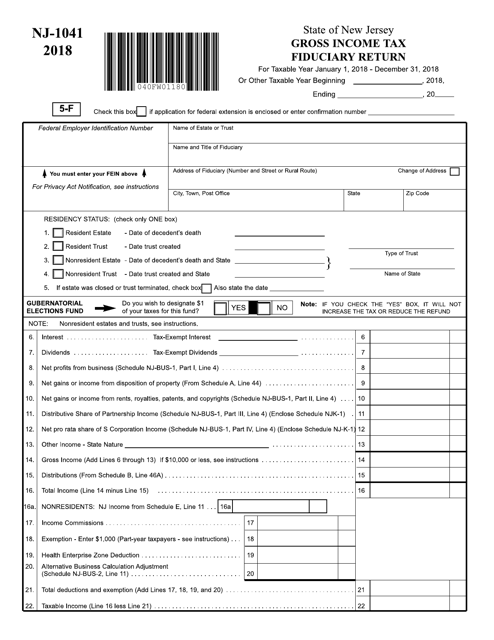

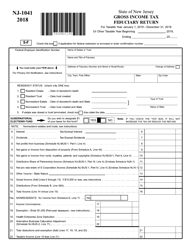

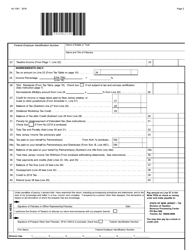

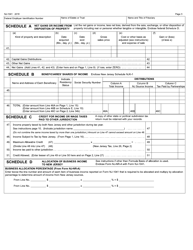

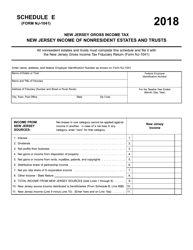

