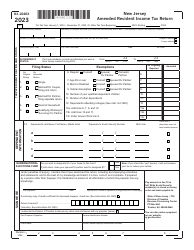

This version of the form is not currently in use and is provided for reference only. Download this version of

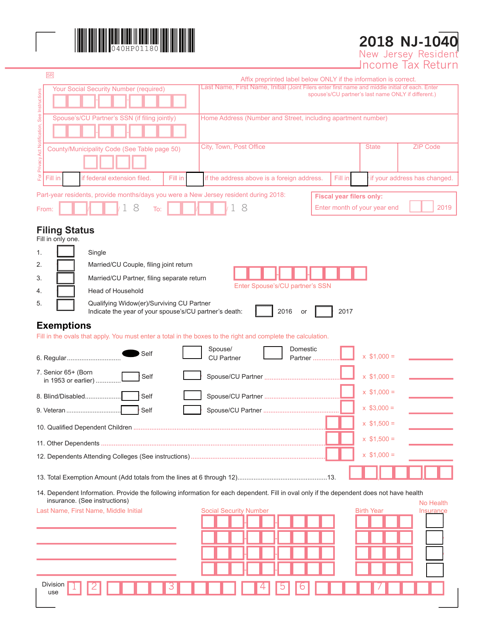

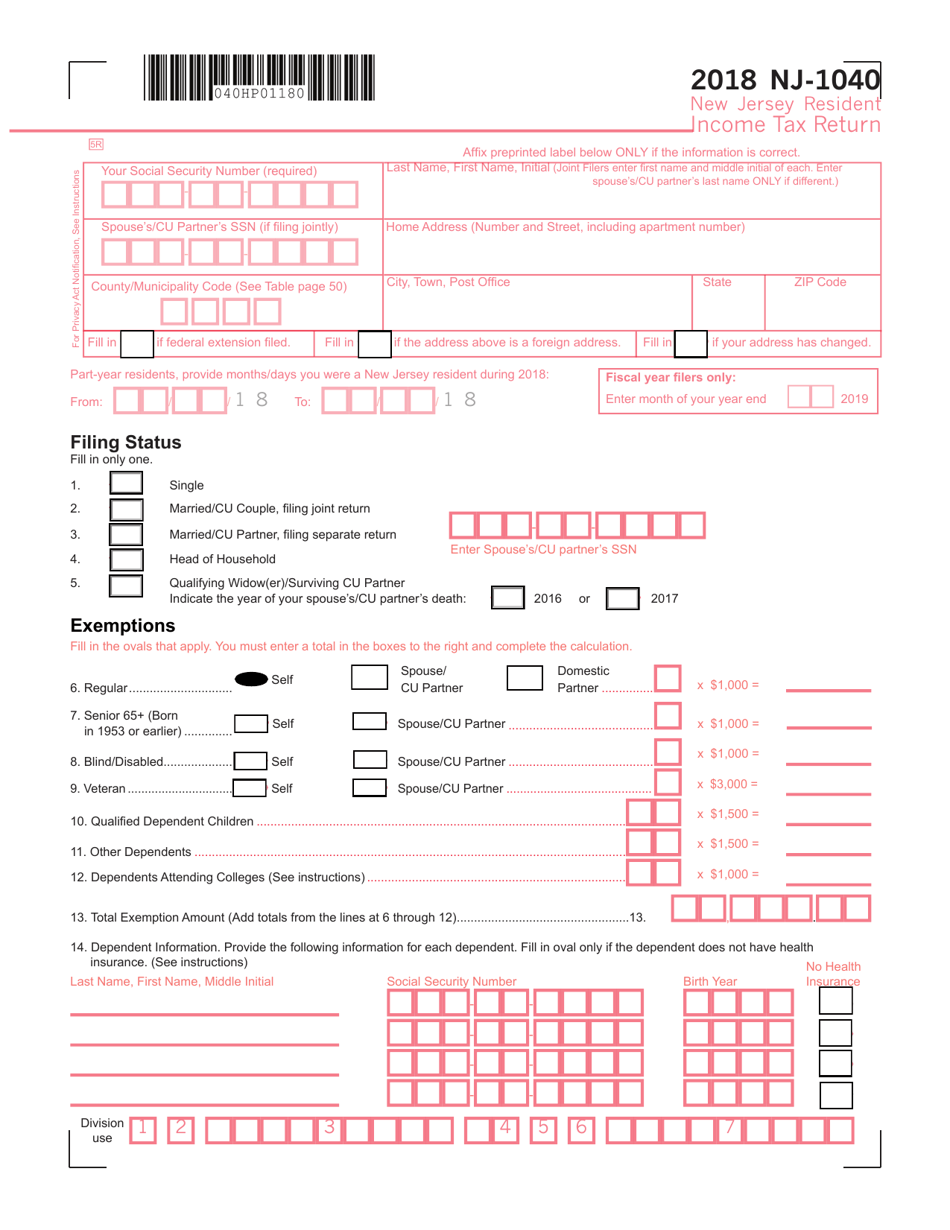

Form NJ-1040

for the current year.

