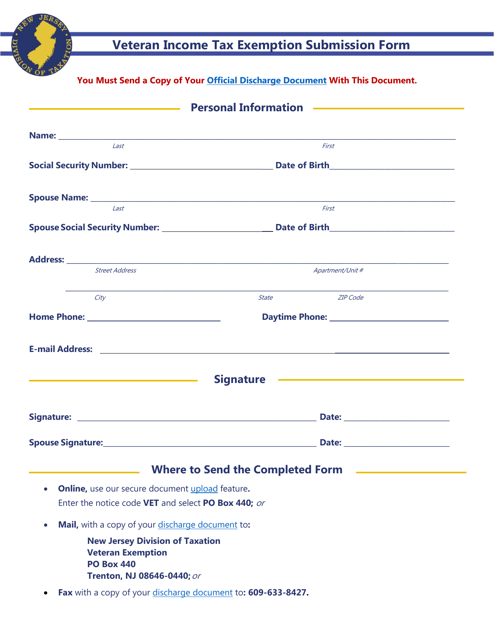

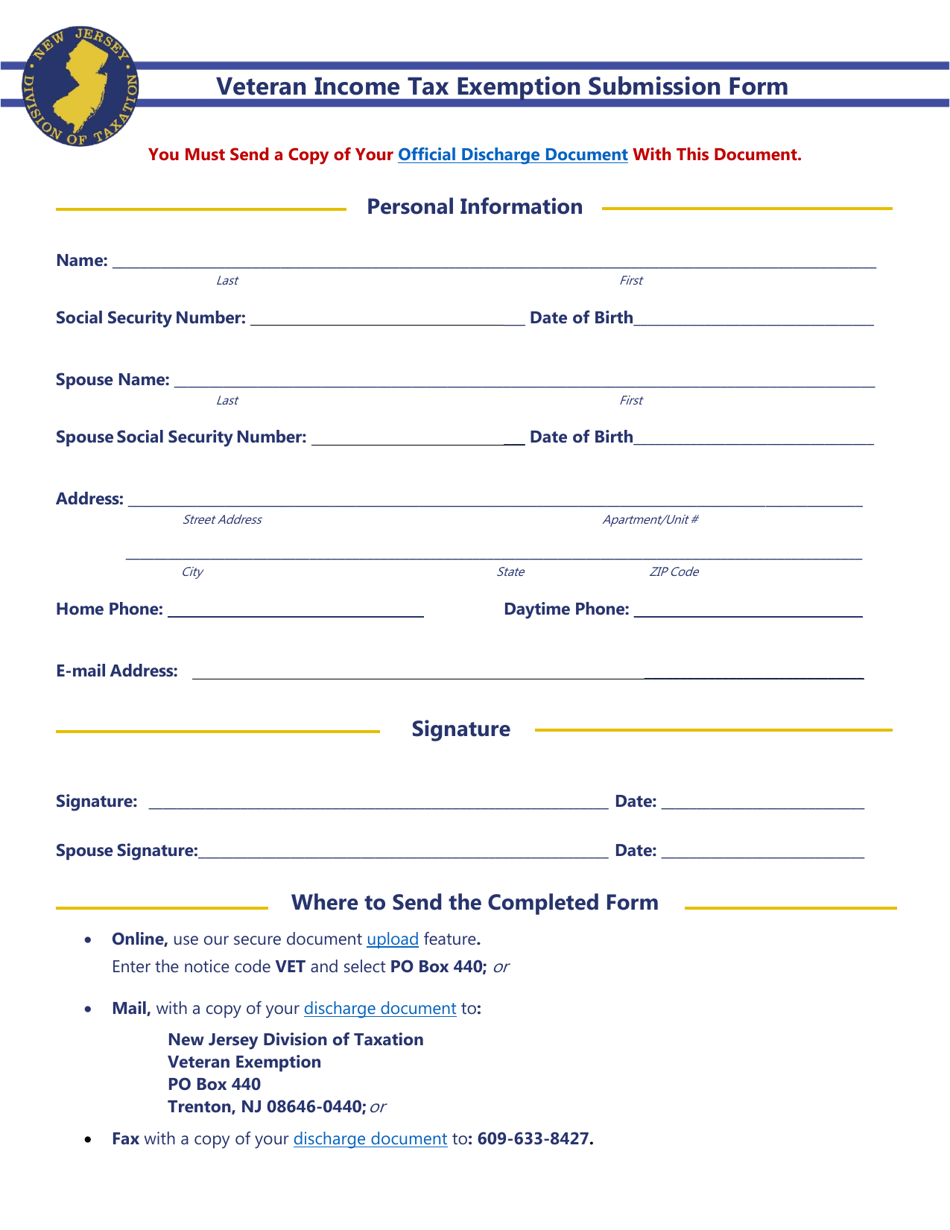

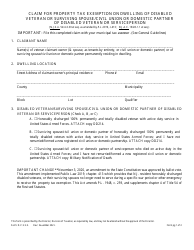

Veteran Income Tax Exemption Submission Form - New Jersey

Veteran Income Tax Exemption Submission Form is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

Q: What is the Veteran Income Tax Exemption Submission Form?

A: The Veteran Income Tax Exemption Submission Form is a form used in New Jersey to claim a tax exemption for veterans.

Q: Who is eligible for the Veteran Income Tax Exemption in New Jersey?

A: Veterans who meet certain criteria, such as being honorably discharged and having income below a certain threshold, are eligible for the Veteran Income Tax Exemption in New Jersey.

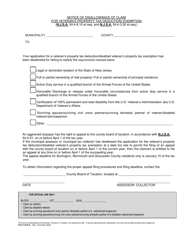

Q: How do I submit the Veteran Income Tax Exemption Submission Form?

A: The Veteran Income Tax Exemption Submission Form can be submitted to the New Jersey Division of Taxation either by mail or electronically.

Q: Are there any deadlines for submitting the Veteran Income Tax Exemption Submission Form?

A: Yes, the form must be submitted by April 15th of the calendar year following the year for which the exemption is claimed.

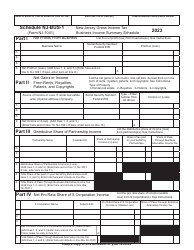

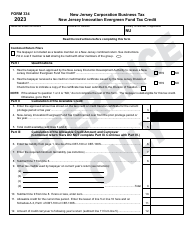

Form Details:

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.