This version of the form is not currently in use and is provided for reference only. Download this version of

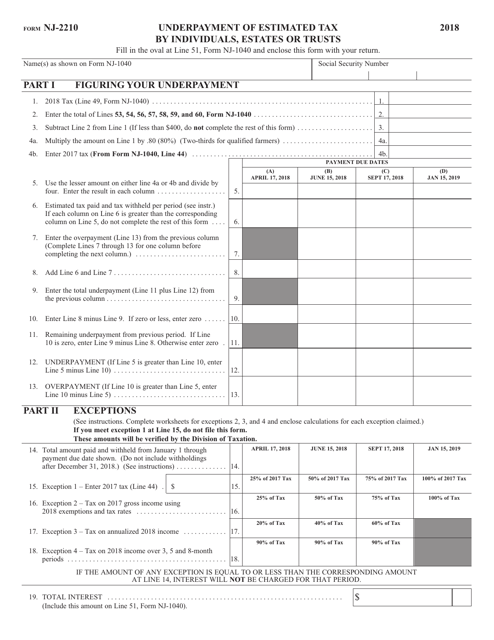

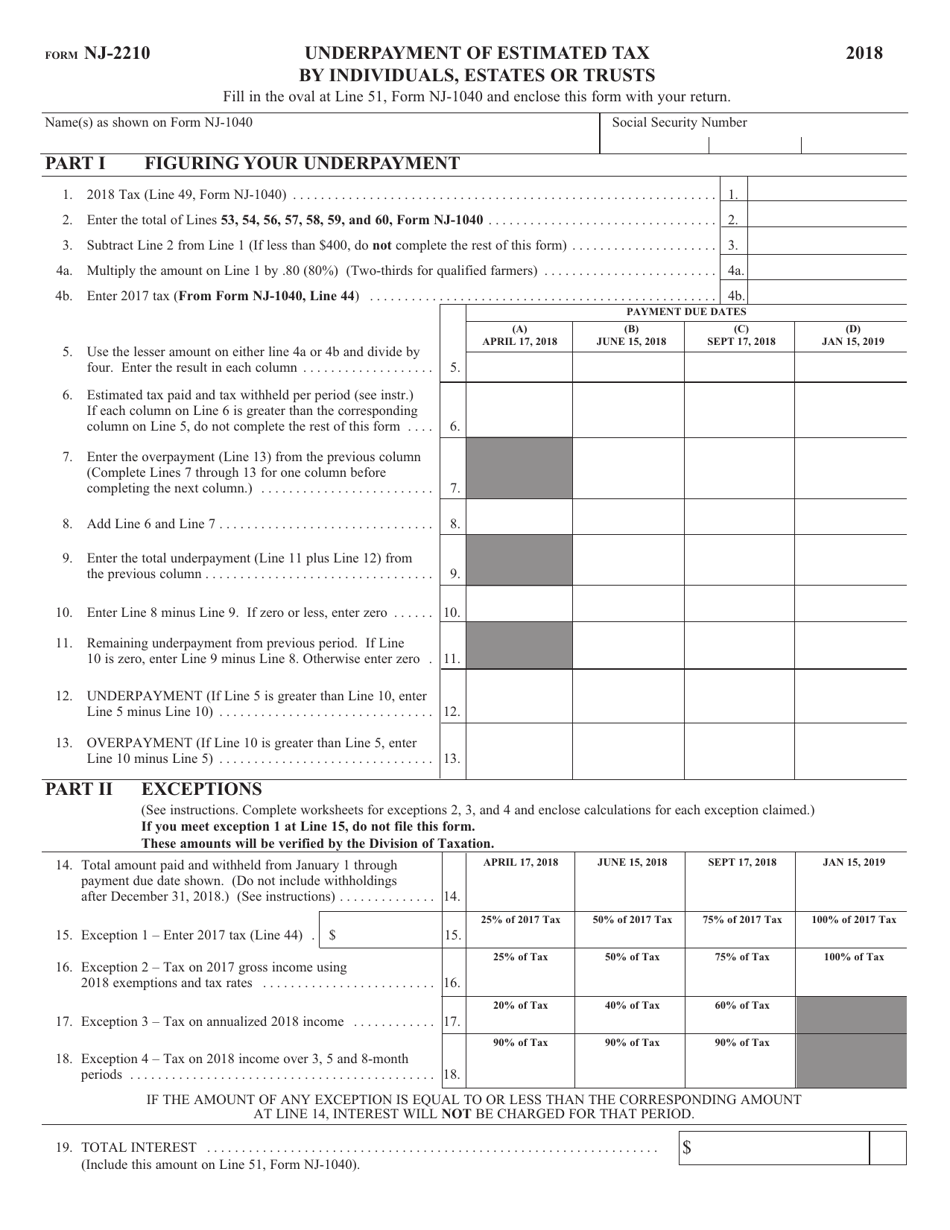