Form NJ-1040 Resident Income Tax Return - New Jersey

What Is Form NJ-1040?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1040?

A: Form NJ-1040 is the Resident Income Tax Return for individuals living in New Jersey.

Q: Who is required to file Form NJ-1040?

A: Any New Jersey resident who has gross income of $10,000 or more must file Form NJ-1040.

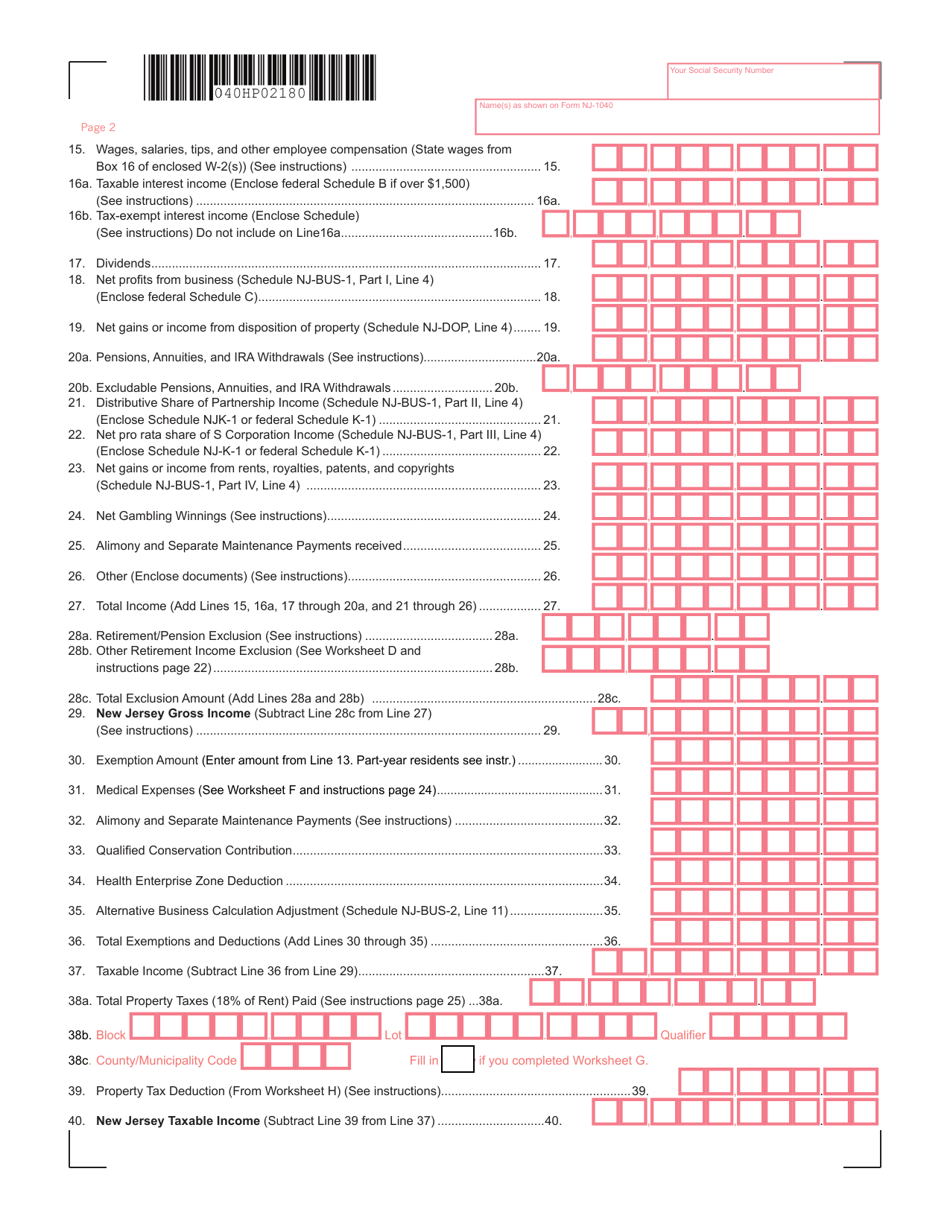

Q: What information do I need to complete Form NJ-1040?

