This version of the form is not currently in use and is provided for reference only. Download this version of

Form EM

for the current year.

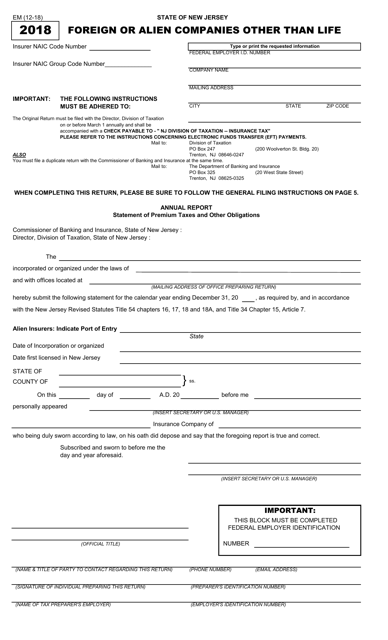

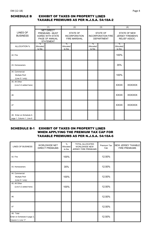

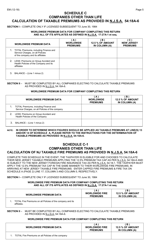

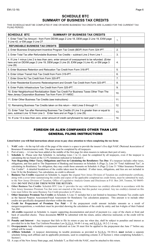

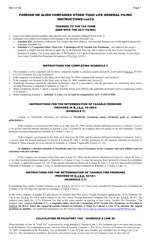

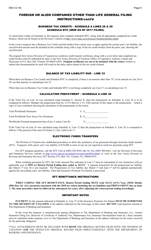

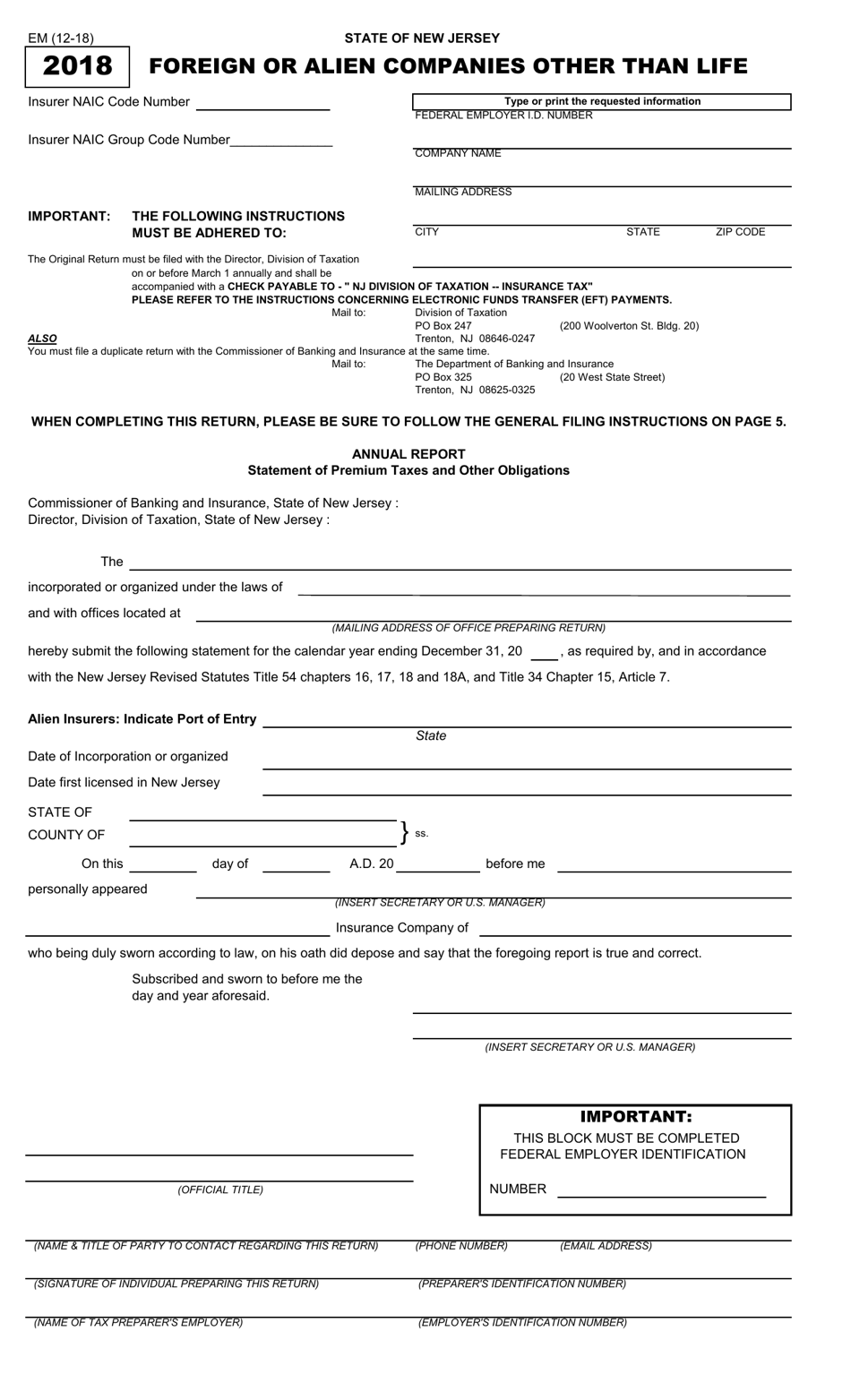

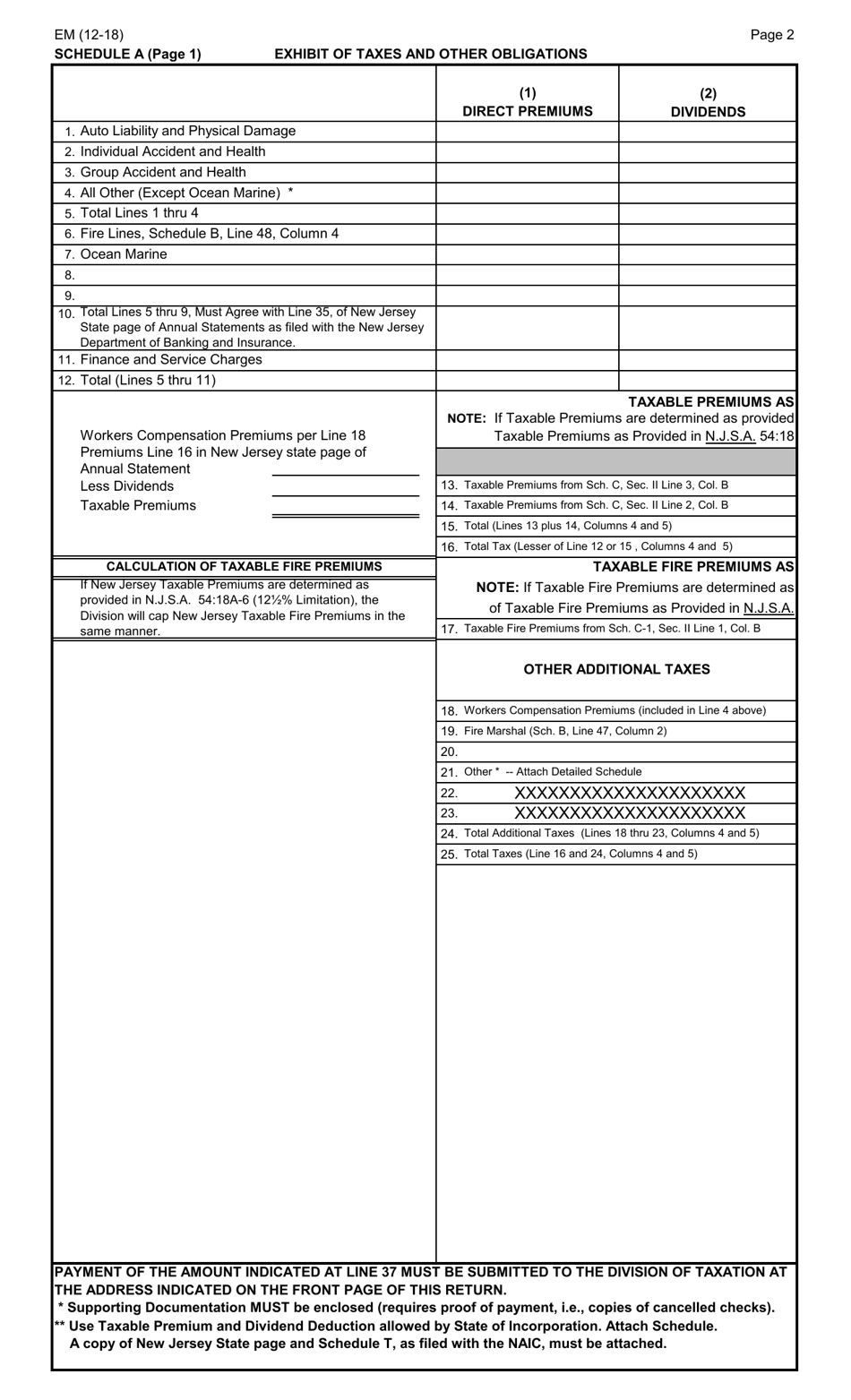

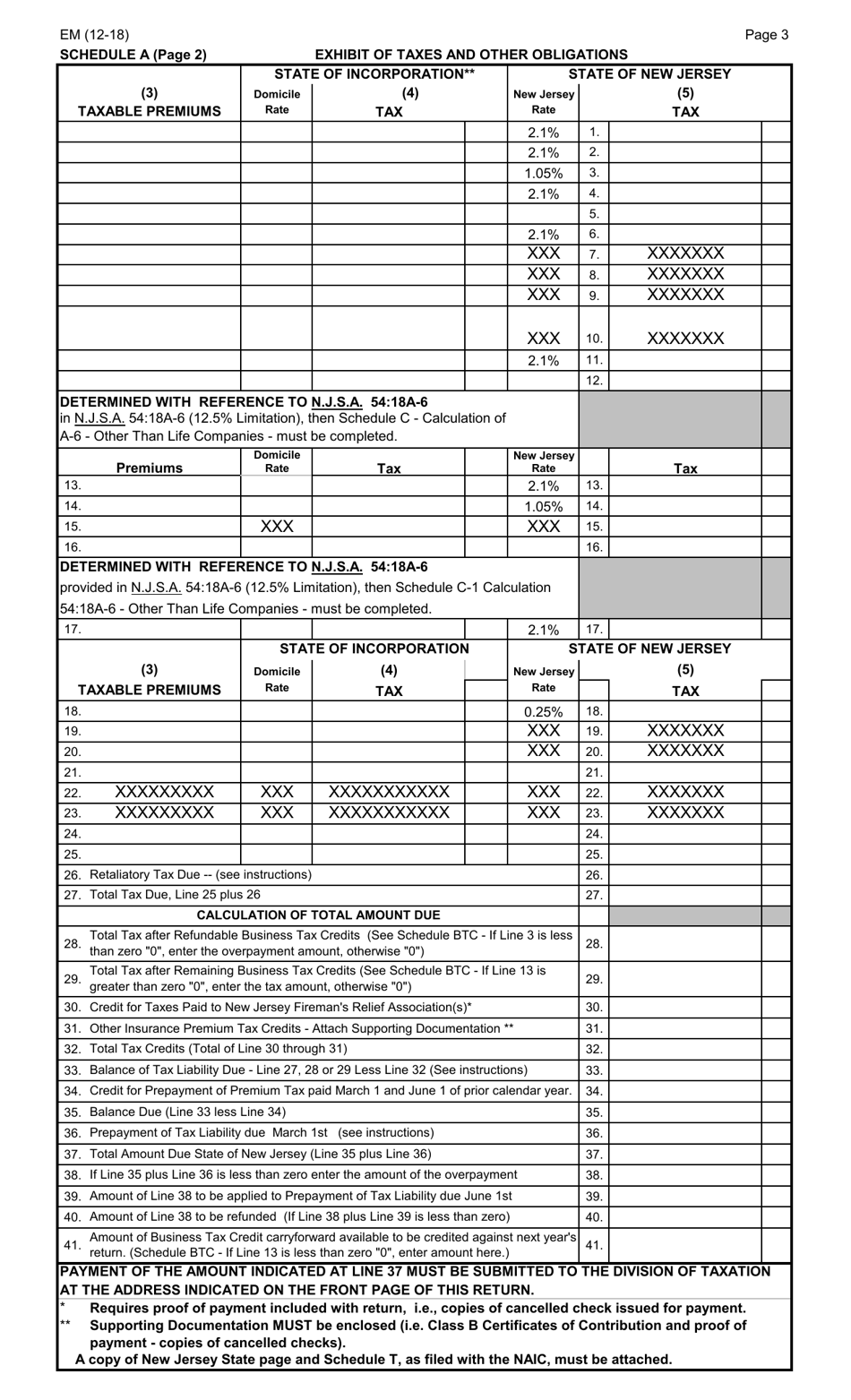