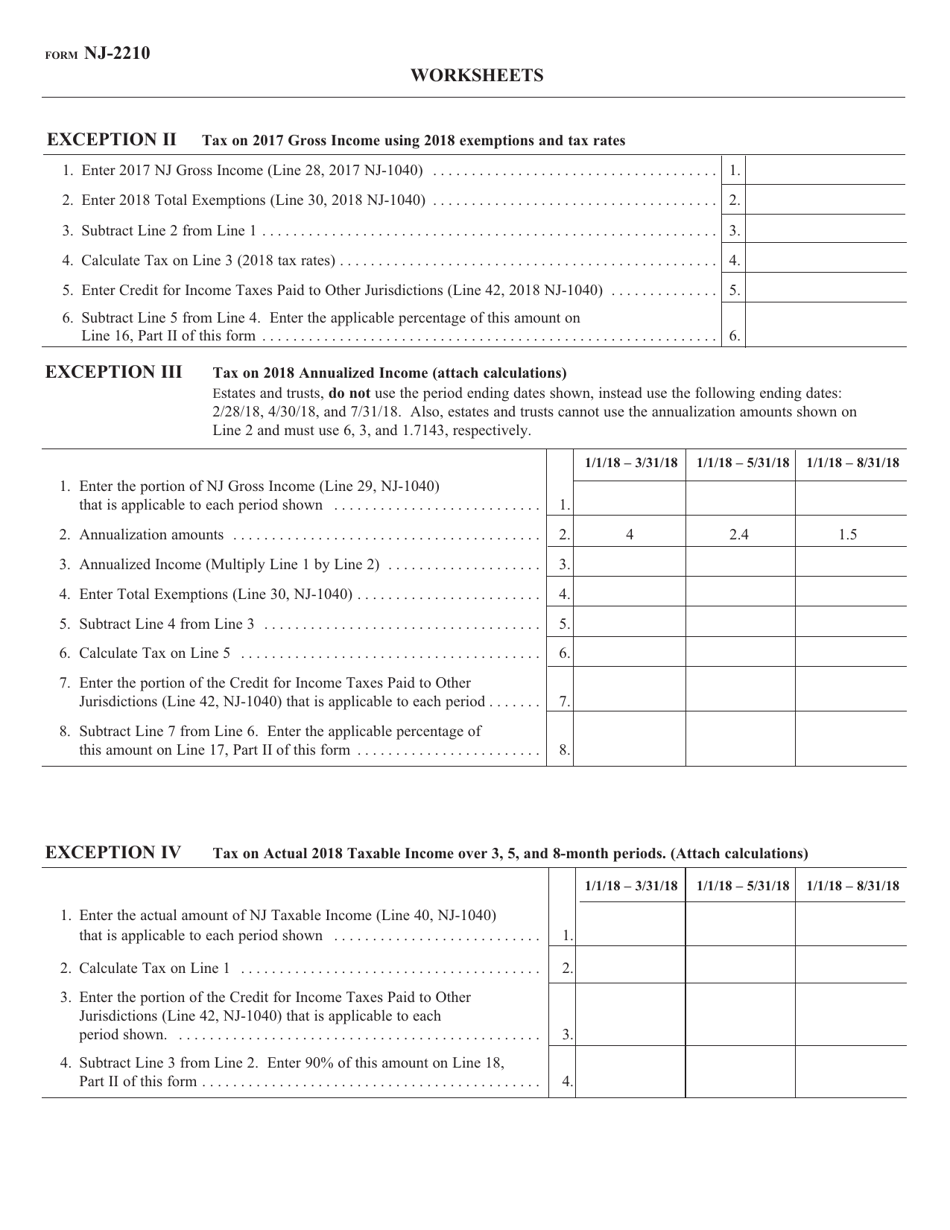

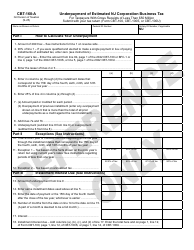

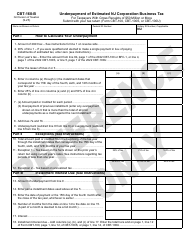

Form NJ-2210

for the current year.