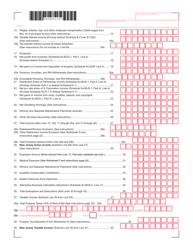

A: You will need your W-2 forms, 1099 forms, and other documentation of your income, as well as any applicable deductions and credits.

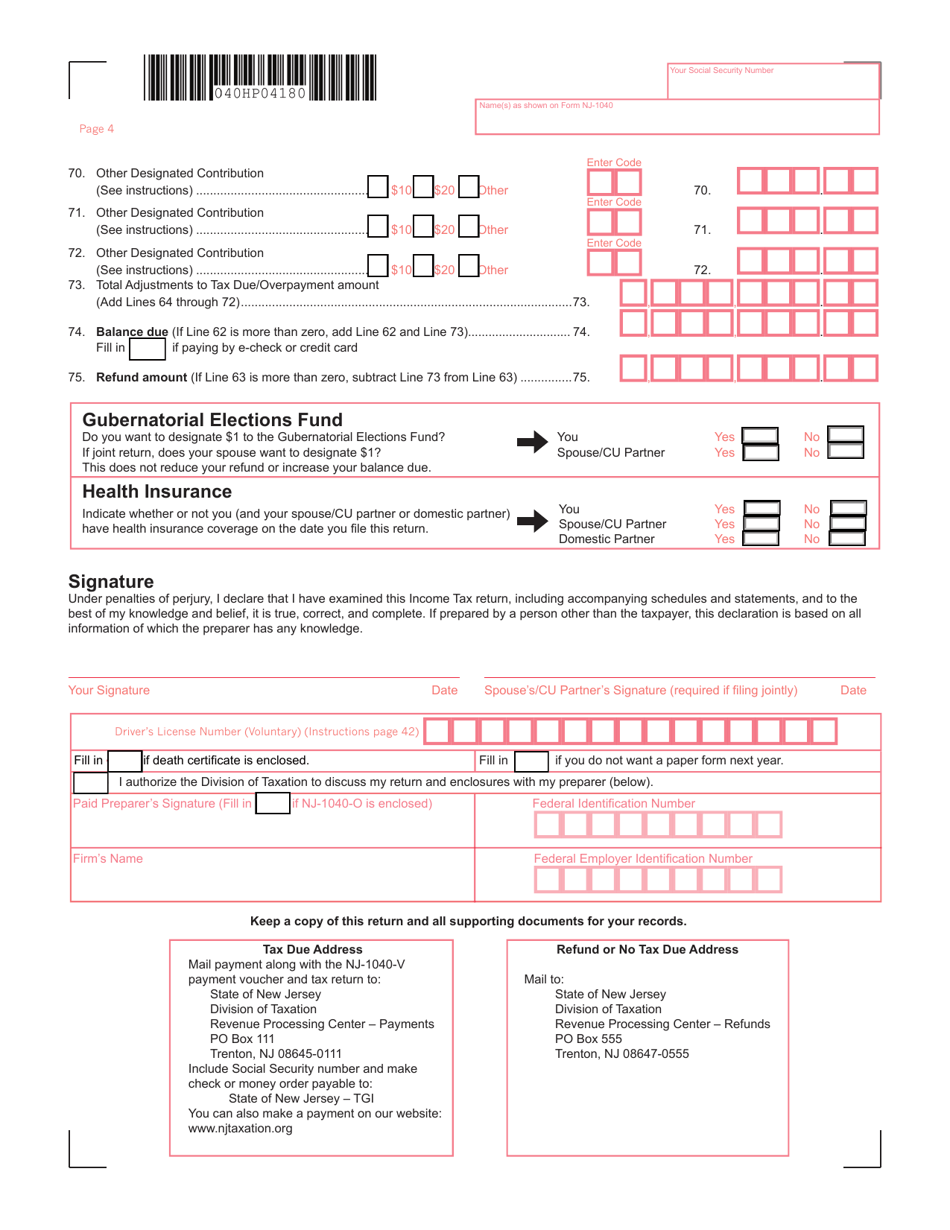

Q: When is the deadline to file Form NJ-1040?

A: The deadline to file Form NJ-1040 is usually April 15th, but it may vary depending on holidays and weekends. Check the specific year's deadline.

Q: What if I cannot file Form NJ-1040 by the deadline?

