This version of the form is not currently in use and is provided for reference only. Download this version of

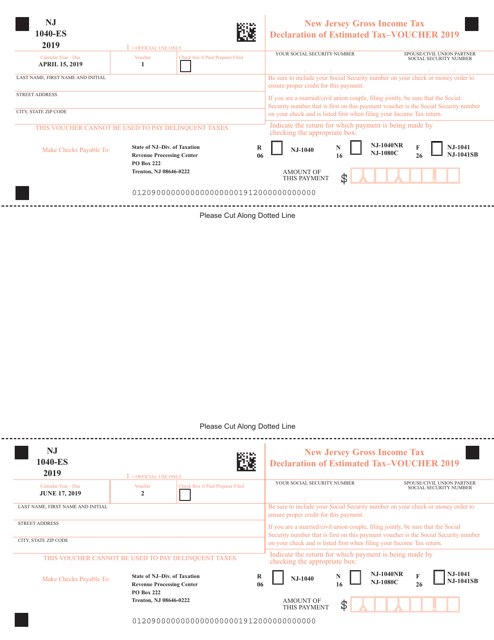

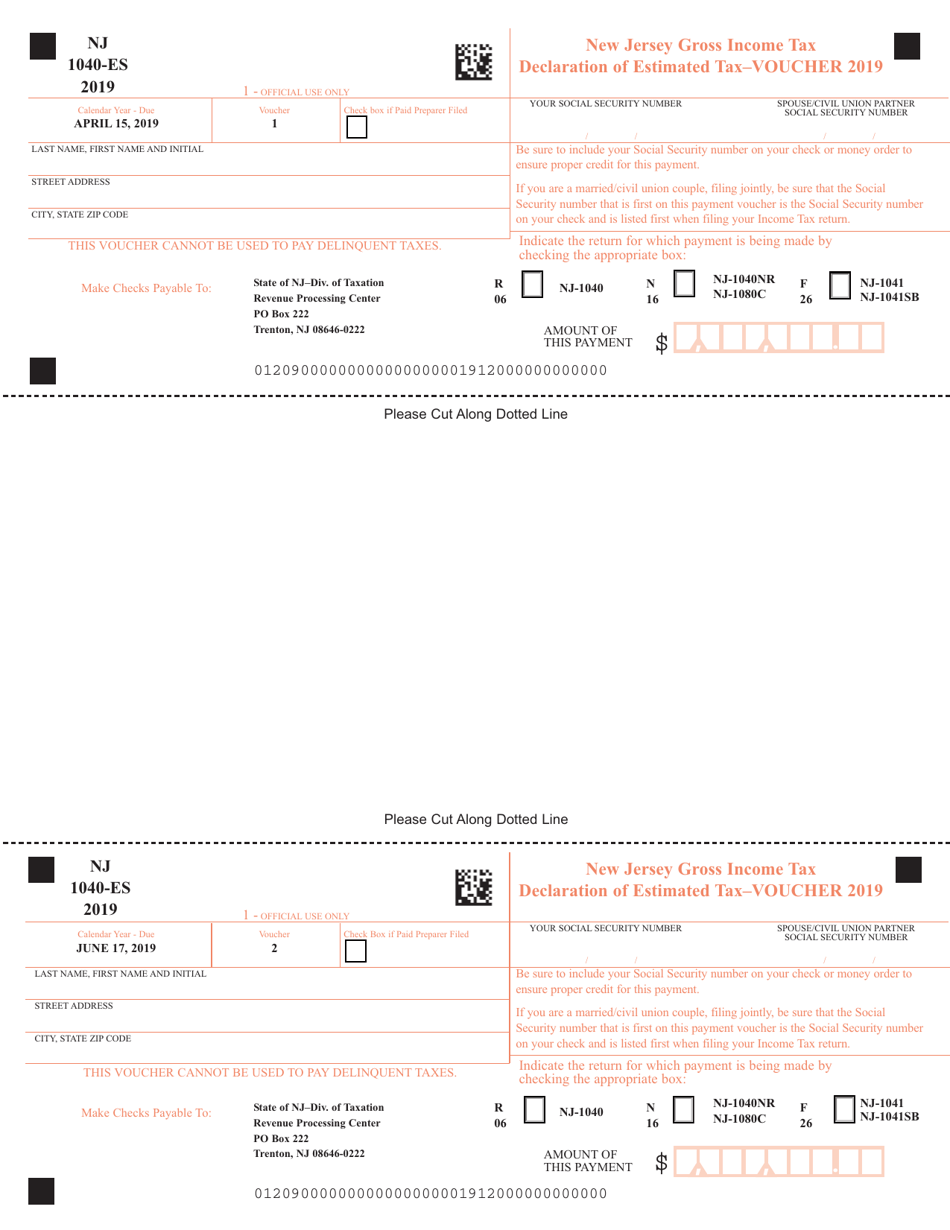

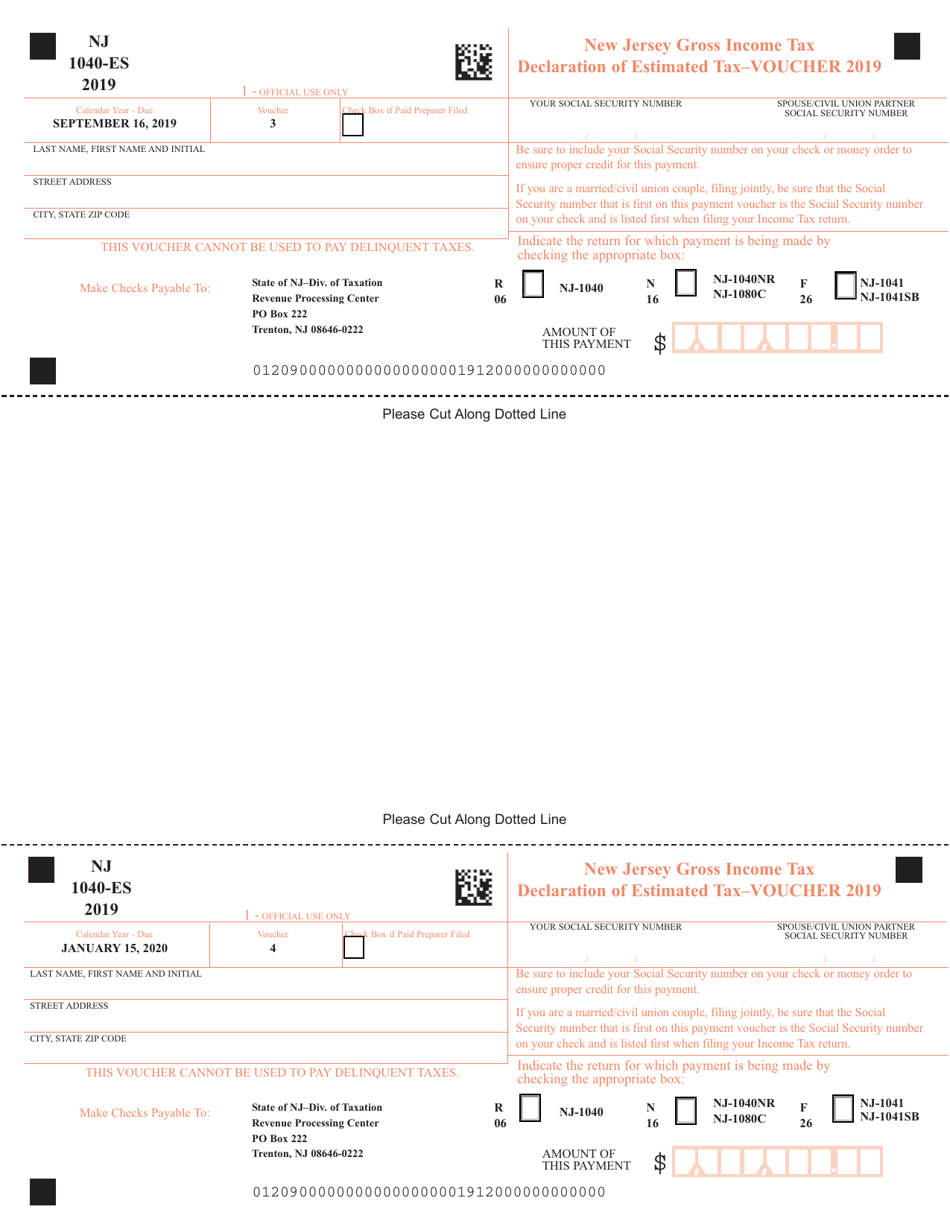

Form NJ-1040-ES

for the current year.

Form NJ-1040-ES Estimated Tax Voucher - New Jersey

What Is Form NJ-1040-ES?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NJ-1040-ES form?

A: The NJ-1040-ES form is a Estimated Tax Voucher for residents of New Jersey.

Q: Why do I need the NJ-1040-ES form?

A: You need the NJ-1040-ES form to make estimated tax payments if you are a New Jersey resident.

Q: What are estimated tax payments?

A: Estimated tax payments are periodic payments made by taxpayers to cover their tax liability throughout the year.

Q: Who needs to make estimated tax payments in New Jersey?

A: New Jersey residents who expect to owe more than $400 in state income tax must make estimated tax payments.

Q: When are estimated tax payments due?

A: Estimated tax payments are due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040-ES by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.