Form NJ-2210 Underpayment of Estimated Tax by Individuals, Estates or Trusts - New Jersey

What Is Form NJ-2210?

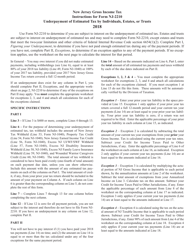

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-2210?

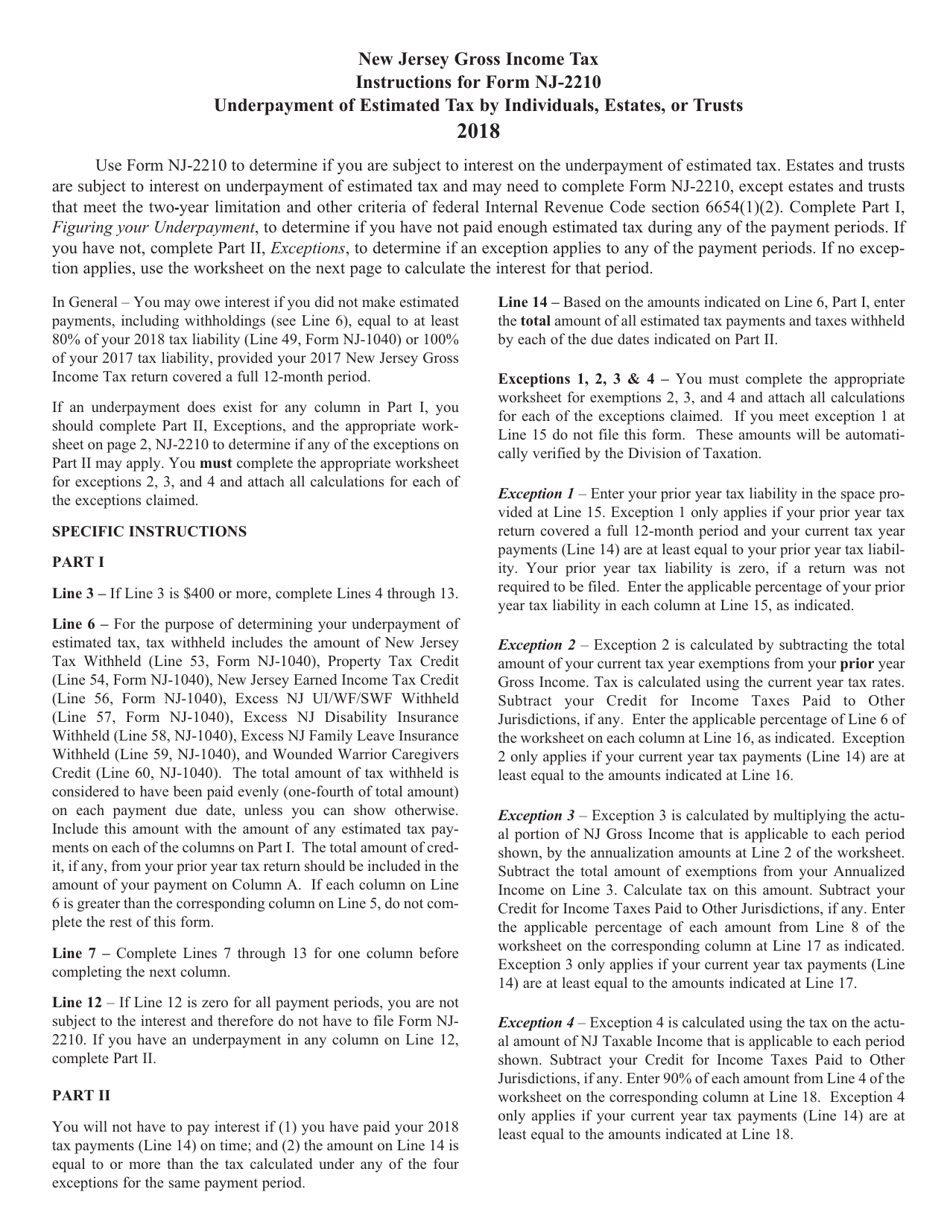

A: Form NJ-2210 is a form used in the state of New Jersey to calculate and report underpayment of estimated tax by individuals, estates or trusts.

Q: Who needs to file Form NJ-2210?

A: Individuals, estates, or trusts in New Jersey who have underpaid their estimated tax need to file Form NJ-2210.

Q: What is the purpose of Form NJ-2210?

