This version of the form is not currently in use and is provided for reference only. Download this version of

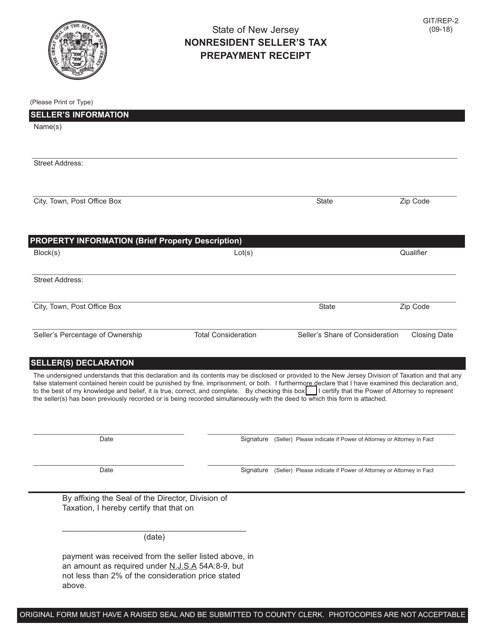

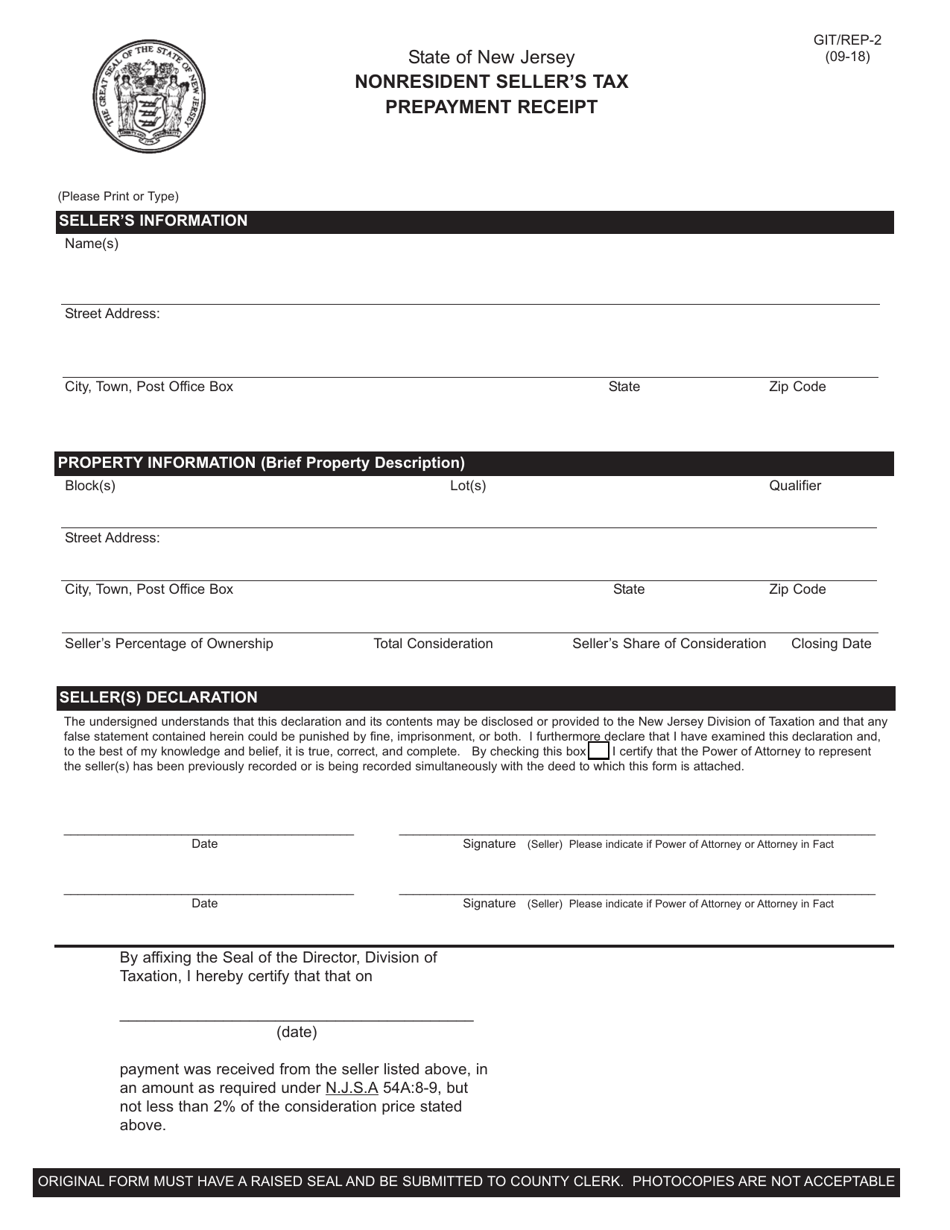

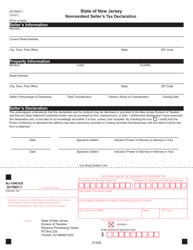

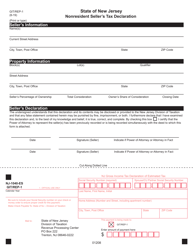

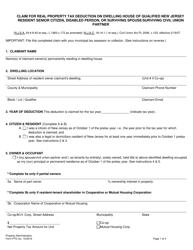

Form GIT/REP-2

for the current year.

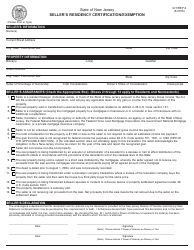

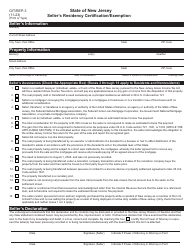

Form GIT / REP-2 Nonresident Seller's Tax Prepayment Receipt - New Jersey

What Is Form GIT/REP-2?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of form GIT/REP-2?

A: Form GIT/REP-2 is used to report and make a tax prepayment for nonresident sellers in New Jersey.

Q: Who needs to file form GIT/REP-2?

A: Nonresident sellers in New Jersey who made a taxable sale of real property need to file form GIT/REP-2.

Q: What is a tax prepayment?

A: A tax prepayment is an advance payment of taxes to the state, which is based on the anticipated tax liability.

Q: When is the deadline to file form GIT/REP-2?

A: The form must be filed within 30 days of the date of the taxable sale of real property.

Q: What happens if I fail to file form GIT/REP-2?

A: Failure to file form GIT/REP-2 may result in penalties and interest charges.

Q: Can I file form GIT/REP-2 electronically?

A: No, form GIT/REP-2 must be filed by mail.

Q: Is there a fee to file form GIT/REP-2?

A: No, there is no fee to file form GIT/REP-2.

Q: Is form GIT/REP-2 used for residents of New Jersey?

A: No, form GIT/REP-2 is specifically for nonresident sellers.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT/REP-2 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.