This version of the form is not currently in use and is provided for reference only. Download this version of

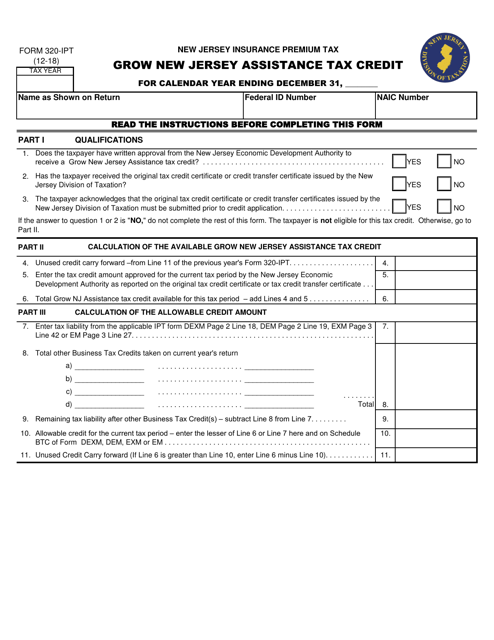

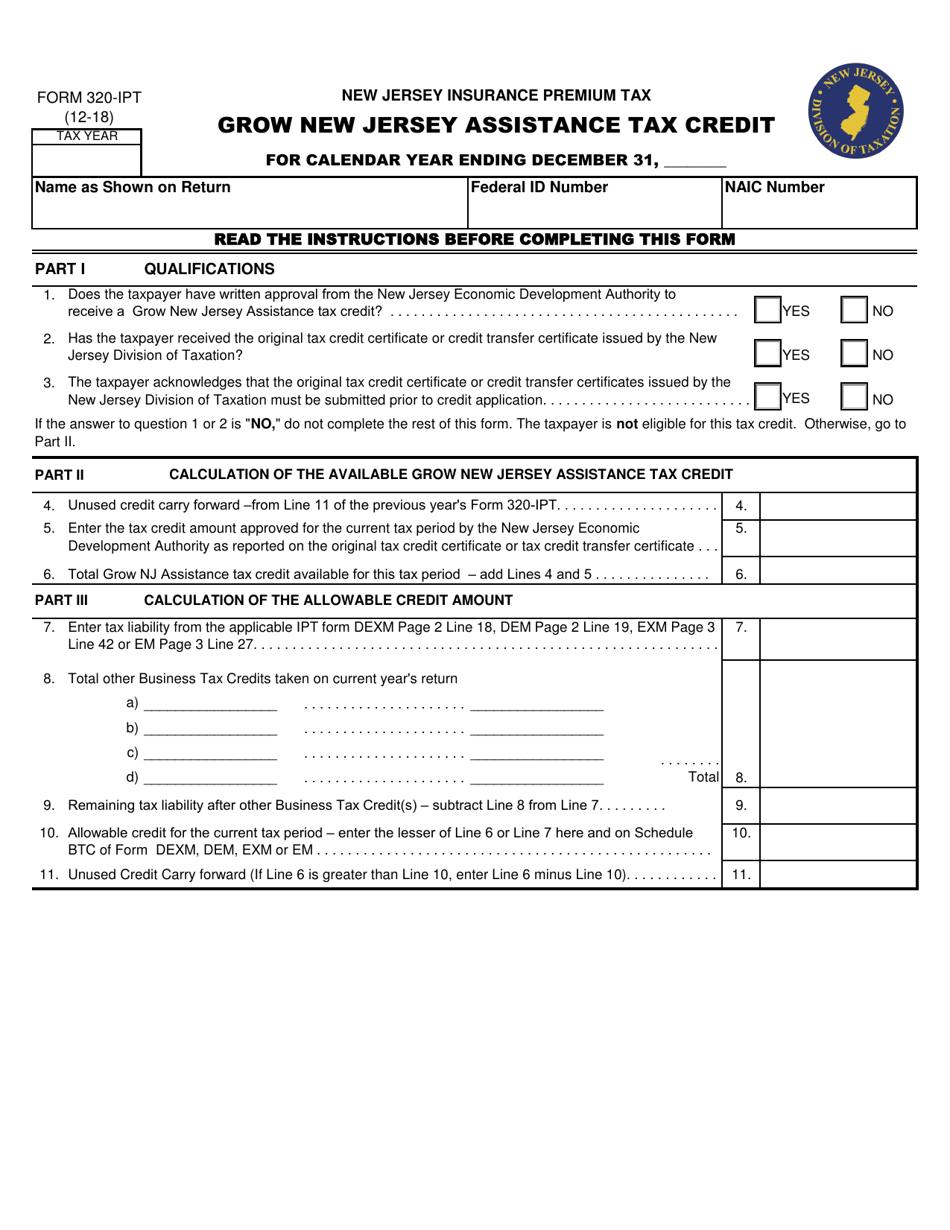

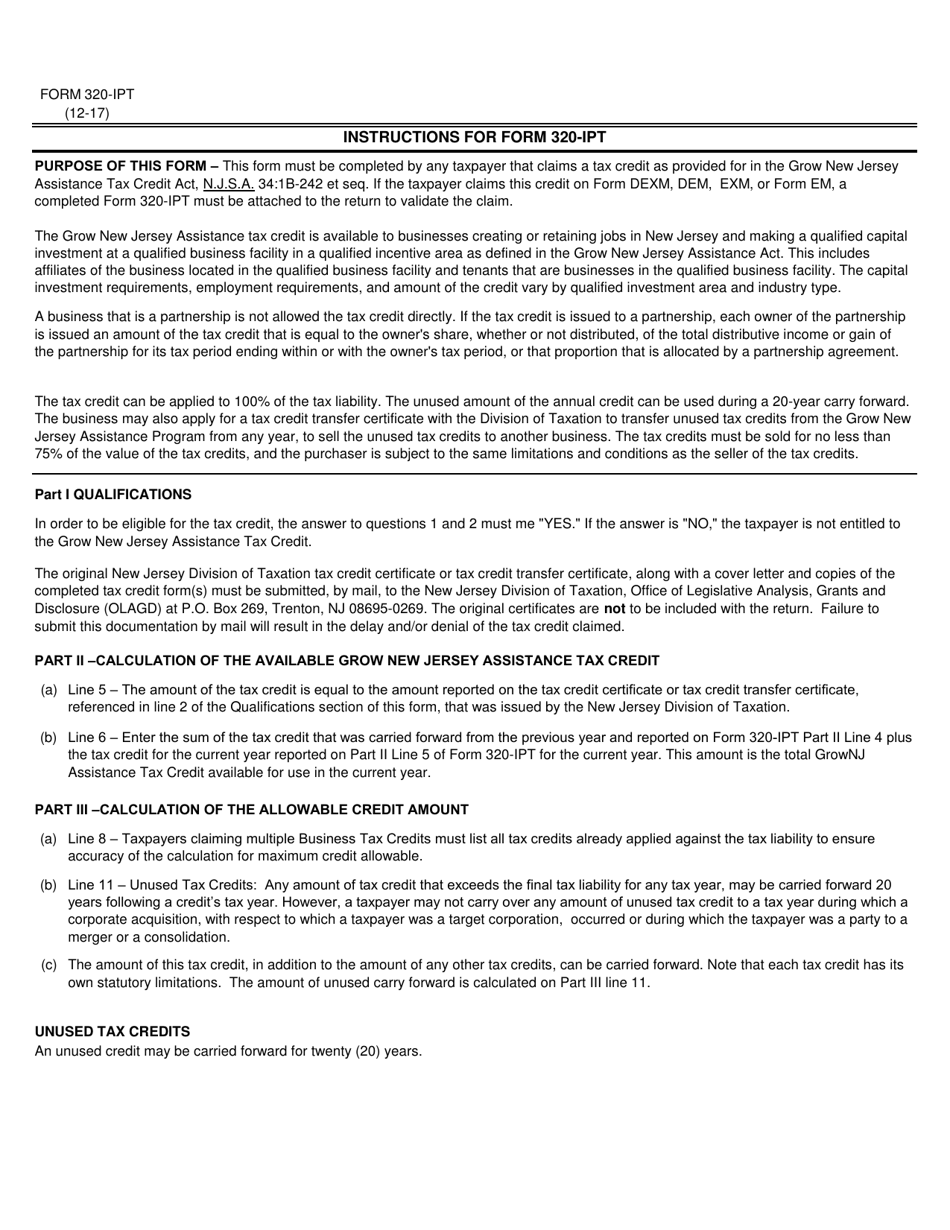

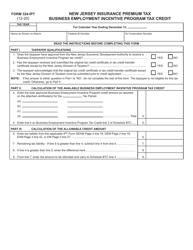

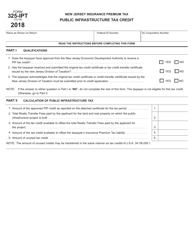

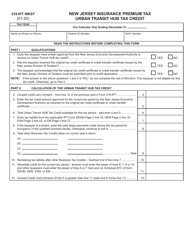

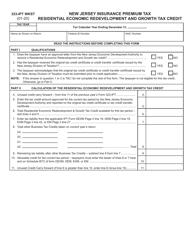

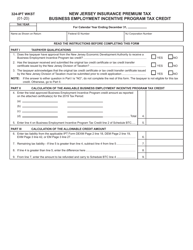

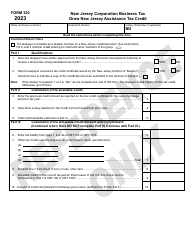

Form 320-IPT

for the current year.

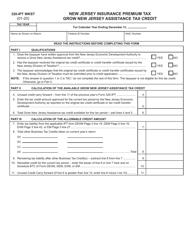

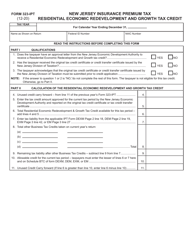

Form 320-IPT Grow New Jersey Assistance Tax Credit - Insurance Premium Tax - New Jersey

What Is Form 320-IPT?

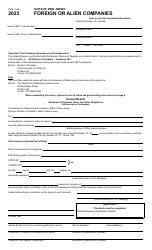

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 320-IPT Grow New Jersey Assistance Tax Credit?

A: Form 320-IPT Grow New Jersey Assistance Tax Credit is a form used in New Jersey to claim the Insurance PremiumTax credit for businesses under the Grow NJ Assistance Program.

Q: What is the purpose of the Grow New Jersey Assistance Tax Credit?

A: The purpose of the Grow New Jersey Assistance Tax Credit is to incentivize businesses to create and retain jobs in New Jersey.

Q: Who is eligible for the Grow New Jersey Assistance Tax Credit?

A: Businesses that meet certain criteria, such as creating new jobs or making capital investments in New Jersey, may be eligible for the Grow New Jersey Assistance Tax Credit.

Q: How does the Grow New Jersey Assistance Tax Credit work?

A: The Grow New Jersey Assistance Tax Credit allows eligible businesses to claim a credit against their insurance premium tax liability.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 320-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.