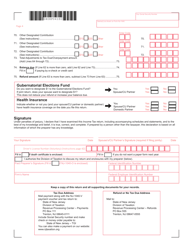

A: If you cannot file Form NJ-1040 by the deadline, you should request an extension using Form NJ-630.

Q: Is there a penalty for late filing of Form NJ-1040?

A: Yes, if you fail to file Form NJ-1040 by the deadline and do not have a valid extension, you may be subject to penalties and interest.

Q: Can I e-file my New Jersey state taxes if I paper filed my federal taxes?

A: Yes, you can still e-file your New Jersey state taxes even if you paper filed your federal taxes.

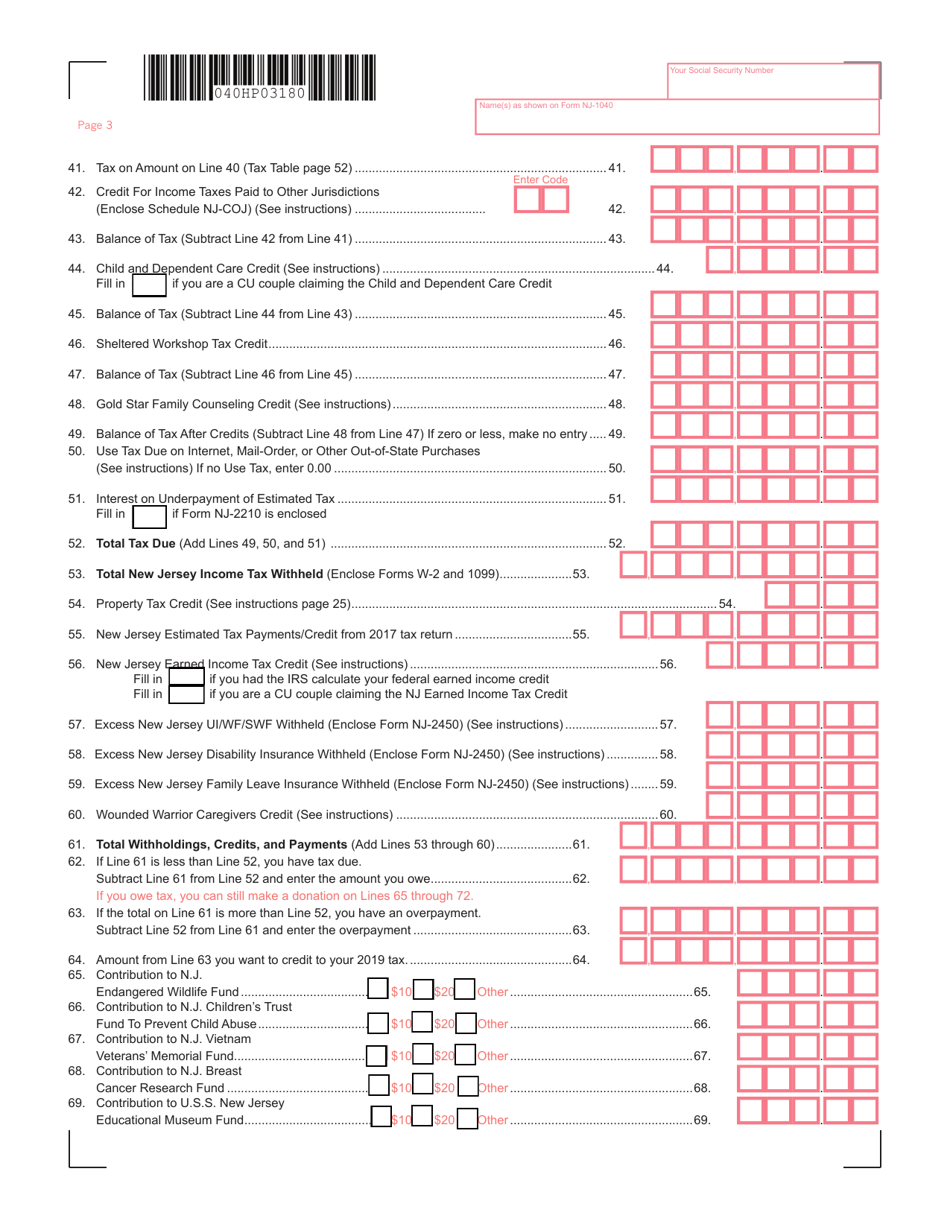

Q: Can I claim a refund if I overpaid my New Jersey state taxes?

A: Yes, if you overpaid your New Jersey state taxes, you can claim a refund on Form NJ-1040.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.