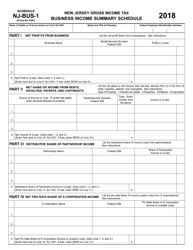

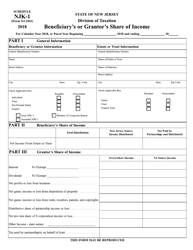

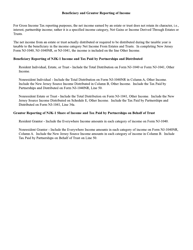

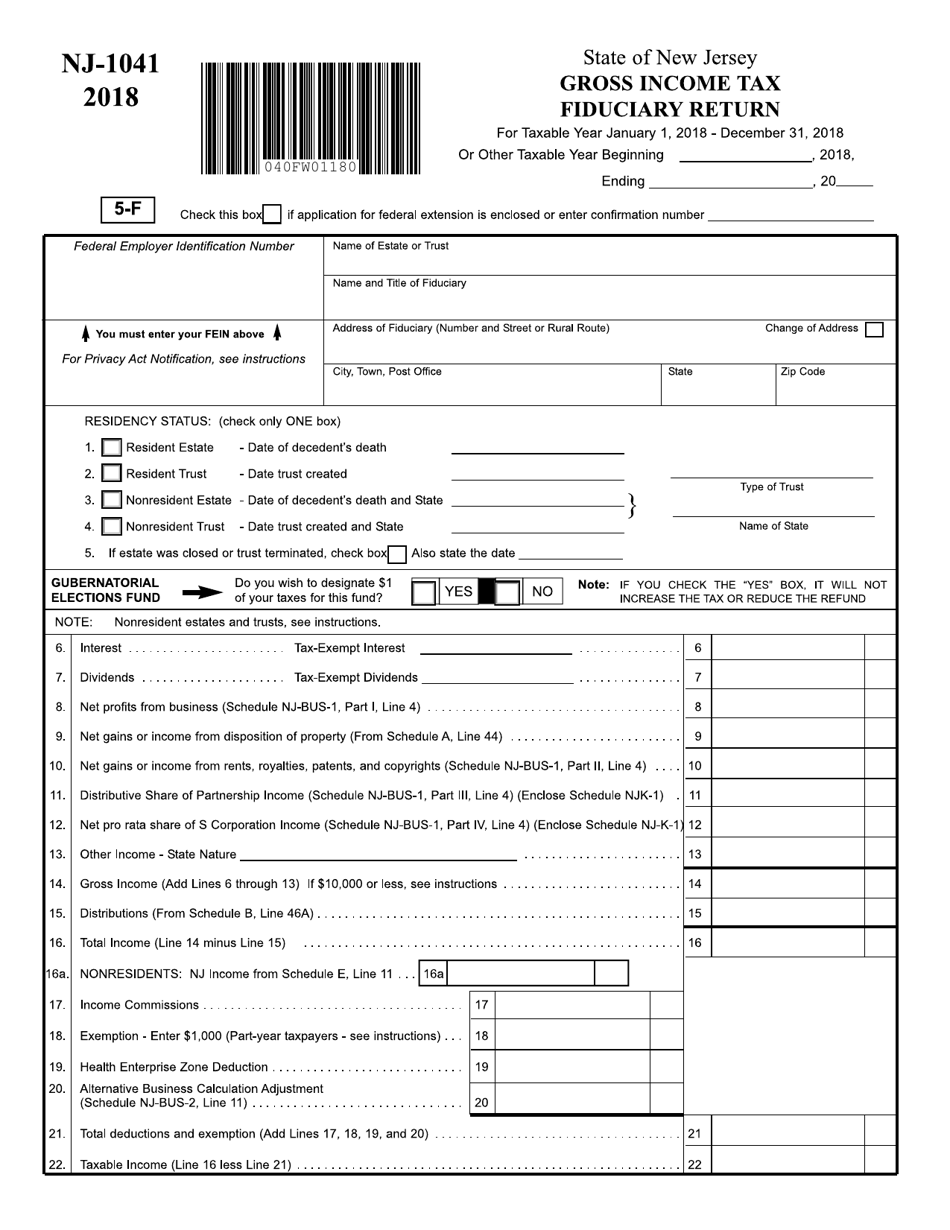

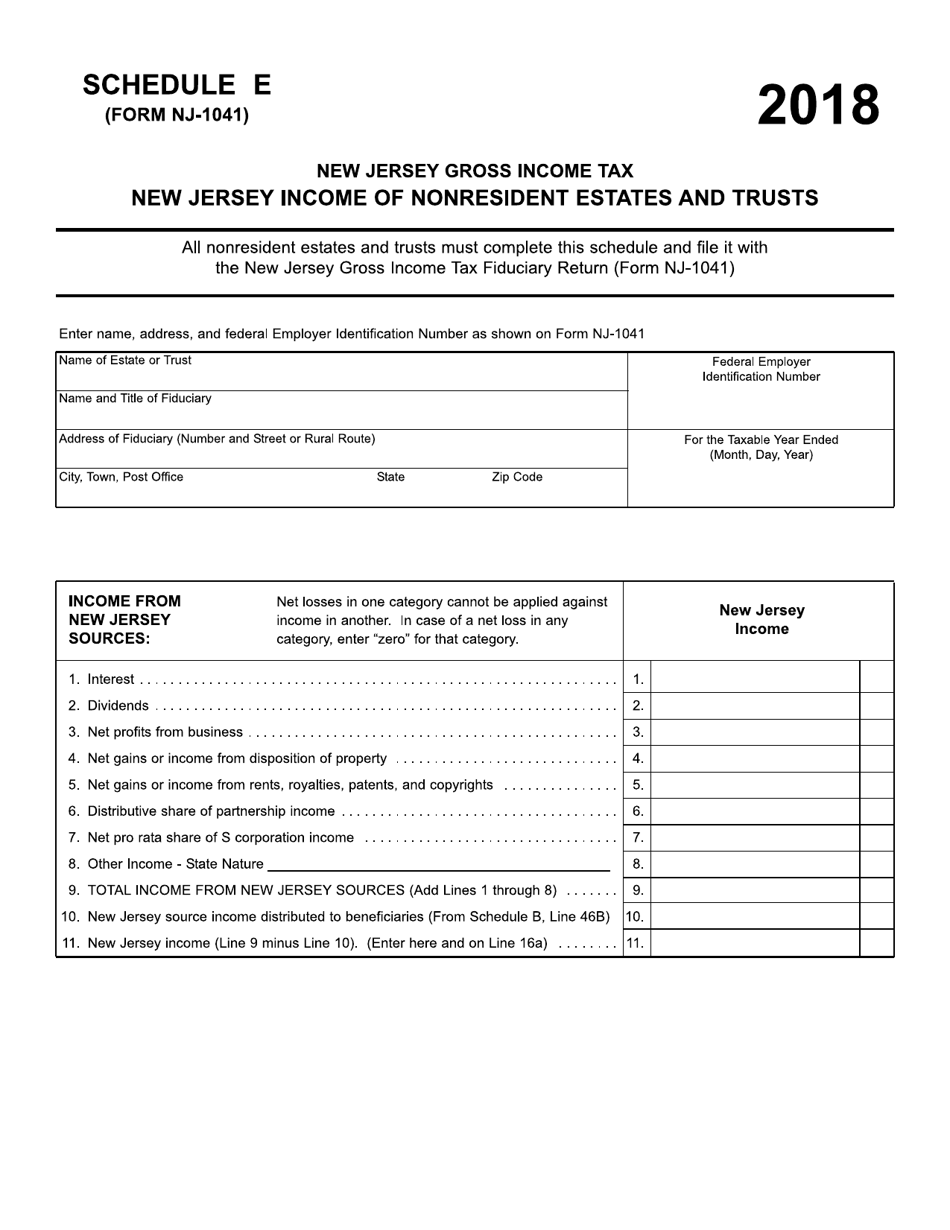

