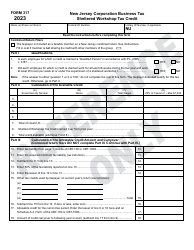

This version of the form is not currently in use and is provided for reference only. Download this version of

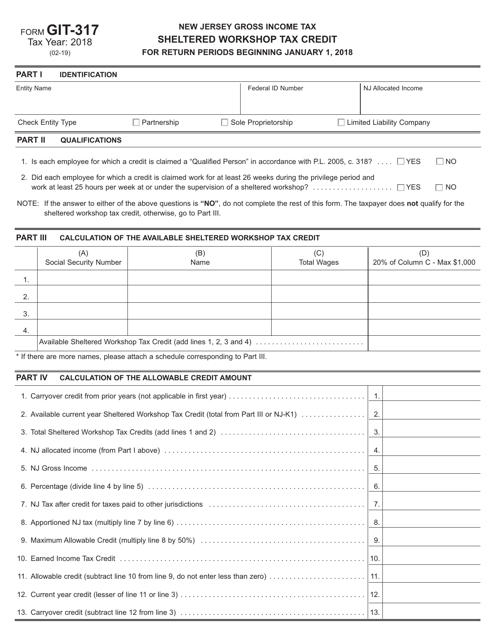

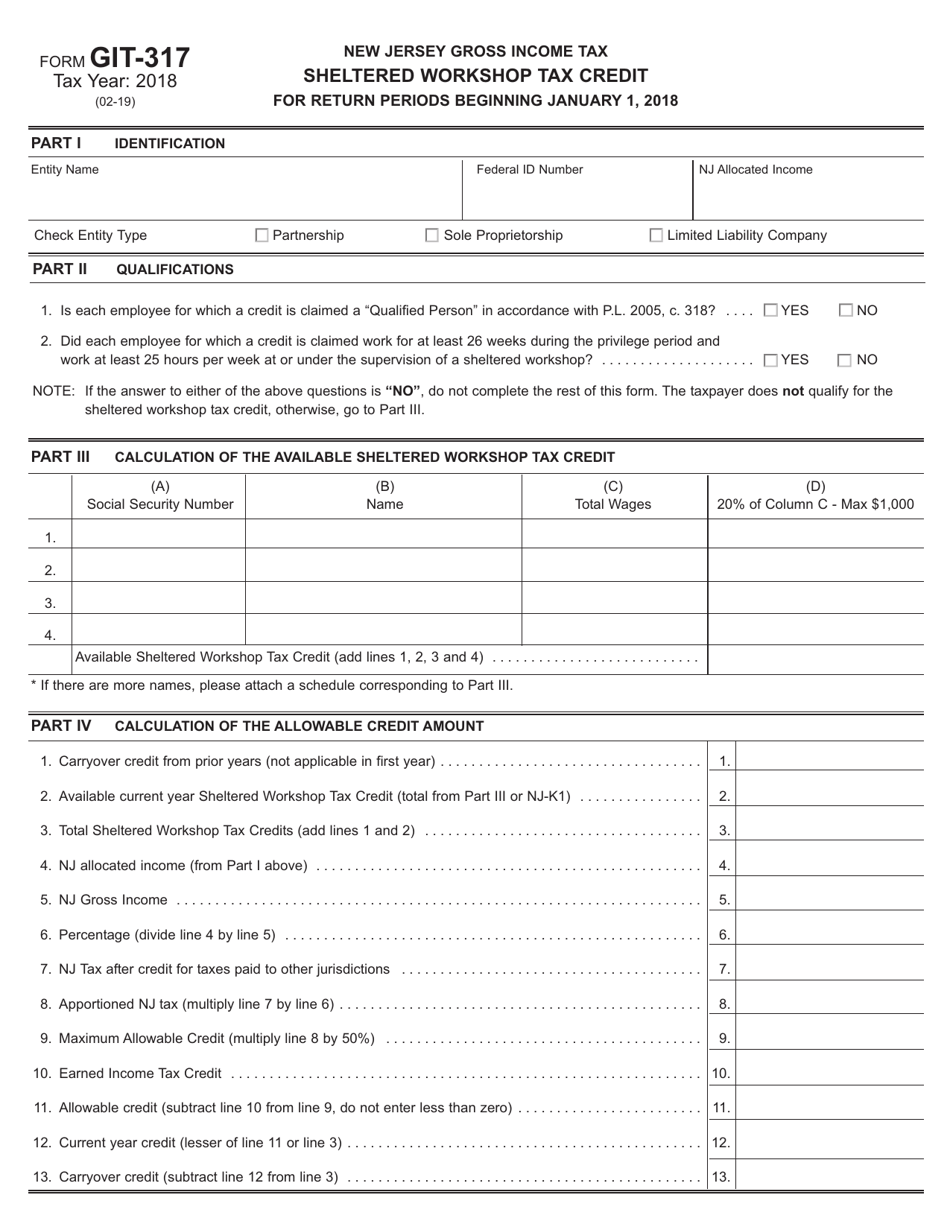

Form GIT-317

for the current year.

