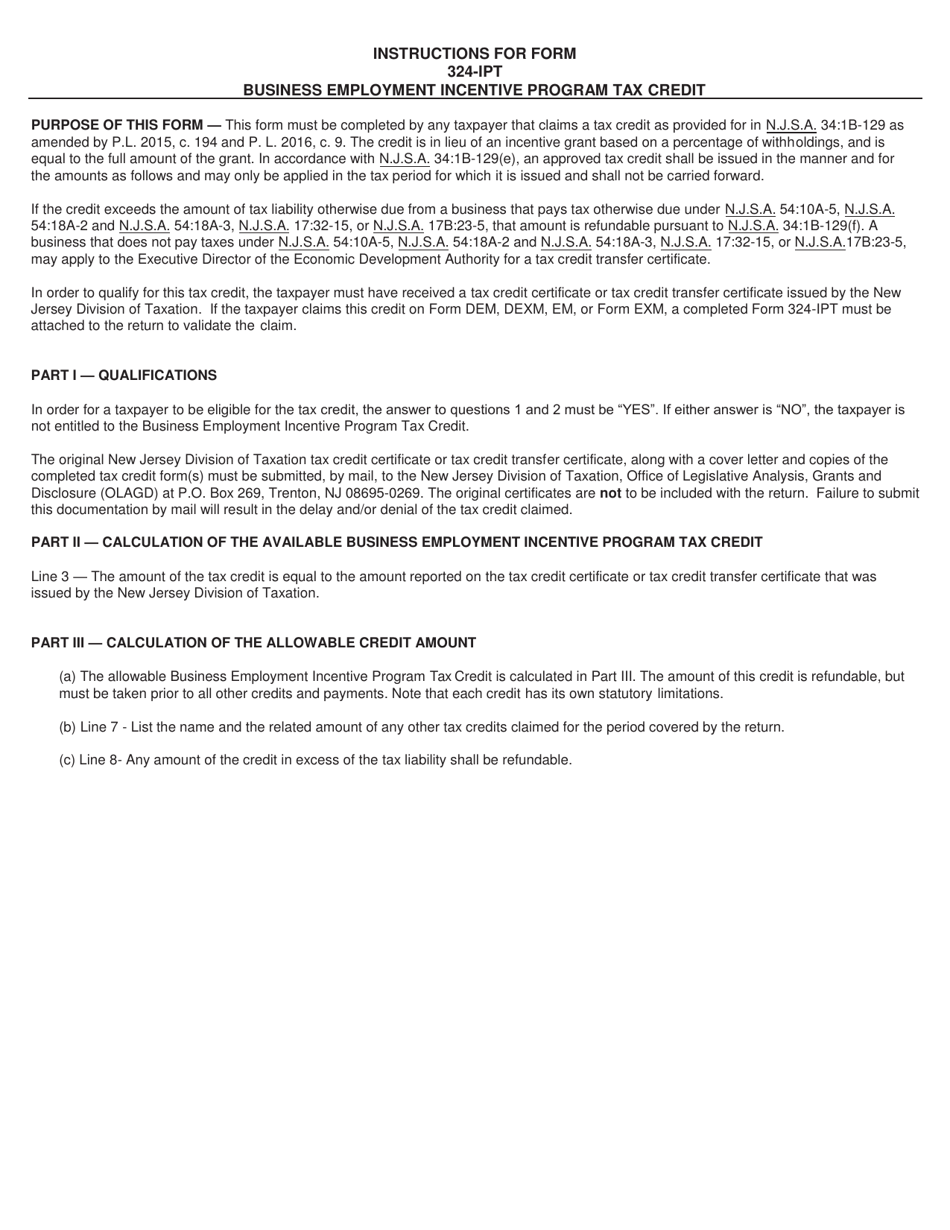

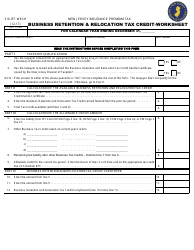

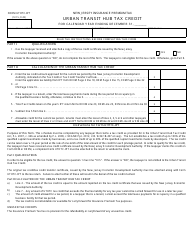

Form 324-IPT

for the current year.

Form 324-IPT Business Employment Incentive Program Tax Credit - New Jersey

What Is Form 324-IPT?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

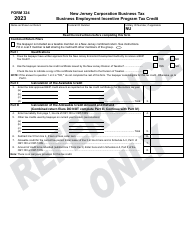

Q: What is Form 324-IPT?

A: Form 324-IPT is a tax form used for the Business Employment IncentiveProgram Tax Credit in New Jersey.

Q: What is the purpose of the Business Employment Incentive Program Tax Credit?

A: The purpose of the Business Employment Incentive Program Tax Credit is to provide incentives for businesses to create new jobs in New Jersey.

Q: Who is eligible for the Business Employment Incentive Program Tax Credit?

A: Businesses that meet certain criteria set by the program are eligible for the Business Employment Incentive Program Tax Credit.

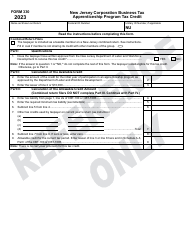

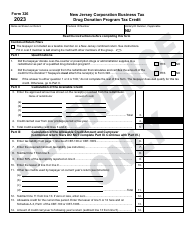

Q: What information is required to complete Form 324-IPT?

A: Form 324-IPT requires information about the business's employment and wages, as well as other details related to the incentive program.

Q: When is the deadline to file Form 324-IPT?

A: The deadline to file Form 324-IPT varies and depends on the specific tax year. It is important to check the instructions provided with the form for the correct deadline.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 324-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.