This version of the form is not currently in use and is provided for reference only. Download this version of

Form NJ-1040-HW

for the current year.

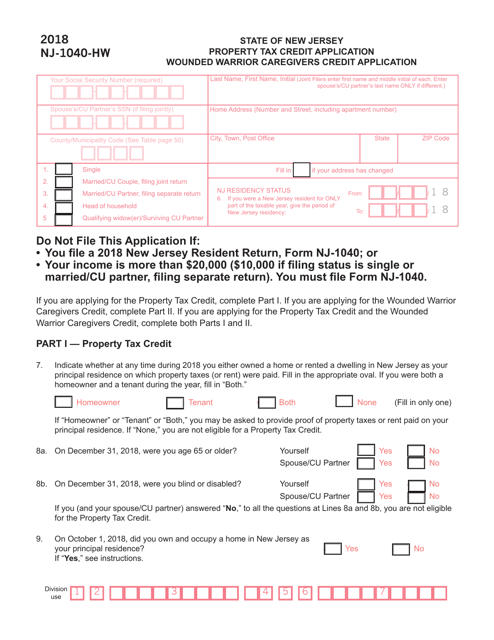

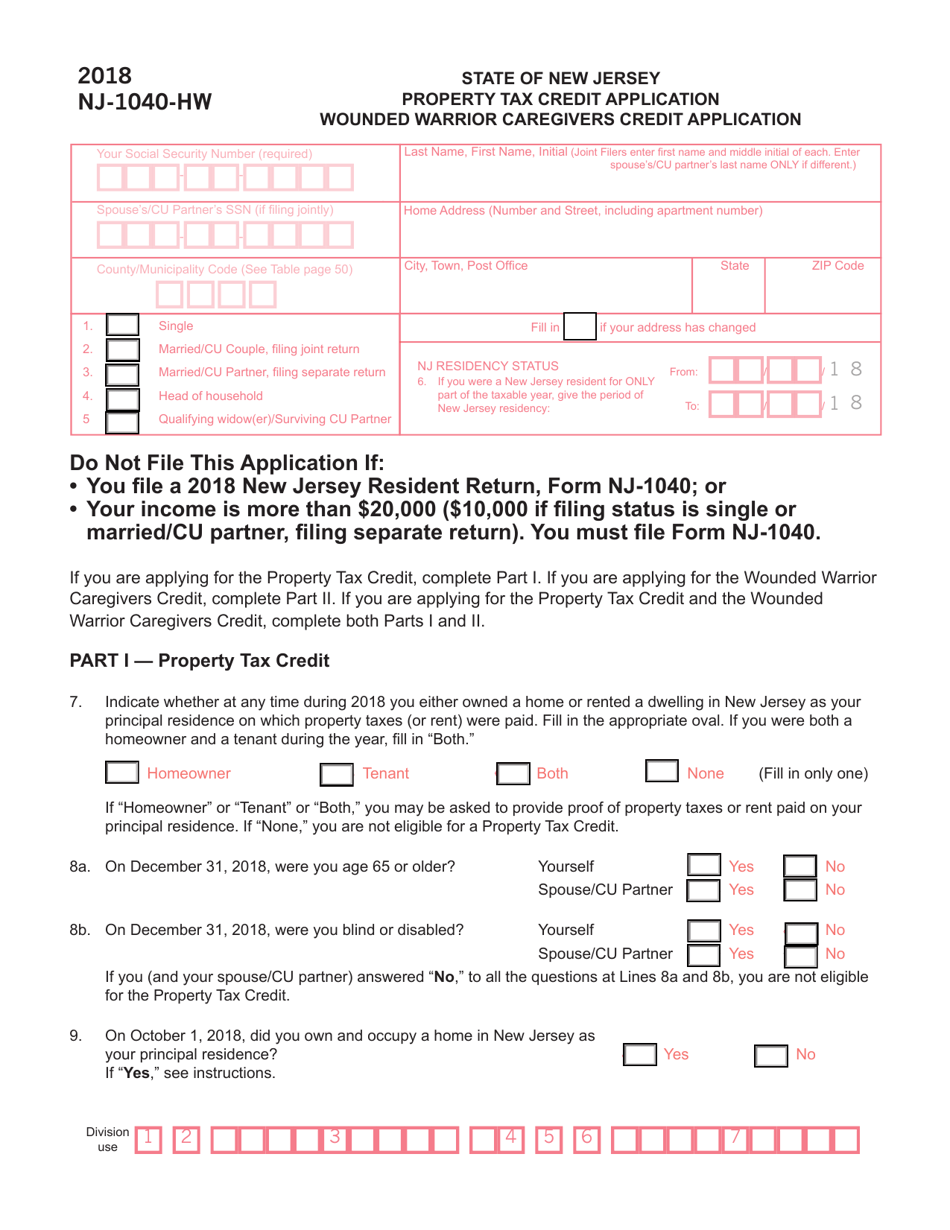

Form NJ-1040-HW Property Tax Credit Application Wounded Warrior Caregivers Credit Application - New Jersey

What Is Form NJ-1040-HW?

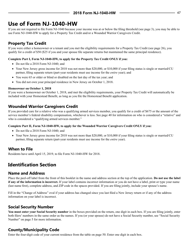

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NJ-1040-HW?

A: Form NJ-1040-HW is the Property Tax Credit Application Wounded Warrior Caregivers Credit Application for residents of New Jersey.