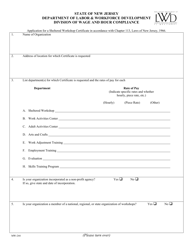

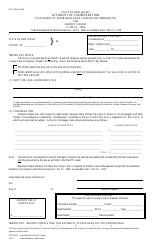

Form GIT-317 Sheltered Workshop Tax Credit - New Jersey

What Is Form GIT-317?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GIT-317?

A: Form GIT-317 is the application for the Sheltered WorkshopTax Credit in New Jersey.

Q: What is the Sheltered Workshop Tax Credit?

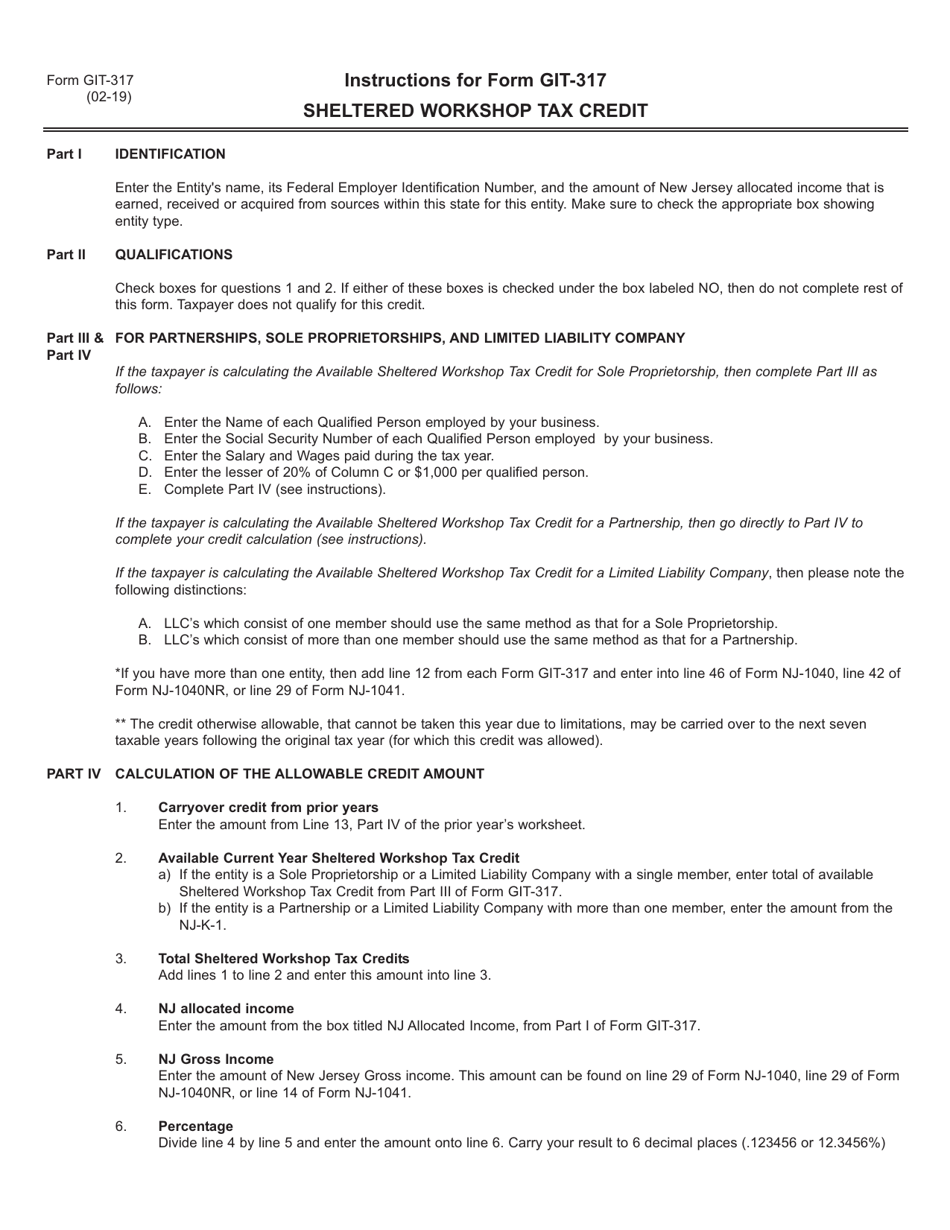

A: The Sheltered Workshop Tax Credit is a tax incentive provided to businesses that hire individuals with disabilities who work at a sheltered workshop.

