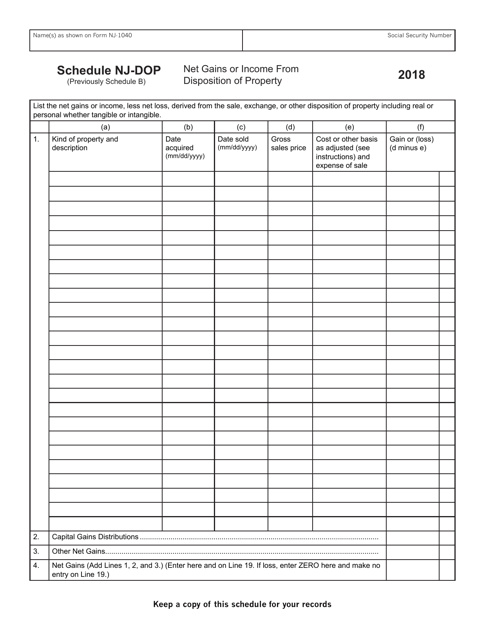

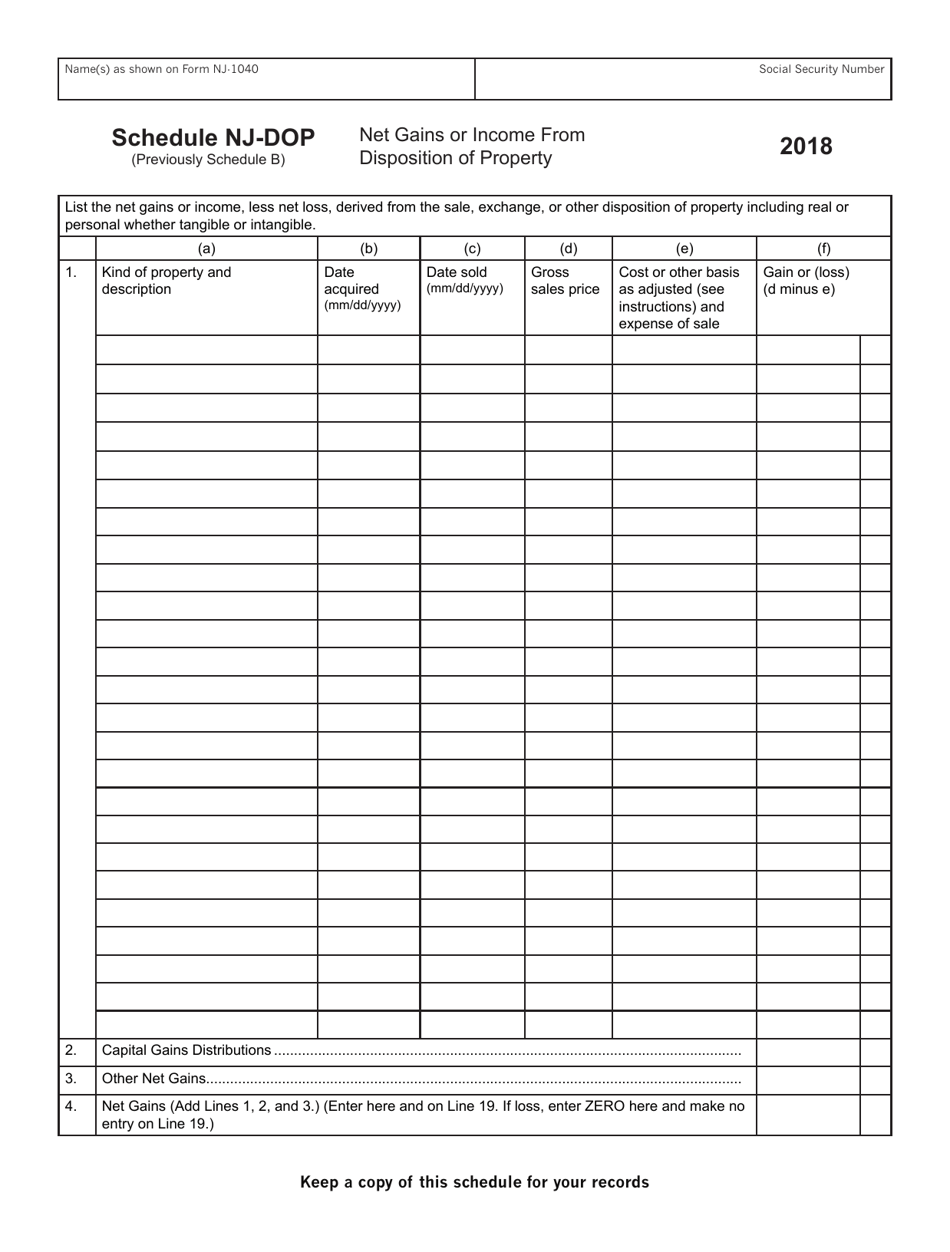

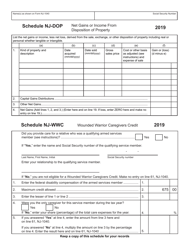

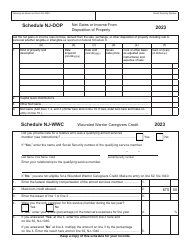

Form NJ-1040 Schedule NJ-DOP Net Gains or Income From Disposition of Property - New Jersey

What Is Form NJ-1040 Schedule NJ-DOP?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form NJ-1040, Resident Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NJ-1040 Schedule NJ-DOP?

A: NJ-1040 Schedule NJ-DOP is a form used in New Jersey to report net gains or income from the disposition of property.

Q: What is considered a disposition of property?

A: A disposition of property refers to the sale, transfer, or exchange of property.

Q: Do I need to file NJ-1040 Schedule NJ-DOP?

A: You need to file NJ-1040 Schedule NJ-DOP if you have net gains or income from the disposition of property in New Jersey.

Q: What should I report on NJ-1040 Schedule NJ-DOP?

A: You should report any net gains or income from the disposition of property in New Jersey on NJ-1040 Schedule NJ-DOP.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040 Schedule NJ-DOP by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.