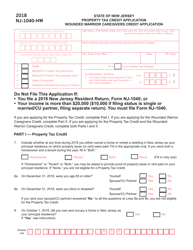

Q: Who is eligible for the Property Tax Credit?

A: The Property Tax Credit is available for residents of New Jersey who own or rent a home and meet certain income requirements.

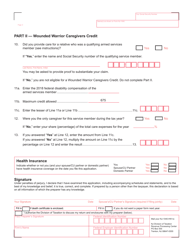

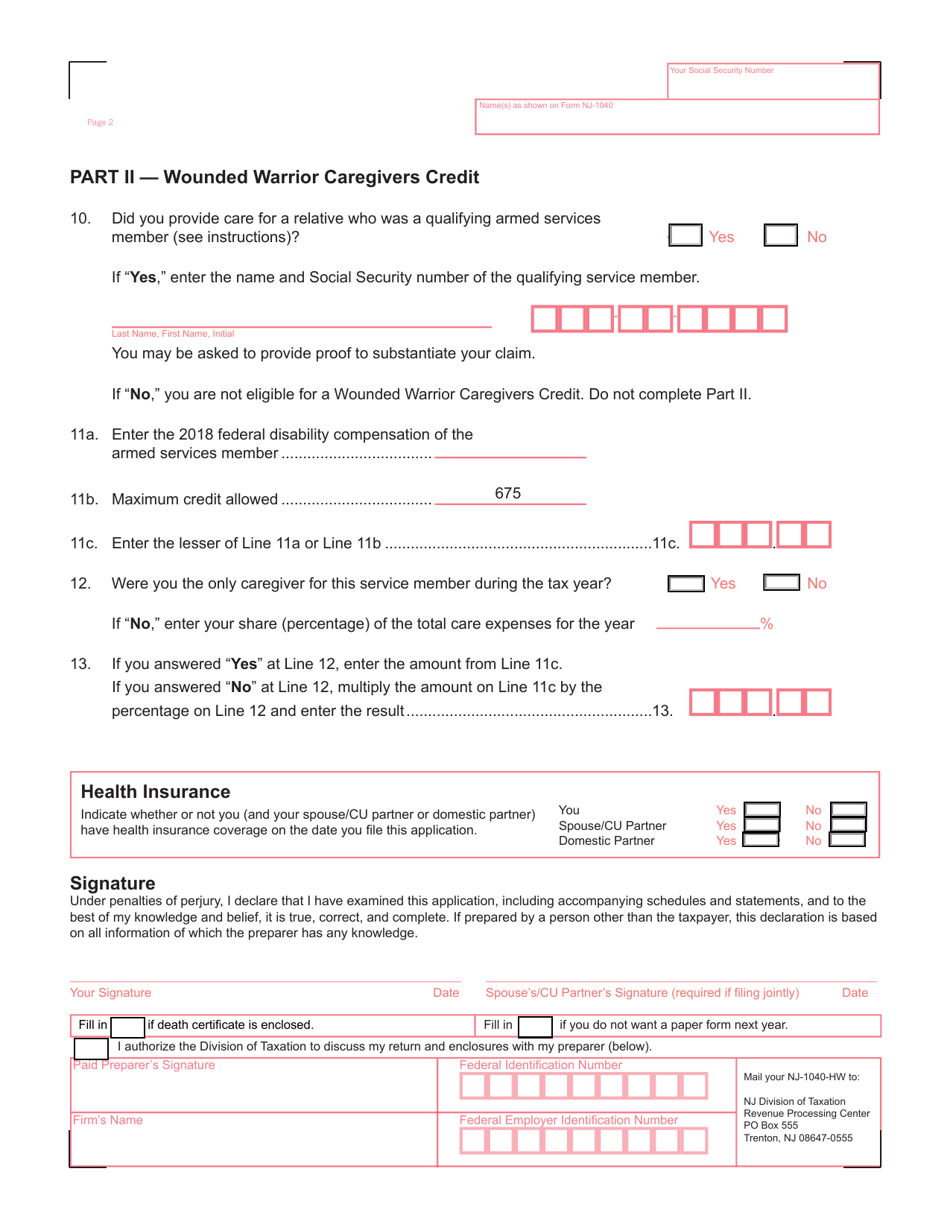

Q: What is the Wounded Warrior Caregivers Credit?

A: The Wounded Warrior Caregivers Credit is a tax credit available for caregivers of qualified veterans in New Jersey.

Q: Is the Wounded Warrior Caregivers Credit available to all caregivers?

A: No, the Wounded Warrior Caregivers Credit is only available to caregivers who meet specific criteria.

Q: What other documentation do I need to include with Form NJ-1040-HW?

A: You may need to include proof of income and proof of residency, as well as any additional documentation required by the Division of Taxation.

Q: When is the deadline for submitting Form NJ-1040-HW?

A: The deadline for submitting Form NJ-1040-HW is usually April 15th, but it may vary from year to year. It is recommended to check the latest deadline with the Division of Taxation.

Q: Is the Property Tax Credit refundable?

A: No, the Property Tax Credit is not refundable. It can only be used to reduce your New Jersey income tax liability.

Q: Can I claim both the Property Tax Credit and the Wounded Warrior Caregivers Credit?

A: Yes, if you are eligible, you can claim both credits on your New Jersey tax return.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040-HW by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.