This version of the form is not currently in use and is provided for reference only. Download this version of

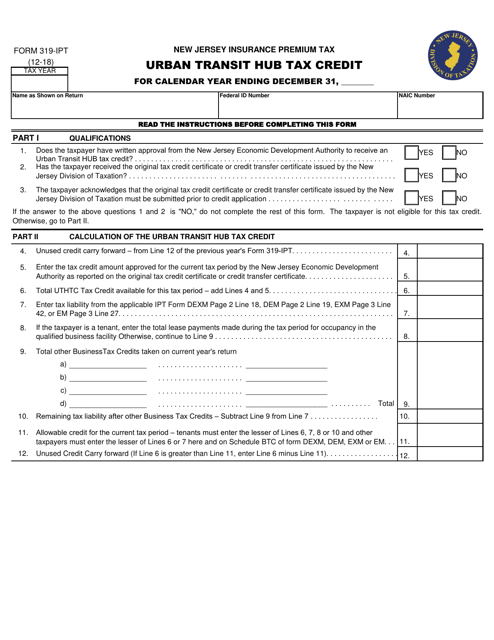

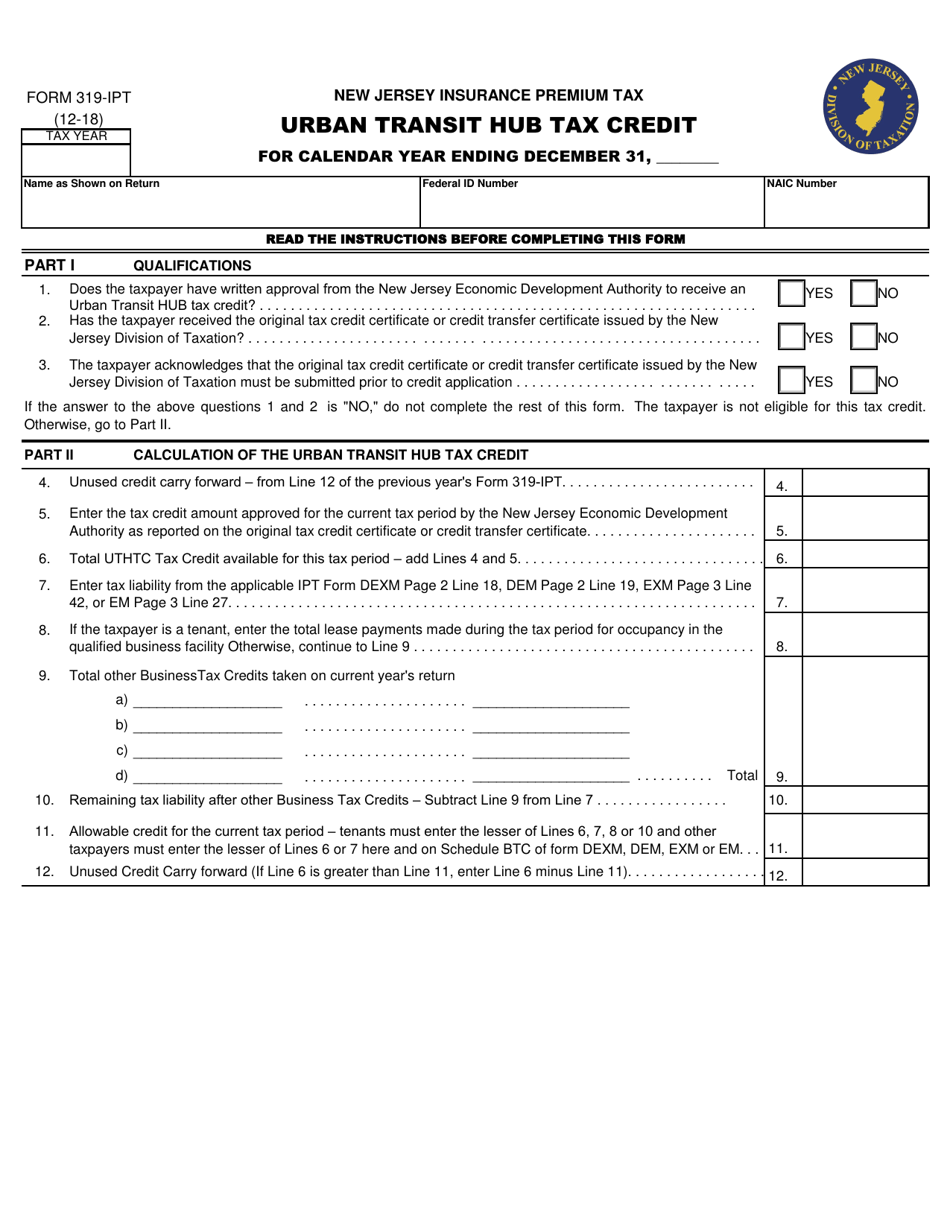

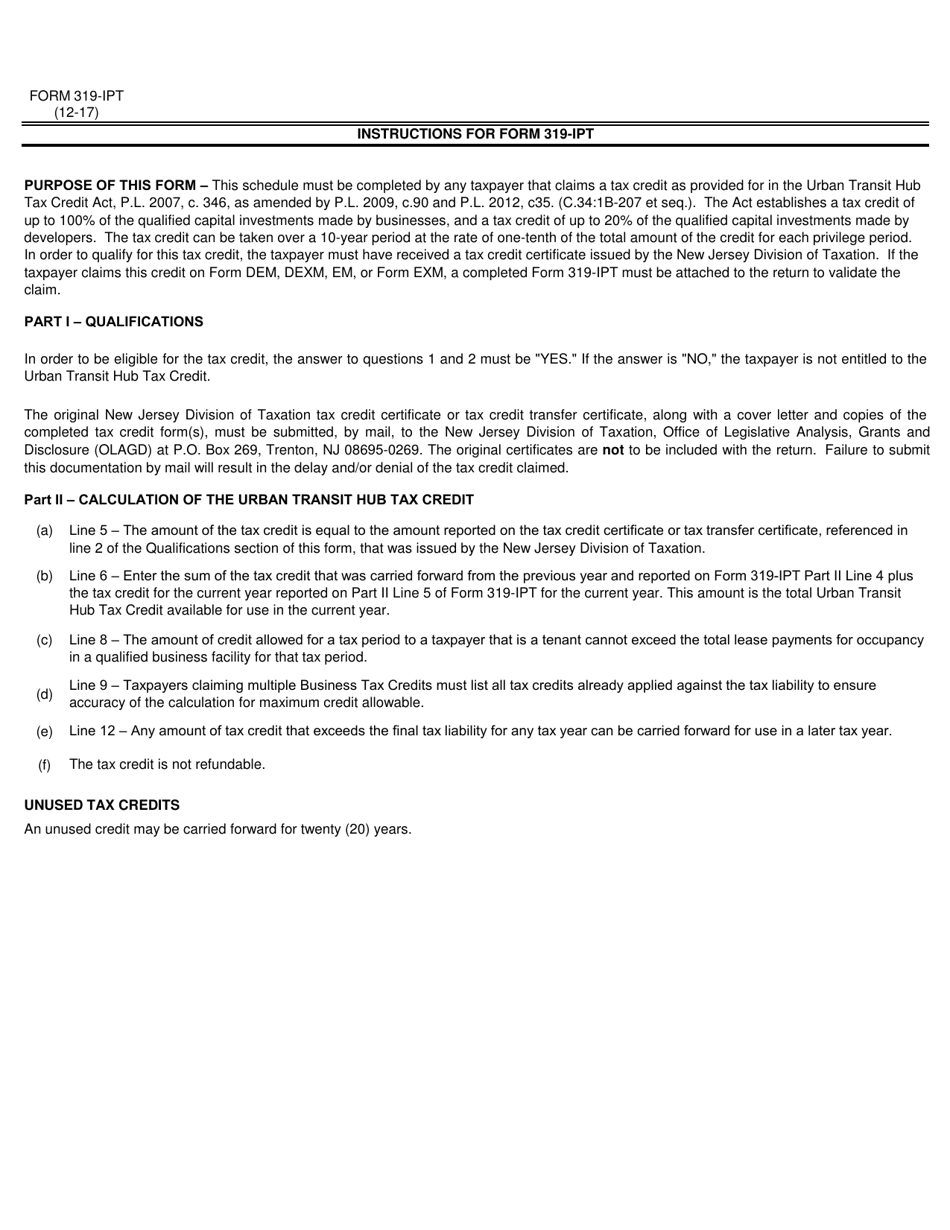

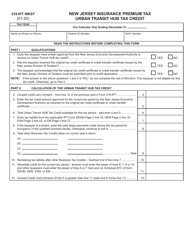

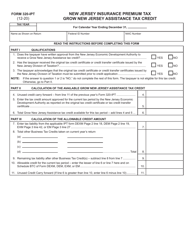

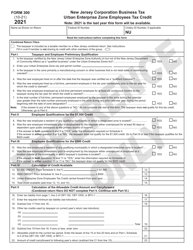

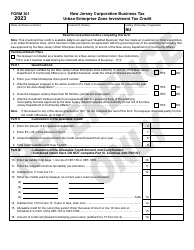

Form 319-IPT

for the current year.

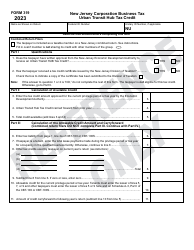

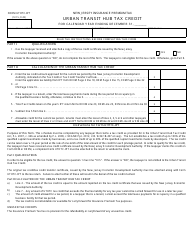

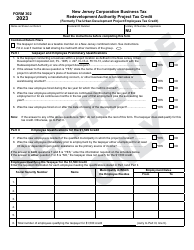

Form 319-IPT Urban Transit Hub Tax Credit - New Jersey

What Is Form 319-IPT?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 319-IPT?

A: Form 319-IPT is the application for the Urban Transit Hub Tax Credit in the state of New Jersey.