Q: Who is eligible for the Sheltered Workshop Tax Credit?

A: Businesses that employ individuals with disabilities who work at a sheltered workshop in New Jersey may be eligible for the tax credit.

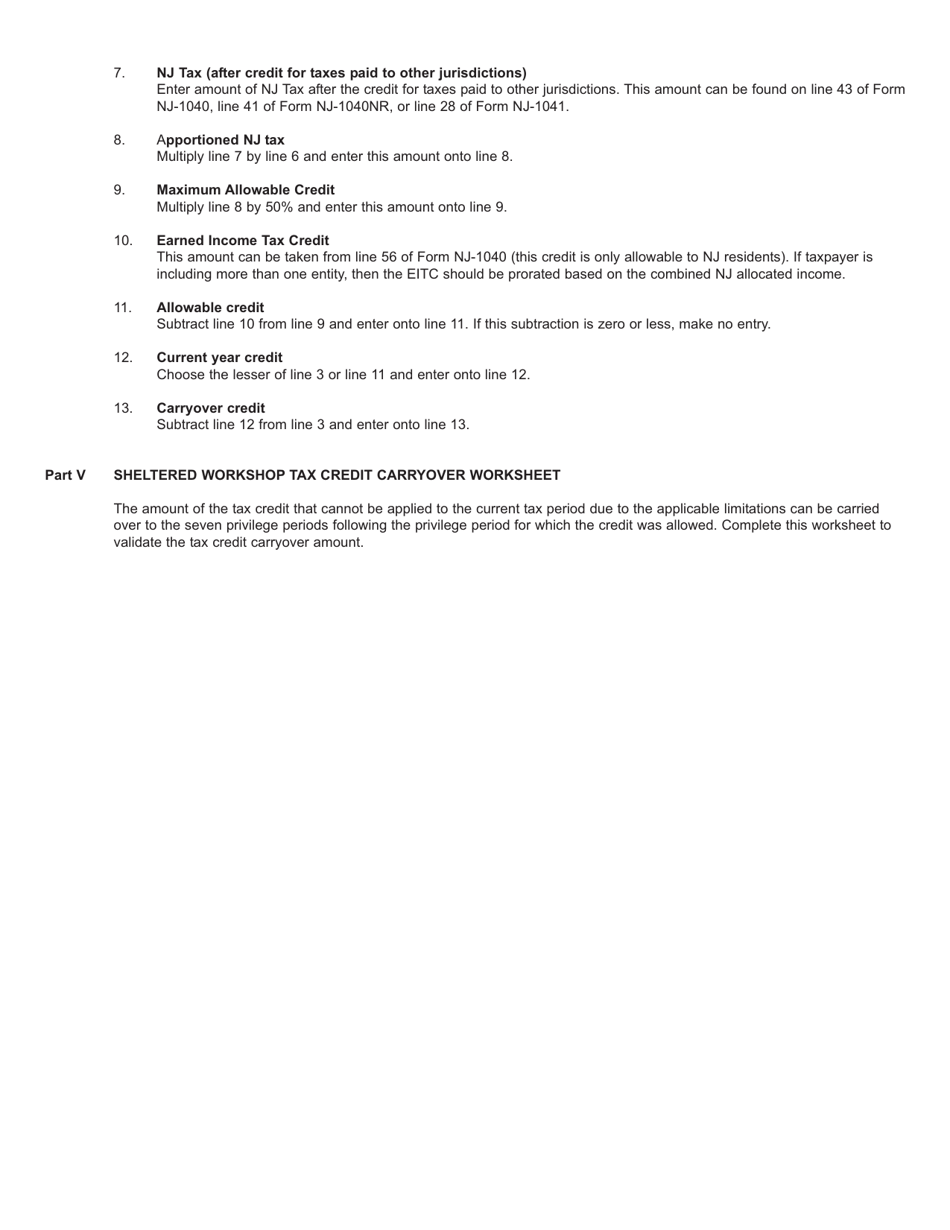

Q: How can businesses claim the Sheltered Workshop Tax Credit?

A: Businesses must complete and submit Form GIT-317 to claim the Sheltered Workshop Tax Credit.

Q: What is the deadline to submit Form GIT-317?

A: The deadline to submit Form GIT-317 is typically April 15th of the following year.