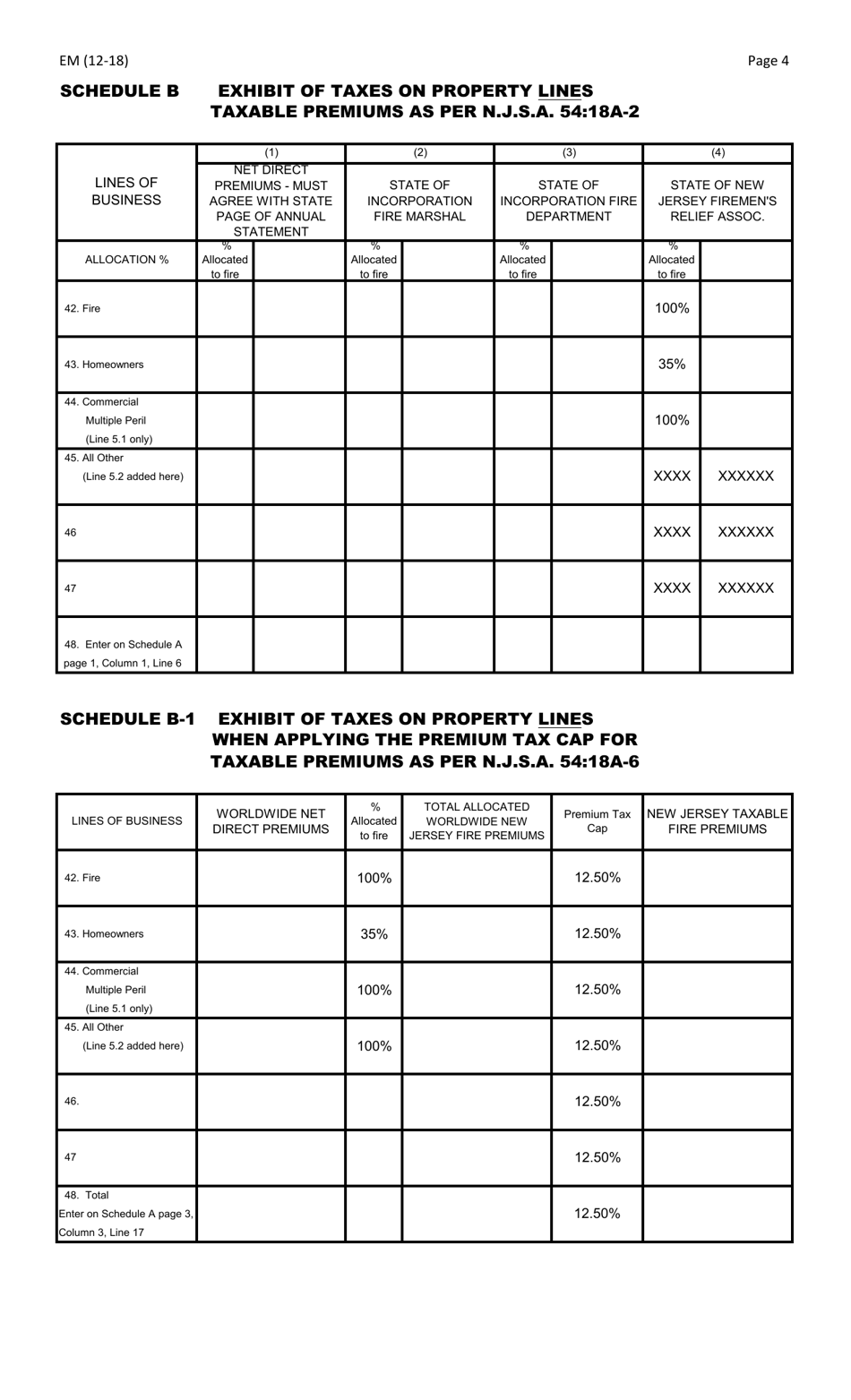

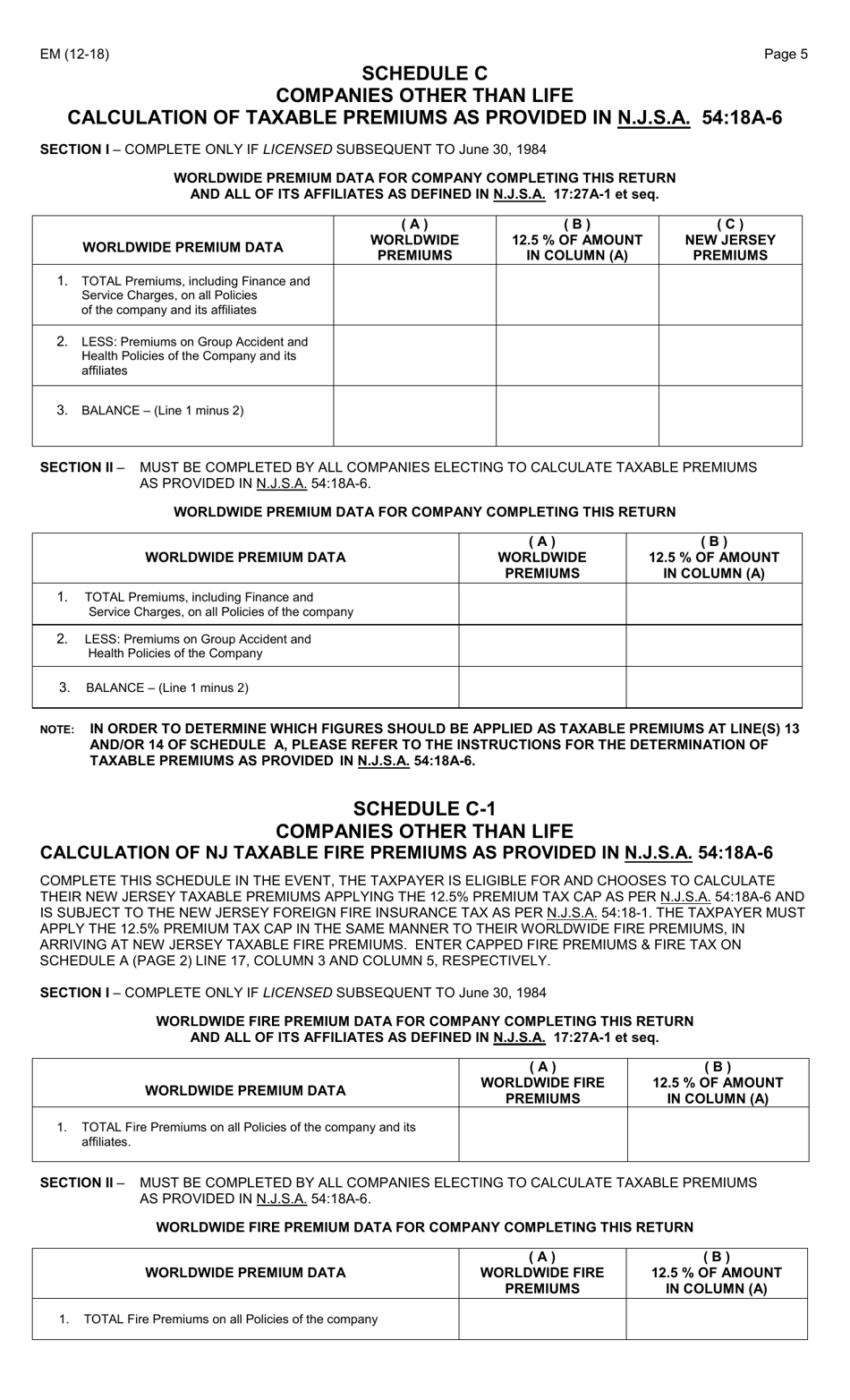

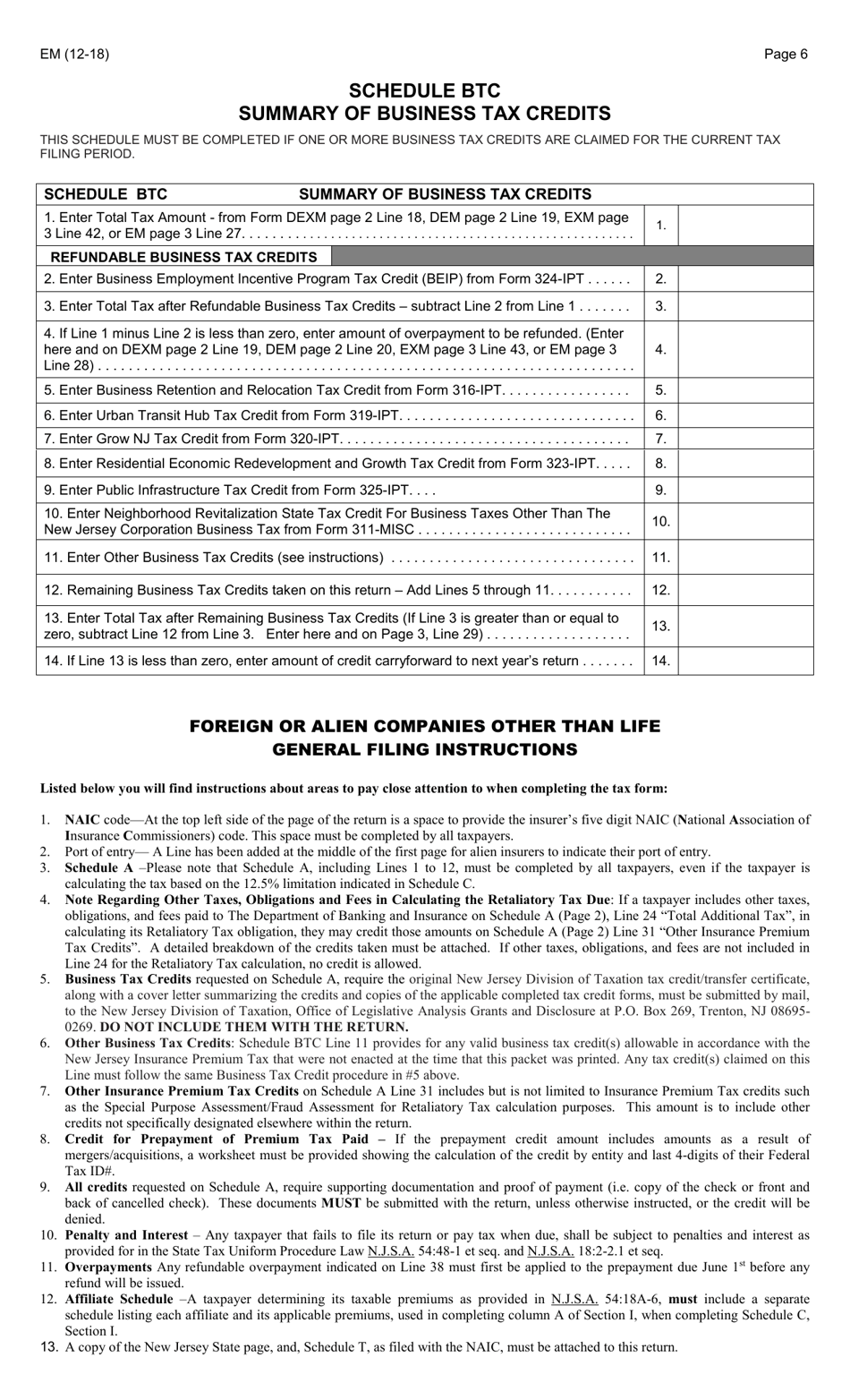

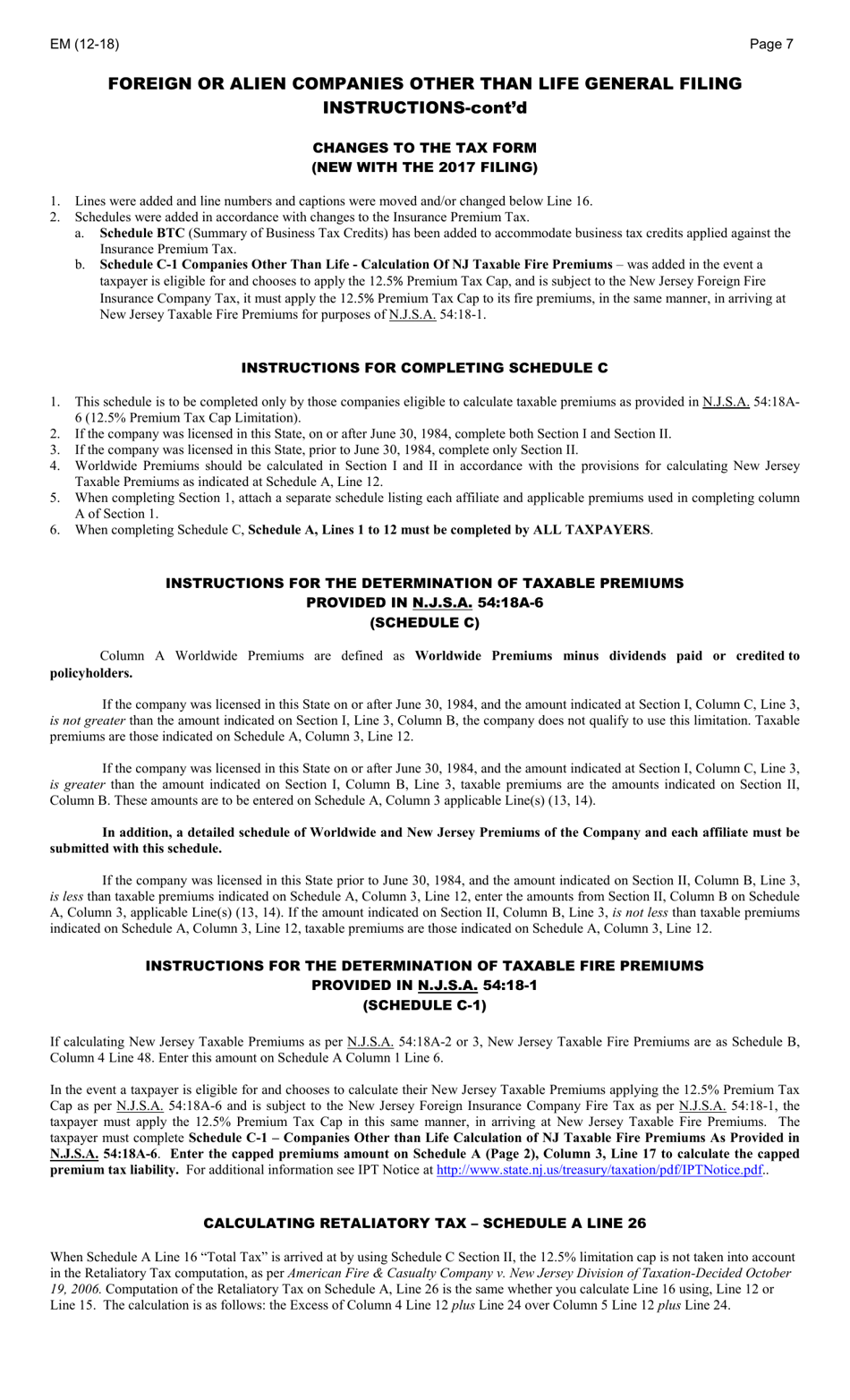

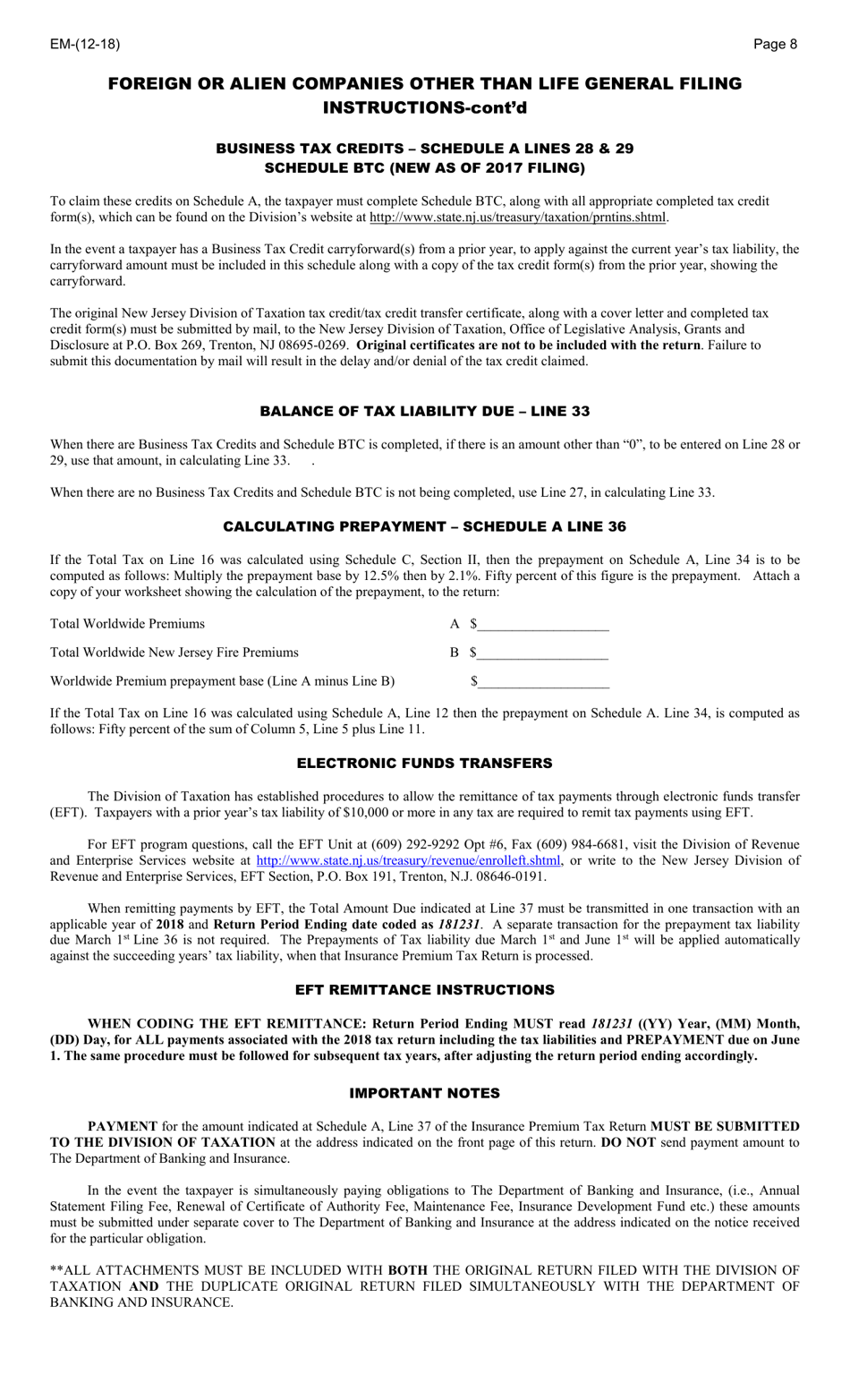

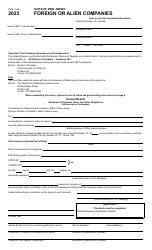

Form EM Foreign or Alien Companies Other Than Life Insurance Premium Tax Return - New Jersey

What Is Form EM?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an EM foreign or alien company?

A: An EM foreign or alien company is a company that is not organized under the laws of the United States or any state, but does business in the US.

Q: What is the purpose of the EM Foreign or Alien Companies other than Life Insurance Premium Tax Return in New Jersey?

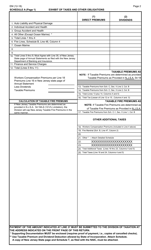

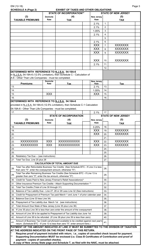

A: The purpose of this tax return is to report and pay the premium tax owed by EM foreign or alien companies (other than life insurance companies) doing business in New Jersey.

Q: Who is required to file EM Foreign or Alien Companies other than Life Insurance Premium Tax Return in New Jersey?

A: EM foreign or alien insurance companies that do business in New Jersey must file this tax return.

Q: How often does the EM Foreign or Alien Companies other than Life Insurance Premium Tax Return need to be filed?

A: This tax return is filed on an annual basis. The due date is March 1st of each year.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EM by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.