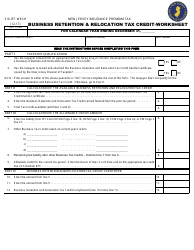

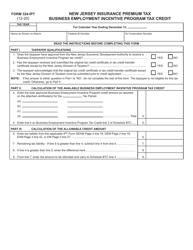

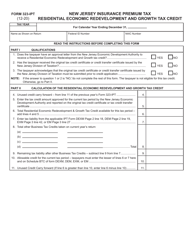

Q: What is the Urban Transit Hub Tax Credit?

A: The Urban Transit Hub Tax Credit is a program in New Jersey that provides tax credits to businesses that create jobs and make certain investments in designated urban areas.

Q: How do I qualify for the Urban Transit Hub Tax Credit?

A: To qualify for the Urban Transit Hub Tax Credit, you must be a business that creates jobs and makes qualifying investments in a designated urban area in New Jersey.

Q: Are there any deadlines for filing Form 319-IPT?

A: Yes, there are specific deadlines for filing Form 319-IPT. It is important to refer to the instructions on the form or consult with the New Jersey Division of Taxation for the current year's deadline.

Q: Can I claim the Urban Transit Hub Tax Credit if I am not located in a designated urban area?

A: No, the Urban Transit Hub Tax Credit is only available for businesses that make qualifying investments in designated urban areas in New Jersey.

Q: What kind of investments are eligible for the Urban Transit Hub Tax Credit?

A: Eligible investments for the Urban Transit Hub Tax Credit include certain capital investments in real or tangible personal property and qualified transportation infrastructure projects.

Q: How much is the Urban Transit Hub Tax Credit?

A: The amount of the Urban Transit Hub Tax Credit varies depending on the specific details of the qualifying investments and job creation.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 319-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.