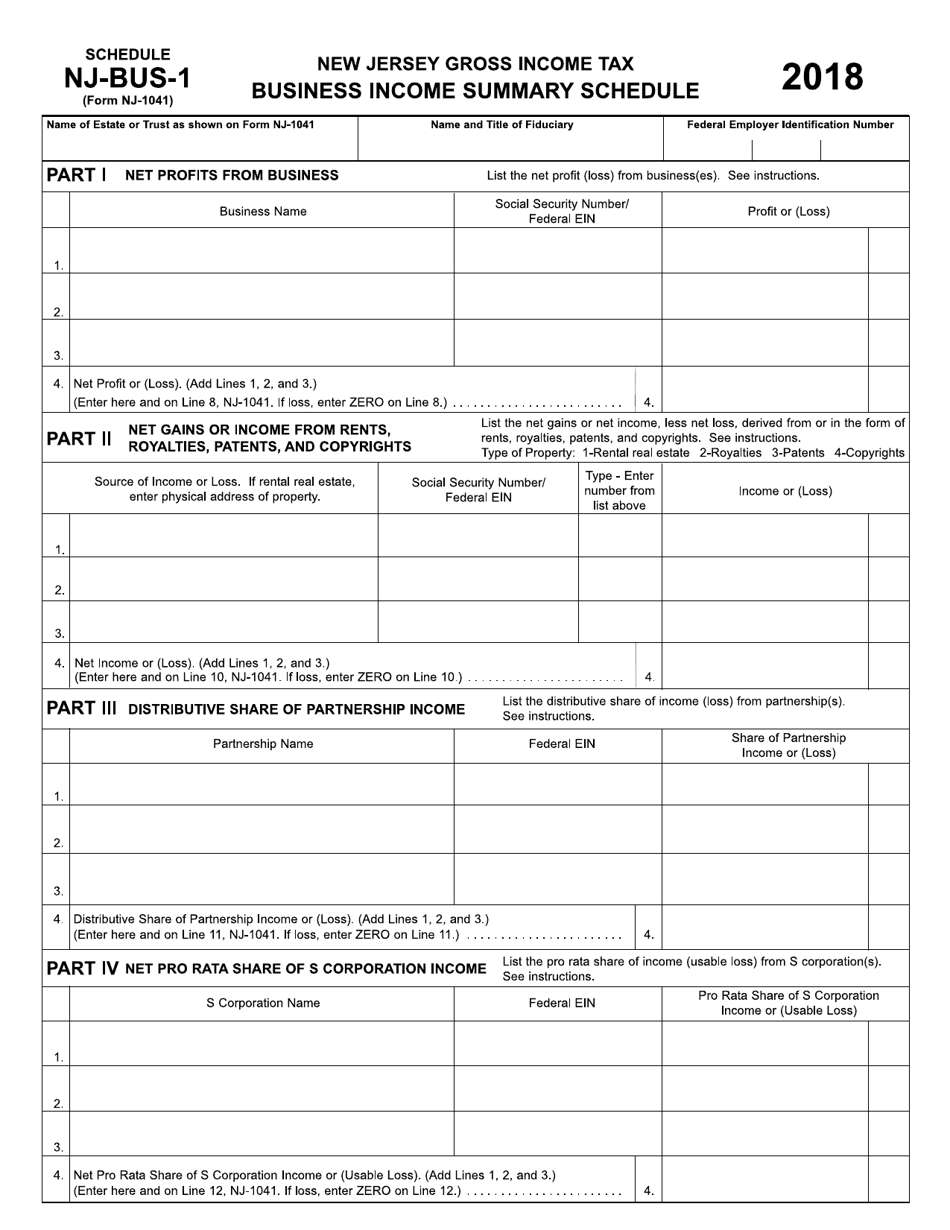

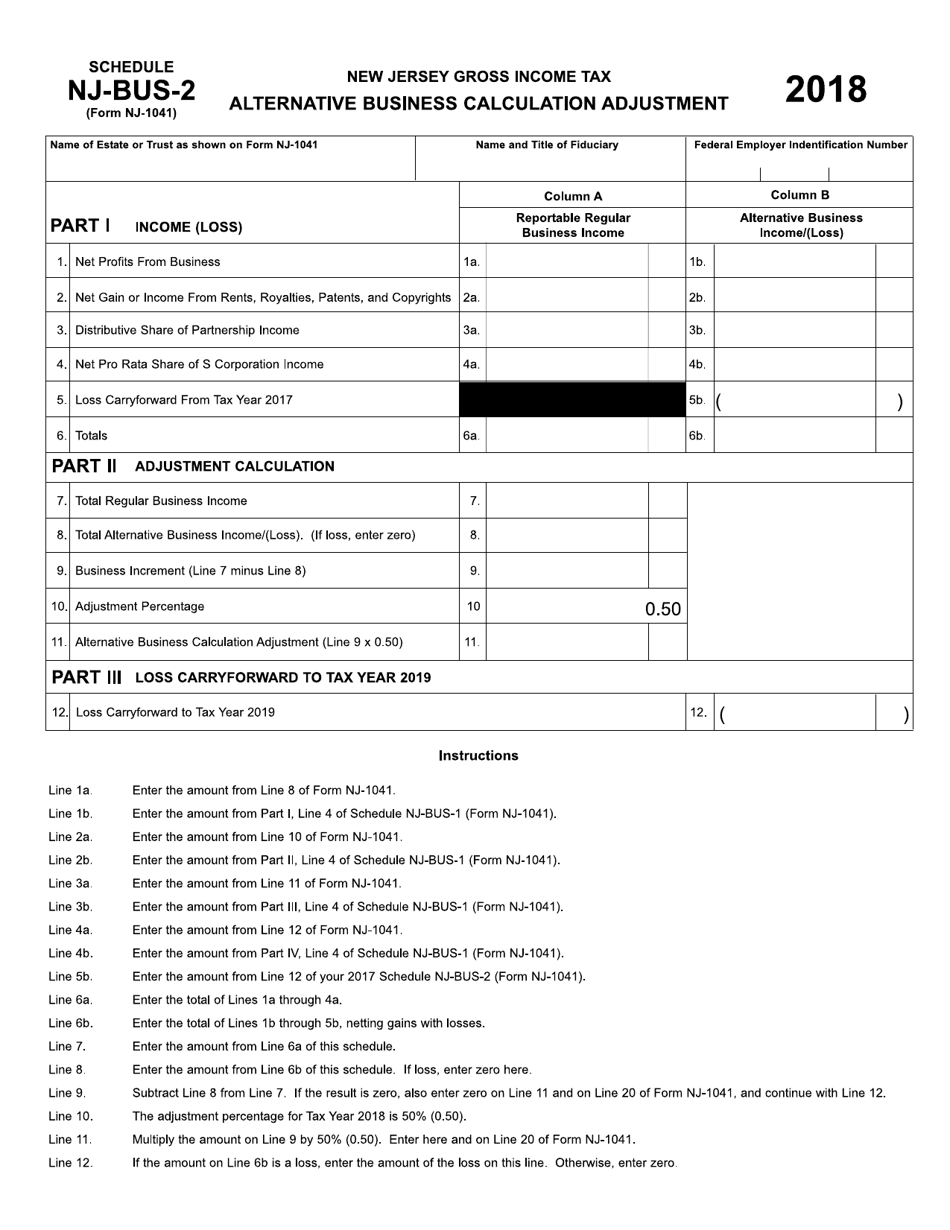

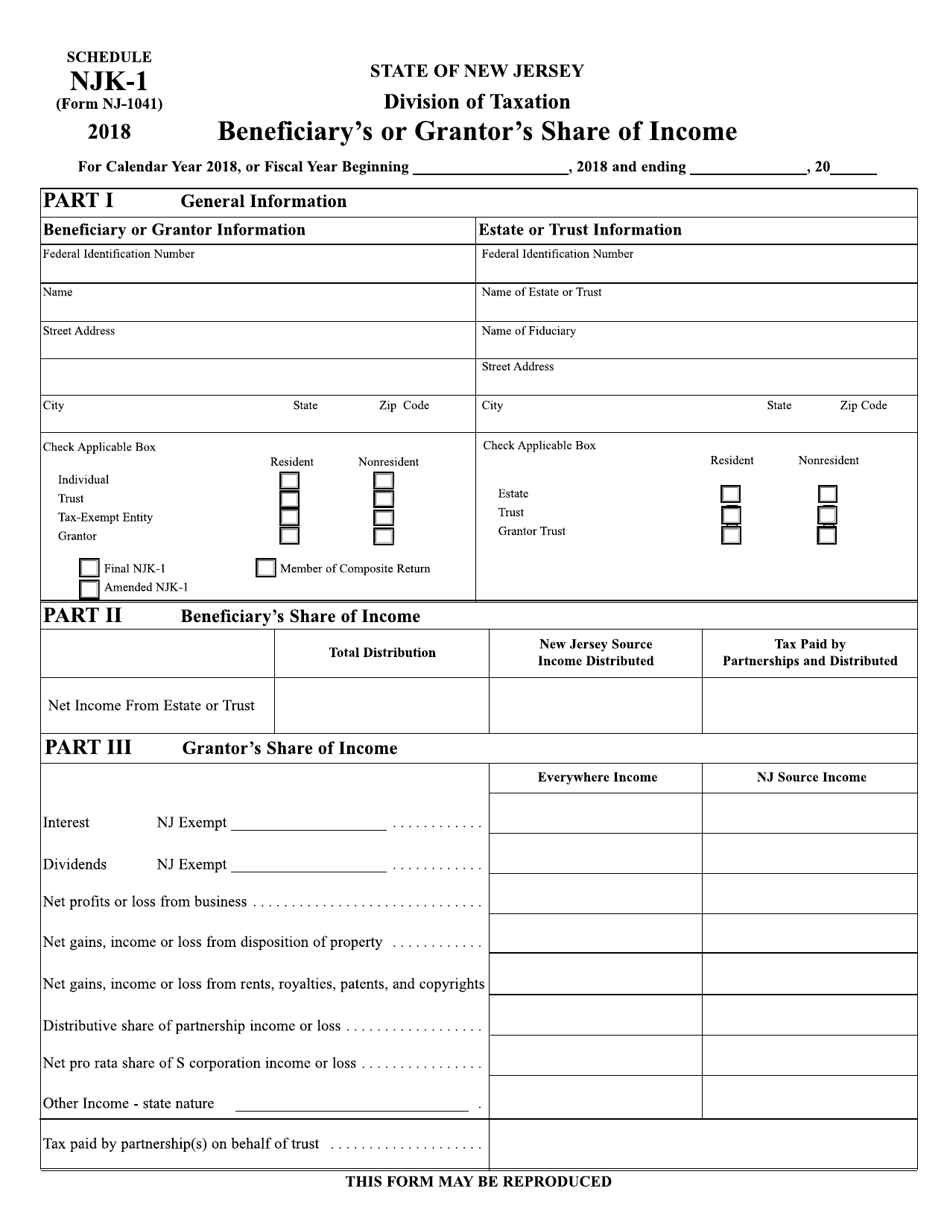

Form NJ-1041 Fiduciary Return - New Jersey

What Is Form NJ-1041?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

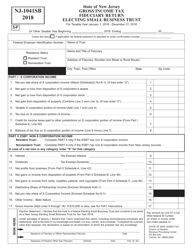

Q: What is Form NJ-1041?

A: Form NJ-1041 is the Fiduciary Return form for individuals or entities acting as fiduciaries in the state of New Jersey.

Q: Who needs to file Form NJ-1041?

A: Anyone who is acting as a fiduciary in New Jersey, such as an executor, administrator, trustee, or guardian, must file Form NJ-1041.