Q: Are there any other requirements to qualify for the Sheltered Workshop Tax Credit?

A: Yes, businesses must meet certain criteria, such as operating a certified sheltered workshop and employing individuals with disabilities for at least 35 hours per week.

Q: How much is the Sheltered Workshop Tax Credit?

A: The amount of the tax credit is based on the wages paid to eligible employees and the number of hours they work at the sheltered workshop.

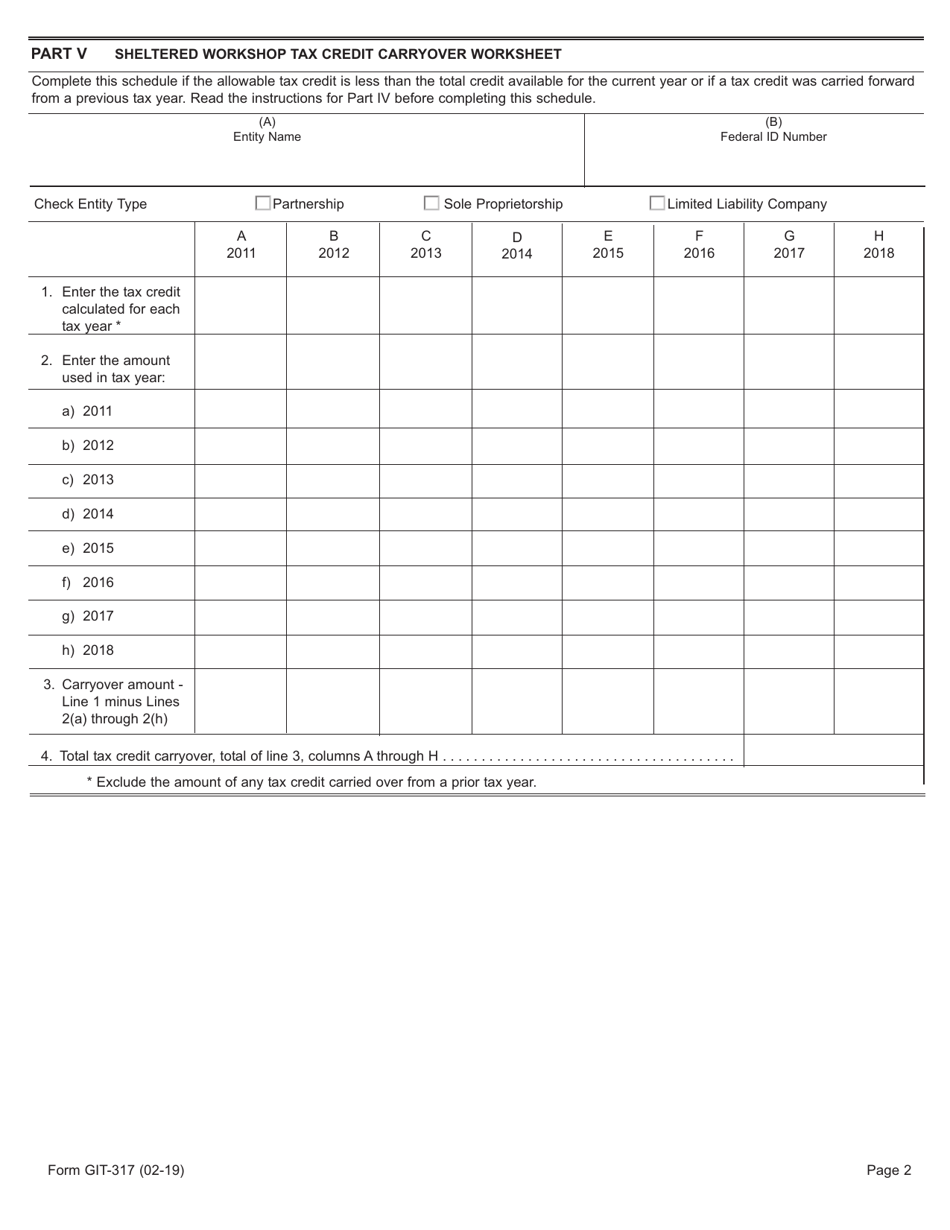

Q: Can the Sheltered Workshop Tax Credit be carried forward or refunded?

A: No, the tax credit cannot be carried forward to future years or refunded as cash. It can only be used to offset the business's tax liability.

Q: Are there any other tax incentives available for hiring individuals with disabilities in New Jersey?

A: Yes, New Jersey also offers the Work Opportunity Tax Credit (WOTC) and the Disabled Access Credit (DAC) as additional incentives for businesses that hire individuals with disabilities.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-317 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.