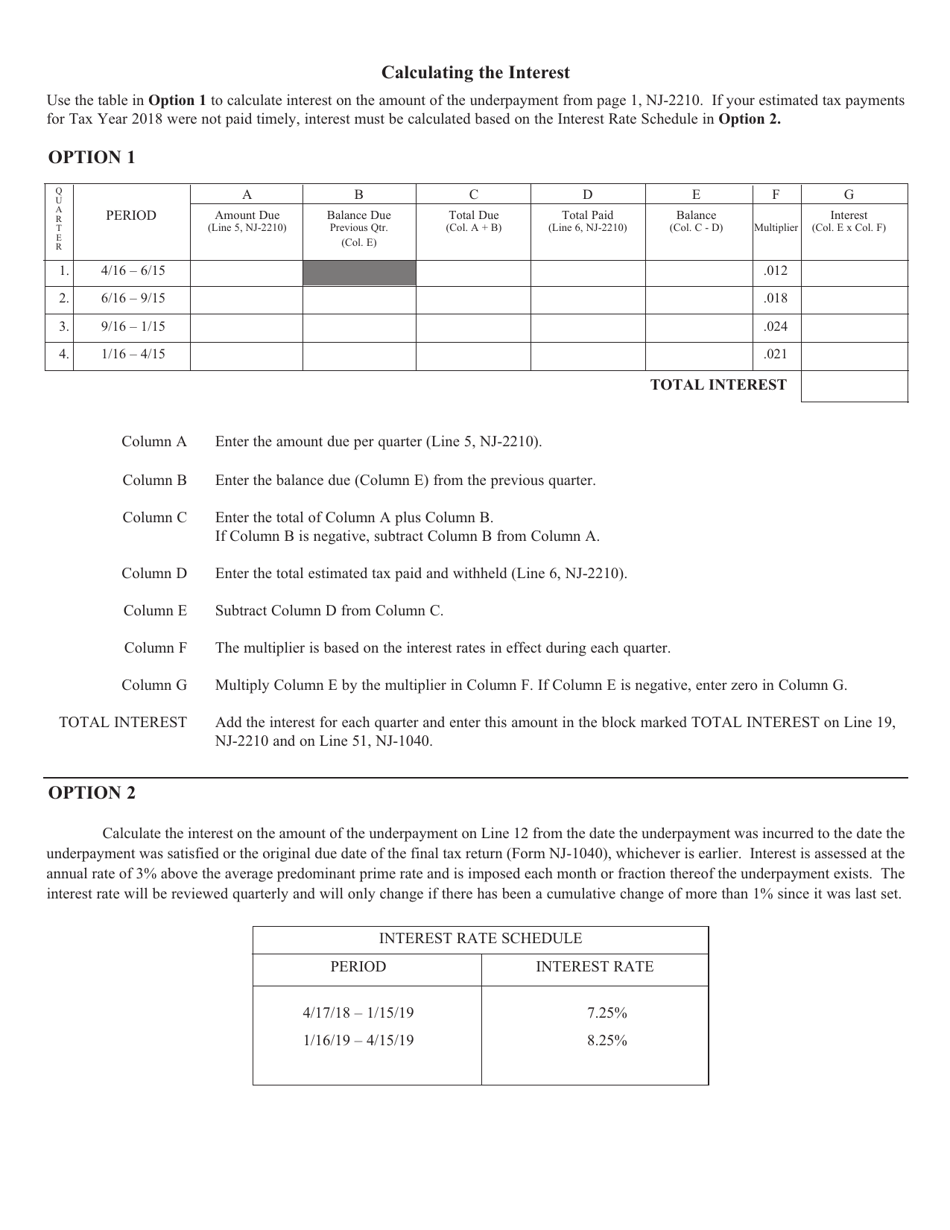

A: The purpose of Form NJ-2210 is to calculate and report any underpayment of estimated tax in order to determine if additional penalties or interest are owed.

Q: When should Form NJ-2210 be filed?

A: Form NJ-2210 should be filed when an individual, estate, or trust has underpaid their estimated tax and wants to calculate any penalties or interest that may be owed.

Q: What information is required on Form NJ-2210?

A: Form NJ-2210 requires information such as the taxpayer's name, identification number, income, tax liability, and estimated tax payments made.

Q: Are there any penalties for underpayment of estimated tax in New Jersey?

A: Yes, there may be penalties for underpayment of estimated tax in New Jersey. Form NJ-2210 helps to calculate and determine if any penalties or interest are owed.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-2210 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.