This version of the form is not currently in use and is provided for reference only. Download this version of

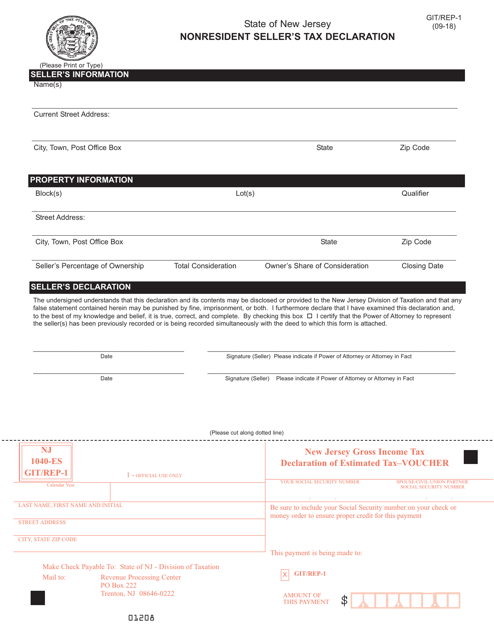

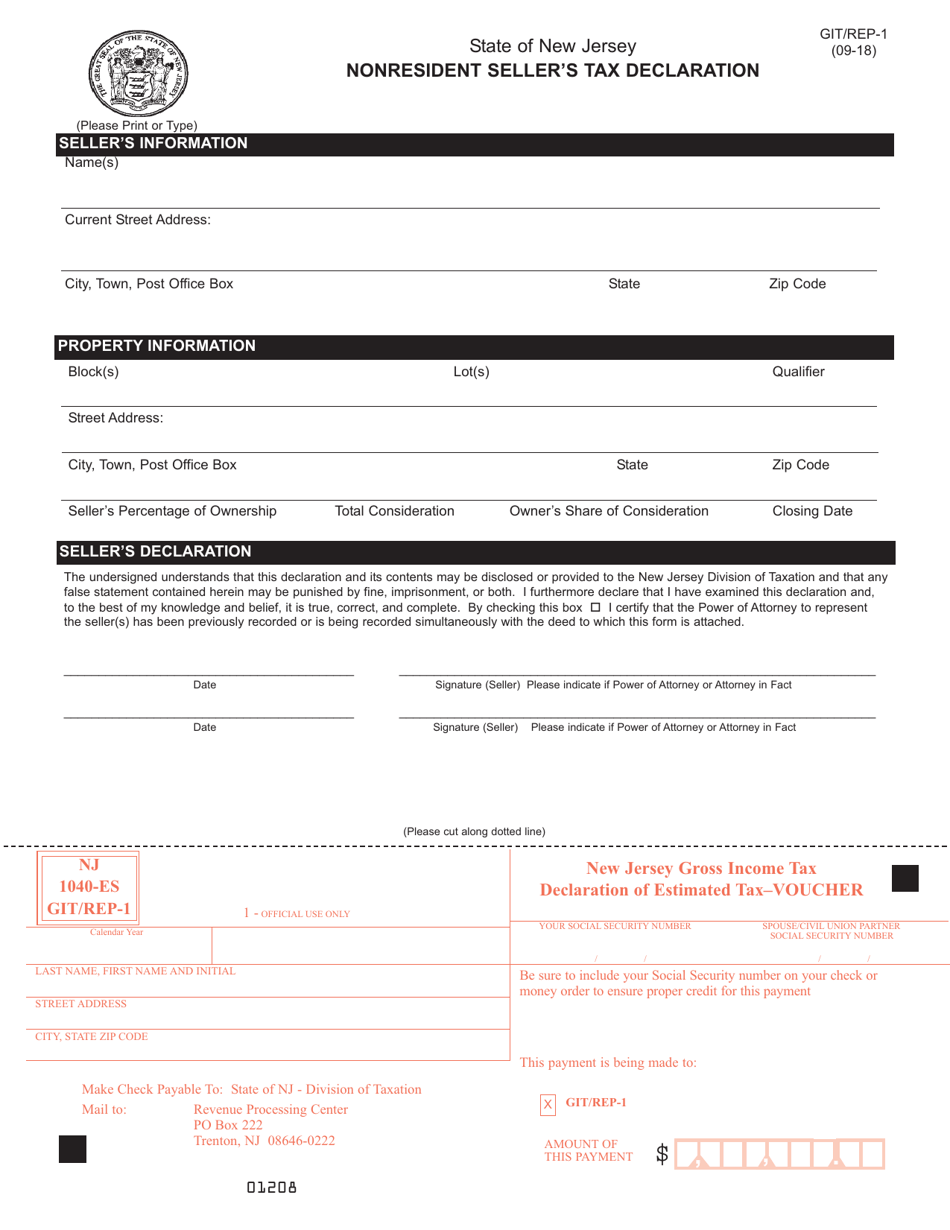

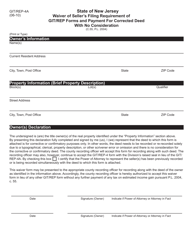

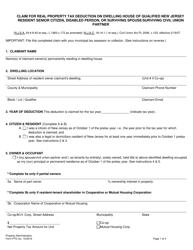

Form GIT/REP-1

for the current year.

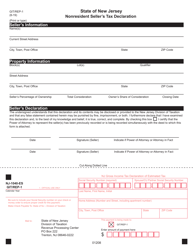

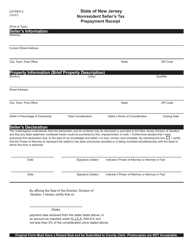

Form GIT / REP-1 Nonresident Seller's Tax Declaration - New Jersey

What Is Form GIT/REP-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GIT/REP-1?

A: Form GIT/REP-1 is the Nonresident Seller's Tax Declaration for the state of New Jersey.

Q: Who needs to file Form GIT/REP-1?

A: Nonresident sellers who have made a profit from the sale of real property located in New Jersey need to file Form GIT/REP-1.

Q: What information is required on Form GIT/REP-1?

A: Form GIT/REP-1 requires information about the seller, the property being sold, and the financial details of the sale.

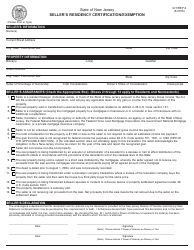

Q: When is Form GIT/REP-1 due?

A: Form GIT/REP-1 is due on the 15th day of the month following the closing date of the sale.

Q: Are there any penalties for not filing Form GIT/REP-1?

A: Yes, failure to file Form GIT/REP-1 or filing it late may result in penalties and interest charges.

Q: Can I file Form GIT/REP-1 electronically?

A: No, Form GIT/REP-1 must be submitted by mail to the New Jersey Division of Taxation.

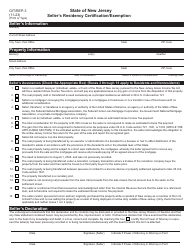

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT/REP-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.