Q: What is the purpose of Form NJ-1041?

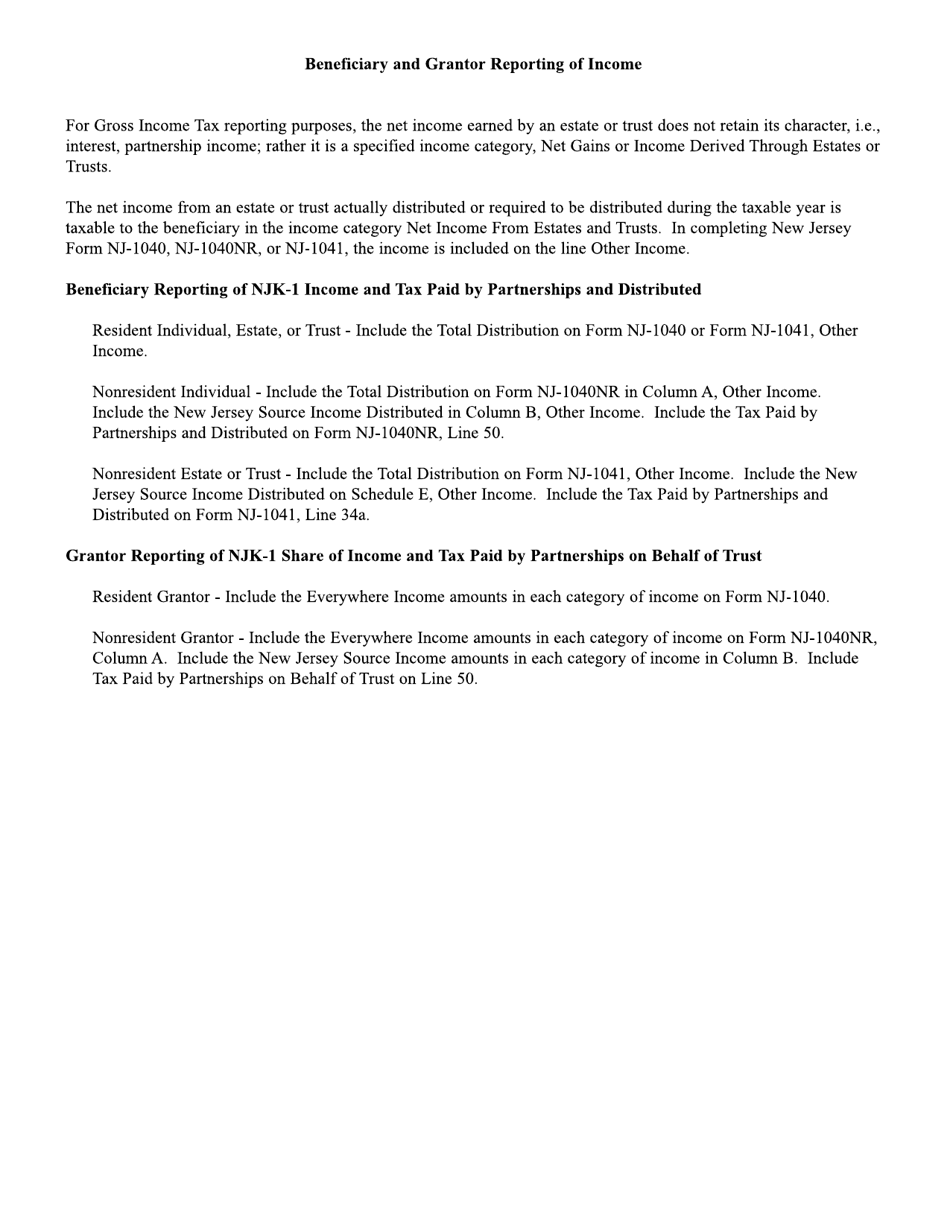

A: The purpose of Form NJ-1041 is to report and pay taxes on income earned by an estate or trust in New Jersey.

Q: When is Form NJ-1041 due?

A: Form NJ-1041 is due on or before the 15th day of the 4th month following the close of the tax year, which is usually April 15th.

Q: Are there any extensions available for filing Form NJ-1041?

A: Yes, you can request an extension of time to file Form NJ-1041. The extension allows you an additional 6 months to file the return, but it does not extend the time to pay any taxes owed.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1041 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.